- The Dow closed up 410 points or 0.97%, (Closed at 42,864, New Historic high 42,900)

- Nasdaq closed up 61 points or 0.33%,

- S&P 500 closed up 35 points or 0.61%, (Closed at 5,815, New Historic high 5,822)

- Gold $2,673 up $34.20 or 1.28%,

- WTI crude oil settled at $76 down $0.27 or 0.34%,

- 10-year U.S. Treasury 4.088 up 0.006 points or 0.051%,

- USD index $102.94 down $0.05 or 0.05%,

- Bitcoin $62,955 up $2,696 or 4.49%,

- Baker Hughes Rig Count: U.S. +1 to 586 Canada -4 to 219

U.S. Rig Count is up 1 from last week to 586 with oil rigs up 2 to 481, gas rigs down 1 to 101 and miscellaneous rigs unchanged at 4.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

JPMorgan Chase and other major U.S. banks kicked off the Q3 2024 earnings season on Friday, helping push the Dow Jones Industrial Average and S&P 500 to new record highs. The Dow rose to a new all-time high. The S&P 500 closed above 5,800 for the first time. All three major indexes finished the week with gains of over 1%. JPMorgan Chase reported better-than-expected Q3 results, with earnings of $4.37 per share beating estimates of $4.021. The bank’s revenue grew to $42.65 billion, surpassing analyst expectations of $40.85 billion. JPMorgan’s shares rose nearly 5% following the earnings release. Wells Fargo also reported strong Q3 results, contributing to the positive sentiment in the financial sector. Investors are weighing recent economic data and its potential impact on Federal Reserve policy: A hot inflation print earlier in the week raised questions about the Fed’s next moves. Wholesale inflation remained unchanged, adding to the complex economic picture. The market is closely watching for signs of how the Fed’s potential rate cuts might affect bank lending margins and profits. Earnings season will continue next week with reports from major companies like Citigroup, United Airlines, ASML, Netflix, and American Express. Investors will be focusing on company forecasts and any early indications of improvement given the lower rate environment.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

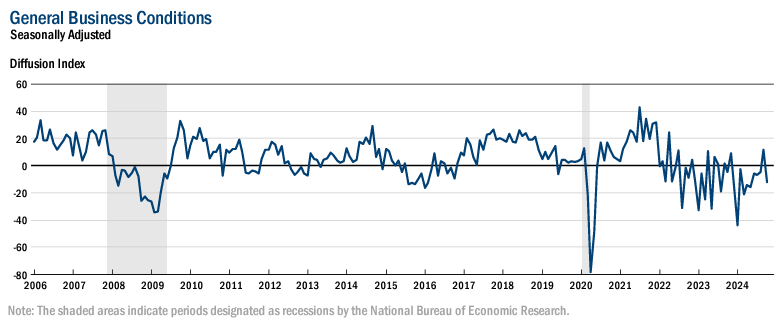

The Producer Price Index (PPI) declined from 1.9% year-over-year to 1.8% year-over-year. The good news is that there is now disinflation in goods production but growing inflation in services. I cannot believe the spin on this data. Some say the Consumer Price Index (CPI) came in hot but the PPI came in supporting the notion that inflation was moderating. Folks, the opposite is true. To get a handle of the underlying pressures on an inflation index is to remove food and energy. For the CPI, if food and energy are excluded inflation remains little changed at 3.3% year-over-year. For the PPI, if food and energy are excluded inflation increased from 2.7% year-over-year to 2.8% (see red line on graph below). Everywhere I look – there are inflationary pressures present.

