Today Through the Fourth Friday (22 to 28 days) Weather Outlook for the U.S. and a Six-Day Forecast for the World: posted March 26, 2024

It is difficult to find a more comprehensive Weather Outlook anywhere else with the ability to get a local 10-day Forecast also.

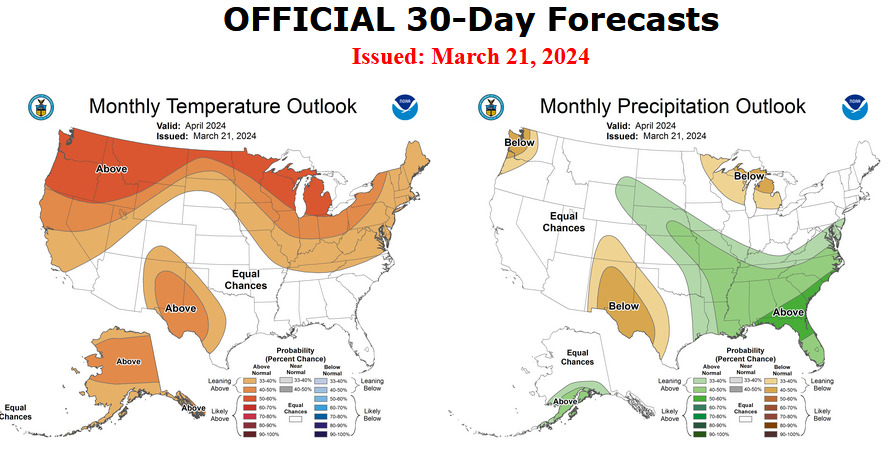

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here but it is unlikely to have changed very much. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Tue Mar 26 2024

Valid 12Z Tue Mar 26 2024 – 12Z Thu Mar 28 2024…Winter Storm comes to an end over the Northern/Central Plains and Upper

Midwest; well below average temperatures over Great Plains……Severe Weather potential over parts of the Midwest and central Gulf

Coast today……Heavy to Excessive Rainfall possible over portions of the Southeast and

Mid-Atlantic……Unsettled weather returns to the Northwest on Wednesday…

Heavy snow and blizzard conditions associated with a deep mid-latitude

cyclone impacting the Northern/Central Plains and Upper Midwest will come

to an end today. Additional snowfall accumulations of 2-4 inches are

expected across eastern Minnesota by Wednesday morning, when the system is

forecast to move into Ontario/southern Canada. A frigid airmass will

continue to spread across the Great Plains today and Wednesday behind a

cold front. Highs will be 15-25 degrees below average for much of the

Plains today. Temperatures will moderate later this week.Rain showers and scattered to isolated thunderstorm activity are likely

east of the Mississippi River today. Storms will organize along a pair of

cold fronts associated with two separate low pressure systems; the Upper

Midwest system and the Gulf Coast system. The Storm Prediction Center

issued a Slight Risk of Severe Thunderstorms (level 2/5) for parts of the

southern Great Lakes and for portions of the Gulf Coast today. Damaging

wind gusts will be the main threat for both areas, but a brief tornado

can’t be ruled out over the Gulf Coast. The Gulf system is forecasted to

stall out over the Southeast/Florida panhandle this afternoon/evening

leading to potentially heavy rainfall occurring particularly over the

Florida panhandle. Significant moisture return from the Gulf will interact

with the slow moving cold front, which will produce an axis of 2-4 inches

of rain from northern Florida through the Southeast coast on Wednesday. A

Slight Risk (at least 15%) of Excessive Rainfall leading to Flash Flooding

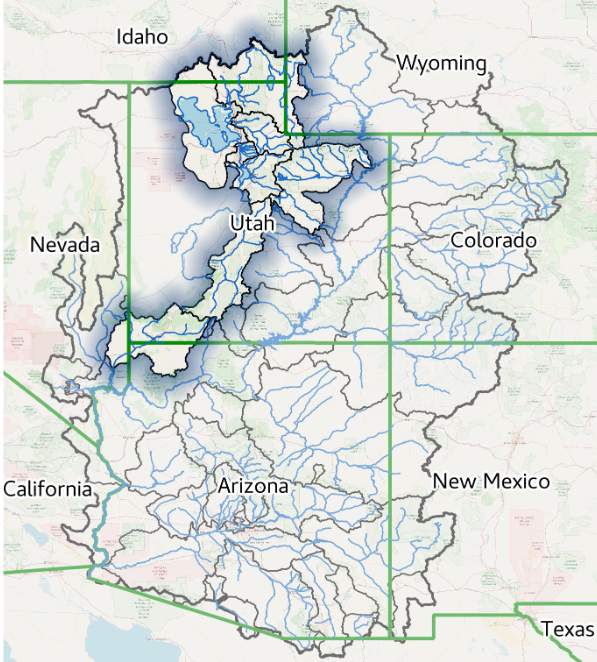

is in effect for parts of north-central Florida into southern Georgia.A deep low pressure system will bring another round of unsettled weather

to the Northwest beginning on Wednesday. Low elevation rain and mountain

snow are expected from this system. Accumulating snow should remain

confined to the higher elevations of the Cascades, Sierra Nevada and

Northern Rockies. Some 1-2 inch 24 hour rainfall totals pose a Marginal

Risk (at least 5%) of Excessive Rainfall leading to Flash Flooding over

parts of the northern California into southern Oregon coastline.