Summary Of the Markets Today:

- The Dow closed up 304 points or 1.00%,

- Nasdaq closed up 2.50%,

- S&P 500 closed up 1.46%,

- WTI crude oil settled at 116, down 2.73%,

- USD $104.88 down 0.56%,

- Gold 1831 up 0.90%,

- Bitcoin $21676 down 2.72% – Session Low 20113,

- 10-year U.S. Treasury down 0.167% / 3.314%

Today’s Economic Releases:

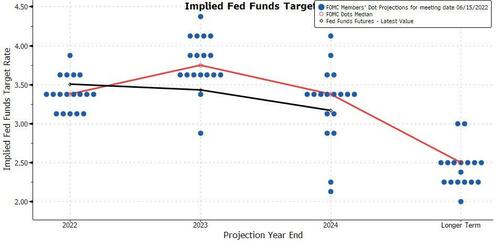

The Federal Reserve must believe inflation is overwhelming the economy as they voted today to raise the federal funds rate by 3/4% (the market expected the rate to raise 1/2%). This is the largest increase since 1994. Part of the FOMC statement:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1‑1/2 to 1-3/4 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

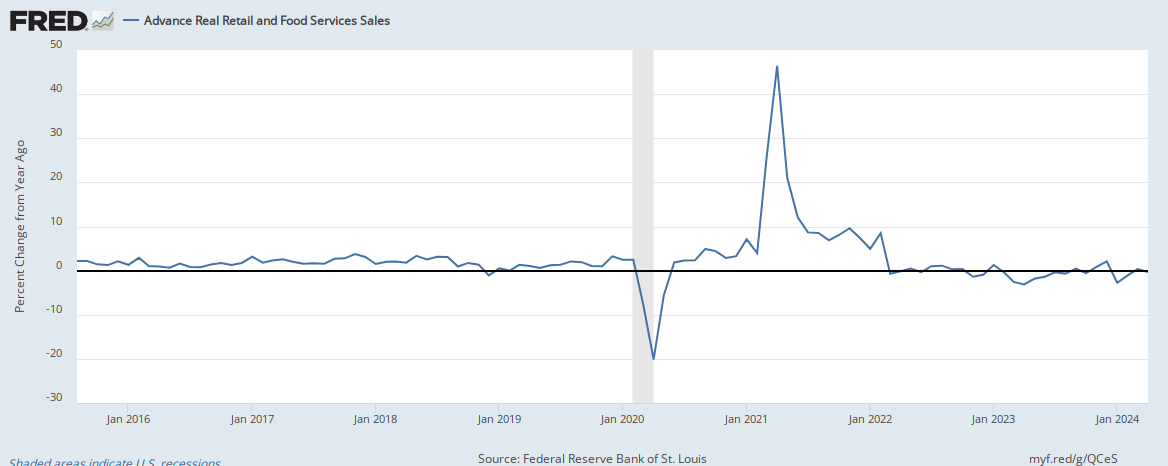

Advance real (inflation-adjusted) retail and food services sales declined 0.4% year-over-year in May 2022 – and remains in a contraction trend since March 2022. Much of the reason for the contraction is that the data is being compared to a surge period of retail sales following the opening of the economy after the COVID lockdown. Having said that, surges normally happen after recessions – but three months of contraction could be considered a recession flag. At a minimum, it is a signal of a weak economy.

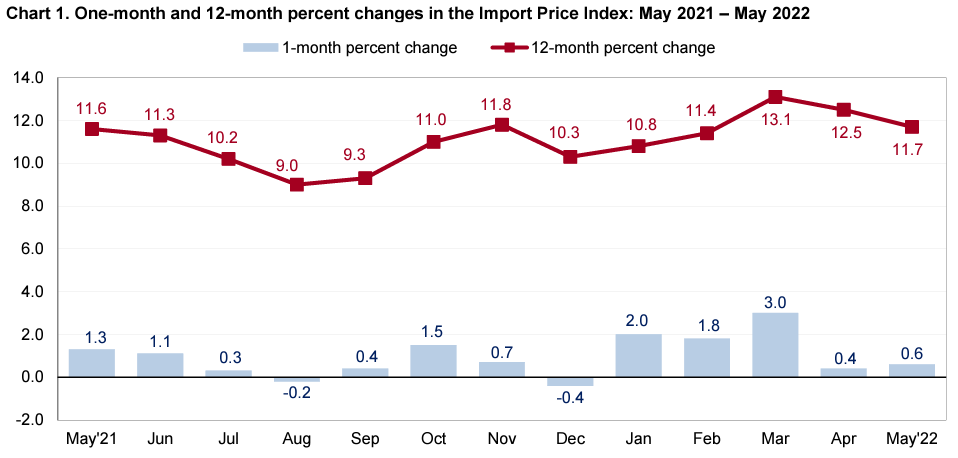

Import prices continued to moderate year-over-year in May 2022 but remains in the range seen since May 2021.

