15June2022 Market Close & Major Financial Headlines: Wall Street Ends In The Green After Fed announced its largest rate hike in 28 years, Dow Snaps Five-Day Slide In Volatile Trading, Crude Falls Sharply After Fed Rate Increase

Summary Of the Markets Today:

- The Dow closed up 304 points or 1.00%,

- Nasdaq closed up 2.50%,

- S&P 500 closed up 1.46%,

- WTI crude oil settled at 116, down 2.73%,

- USD $104.88 down 0.56%,

- Gold 1831 up 0.90%,

- Bitcoin $21676 down 2.72% – Session Low 20113,

- 10-year U.S. Treasury down 0.167% / 3.314%

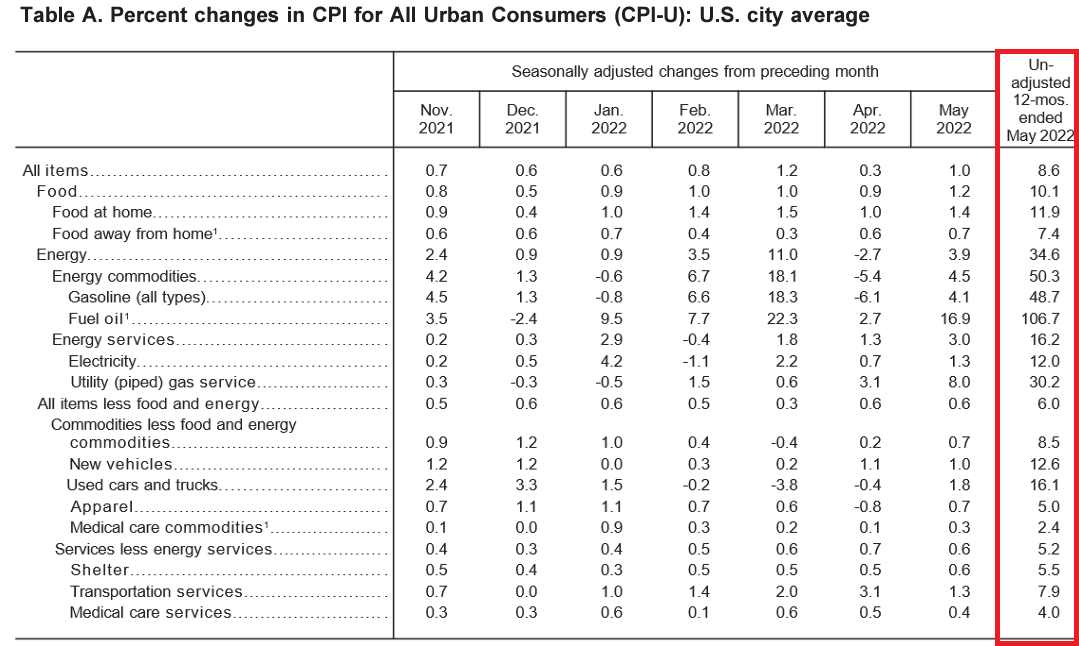

Today’s Economic Releases:

The Federal Reserve must believe inflation is overwhelming the economy as they voted today to raise the federal funds rate by 3/4% (the market expected the rate to raise 1/2%). This is the largest increase since 1994. Part of the FOMC statement:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1‑1/2 to 1-3/4 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

