28 Feb 2023 Market Close & Major Financial Headlines: Another Session Of Roller Coasting Trading Sends Indexes Deep Into The Red Finally closing Moderately Down

Summary Of the Markets Today:

- The Dow closed down 23 points or 0.06%,

- Nasdaq closed down 0.55%,

- S&P 500 closed down 0.17%,

- Gold $2,043 down $1.10,

- WTI crude oil settled at $78 down $0.53,

- 10-year U.S. Treasury 4.266% down 0.049 points,

- USD index $103.95 up $0.12,

- Bitcoin $60,088 up $3,216 (5.66%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

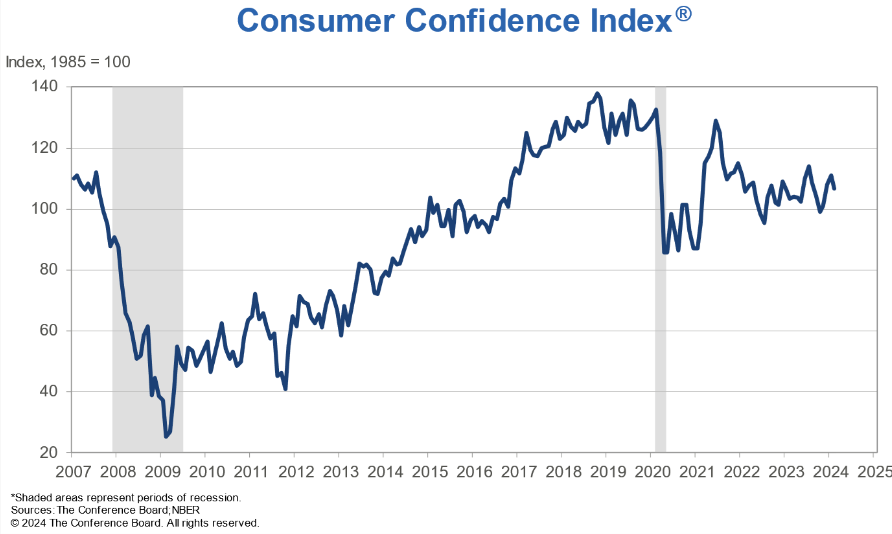

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

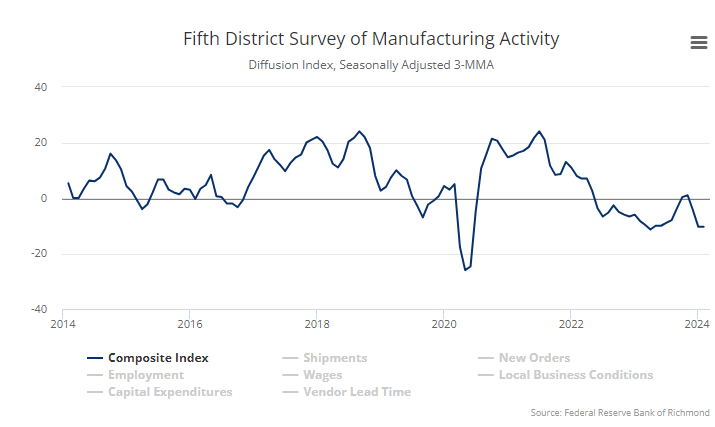

Real gross domestic product (GDP) increased at an annual rate of 3.2% in the fourth quarter of 2023 – down slightly from the advance estimate of 3.3%. With the second estimate, downward revisions to private inventory investment and federal government spending were partly offset by upward revisions to state and local government spending, consumer spending, residential fixed investment, nonresidential fixed investment, and exports. Imports were revised up. Year-over-year Real GDP growth remains at 3.1%.

Here is a summary of headlines we are reading today:

- U.S. Has Launched 230 Attacks on Houthis Over Red Sea Disruption

- U.S. Natural Gas Prices Gain Over 3% After Hitting 1997 Low

- Raging Wildfire Threatens Texas Oil Rigs, Refinery

- Ford Halts Shipments of 2024 F-150 Lightning Pickup Trucks

- EIA Confirms Moderate Crude Build, Products Draw

- S&P 500, Nasdaq close lower Wednesday as inflation report looms: Live updates

- Coinbase users see $0 balance after crypto-trading app suffers glitch

- Bitcoin rockets to $64,000 as it closes in on previous all-time high: CNBC Crypto World

- Microsoft OpenAI Chatbot Suggests Suicide, Other ‘Bizarre, Harmful’ Responses

- Government would avoid shutdown under House speaker’s proposal

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.