Summary Of the Markets Today:

- The Dow closed up 127 points or 0.32%,

- Nasdaq closed up 0.75%,

- S&P 500 closed up 0.48%,

- Gold $2,362 up $18.90,

- WTI crude oil settled at $78 down $0.99,

- 10-year U.S. Treasury 4.449 down 0.032 points,

- USD index $105.02 down $0.20,

- Bitcoin $61,547 down $1,500 (2.38%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

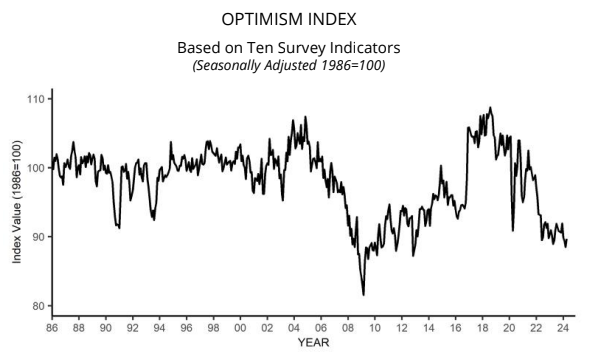

NFIB’s Small Business Optimism Index rose by 1.2 points in April to 89.7, marking the first increase of this year but the 28th consecutive month below the 50-year average of 98. Twenty-two percent of owners reported that inflation was their single most important problem in their business, down three points from March but still the number one problem for small business owners. Bill Dunkelberg, NFIB Chief Economist stated:

Cost pressures remain the top issue for small business owners, including historically high levels of owners raising compensation to keep and attract employees. Overall, small business owners remain historically very pessimistic as they continue to navigate these challenges. Owners are dealing with a rising level of uncertainty but will continue to do what they do best – serve their customers.

Inflation continued in the Producer Price Index which was 2.2% year-over-year in April 2024 – up from 1.8% in March. Growth continued in both services and goods in the PPI. Tomorrow, the Consumer Price Index for April will be released with our estimate being 3.6% year-over-year (and the market consensus is 3.4% year-over-year.

Here is a summary of headlines we are reading today:

- Putin’s Cabinet Shakeup Reflects Shift in Strategy As Ukraine War Persists

- The Controversy That Nearly Destroyed OPEC Has Resurfaced

- Inflation Fears Keep Oil Prices Suppressed

- Chevron Surpasses Tesla as the Most Shorted U.S. Large-Cap Stock

- U.S. Gasoline Prices Set for Slight Drop Ahead of Memorial Day

- Electric Vehicles Lose Market Share in the U.S. as Sales Decline

- Google rolls out its most powerful AI models as competition from OpenAI heats up

- Fed Chair Powell says inflation has been higher than thought, expects rates to hold steady

- Nasdaq jumps to record close, Dow adds more than 100 points ahead of consumer inflation report: Live updates

- Walmart is laying off, relocating hundreds of corporate workers across the country. Read the memo

- Another “Behemoth Solar Flare” Sparks Radio Blackout Across North America

- ‘Bidenomics’ 2.0 or ‘Trumponomics’ 2.0? Both would hurt trade and growth.

- Treasury yields fall for second straight session after PPI revision for March

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Comparing Big Oil to Big Tobacco is LudicrousRecently the Senate Budget Committee held a hearing to discuss a recent report that accused “Big Oil” of a “decades-long deception campaign” to misinform the public about the dangers of climate change. Sharon Eubanks, a former federal litigator, proposed that the government should pursue legal action against the petroleum industry, drawing parallels to the litigation against Big Tobacco in the past. Eubanks, who previously led the racketeering lawsuit against the tobacco industry, argued that major oil and gas… Read more at: https://oilprice.com/Energy/Energy-General/Comparing-Big-Oil-to-Big-Tobacco-is-Ludicrous.html |

