19May2022 Market Close & Major Financial Headlines: S&P 500 Approaches Bear Territory Again, Stagflation Fears Drive Three Major Indexes Into The Red, Markets Sea-Sawed Across Unchanged Line In Today’s Volatile Session

Summary Of the Markets Today:

- The Dow closed down 0.75% -237 points,

- Nasdaq closed down 0.26%,

- S&P 500 closed down 0.58%,

- WTI crude oil settled at 111.22, up 1.82%,

- USD $102.81 down 1.05%,

- Gold 1842 down 0.03%,

- Bitcoin down 0.13% to $30048,

- 10-year U.S. Treasury down 0.031% / 2.853%

Today’s Economic Releases:

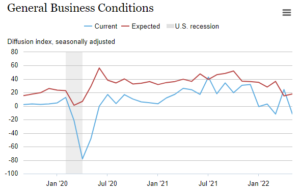

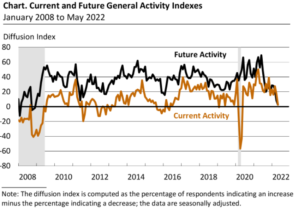

Philadelphia Fed’s May 2022 Manufacturing Index remained in expansion but fell to the lowest level in two years.

According to executive coaching firm Challenger, Gray & Christmas, Inc., the rate of job seekers who started their own businesses in the first quarter of 2022 hit the highest rate since the first quarter of 2019.

For week ending 14 May 2022, the 4 week rolling average for initial unemployment claims continues to modestly worsen.

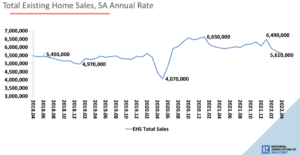

April 2022 existing home sales declined for the third straight month – and down 5.9% from one year ago. Per Lawrence Yun, NAR’s chief economist:

Higher home prices and sharply higher mortgage rates have reduced buyer activity. It looks like more declines are imminent in the upcoming months, and we’ll likely return to the pre-pandemic home sales activity after the remarkable surge over the past two years.

A summary of headlines we are reading today:

- Here’s what Walmart, Target, Home Depot and Lowe’s tell us about the state of the American consumer

- Earth’s oceans have reached the hottest and most acidic levels on record, UN says

- Gas prices have now topped $4 in ALL 50 STATES for the first time in history

- Gas prices just hit a new record high. Here are a few ways to cut down the cost

- Bitcoin, Bonds, & Bullion Jump As Dollar Dumps After Dismal Data

- Goldman Is Quietly Handing Out A “Recession Manual” To Clients

These and other headlines and news summaries moving the markets today are included below.