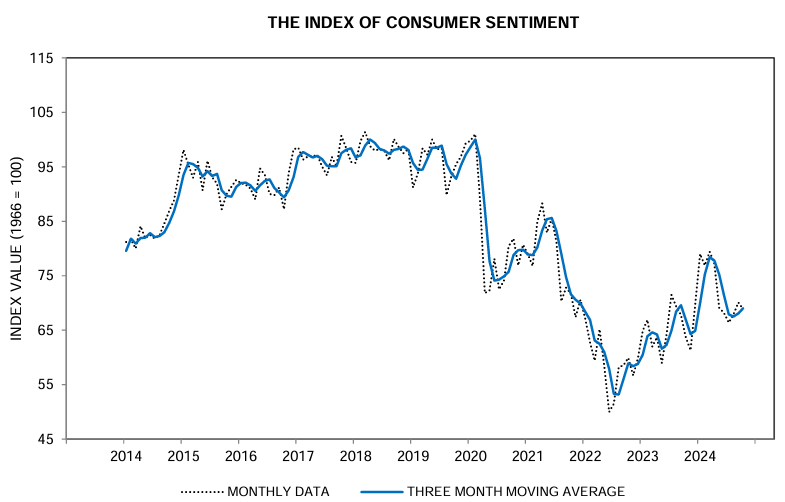

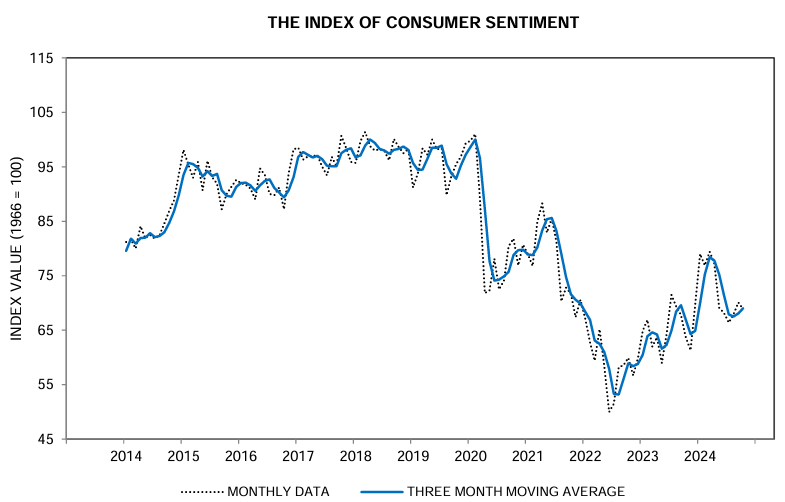

The University of Michigan’s consumer sentiment index decreased from 70.1 in September to 68.9 in October, a drop of 1.2 points. Despite the minor dip, consumer sentiment remains 8% higher than a year ago and nearly 40% above its lowest point in June 2022. This indicates a general trend of improvement in consumer outlook over the past year. Consumers continue to express frustration over high prices, even though inflation expectations have eased significantly since June 2022. The year-ahead inflation expectation rose slightly to 2.9% in October from 2.7% in September.

Here is a summary of headlines we are reading today:

- U.S. Oil Drilling Activity Inches Up

- Tripling Renewable Energy Capacity by 2030 Will Require $1.5 Trillion Per Year

- Will Tesla’s Cybercab Revolutionize Transportation? Analysts Weigh In

- Spanish Power Giant Iberdrola Doubles UK Investment to $31 Billion

- China Starts Tracking Ship Emissions Data

- Geopolitical Risk and Hurricane Milton Push Oil Prices Toward a Weekly Gain

- The Federal Reserve may have pretty much just hit its 2% inflation target

- Dow jumps 400 points to a record on Friday, S&P 500 closes above 5,800 for the first time: Live updates

- Jamie Dimon says geopolitical risks are surging: ‘Conditions are treacherous and getting worse’

- Stock market next week: Earnings season ramps up with more big bank results

- Bitcoin bounces back to $62,000 as economic outlook remains in focus: CNBC Crypto World

- Nation’s Largest Generic Drug Maker To Pay $450 Million To Resolve Kickback, Price-Fixing Claims

- 2-year Treasury yield ends at lowest level in a week after flat producer-price report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.