- The Dow closed up 260 points or 0.62%,

- Nasdaq closed up 0.60%,

- S&P 500 closed up 0.40%, (Closed at 5,745, New Historic high 5,767)

- Gold $2,696 up $11.30,

- WTI crude oil settled at $67 down $2.39,

- 10-year U.S. Treasury 3.794 up 0.013 points,

- USD index $100.55 down $0.36,

- Bitcoin $64,793 up $1,687 or 2.67%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks rallied on Thursday, with the S&P 500 closing at a new record high. The positive momentum was driven by several key factors: The final US GDP growth report for Q2 exceeded expectations, while weekly jobless claims fell to their lowest level in four months. Micron Technology (MU) reported upbeat earnings, boosting the semiconductor sector: Micron stock: +15% PHLX Semiconductor Index (^SOX): +3.7%. Other chip stocks also gained: AMD +3.4%, Qualcomm +2.4%, Intel +1.3%. Chinese leaders announced plans to increase fiscal spending, address the property crisis, and support the stock market. This led to a significant jump in mainland Chinese stocks, with the CSI 300 (000300.SS) on track for its best week in a decade. Super Micro Computer (SMCI). The stock fell 12% following a Wall Street Journal report about a Department of Justice probe into the company, stemming from a recent Hindenburg Research short seller report. Despite the overall chip sector rally, Nvidia shares rose only 0.16%. However, this slight increase was enough to push the company back into the $3 trillion market cap club. Investors are now looking ahead to Friday’s release of the Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation metric.

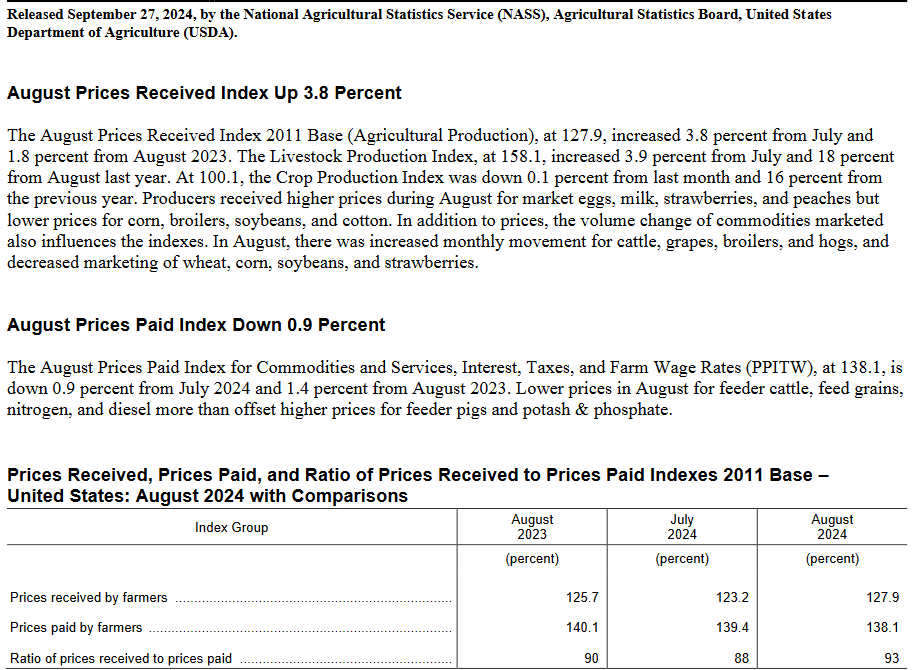

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in August 2024 are up 1.5% year-over-year (down 1.1% inflation adjusted) – and little changed from the previous month. Durable goods remains a drag on the economy.

Real gross domestic product (GDP) third estimate increased at an annual rate of 3.0% in the second quarter of 2024 unchanged from the second estimate. The implicit price index (inflation) was unchanged at 2.5% year-over-year (2.8% excluding food and energy). My projection is that GDP in 3Q2024 should be little changed from these numbers.

The median number of years that wage and salary workers had been with their current employer was 3.9 years in January 2024, down from 4.1 years in January 2022 and the lowest since January 2002. These are interesting numbers but have little impact on the economy.