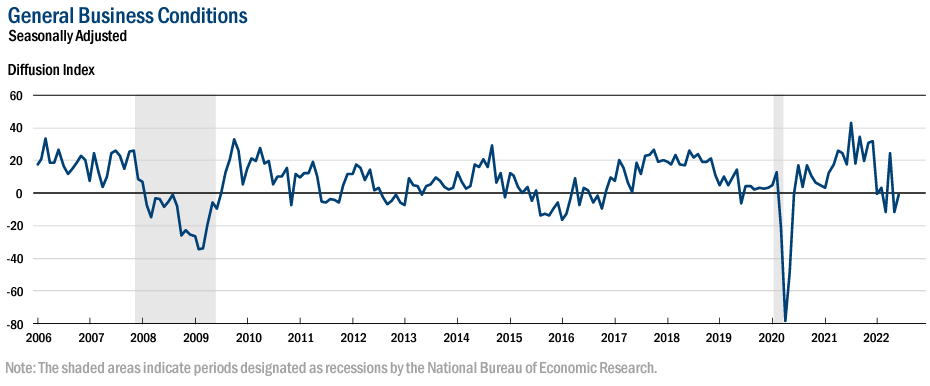

The New York Fed’s June 2022 Empire State Manufacturing Survey remained in contraction for the second consecutive month.

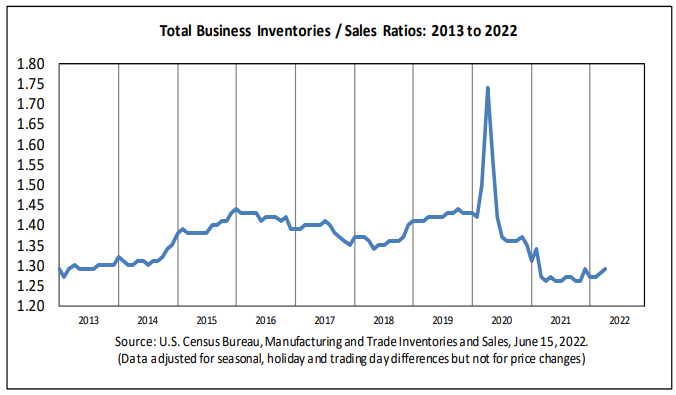

Business sales-to-inventory ratios continued their modest upward trend in April 2022 – but remain within their historical range for times of economic expansion.

The number of changes of CEOs has increased 52% from May 2021. Per Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.:

The CEO exodus continues. Economic conditions, rising inflation, and recession concerns are making boards rethink leadership and leaders rethink if they want to take on these challenges. The ready capital that was available to Tech companies the last few years is starting to slow, and job cuts are following. Generally, new leaders are brought in during a period of uncertainty. Former leaders often remain with the company for a period of time, either as a consultant or continue as a Board Member or Chair to maintain institutional knowledge and have the appearance of a seamless transition.

A summary of headlines we are reading today:

- Oil Prices Fall On Biggest Fed Rate Hike Since 1994

- Dr. Anthony Fauci tests positive for Covid, is having mild symptoms

- U.S. safety agency says Tesla accounts for most driver-assist crashes, but warns data lacks context

- Millionaires are raising cash on fears that the Fed can’t tame inflation and stave off recession

- Stocks, Bonds, & Bullion Rally After Powell’s Perjury-Prone Presser

- US makes biggest interest rate rise in almost 30 years

- Bond Report: 2-year Treasury yield has biggest one-day drop in two years after Fed projections point to a pullback in interest rates in 2024

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

California Can’t Kick Its Fossil Fuel AddictionCalifornia has long touted its reputation as a green pioneer in the U.S. Its lawmakers and regulators have significantly restricted oil exploration in recent years and have increased efforts to decarbonize and introduce renewables to the state. However, recent accusations around California’s leaking methane, legislator donations from Big Oil, and the state’s ongoing backing of natural gas have made many question the merit of its status as a clean energy state. California has announced several plans to curb its oil operations in Read more at: https://oilprice.com/Energy/Energy-General/California-Cant-Kick-Its-Fossil-Fuel-Addiction.html |