|

Putin to Visit China to Discuss Energy TiesRussian President Vladimir Putin is set to visit China on May 16-17 for discussions with President Xi Jinping, in part to discuss expanding energy and trade partnerships. The state visit, initiated by Xi, will cover topics such as China’s Belt and Road Initiative as well as the situation in the Middle East and Asia, and Ukraine. Putin will be accompanied by key officials including Defense Minister Andrei Belousov, Foreign Minister Sergei Lavrov, Security Council Secretary Sergei Shoigu, foreign policy adviser Yuri Ushakov, and executives from major… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Putin-to-Visit-China-to-Discuss-Energy-Ties.html |

|

Putin’s Cabinet Shakeup Reflects Shift in Strategy As Ukraine War PersistsRussian President Vladimir Putin has launched his fifth term with a rare shake-up of the government that analysts say is driven by the need to manage a long and increasingly costly war of aggression against Ukraine and the fallout from Moscow’s mounting confrontation with the West. Putin on May 12 removed Defense Minister Sergei Shoigu – long seen as one of Putin’s closest confidants and mentioned periodically as a possible presidential successor — and replaced him with acting First Deputy Prime Minister Andrei Belousov, a 65-year-old economist… Read more at: https://oilprice.com/Geopolitics/International/Putins-Cabinet-Shakeup-Reflects-Shift-in-Strategy-As-Ukraine-War-Persists.html |

|

Construction Industry Braces for Impact as Copper Prices RiseVia Metal Miner The Construction MMI (Monthly Metals Index) remained firmly in a sideways trend, only budging upward by 1.28%. The rising price of iron ore PB fines in China had the heaviest impact on the index, holding it more up than down. After that, the next biggest factor was European commercial 1050 aluminum sheets. Meanwhile, all other components of the index’s metal prices trended sideways or down. Despite this, the recent ban on Russian aluminum and copper could impact aluminum and copper prices and snowball into the U.S. construction… Read more at: https://oilprice.com/Energy/Energy-General/Construction-Industry-Braces-for-Impact-as-Copper-Prices-Rise.html |

|

The Controversy That Nearly Destroyed OPEC Has ResurfacedKazakhstan reawakened a divisive issue among the OPEC+ group with regard to oil production quotas. Kazakhstan said on Tuesday that it felt it should be allowed to increase its crude oil production in 2025, Interfax reported, despite its membership in the group that seeks to maintain balance in the global crude oil markets. Kazakhstan’s energy ministry said it had not requested an increase to its allowable production levels for 2025. Kazakhstan, as a member of the OPEC+ group, stated its desire to pump more oil ahead of the OPEC+ meeting to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Controversy-That-Nearly-Destroyed-OPEC-Has-Resurfaced.html |

|

Forget ESG, Corporations Have a New Favorite Buzzword To Boost Share PricesAI washing might be a phenomenon you’ve never heard of, but it is rapidly on the rise. Overplaying claims about artificial intelligence in the hope of creating a ‘halo effect’ around their company and boosting their stock price is a new fad, spanning across a variety of sectors. The current wave of AI hype is boosting companies that emphasise their use of AI, with some, like Nvidia, seeing their stock price rise over 500 percent since the start of 2023. This has left many companies eager to jump on the bandwagon, even if their… Read more at: https://oilprice.com/Energy/Energy-General/Forget-ESG-Corporations-Have-a-New-Favorite-Buzzword-To-Boost-Share-Prices.html |

|

Yerevan and Baku Disagree on Key Provisions of Bilateral TreatyArmenia and Azerbaijan negotiators continue to disagree on key provisions of a bilateral peace treaty, officials in Yerevan and Baku said on May 11 after the foreign ministers of the two nations ended two days of fresh negotiations in Kazakhstan. The Azerbaijani and Armenian foreign ministers were meeting in the Kazakh city, Almaty, in talks aimed at reaching a lasting peace treaty between the longtime South Caucasus rivals. “The parties agreed to continue negotiations on open issues where there are still differences,” both ministries… Read more at: https://oilprice.com/Geopolitics/Africa/Yerevan-and-Baku-Disagree-on-Key-Provisions-of-Bilateral-Treaty.html |

