Dancing Queens & Kings: Call for Participation – New

I am re-starting my book (“Dancing Queens & Kings”), and this is a new CFP (Call for Participation).

I am re-starting my book (“Dancing Queens & Kings”), and this is a new CFP (Call for Participation).

*Stock data, cryptocurrency, and commodity prices at the market closing.

U.S. stocks closed with significant gains as Wall Street responded to cooler-than-expected inflation data and anticipated the upcoming Consumer Price Index (CPI) report. This marked the best three-day stretch for the Nasdaq Composite, Nasdaq 100, and S&P 500, with each index achieving four consecutive wins. The U.S. Producer Price Index (PPI) for July rose just 0.1% month-over-month, lower than economists’ forecasts, and increased 2.2% year-over-year, aligning closely with the Federal Reserve’s 2% inflation target.In the corporate sector, Home Depot’s shares fell after the company lowered its outlook on same-store sales for the rest of the year. Conversely, Starbucks saw a 24% increase in its stock following the announcement of a new CEO, Brian Niccol from Chipotle, whose shares dropped more than 7%. Nvidia continued its upward trend, gaining about 7% after being named a top “rebound” stock by Bank of America.

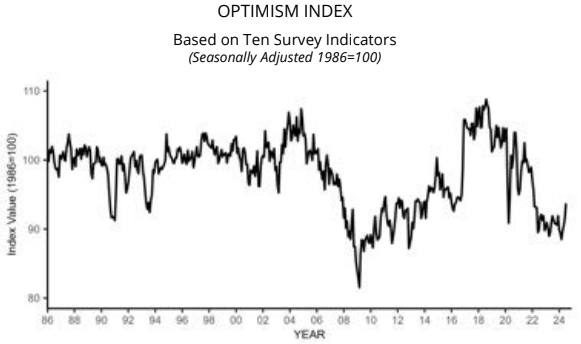

The NFIB Small Business Optimism Index rose 2.2 points in July to 93.7, the highest reading since February 2022. However, this is the 31st consecutive month below the 50-year average of 98. Inflation remains the top issue among small business owners, with 25% reporting it as their single most important problem in operating their business, up four points from June. NFIB Chief Economist Bill Dunkelberg added:

Despite this increase in optimism, the road ahead remains tough for the nation’s small business owners. Cost pressures, especially labor costs, continue to plague small business operations, impacting their bottom line. Owners are heading towards unpredictable months ahead, not knowing how future economic conditions or government policies will impact them.

The Producer Price Index for final demand increased 2.3% for the 12 months ended in July 2024 – down from 2.7% last month. The index for final demand services fell 0.2 percent. The index for final demand less foods, energy, and trade services moved up 3.3%. What a mixed bag of inflation indicators at the producer level! It is saying overall inflation subsided this month – but when you strip away food, energy and trade services (core inflation), it actually worsened this month. In fact, core inflation is nearly as high as any reading in the past 12 months. The good news in this data is that inflation in the services portion of this index declined (but the goods portion worsened).

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Tue Aug 13 2024

Valid 12Z Tue Aug 13 2024 – 12Z Thu Aug 15 2024…Heavy rain and flash flooding threat forecast to stretch from the

central Plains to the Midwest over the next few days……Potentially dangerous heat anticipated across the southern Plains,

lower Mississippi Valley, and Gulf Coast……Fire weather concerns and poor air quality continues for portions of

the Pacific Northwest, Northern Rockies, and Great Basin…A mid-August weather pattern continues to take shape this week with