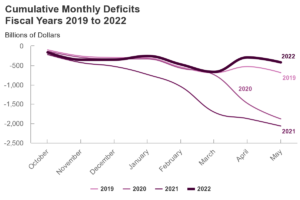

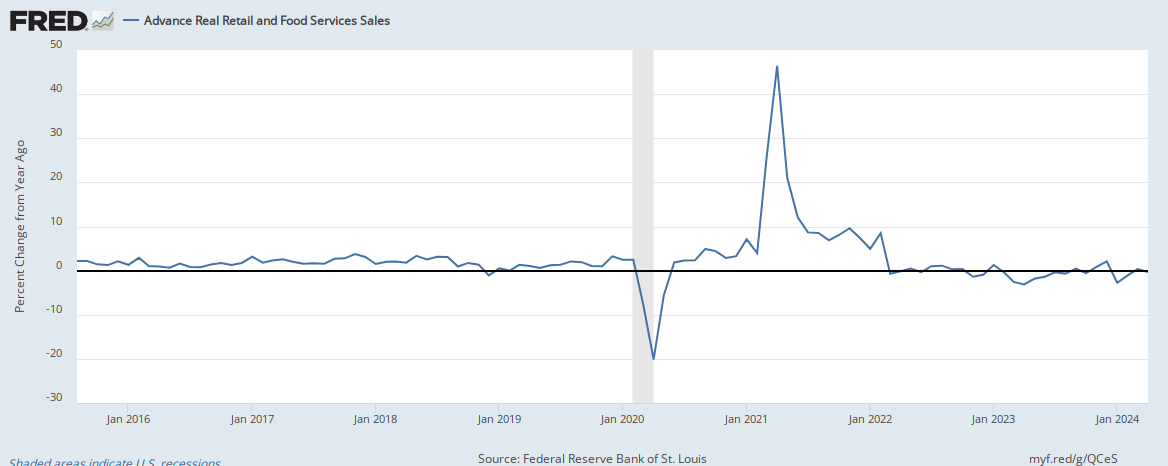

Advance real (inflation-adjusted) retail and food services sales declined 0.4% year-over-year in May 2022 – and remains in a contraction trend since March 2022. Much of the reason for the contraction is that the data is being compared to a surge period of retail sales following the opening of the economy after the COVID lockdown. Having said that, surges normally happen after recessions – but three months of contraction could be considered a recession flag. At a minimum, it is a signal of a weak economy.