|

Inflation Fears Keep Oil Prices SuppressedThe week began positively with robust U.S. gasoline demand and improved Chinese consumption, but optimism waned as Tuesday’s higher-than-expected U.S. inflation data weighed on oil prices.Plunging Diesel Cracks Bring Refinery Run Cuts Back on the Agenda- Higher supply of diesel is eating into middle distillate cracks, with the profitability of making middle distillates halving compared to this year’s February peak levels, prompting run cuts in Europe and Asia. – Asian diesel cracks have fallen to $15 per barrel, half of the $29 per… Read more at: https://oilprice.com/Energy/Energy-General/Inflation-Fears-Keep-Oil-Prices-Suppressed.html |

|

Chevron Surpasses Tesla as the Most Shorted U.S. Large-Cap StockU.S. oil and gas supermajor Chevron ousted Tesla to top the list of the most shorted large-cap stock in the Americas in April, the Shortside Crowdedness Report from Hazeltree showed on Tuesday. Bets that Chevron’s shares would fall jumped in April as oil prices declined in the second half of the month with a tentative easing of the geopolitical tensions in the Middle East. In addition, Chevron’s proposal to buy Hess is getting increased scrutiny from regulators and politicians, while the supermajor is locked in an arbitration… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Surpasses-Tesla-as-the-Most-Shorted-US-Large-Cap-Stock.html |

|

U.S. Gasoline Prices Set for Slight Drop Ahead of Memorial DayGasoline prices in the United States are expected to see a slight drop of up to 10 cents per gallon by Memorial Day weekend, Patrick De Haan, head of petroleum analysis at GasBuddy, said on Tuesday. “I do not expect #gasprices to trend higher ahead of Memorial Day,” De Haan said on X today. “Prices could cycle in some areas that see such, which is normal, but I expect the national average to drop 5-10c/gal by the holiday weekend. Low-to-mid $3.50s/gal,” the petroleum analyst added. AAA estimates showed on… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Prices-Set-for-Slight-Drop-Ahead-of-Memorial-Day.html |

|

Electric Vehicles Lose Market Share in the U.S. as Sales DeclineHybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles made up 18% of all new light-duty vehicle sales in the first quarter of 2024, down from an 18.8% share in the fourth quarter of 2023. Battery electric vehicle (BEV) sales fell for the first time since the onset of Covid in 2020, the Energy Information Administration (EIA) said on Tuesday, citing estimates from Wards Intelligence. This slight decline in the EV market share was driven primarily by a drop in BEV sales, which declined from 8.1% of the total light-duty… Read more at: https://oilprice.com/Energy/Energy-General/Electric-Vehicles-Lose-Market-Share-in-the-US-as-Sales-Decline.html |

|

Australia to Invest $15 Billion in Clean Energy Over the Next DecadeAustralia plans to invest as much as US$15 billion (AUS$22.7 billion) over the next decade to become a renewable energy superpower and boost its domestic critical minerals economy, the country’s Labor Government said on Tuesday. The cabinet unveiled today a Future Made in Australia plan to bring new jobs and opportunities and “help Australia succeed and remain an indispensable part of the global economy as the world undergoes the biggest transformation since the industrial revolution.” The 2024-25 Budget will invest the equivalent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Australia-to-Invest-15-Billion-in-Clean-Energy-Over-the-Next-Decade.html |

|

OPEC Remains Optimistic About Global Oil Demand GrowthA resilient global economy early this year has additional upside potential in the second half with the possible easing of monetary policies, OPEC said on Tuesday, keeping its 2024 and 2025 outlook of robust oil demand unchanged from last month. In its closely-watched Monthly Oil Market Report (MOMR) out today, OPEC maintained its forecast from the April report, which sees global oil demand rising by 2.25 million barrels per day (bpd) this year and by another 1.85 million bpd next year. OPEC estimates that global oil demand rose… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Remains-Optimistic-About-Global-Oil-Demand-Growth.html |

|

OPEC’s Oil Production Drops Ahead of Key Policy MeetingOPEC saw its crude oil production decline by 48,000 barrels per day (bpd) in April compared to March, the organization’s monthly report showed two weeks before the crucial meeting at which the wider OPEC+ group is set to decide on production levels after June. Total crude oil production of all 12 OPEC members averaged 26.58 million barrels per day (bpd) in April, down by 48,000 bpd compared to March, according to secondary sources in OPEC’s closely-watched Monthly Oil Market Report (MOMR) published on Tuesday. Iran, exempted… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPECs-Oil-Production-Drops-Ahead-of-Key-Policy-Meeting.html |