|

John Kerry: Green Transition Will Be Bigger Than The Industrial RevolutionThere are two major arguments for large-scale investment in a global clean energy transition. Number one, we really have no choice; like it or not, the warming climate is going to make the planet increasingly uninhabitable for humans in the near future if we don’t decarbonize the global economy in a hurry. Number two, it’s going to make a lot of people a lot of money. This is the largest market the world has ever been staring at: the energy transition market, Special Presidential Envoy for Climate John Kerry said Read more at: https://oilprice.com/Energy/Energy-General/John-Kerry-Green-Transition-Will-Be-Bigger-Than-The-Industrial-Revolution.html |

|

Oil Prices Fall On Biggest Fed Rate Hike Since 1994In its largest hike since 1994, the Federal Reserve raised rates by three-quarters of a percentage point, or 75 basis points, with oil prices responding by drawing down just under 1%. Wall Street had largely anticipated a 75-basis point hike, and oil prices were down 1% on Wednesday, ahead of the Fed meeting, regaining some ground by the time of the rate hike announcement. At 2:13 p.m. EST, just minutes after the Fed release, Brent was trading down 0.62% on the day, at $120.42. WTI was trading at $118.10, down 0.70%. The Fed also signaled Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Fall-On-Biggest-Fed-Rate-Hike-Since-1994.html |

|

IEA: Fuel Crunch To Persist Despite Solid Refining RecoveryFuel markets, especially those of diesel and kerosene, may continue to be very tight amid uneven global demand growth rates and limits in the refining capacity, the International Energy Agency (IEA) said on Wednesday. After the maintenance season at refineries across the U.S., Europe, and Asia ends, refining activity is set for a solid recovery across the board as demand is robust with the summer travel season, the IEA said in its Oil Market Report for June. Refining capacity globally is also set to increase this year and next, but not fully offsetting Read more at: https://oilprice.com/Latest-Energy-News/World-News/IEA-Fuel-Crunch-To-Persist-Despite-Solid-Refining-Recovery.html |

|

Steel Prices Are SlidingU.S. steel prices continue to retreat. After consistent week-over-week declines, HRC prices now sit more than 15% beneath their late-April peak while plate prices continue to trade sideways as they remain just 6% beneath their all-time high. The Raw Steels Monthly Metals Index (MMI) fell by 7.87% from May to June. U.S. Manufacturing PMI climbed, and Consumer sentiment plummeted The U.S. ISM Manufacturing PMI reached 56.1% in May. While the index climbed from April’s reading of 55.4, it marks the second-lowest reading since September of 2020. Read more at: https://oilprice.com/Metals/Commodities/Steel-Prices-Are-Sliding.html |

|

Total Energies Is Betting Big On Green Hydrogen In IndiaTotal Energies takes stake in Indian renewable specialist to back giant green hydrogen project. Green hydrogen is produced by splitting water into hydrogen and oxygen using renewable electricity in contrast to blue hydrogen which relies on natural gas. The development plans come amid a flurry of green investment activity in India, with the country’s government incentivizing spending plans on renewable projects. Alongside Adani Enterprises, giants such as Reliance Industries and Indian Oil Corp have also pledged to invest billions Read more at: https://oilprice.com/Latest-Energy-News/World-News/Total-Energies-Is-Betting-Big-On-Green-Hydrogen-In-India.html |

|

Netflix’s binge-release model is under new scrutiny as the streaming giant strugglesNetflix disrupted traditional TV by releasing entire seasons of shows all at once. Now, the model is under scrutiny as the streamer deals with big losses. Read more at: https://www.cnbc.com/2022/06/15/will-netflix-stop-binge-releases-experts-weigh-in.html |

|

GM investing $81M to hand-build ultra-exclusive Cadillac Celestiq electric carsThe decision marks the first time GM will build a vehicle for commercial sales at its massive tech campus in Warren, Michigan. Read more at: https://www.cnbc.com/2022/06/15/gm-investing-81m-to-hand-build-luxury-cadillac-celestiq-electric-cars.html |

|

Covid vaccines for kids under 5 move closer to FDA authorization after committee backs shotsThe FDA will likely accept the recommendation and authorize the shots this week. Read more at: https://www.cnbc.com/2022/06/15/covid-shots-for-kids-under-5-move-closer-to-fda-authorization-after-committee-backs-shots.html |

|

Dr. Anthony Fauci tests positive for Covid, is having mild symptomsDr. Anthony Fauci has not been in recent close contact with President Joe Biden. Fauci is the the U.S. government’s leader in coronavirus pandemic response. Read more at: https://www.cnbc.com/2022/06/15/dr-fauci-tests-positive-for-covid-is-having-mild-symptoms.html |

|

Nearly two-thirds of millennial millionaires believe U.S. economy will be stronger by end of 2022, CNBC survey findsMost millennial millionaires feel optimistic about the economy, according to the latest CNBC Millionaire Survey. Read more at: https://www.cnbc.com/2022/06/15/most-millennial-millionaires-believe-economy-will-improve-by-year-end.html |