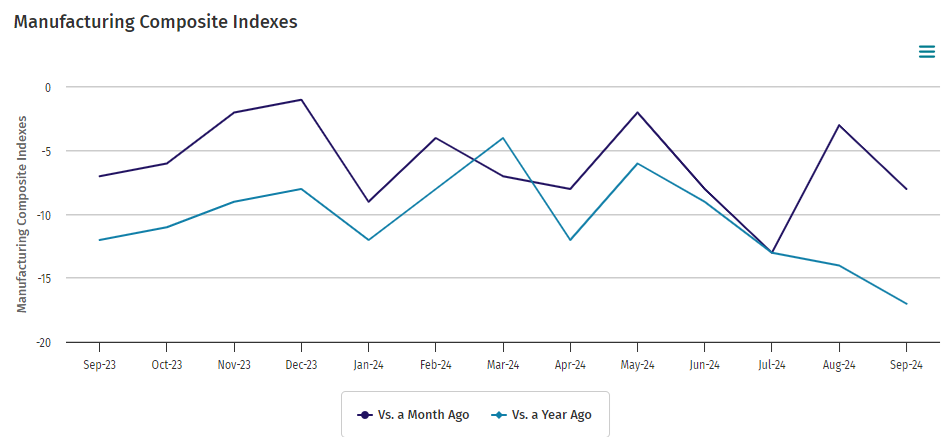

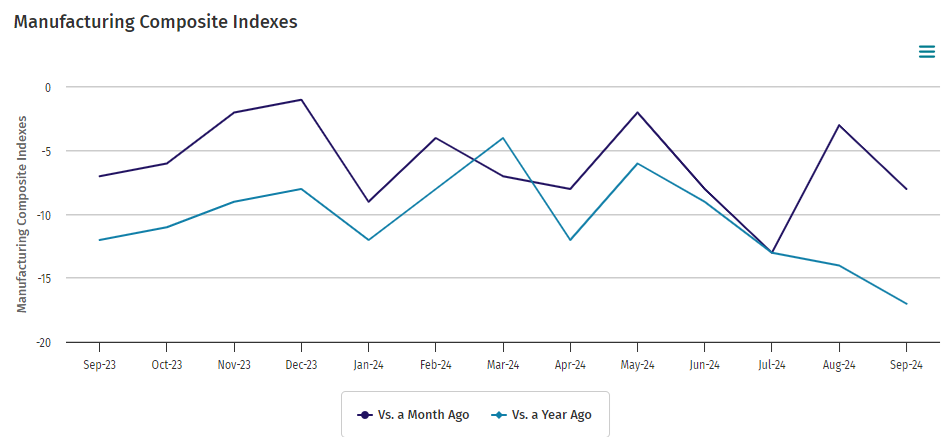

Kansas City Fed manufacturing activity declined moderately in September 2024. The month-over-month composite index was -8 in September, down from -3 in August and up from -13 in July. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing remains in a recession in the US.

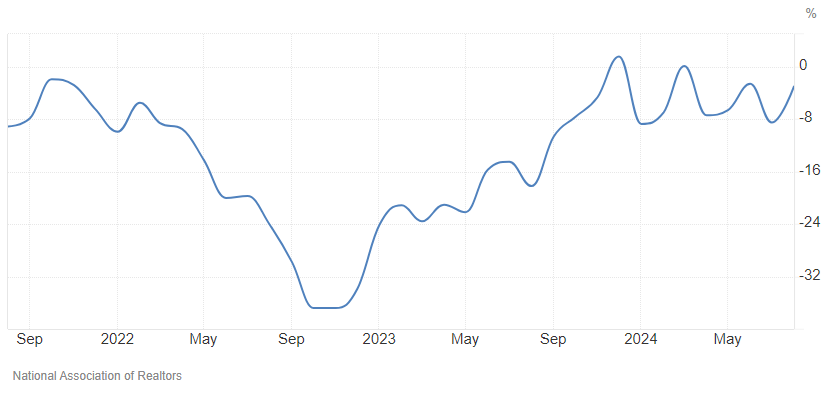

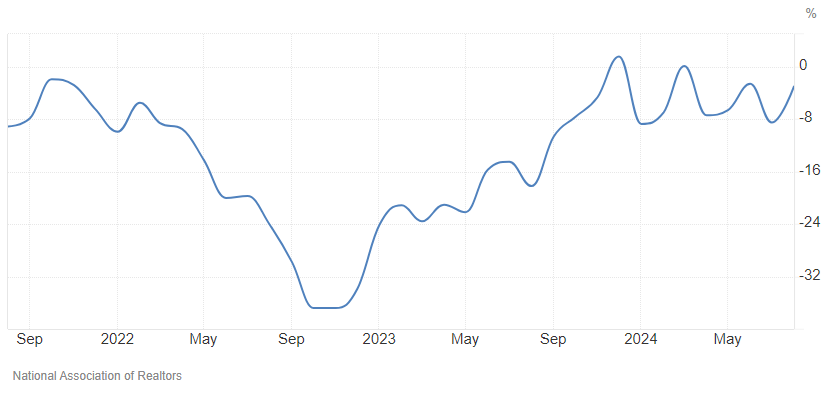

Pending home sales in August 2024 were down 3.0% year-over-year. I know everyone is thinking the federal funds rate will make houses more affordable – but house price appreciation will offset these gains. NAR Chief Economist Lawrence Yun added:

A slight upward turn reflects a modest improvement in housing affordability, primarily because mortgage rates descended to 6.5% in August. However, contract signings remain near cyclical lows even as home prices keep marching to new record highs.