numerous areas of scattered thunderstorms impacting the Nation. A

stationary front currently stretching from the Southeast to the central

High Plains will be the focus for much of this activity, with the boundary

eventually forecast to lift north into the Midwest by Wednesday night due

to a deepening low pressure system in the central Plains. The most likely

weather hazard over the next few days with developing thunderstorms is

expected to be associated with heavy rainfall creating instances of flash

flooding, as well as the potential for isolated areas of damaging wind

gusts. Specifically, three separate areas along the front stand out today

as having the greatest chances for scattered flash floods. Parts of South

Carolina remain sensitive to locally heavy rain as the area continues to

contain saturated ground conditions, leading to a continued threat for

flash flooding as long as the atmosphere supports slow-moving

thunderstorms. For much of eastern Kansas and Missouri, an initial complex

of thunderstorms is forecast to move through the region this morning

containing locally heavy rainfall, while a reforming area of convection

overnight into Wednesday could create additional flooding concerns. This

second round of heavy rain has the potential to produce a narrow corridor

of impressive rainfall totals within a few hours near south-central

Missouri. Additionally, northeast Colorado can expect another round of

storms containing intense rainfall rates this evening as activity forms

along the leeward side of the Rockies and pushes eastward. Residents and

visitors are advised to have multiple ways of receiving warnings, have a

plan should flash flooding occur, and never drive through flooded

roadways. By midweek much of the heavy rain and thunderstorm activity is

anticipated to gradually shift eastward to the Midwest and lower Ohio

Valley, along with the strengthening low pressure system and lifting warm

front. Once again heavy rain will be a concern as ample atmospheric

moisture content creates ripe conditions for scattered vigorous downpours.Dangerous summer heat will be confined to the southern U.S. this week as

highs into the upper 90s and triple digits span from the Southwest to the

Gulf Coast. The most anomalous and potentially dangerous heat is forecast

across the southern Plains and Gulf Coast States through the end of the

week as highs reach up to 10 degrees above the climatological average for

mid-August. Elevated humidity levels will lead to maximum heat indices up

to 110 degrees during the day and low temperatures only dipping into the

upper 70s and low 80s at night. People spending greater time or effort

outdoors, or in a building without effective cooling, are at an increased

risk of heat-related illnesses.A persistent pattern supporting fire weather concerns across much of the

central and northern Great Basin is forecast to continue today with dry

terrain and periods of gusty winds. Red Flag Warnings remain in place from

eastern Oregon to Idaho. Ongoing wildfires also continue to spread smoke

into the atmosphere, leading to poor air quality.

*Stock data, cryptocurrency, and commodity prices at the market closing.

US stocks closed mixed on Monday as investors prepared for a week filled with significant economic data. Key stock movements included Nvidia, which surged nearly 4%, driving a rally in the tech sector. This mixed performance comes after a volatile week that left markets feeling jittery, with major indexes ending the previous week close to where they started despite significant fluctuations. Looking ahead, investors are focused on crucial economic indicators. Wednesday, the Consumer Price Index (CPI) data will be brought, providing insights into inflation, followed by retail sales figures and Walmart’s earnings on Thursday. These reports are expected to influence market volatility, as Wall Street tends to react positively to good news. The current economic climate suggests a slowing economy, shifting discussions from whether the Federal Reserve will cut interest rates in September to the extent of potential cuts. A slight majority of traders anticipate a 25 basis point cut, while around 48% expect a larger 50 basis point reduction.

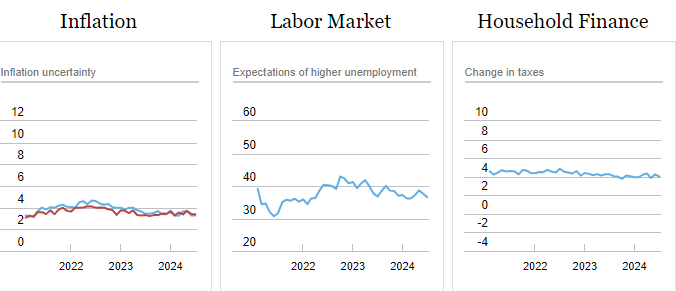

The July 2024 Survey of Consumer Expectations from the Federal Reserve Bank of New York revealed a mixed economic outlook with stable short- and long-term inflation expectations, a decline in medium-term expectations, and concerns about credit access and debt delinquency.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Mon Aug 12 2024

Valid 12Z Mon Aug 12 2024 – 12Z Wed Aug 14 2024…Unsettled weather with chances for scattered flash flooding and

damaging wind gusts stretches from the Intermountain West to the

Mid-Mississippi Valley……Dangerous heat builds across the Southern Plains and Gulf Coast this

week……Critical Fire Weather and poor air quality remains throughout parts of

the Great Basin and Northwest…An active August weather pattern is expected to continue through at least

midweek thanks in part to a stationary boundary stretching from the

Southeast to the central Plains and an upper-level trough moving from the

West Coast to the northern Rockies. Organized complexes of showers and

thunderstorms are forecast to ride along and just north of the stationary

front today from eastern Colorado to the Ozarks, with the main weather

hazard associated with intense rainfall rates and scattered flash

flooding. The heavy rainfall threat is then forecast to slide eastward

each day this week, centered over the Mid-Mississippi Valley on Tuesday

and Midwest by Wednesday. These areas coincide with a Slight Risk (level

2/4) of Excessive Rainfall. Additionally, some of the stronger storms will

have the potential to produce isolated hail and the potential for

localized damaging wind gusts. Thunderstorms will also develop throughout

parts of the Southwest, Intermountain West, and Rockies through Tuesday,

producing an isolated flash flood threat for these regions as well.For the Southeast, the lingering frontal boundary will produce another few

days with scattered thunderstorm chances overlapping with saturated ground

conditions, particularly over the eastern Carolinas. Urban corridors and

locations with poor drainage (even more degraded than usual due to recent

heavy rain and flooding associated with T.S. Debby) will be most at risk.

