16May2024 Market Close & Major Financial Headlines: A Modest Down Day For The Markets. Industrial Production Down.

Summary Of the Markets Today:

- The Dow closed down 38 points or 0.10%,

- Nasdaq closed down 0.26%,

- S&P 500 closed down 0.21%,

- Gold $2,384 down $10.80,

- WTI crude oil settled at $79 up $0.66,

- 10-year U.S. Treasury 4.377% down 0.021 points,

- USD index $104.51 up $0.17,

- Bitcoin $63,127 up $1,675,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Industrial production was little changed in April 2024 with total industrial production 0.4 percentage point lower than its year-earlier level. Capacity utilization moved down to 78.4 percent in April, a rate that is 1.2 percentage points below its long-run (1972–2023) average. Industrial production component manufacturing was down 0.5% year-over-year, mining was down 1.3%, and utilities were up 2.3%. Manufacturing remains in a recession and is a drag on economic growth.

Molly Boesel from CoreLogic discussed the increasing consumer debt and how it might impact housing foreclosures:

Mortgage debt is larger, but the delinquencies on mortgages are very low right now, and they’ve remained low. But as consumers are building other debt, the delinquencies on that other debt are starting to go up. So, specifically, credit card debt and auto loan debt has been increasing.

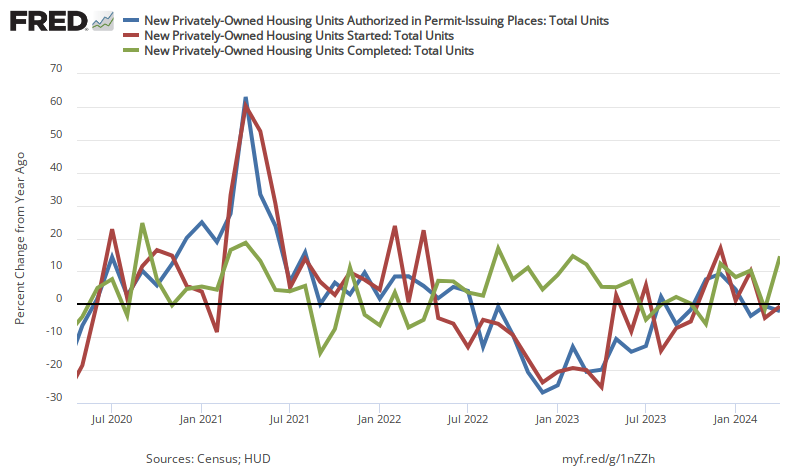

Privately‐owned housing units authorized by building permits in April 2024 were 2.0% below April 2023. Privately‐owned housing starts were 0.6% below April 2023. Privately‐owned housing completions were 14.6% above April 2023. Housing completions are near record highs. Housing construction is a bright spot in the economy. The reason permits and starts are so low is that there is a huge backlog of housing units under construction which are tied for all time highs of 1975.

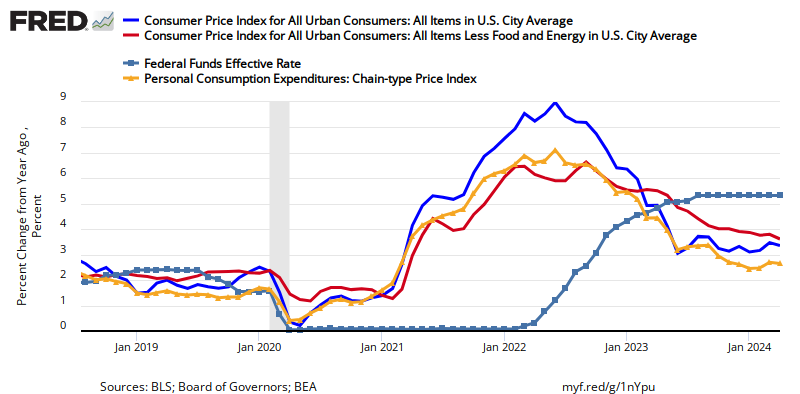

Import prices increased 1.1% year-over-year in April 2024 whilst export prices decreased 1.0% year-over-year. This is well within the 2% inflation target set by the Federal Reserve but the trend lines are upward. Following the current trend lines, within one year inflation would exceed 6% in this sector.

The Philly Fed Manufacturing Business Outlook Survey weakened overall. The diffusion index for current general activity remained positive but declined 11 points to 4.5 in May, mostly undoing its increase from last month. The survey’s indicators for new orders, and shipments all declined, with the latter two turning negative. The employment index suggests declines in employment overall. Both price indexes indicate overall increases in prices but remain below their long-run averages.

In the week ending May 11, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 217,750, an increase of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 215,000 to 215,250.

Here is a summary of headlines we are reading today:

- U.S. Fast-Tracks $2 Billion Military Aid for Ukraine

- Putin Meets With Xi Jinping As Sanctions Weigh on Russian Economy

- Russia’s Shadow Oil Tanker Fleet Causes 50 Maritime Accidents

- Existing Foreign Oil Producers in Venezuela May Get Licenses Despite Sanctions

- Are High Commodity Prices Becoming a Problem for the Fed?

- Refinery Repairs Drag Down Russia’s Oil Product Exports in April

- Walmart surges to all-time high as earnings beat on high-income shopper, e-commerce gains

- Walmart says more diners are buying its groceries as fast food gets pricey

- US Spy Balloon Crashes In Northeast Syria

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.