|

Anglo American to Exit Diamonds and Platinum After Rebuffing BHP BidsAfter rejecting a second takeover bid from BHP, mining peer Anglo American unveiled on Tuesday plans to divest or demerge its diamond, platinum, steelmaking coal, and nickel businesses as it seeks to radically simplify its portfolio to focus on its copper, premium iron ore, and crop nutrients assets. Anglo American, which has been a target of two unsolicited takeover bids from BHP – both rejected – is now looking to unlock significant value from its portfolio and accelerate the delivery of “consistently stronger… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Anglo-American-to-Exit-Diamonds-and-Platinum-After-Rebuffing-BHP-Bids.html |

|

Google rolls out its most powerful AI models as competition from OpenAI heats upGoogle on Tuesday announced new additions to its AI model following a flashy rollout a day earlier from OpenAI. Read more at: https://www.cnbc.com/2024/05/14/google-announces-lightweight-ai-model-gemini-flash-1point5-at-google-i/o.html |

|

Fed Chair Powell says inflation has been higher than thought, expects rates to hold steadySpeaking to the Foreign Bankers’ Association, the central bank leader noted that the rapid disinflation that happened in 2023 has slowed considerably this year. Read more at: https://www.cnbc.com/2024/05/14/powell-says-inflation-has-been-higher-than-thought-and-expects-rates-to-hold-steady.html |

|

GameStop, AMC attracting a fraction of retail trader interest seen during 2021’s meme maniaMom-and-pop traders snapped up shares after the man credited with starting the meme stock mania resurfaced online, though at a lesser extent than seen in 2021. Read more at: https://www.cnbc.com/2024/05/14/gamestop-amc-attracting-a-fraction-of-retail-trader-interest-seen-during-2021s-meme-mania.html |

|

Disney+ will stream Caitlin Clark’s WNBA debut in the platform’s first live sports eventThe WNBA regular season opens tonight with NCAA star Caitlin Clark making her debut. The game will be the first-ever live sports event streamed on Disney+. Read more at: https://www.cnbc.com/2024/05/14/disney-to-stream-caitlin-clarks-wnba-debut-with-indiana-fever.html |

|

Trading CPI: How stocks could react to Wednesday’s inflation reportThe consumer price index reading for April is slated for release at 8:30 a.m. ET. Read more at: https://www.cnbc.com/2024/05/14/trading-cpi-how-stocks-could-react-to-wednesdays-inflation-report.html |

|

Nasdaq jumps to record close, Dow adds more than 100 points ahead of consumer inflation report: Live updatesOn Tuesday, traders looked for clarity on future Federal Reserve policy moves after April’s producer price index rose more than expected. Read more at: https://www.cnbc.com/2024/05/13/stock-market-today-live-updates.html |

|

Education Dept. announces highest federal student loan interest rate in more than a decadeThe U.S. Department of Education announced Tuesday the interest rates on federal student loans for the 2024-2025 academic year. Read more at: https://www.cnbc.com/2024/05/14/education-dept-announces-2024-25-interest-rates-on-student-loans.html |

|

Biden bars Chinese-backed miner near nuclear missile base, citing spying concerns: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Muneeb Ali, the co-founder and CEO of Trust Machines, weighs in on bitcoin’s price movements and explains how the launch of spot crypto ETFs in Hong Kong has changed the industry. Read more at: https://www.cnbc.com/video/2024/05/14/biden-bars-chinese-backed-miner-near-nuclear-missile-base-citing-spying-concerns-cnbc-crypto-world.html |

|

Trump lawyer calls out Michael Cohen TikTok insults in hush money trial cross-examinationMichael Cohen told jurors key details about the alleged awareness and involvement of Donald Trump in hush money payments to a porn star and a Playboy model. Read more at: https://www.cnbc.com/2024/05/14/trump-trial-michael-cohen-returns-to-testify-in-hush-money-case.html |