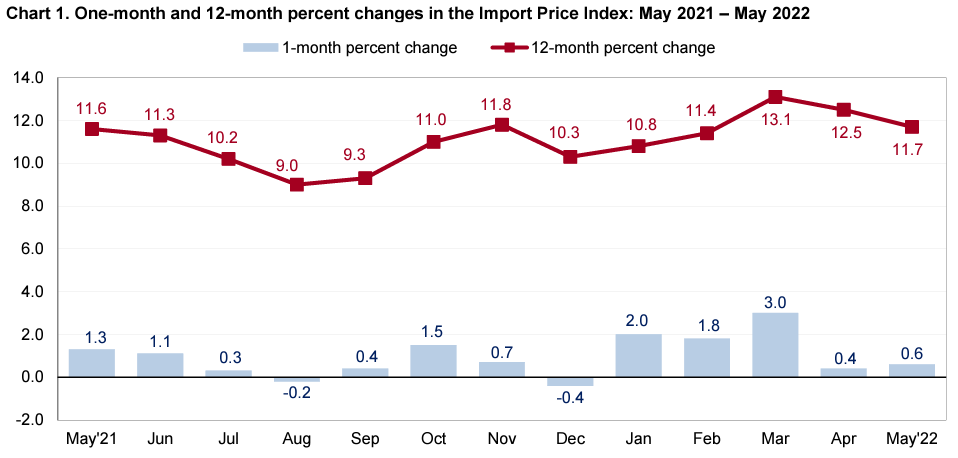

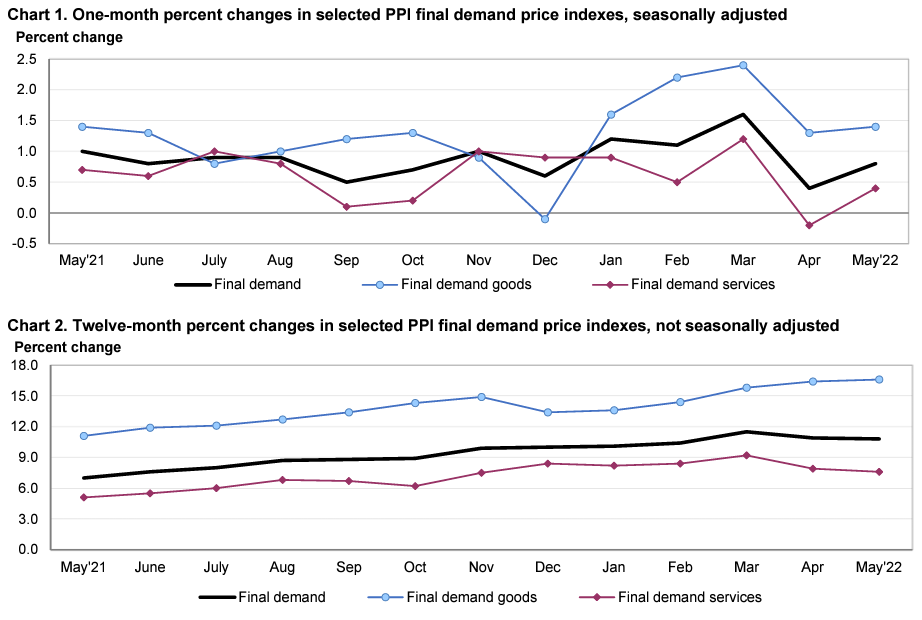

Import prices continued to moderate year-over-year in May 2022 but remains in the range seen since May 2021.

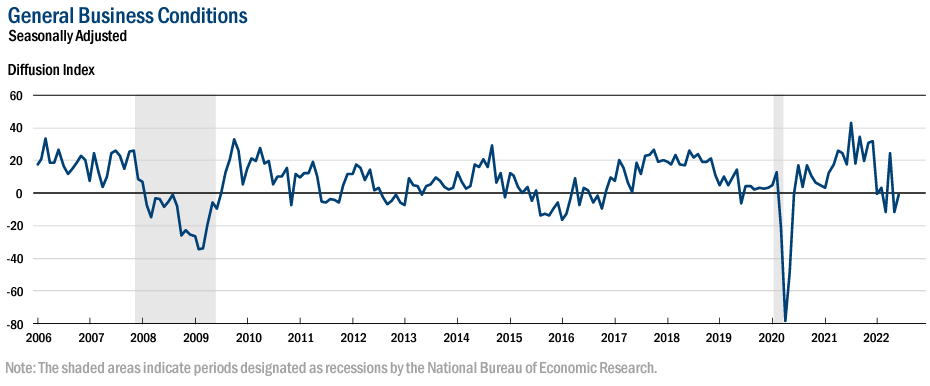

The New York Fed’s June 2022 Empire State Manufacturing Survey remained in contraction for the second consecutive month.

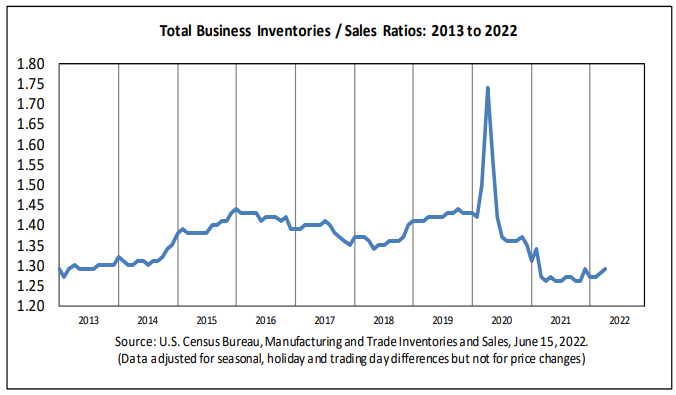

Business sales-to-inventory ratios continued their modest upward trend in April 2022 – but remain within their historical range for times of economic expansion.

The number of changes of CEOs has increased 52% from May 2021. Per Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.:

The CEO exodus continues. Economic conditions, rising inflation, and recession concerns are making boards rethink leadership and leaders rethink if they want to take on these challenges. The ready capital that was available to Tech companies the last few years is starting to slow, and job cuts are following. Generally, new leaders are brought in during a period of uncertainty. Former leaders often remain with the company for a period of time, either as a consultant or continue as a Board Member or Chair to maintain institutional knowledge and have the appearance of a seamless transition.

A summary of headlines we are reading today:

- Oil Prices Fall On Biggest Fed Rate Hike Since 1994

- Dr. Anthony Fauci tests positive for Covid, is having mild symptoms

- U.S. safety agency says Tesla accounts for most driver-assist crashes, but warns data lacks context

- Millionaires are raising cash on fears that the Fed can’t tame inflation and stave off recession

- Stocks, Bonds, & Bullion Rally After Powell’s Perjury-Prone Presser

- US makes biggest interest rate rise in almost 30 years

- Bond Report: 2-year Treasury yield has biggest one-day drop in two years after Fed projections point to a pullback in interest rates in 2024

These and other headlines and news summaries moving the markets today are included below.