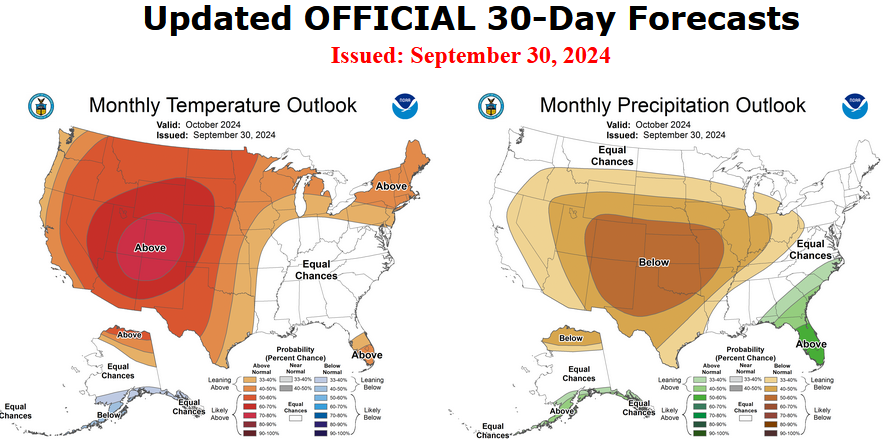

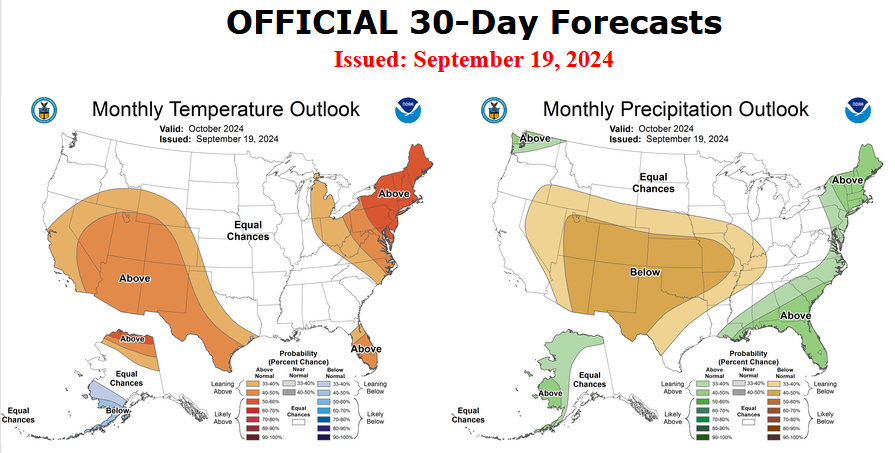

Weather Outlook for the U.S. for Today Through at Least 22 Days and a Six-Day Forecast for the World: posted October 2, 2024

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here after about 4 p.m. New York time but it is unlikely to have changed very much from the morning update. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Wed Oct 02 2024

Valid 12Z Wed Oct 02 2024 – 12Z Fri Oct 04 2024….There is a Marginal Risk of excessive rainfall over parts of the

Central Gulf Coast on Thursday……There is a Critical Risk of fire weather over parts of the Central High

Plains/Central Rockies on Wednesday……There are Excessive Heat Warnings and Heat Advisories over parts of

Southern California and the Southwest…A front extending from the Lower Great Lakes to the Central Appalachians

to the Central Gulf Coast moves eastward to the Northeast and dissipates.

On Wednesday, the front will produce light rain over parts of the Lower

Great Lakes, Central Appalachians, and Mid-Atlantic. The light rain will

end overnight Wednesday. In addition, showers and thunderstorms will

develop over parts of Florida through Friday.On Thursday, tropical moisture will start to build over the

Central/Eastern Gulf Coast and Florida. Upper-level energy over the

Western Gulf Coast and Northern Gulf of Mexico will move into parts of the

Southeast and Central Gulf Coast, producing moderate to heavy rain over

parts of the Central Gulf Coast. Therefore, the WPC has issued a Marginal

Risk (level 1/4) of excessive rainfall over parts of the Central Gulf

Coast from Thursday into Friday morning. The associated heavy rain will

create localized areas of flash flooding, affecting areas that experience

rapid runoff with heavy rain. Light rain and showers will also develop

over parts of the Southeast/southern Mid-Atlantic on Thursday into Friday.Meanwhile, a front extending from the Northern Plains to parts of the

Pacific Northwest will move eastward to the Great Lakes and southward to

the Central Plains by Thursday evening. As the boundary continues to move

eastward, light rain will develop over parts of the Middle Mississippi

Valley and expand into the Upper Great Lakes by Friday.Furthermore, down-slope flow over parts of the Northern/Central Rockies

will create warm air over parts of the Central Rockies, combined with

strong gust wind and dry fuels, which have prompted a Critical Risk of

fire weather over parts of the Central Rockies on Wednesday.Moreover, the upper-level ridge over the Four Corners Region will create

high temperatures over Southern California and the Southwest, ranging from

the upper 90s to 110s. Low temperatures will be in the upper 80s to low

90s, providing little relief from the heat overnight. The temperatures

have prompted Excessive Heat Warnings and Heat Advisories over parts of

Southern California and the Southwest.Record-breaking heat is expected across portions of the Southwest this

week. Moderate to major heat impacts are possible in areas near San

Francisco, Las Vegas, and Los Angeles. Extreme Heat Risk impacts are

forecast in Phoenix. Remember, Heat is the Deadliest Weather Phenomenon in

the U.S.! People spending more time outdoors or in a building without

cooling are at an increased risk of heat-related illness. Visit

www.weather.gov/safety/heat and check local media and government websites

for information on cooling centers.

To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code.