|

These are the 2024 CNBC Disruptor 50 companies: See the full list of startups riding the AI waveCNBC reveals the 2024 Disruptor 50 list, AI-driven startups moving beyond the ‘better, faster, cheaper’ mantra that defined Silicon Valley’s past. Read more at: https://www.cnbc.com/2024/05/14/these-are-the-2024-cnbc-disruptor-50-companies.html |

|

Fat Brands confidentially files to IPO its Twin Peaks and Smokey Bones restaurant chainsFat Brands and its chair Andy Wiederhorn were criminally indicted for an alleged $47 million bogus loan scheme. Read more at: https://www.cnbc.com/2024/05/14/fat-brands-twin-peaks-smokey-bones-confidentially-file-for-ipo.html |

|

Walmart is laying off, relocating hundreds of corporate workers across the country. Read the memoThe move follows the closures of the company’s health clinics and comes ahead of its earnings report on Thursday. Read more at: https://www.cnbc.com/2024/05/14/walmart-to-lay-off-relocate-hundreds-of-corporate-workers.html |

|

Comcast offers subscribers Peacock, Netflix and Apple TV+ bundleThe announcement comes as major media players, like Disney and Warner Bros. Discovery, increasingly join forces to boost subscriptions for streaming services. Read more at: https://www.cnbc.com/2024/05/14/comcast-bundle-for-subscribers-peacock-netflix-and-apple-tv.html |

|

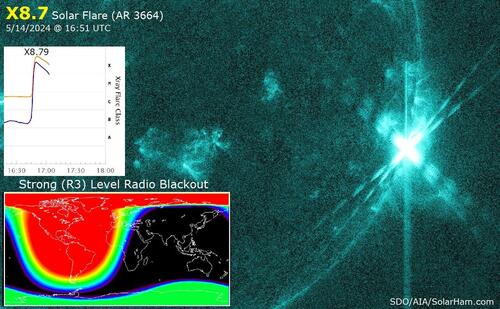

Another “Behemoth Solar Flare” Sparks Radio Blackout Across North AmericaAfter a weekend of the strongest solar storms to rock the planet in years, producing aurora across Europe, the United States, and as far as New Zealand, there is news the sun just burped its largest solar flare of Solar Cycle 25, according to space weather website Solarham. “The largest solar flare of the current solar cycle 25, and largest since 2017 was just observed around deparing AR 3664 off the west limb. The X8.7 event peaked at 16:51 UTC (May 14) causing a strong R3 level radio blackout directly over North America,” Solarham wrote.

Solarham continued: “A filament located in the northeast quadrant erupted earlier today and produced a light bulb shaped CME. So far the blast appears to be headed mostly north of the Sun-Earth line. A further update will be provided whenever necessary.” Read more at: https://www.zerohedge.com/weather/behemoth-x87-class-solar-flare-reported-radio-blackout-directly-over-north-america |

|

Peter Schiff: All Inflation Has One SourceVia SchiffGold.com, Last week, Peter appeared on This Week in Mining with Jay Martin. Jay and Peter discuss the state of the economy, the government’s assault on sound money, and why the mining sector constitutes a good investment. Early on in the interview, Peter lays out the dilemma the Federal Reserve will face in the near future:

As the government continues to grow and encroach on individual liberty, Peter explains what would happen if gold is ever outlawed, as it was in the 1930s:

|

|

Clearing DemandBy Ahmed Bin Sulayem Since its establishment in 2005, the Dubai Commodities Clearing Corporation (DCCC) has been the central counterparty for clearing and settlement services to the Dubai Gold & Commodities Exchange (DGCX). Emerging as the largest clearing house in the MENA region by volume, DCCC is now poised to play a far more multinational role in line with the transition of economic power from west to east, while providing a broader range of products and services. Why the DCCC? As a wholly owned subsidiary of DGCX, which in turn is a wholly owned subsidiary of Dubai Multi Commodities Centre, DCCC’s success may have started out of functionality, but has since expanded to provide a streamlined mechanism for its members with numerous competitive advantages. Outside of providing guaranteed settlement and reduced counterparty risk, DCCC also offers the advantages of transacting and clearing business within the UAE, thus benefiting from a strong and safe business and regulatory environment. For greater transparency and predictability, DCCC also operates a simplified fee structure that applies to all clearing members, including identical margins regardless of commercial or non-commercial status. Overlapping across Asian, European and U.S. trading hours, DCCC’s robust regulation, under the Securities & Commodities Authority (SCA), recognition by the Monetary Authority of Singapore (MAS), the Bank of England, and Abu Dhabi Global Market (ADGM) and Read more at: https://www.zerohedge.com/markets/clearing-demand |