Residents and visitors are advised to have multiple ways of receiving

warnings and never drive into flooded roadways.While most of the country enjoys a break from the oppressive summer heat,

much of the southern Plains and Gulf Coast States will experience a

warming trend back to uncomfortable conditions this week. Widespread highs

into the upper 90s are forecast to stretch from the southern High Plains

to the Florida Panhandle, with triple digits possible over portions of the

Lone Star State. When combined with elevated humidity levels, heat indices

may reach up to around the 110 degree mark. Overnight temperatures will

not offer much relief as lows only dip into the upper 70s and low 80s.

This level of heat affects anyone without effective cooling and/or

adequate hydration as denoted by Major to Extreme HeatRisk stretching from

Oklahoma and Texas to the Gulf Coast and much of Florida by Wednesday.Gusty winds combined with dry terrain are forecast to create Critical Fire

Weather across parts of northwest Nevada today. Meanwhile, ongoing

wildfires will also continue to pump additional smoke into the atmosphere

and produce poor air quality for much of the region.

To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code.

Learn about wave patterns HERE.

Then, looking at the world and of course, the U.S. shows here also. Today we are looking at precipitation.

Please click on “Read More” below to access the full Daily Report issued today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sun Aug 11 2024

Valid 12Z Sun Aug 11 2024 – 12Z Tue Aug 13 2024…Scattered thunderstorms capable of containing locally heavy rainfall

are forecast across much of the Southwest, Intermountain West, and

Plains……Lingering flash flood potential exists across the coastal Carolinas

over the next few days……Sultry summer heat returns to much of the Southern Plains and central

Gulf Coast States this week…The weather pattern through early this week will feature daily chances for

thunderstorms from the Southwest and Intermountain West into the Plains,

as well as Florida and coastal sections of the Southeast. An upper level

low in southeast Canada will also provide scattered precipitation chances

to the Great Lakes and Northeast. Anomalous atmospheric moisture content

throughout the Southwest and Great Basin when combined with shortwaves

riding overtop of an upper ridge set up over the region will provide

enough coverage of thunderstorms to support the potential for scattered

flash flooding today from northwest Arizona to central Utah. Complex

terrain and the sensitive slot canyon region of Utah increase the threat

for flooding impacts. Additional chances for heavy rain extend to the

southern California ranges and the remainder of the Southwest and Four

Corners region over the next few days. Meanwhile, northwest flow aloft and

nearby frontal boundaries will help aid thunderstorm development across

the Great Plains. A few rounds of organized convection north of a warm

front forecast to stretch from Oklahoma to the lower Mississippi Valley

could lead to instances of flash flooding through tonight across parts of

eastern Oklahoma, southeast Kansas, southwest Missouri, and northwest

Arkansas. Localized downpours associated with thunderstorm activity are

also possible throughout the remainder of the central and northern Plains

today, with isolated severe storms a possibility for the central High

Plains into the Black Hills region. This unsettled weather pattern is

anticipated to remain in place early this week across the central United

States.A lingering frontal boundary draped across the Southeast will provide a

focus for additional thunderstorm activity over the next few days,

overlapping with saturated ground conditions from last week’s widespread

heavy rainfall. As a result, localized downpours could result in

additional flash flooding throughout the coastal Carolinas. Residents and

visitors are reminded to avoid driving through flooded roadways and to not

swim or play in floodwater.For much of the Nation, summer heat will be on hold to start the week as a

cooler weather pattern takes shape compared to previous weeks. However,

building heat will be felt throughout the southern Plains and Deep South

as highs soar back into the upper 90s and triple digits by Monday. When

combined with elevated humidity levels, afternoons will feel closer to

heat index values of 110 degrees in the lower Mississippi Valley and

immediate Gulf Coast. It is also worth noting that overnight temperatures

will not offer much relief as lows only dip into the upper 70s and low

80s. This level of heat could affect anyone without effective cooling

and/or hydration, so it is important to follow proper heat safety tips and

check on vulnerable individuals.Elsewhere, poor air quality due to ongoing wildfires throughout the

northern Great Basin is expected to continue. Upper level winds are

forecast to carry smoke eastward over parts of the Midwest, Ohio Valley,

and Mid-Atlantic, leading to hazy skies for some locations.To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code.

