24 OCT 2024 Market Close & Major Financial Headlines: The Dow Records The Fourth Session Decline While The Small Caps And Bitcoin Reclaim Some Weekly Losses

Summary Of the Markets Today:

- The Dow closed down 141 points or 0.33%,

- Nasdaq closed up 139 points or 0.76%,

- S&P 500 closed up 12 points or 0.21%,

- Gold $2,749 up $19.10 or 0.07%,

- WTI crude oil settled at $71 down $0.26 or 0.35%,

- 10-year U.S. Treasury 4.210 up 0.032 points or 0.258%,

- USD index $104.02 down $0.41 or 0.39%,

- Bitcoin $68,144 up $1,894 or 2.78%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The Nasdaq Composite gained, led by Tesla’s strong performance. The S&P 500 closed up while the Dow Jones Industrial Average fell extending losses from the previous day. Tesla reported its biggest quarterly profit in over a year. Tesla shares surged more than 20%, its best day in over a decade. CEO Elon Musk forecasted 20% to 30% EV sales growth next year. The company grew adjusted EBITDA margins for the first time in over a year. IBM shares fell over 6% following a third-quarter revenue miss. Boeing shares sagged around 1% after striking workers rejected a pay deal.

Click here to read our current Economic Forecast – October 2024 Economic Forecast: One More Recession Flag Removed Yet Little Headway On Inflation

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Sales of new single-family houses in September 2024 were up 6.3% above September 2023. The median sales price of new houses sold in September 2024 was $426,300. The average sales price was $501,000. The seasonally-adjusted estimate of new houses for sale at the end of September was 470,000. This represents a supply of 7.6 months at the current sales rate. New home construction is one of the bright spots in the economy.

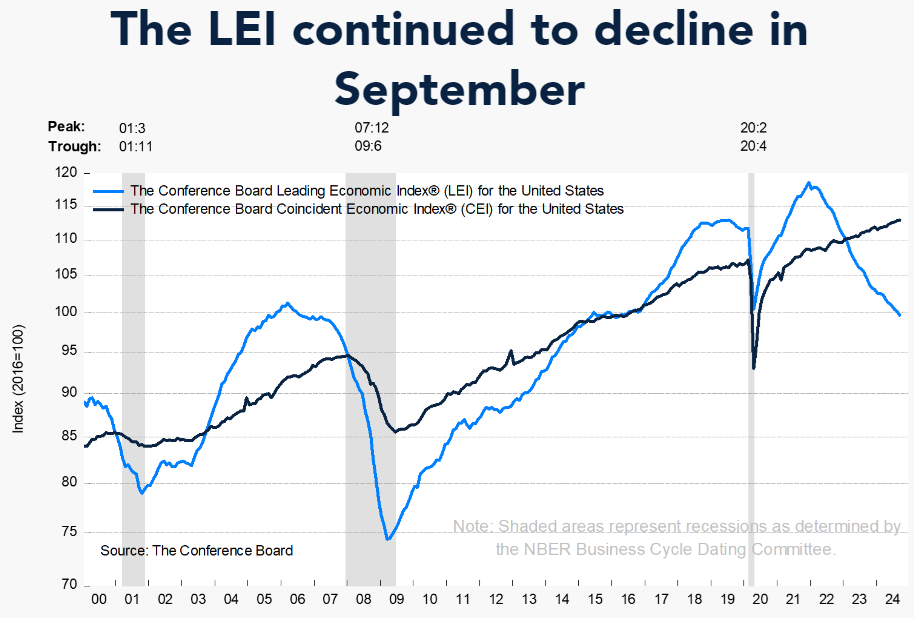

The Chicago Fed National Activity Index (CFNAI ) three-month moving average, CFNAI-MA3, decreased to –0.19 in September from –0.14 in August. A zero value for the CFNAI has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth. The CFNAI is my favorite coincident indicator, and shows a continuing weak economy.

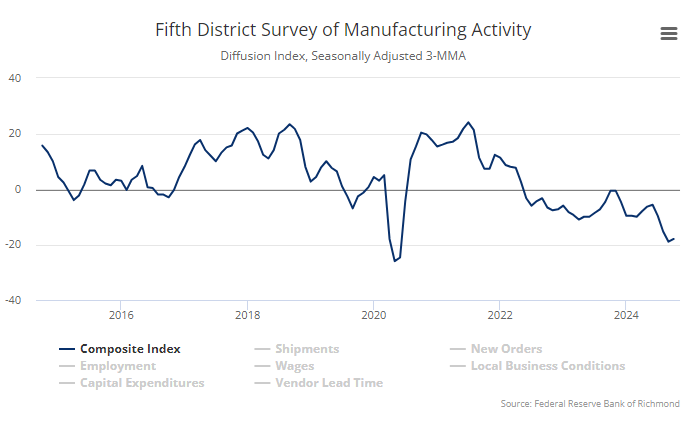

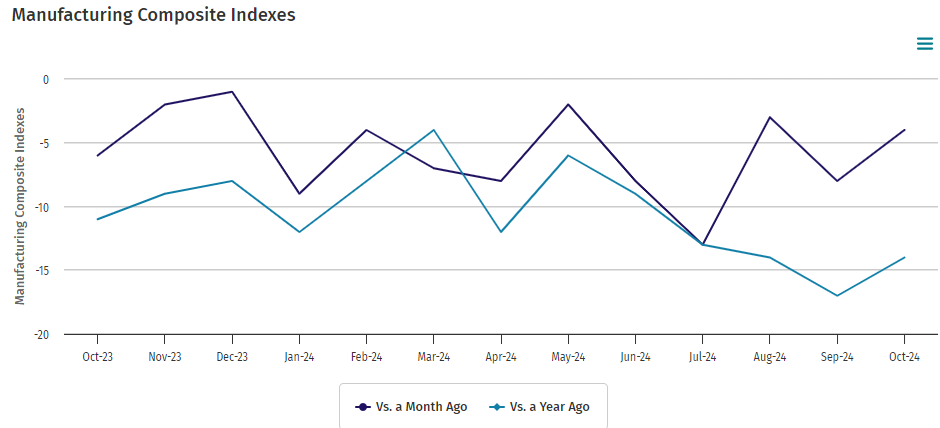

Kansas Fed manufacturing activity declined modestly in October 2024. The month-over-month composite index was -4, up from -8 in September. Manufacturing remains in a recession in the US.

In the week ending October 19, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 238,500, an increase of 2,000 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,250 to 236,500. There is no sign of a recession in this data.

Here is a summary of headlines we are reading today:

- Valero Could Be Next To Shutter California Oil Refineries

- Mckinsey: Europe’s Data Center Power Demand To Triple By 2030

- Russia’s Advance Threatens to Cripple Ukraine’s Steel Industry

- Saudi Oil Export Revenues Hit Three-Year Low as Prices Decline

- Tesla Stock Soars After Q3 Earnings Beat

- China’s Coal Imports Could Decline in 2025

- Tesla stock soars 20%, heads for best day in over a decade on Musk’s 2025 growth projection

- S&P 500 rises to end three-day losing run, lifted by surge in Tesla: Live updates

- U.S. will be ‘more pro-crypto’ after this election, no matter who wins, says Ripple CEO Garlinghouse

- Bitcoin eyes $68,000 as it reclaims some weekly losses: CNBC Crypto World

- Hezbollah Targets Tel Aviv With Large Iranian Missiles Launched From Underground Silos

- Why stock investors have been on edge over the prospects of a total sweep for Republicans

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.