|

Cocoa Market Hit With Second Crash In Weeks As Liquidity EvaporatesCocoa futures in New York crashed for the second time in just days as liquidity evaporated, and a new weather forecast points to improved weather conditions for top producers of the bean in West Africa. The most active cocoa contract in New York plunged 19% on Monday, recovering some losses on Tuesday, up about 5%. This followed the cocoa crash on May 1 of 18%.

Cocoa prices are retracing at the 61.8% Fibo level from this year’s record surge from $4,000 a ton to $12,000. The rollercoaster price action continues to propel 60-day historical volatility higher. Read more at: https://www.zerohedge.com/commodities/cocoa-market-hit-second-crash-weeks-liquidity-evaporates |

|

Tesco boss’s pay more than doubles to £10mKen Murphy’s package includes a pay-out from shares awarded after he joined the supermarket giant. Read more at: https://www.bbc.com/news/articles/c51nn8rz057o |

|

Bumble apologises for anti-celibacy ad after backlashThe dating apps will remove adverts critics said shamed women who were not sexually active. Read more at: https://www.bbc.com/news/articles/cz4xx2rw0leo |

|

My emails look ludicrous, says ex-Post Office PR bossDuring his time at the Post Office, Mark Davies presided over an aggressive media strategy. Read more at: https://www.bbc.com/news/articles/cq5nnpgywevo |

|

Hero MotoCorp’s market cap reaches Rs 1 lakh croreHero MotoCorp’s market cap stood at Rs 100,803.27 crore at the close on the BSE on Tuesday, just behind TVS Motor Company, which had a market cap of Rs 101,390.72 crore. Investors have been upbeat on the stock on the back of the company’s focus on premium and electric vehicle segments. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/hero-motocorps-market-cap-reaches-rs-1-lakh-crore/articleshow/110126008.cms |

|

SBI, Godrej Consumer top buys post Q4 results; could give 13-17% upside in 1 yearSBI and Godrej Consumer are top buys post Q4 results, led by BFSI and Auto sectors. Nifty stocks show growth, while Tier-1 IT companies face challenges. Business and credit growth outlook positive for SBI. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sbi-godrej-consumer-top-buys-post-q4-results-could-give-13-17-upside-in-1-year/articleshow/110111038.cms |

|

GameStop’s meme-stock rally is a ‘short-term baseless frenzy,’ brokerage CEO saysThe meme rally that sent shares of GameStop Corp. soaring this week will likely peter out in a couple of days, says Dan Raju, the CEO of cloud-based financial-services provider Tradier. Read more at: https://www.marketwatch.com/story/gamestops-meme-stock-rally-is-a-short-term-baseless-frenzy-brokerage-ceo-says-352096f3?mod=mw_rss_topstories |

|

‘Bidenomics’ 2.0 or ‘Trumponomics’ 2.0? Both would hurt trade and growth.Joe Biden and Donald Trump are each pushing a protectionist agenda that weakens U.S. interests at home and globally. Read more at: https://www.marketwatch.com/story/bidenomics-2-0-or-trumponomics-2-0-both-would-hurt-trade-and-growth-d5551c99?mod=mw_rss_topstories |

|

Treasury yields fall for second straight session after PPI revision for MarchTreasury yields finished lower on Tuesday after a downward revision to the U.S. producer-price index for March took some of the sting out of the unexpectedly hotter reading for April. Read more at: https://www.marketwatch.com/story/treasury-yields-a-tad-softer-as-traders-await-inflation-data-95c5b1d1?mod=mw_rss_topstories |