Learn about wave patterns HERE.

Then, looking at the world and of course, the U.S. shows here also. Today we are looking at precipitation.

Please click on “Read More” below to access the full Daily Report issued today.

One of the most impressive aspects of the Ukraine war has been how over 40 countries, led by NATO, have rallied together to offer military, financial, and humanitarian support to Ukraine since the Russian invasion in February 2022.

But one of the most disturbing aspects has been how fellow autocratic regimes, notably China, Iran, and North Korea, have been providing substantial support to Russia. Without this support, Russia’s war efforts would have most likely collapsed quite some time ago. This is just one example of how modern autocracies are joining forces against their “common enemies”, the group of capitalist democracies and the rules-based world order, according to Anne Applebaum’s new book, Autocracy, Inc.: The Dictators Who Want to Run the World.

From photo by Andrea De Santis on Unsplash.

The links lead to graphics that are very technical and IMO not too helpful but the links are HERE, and HERE (and this pertains to the Eastern Pacific).

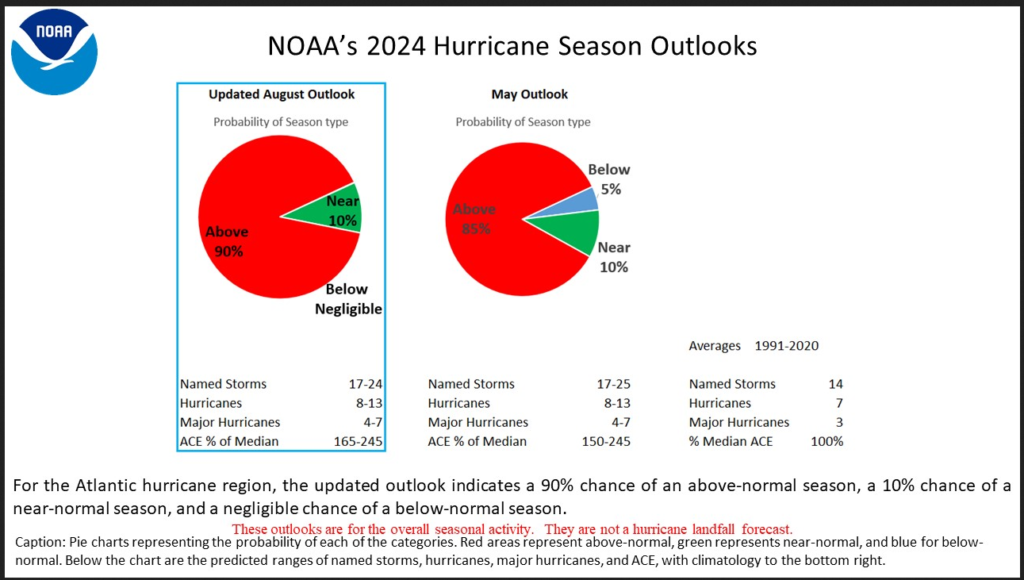

This is a good summary of the current Outlook compared to what was issued in May.

The above I believe just covers the Atlantic and is not much changed. They do not define the term ACE which is defined on the Colorado State Website as: “ACE is calculated by summing the square of the maximum sustained winds of each tropical cyclone (in knots) every six hours when the system is classified as either tropical or sub-tropical. The resulting value is then divided by 10,000. Details of the calculation are available on Wikipedia’s website:” It is generally accepted that the impact of wind increases with the square of the wind speed so this measure is to some extent logical. Notice how this year is expected to compare to the 1991-2020 average which is considered climatology.

I will now present to full NOAA Press Release. Any comments by me will be in a box or I will simply highlight in bold type what I consider to be important or insert my thoughts within brackets [ ].

