21Mar2024 Market Close & Major Financial Headlines: Markets Rally To New Highs Likely Believing Fed Is Not Serious About Its 2% Inflation Target

Summary Of the Markets Today:

- The Dow closed up 269 points or 0.68%,

- Nasdaq closed up 0.20%,

- S&P 500 closed up 0.32%,

- Gold $2192 up $21.80,

- WTI crude oil settled at $81 down $0.24,

- 10-year U.S. Treasury 4.271% down 0.001 points,

- USD index $104.04 up $0.20,

- Bitcoin $65,220 down $2,633

Click here to read our current Economic Forecast – March 2024 Economic Forecast: A Modest Improvement In Our Index Predicting Little Change In Main Street Growth

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Philly Fed Manufacturing Business Outlook Survey edged down 2 points to 3.2 in March 2024. This is only the index’s fifth positive reading since May 2022. Nearly 24 percent of the firms reported increases in general activity this month, while 21 percent reported decreases; 52 percent reported no change. The index for new orders turned positive for the first time since October, rising from -5.2 in February to 5.4 in March. Historically, this index is an outlier versus other regional fed surveys in that its results are usually higher. I continue to state that manufacturing in the US remains in a recession.

In the week ending March 16, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 211,250, an increase of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 750 from 208,000 to 208,750.

Total existing-home sales slid 3.3% year-over-year. The median existing-home price for all housing types in February was $384,500, an increase of 5.7% from the prior year ($363,600). NAR Chief Economist Lawrence Yun stated:

Additional housing supply is helping to satisfy market demand. Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.

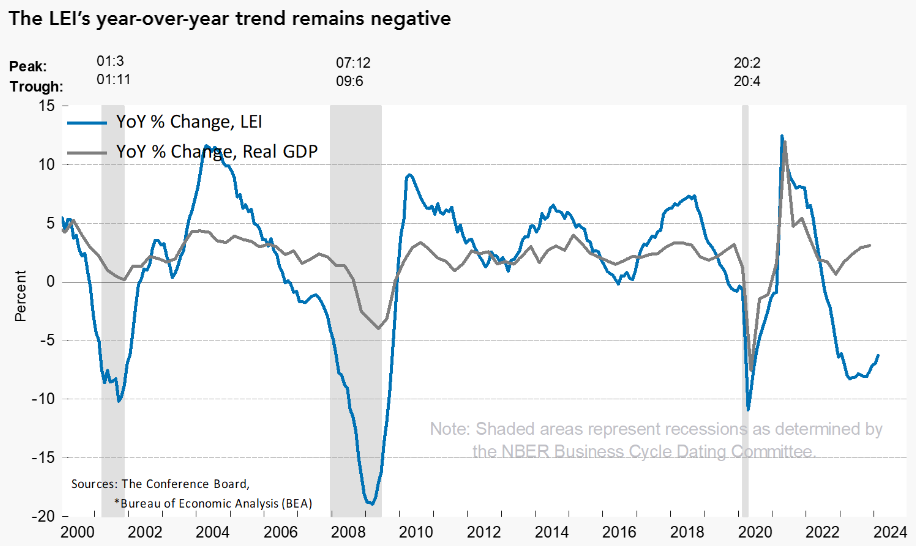

The Conference Board Leading Economic Index® (LEI) for the U.S. increased by 0.1 percent in February 2024 to 102.8 (2016=100), following a 0.4 percent decline in January. At least the Conference Board is no longer forecasting a recession. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

The U.S. LEI rose in February 2024 for the first time since February 2022. Strength in weekly hours worked in manufacturing, stock prices, the Leading Credit Index™, and residential construction drove the LEI’s first monthly increase in two years. However, consumers’ expectations and the ISM® Index of New Orders have yet to recover, and the six- and twelve-month growth rates of the LEI remain negative. Despite February’s increase, the Index still suggests some headwinds to growth going forward. The Conference Board expects annualized US GDP growth to slow over the Q2 to Q3 2024 period, as rising consumer debt and elevated interest rates weigh on consumer spending.

Here is a summary of headlines we are reading today:

- Tokyo Tech Scientists Crack Hydrogen Storage Conundrum

- Taxpayer Money Funds EV Infrastructure Push Despite Slow Adoption

- Restored Import Tax Hits Russian Coal Sales to China

- EPA’s New Car Emission Standards Doom the Gasoline Car

- IEA Chief: No Chance of Hitting Climate Goals Without Nuclear Power

- European Power Giant Bets on U.S. Despite Possible Trump Presidency

- Republican Lawmakers Blame IEA for Straying From Energy Security Mission

- Auto prices are cooling, but ‘we’re never going back to the old normal,’ expert says. Here’s what car shoppers can expect

- “Freedom Bonds”: US Wants $50BN Bond For Ukraine Backed By Frozen Russian Assets

- Stock market’s post-Fed rally hides some worry about officials’ commitment to 2% inflation

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.