In the week ending September 21, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 224,750, a decrease of 3,500 from the previous week’s revised average. The previous week’s average was revised up by 750 from 227,500 to 228,250. There is no indication of a recession or slowing economy in these numbers.

Here is a summary of headlines we are reading today:

- Ranking the World’s Financial Centers

- Russia Lowers Nuclear Threshold, Citing Western Threats

- Oil Plunges Over 2% on Rumor Saudis Ready To Increase Output

- Russia Could Scrap Gasoline Export Ban if Domestic Surplus Emerges

- The Fed slashed interest rates last week, but Treasury yields are rising. What’s going on?

- Dow jumps more than 250 points, S&P 500 closes higher to post fresh record: Live updates

- David Tepper says the Fed has to cut rates at least two or three more times to keep credibility

- Misinformation running rampant on Facebook has officials concerned about election disruptions

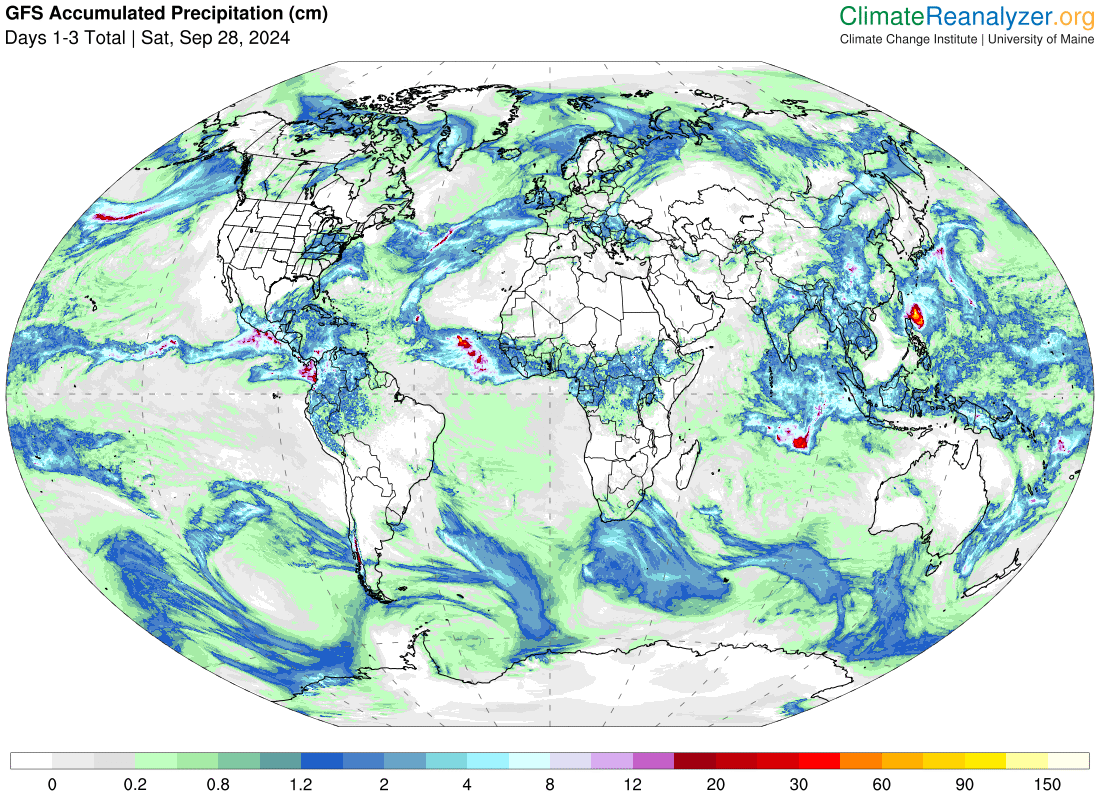

- Hurricane Helene is upgraded to a Category 3 as it barrels toward Florida

- Yield on 2-year Treasury logs biggest jump in five weeks after strong U.S. GDP report

- A port strike would be ill-timed, but disruption could boost these companies

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.