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sat Aug 10 2024

Valid 12Z Sat Aug 10 2024 – 12Z Mon Aug 12 2024…Unsettled weather extends from the Southwest to the central U.S. over

the next few days, with chances for scattered flash flooding and severe

thunderstorms……Lingering heavy rain potential exists across the eastern Carolinas this

weekend……Above average temperatures continue across the West today before

confining to the southern Plains and Gulf Coast by early next week…The upper level pattern and anomalous atmospheric moisture content in

place across the Southwest and Plains will remain conducive for more

active weather through this weekend. Starting with the Southwest, Four

Corners, and southern/central Rockies, the main threat associated with

developing thunderstorms will be related to intense rainfall rates and

flash flooding. Uncertainty remains on where exactly the heaviest rainfall

will occur, but sensitive terrain and burn scars are most likely to see

impacts. This flash flooding threat also extends westward to the southern

California ranges through Sunday, where slow-moving thunderstorms over

complex terrain could lead to isolated flash flooding concerns. Shifting

to the central and southern Plains, convection is expected to become more

organized as a lingering frontal boundary provides a focus for heavy

rainfall potential from Oklahoma to southern Missouri. After an initial

round of storms over central Oklahoma tonight, another round of possibly

slow-moving convection is expected Sunday night from southeast KS and

northeast OK to the western Ozarks. Several inches of rainfall are

possible within a short period of time, which could lead to scattered

instances of flash flooding. Scattered thunderstorms are also forecast to

extend throughout much of the central and northern Plains, but quick

forward motions and lesser coverage should keep the flash flooding threat

localized. In addition to heavy rainfall, these storms could contain

isolated hail and damaging wind gusts.After recently getting doused by T.S. Debby with several days of tropical

downpours, the eastern Carolinas may see additional bouts of heavy

rainfall over the next few days as sufficient atmospheric moisture content

remain in place along a stalled frontal boundary. This stationary front

combined with diurnal sea breeze activity could spark numerous slow-moving

thunderstorms capable of containing intense rainfall rates. Given most

soils remain overly saturated across the Carolinas, the flash flooding

threat will remain slightly elevated. Residents and visitors are advised

to have multiple ways of receiving warnings and never drive through

flooded roadways.Temperatures throughout the Lower 48 into the beginning of next week will

feature widespread below average highs from the Plains to the Northeast

underneath broad high pressure, with forecast high temperatures in the 70s

and low 80s. Summer heat will remain confined to the Southern Tier,

including the Southwest today before a cooling trend commences. Meanwhile,

oppressive heat and humidity will continue and rebuild across the southern

Plains and Gulf Coast by Sunday and Monday as highs soar into the upper

90s and triple digits. This equates to around 10 degrees above the

climatological mean for mid-August, but forecast highs at the moment don’t

appear to threaten any daily records.Elsewhere, continued dry conditions and ongoing wildfires will continue to

produce elevated fire weather conditions and poor air quality across parts

of the Northwest and northern Great Basin. Little changes in the overall

weather pattern should maintain this environment.To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code.

Learn about wave patterns HERE.

Then, looking at the world and of course, the U.S. shows here also. Today we are looking at precipitation.

Please click on “Read More” below to access the full Daily Report issued today.

*Stock data, cryptocurrency, and commodity prices at the market closing.

The outlook for the U.S. economy is more mixed than three months ago, according to the Philadelphia Fed’s Third Quarter 2024 Survey of Professional Forecasters. The panelists predict GDP will grow at an annual rate of 1.9% this quarter, down from 2.0% in the previous survey. The forecasters also see higher unemployment rates across all horizons compared with the previous survey.

| Real GDP (%) | Unemployment Rate (%) | Payrolls (000s/month) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Previous | New | Previous | New | Previous | New | ||||

| Quarterly data: | |||||||||

| 2024:Q3 | 2.0 | 1.9 | 4.0 | 4.2 | 147.3 | 143.9 | |||

| 2024:Q4 | 1.5 | 1.7 | 4.0 | 4.3 | 129.7 | 125.4 | |||

| 2025:Q1 | 1.8 | 1.7 | 4.1 | 4.3 | 144.2 | 128.7 | |||

| 2025:Q2 | 2.0 | 1.8 | 4.1 | 4.3 | 108.7 | 116.2 | |||

| 2025:Q3 | N.A. | 2.2 | N.A. | 4.3 | N.A. | 145.8 | |||

| Annual data (projections are based on annual-average levels): | |||||||||

| 2024 | 2.5 | 2.6 | 3.9 | 4.1 | 212.6 | 210.1 | |||

| 2025 | 1.9 | 1.9 | 4.1 | 4.3 | 140.6 | 130.0 | |||

| 2026 | 1.9 | 2.3 | 4.1 | 4.2 | N.A. | N.A. | |||

| 2027 | 2.1 | 2.0 | 4.1 | 4.2 | N.A. | N.A. | |||

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.