|

Here are 5 Investing Club stocks in the news and our take on what’s happeningWe break down five developments involving our stocks including Apple, Qualcomm and Eli Lilly. Read more at: https://www.cnbc.com/2022/06/15/investing-club-here-are-headlines-around-5-stocks-in-the-portfolio-and-our-club-take-on-the-news.html |

|

Here’s what changed in the new Fed statementThis is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting on May 4. Read more at: https://www.cnbc.com/2022/06/15/heres-what-changed-in-the-new-fed-statement.html |

|

These could be the next hot food and drink trendsThe Summer Fancy Food Show returned for the first time since 2019. It has gained a reputation for being the place to spot the next big flavors and foods. Read more at: https://www.cnbc.com/2022/06/15/these-could-be-the-next-hot-food-and-drink-trends.html |

|

Mortgage demand is now roughly half of what it was a year ago, as interest rates move even higherSharply rising interest rates are decimating refinance volume, and those rates, along with sky-high home prices, are hitting demand from buyers. Read more at: https://www.cnbc.com/2022/06/15/mortgage-demand-is-now-roughly-half-of-what-it-was-a-year-ago-as-interest-rates-move-even-higher.html |

|

U.S. safety agency says Tesla accounts for most driver-assist crashes, but warns data lacks contextFederal safety officials stressed that the data is not meant to portray whether one advanced driver-assist system is safer than another. Read more at: https://www.cnbc.com/2022/06/15/data-shows-tesla-accounts-for-most-reported-driver-assist-crashes-but-officials-warn-report-lacks-context.html |

|

American Airlines CEO vows to improve pilot pay as wages at other carriers riseAmerican Airlines CEO Robert Isom told pilots that they “will not fall behind network peers.” Read more at: https://www.cnbc.com/2022/06/15/american-airlines-ceo-vows-to-improve-pilot-pay-as-wages-at-other-carriers-rise.html |

|

Ford CFO says inflation has erased Mustang Mach-E profits, but isn’t hurting demand for new vehiclesFord Motor’s CFO said Wednesday that the company isn’t yet seeing consumer demand for new vehicles drop off. Read more at: https://www.cnbc.com/2022/06/15/ford-cfo-says-inflation-has-erased-mustang-mach-e-profits-but-isnt-hurting-demand.html |

|

Millionaires are raising cash on fears that the Fed can’t tame inflation and stave off recessionMillionaires surveyed by CNBC ranked inflation as the top risk to both the economy and their personal wealth. Read more at: https://www.cnbc.com/2022/06/15/millionaire-fear-fed-cant-tame-inflation-and-stave-off-recession.html |

|

Stocks, Bonds, & Bullion Rally After Powell’s Perjury-Prone PresserStocks, Bonds, & Bullion Rally After Powell’s Perjury-Prone PresserThe Fed hiked rates by 75bps – the most since 1994 – and the dotplot signaled a much more aggressive Fed rate trajectory than at the last SEP release… but The Fed sees only marginal impacts of these aggressive “strongly committed” inflation-fighting rate-hikes on the unemployment rate. Former NY Fed president Bill Dudley said “I think the Fed’s forecasts are still remarkably optimistic… This is a very ‘soft landing’ sort of forecast.”

Powell prevaricated all over the place during his presser to persuade listeners that the US economy “is in a strong position” and “well-positioned to deal with higher interest rates.” He then shifted from prevarication to total perjury when – on the day that retail sales printed negative and the Atlanta Fed GDPNOW model forecast tumbled to 0.0% – he dared to utter the following words:

|

|

Bank Which First Correctly Called 75bps Hike Now Sees 50bps In July Due To Economic SlowdownBank Which First Correctly Called 75bps Hike Now Sees 50bps In July Due To Economic SlowdownOne week ago, well before the WSJ’s leaked flipflop on what the Fed will do, Barclays rates strategists Jonathan Millar and Ajay Rajadhyaksha were the first to correctly call a 75bps rate hike when 50bps was still the broad consensus. Well, moments after Powell proved them right, the Barclays duo came out with another report which maybe while not as remarkable is still quite noteworthy in its break from consensus. Indeed, with most banks now expecting the Fed’s autopilot to kick in and for the Fed to keep hiking 75bps (even though Powell said not to expect 75bps moves to be common) with Goldman now calling for another 75bps in July, Barclays is once again taking the other side, and writes that “the Fed will go back to a 50bp hike in July, amid signs that consumption and the US housing market are slowing.” Here are some more excerpts from the note available to professional subs in the usual place: Last Friday, right after the CPI report, we changed our call for the Fed’s June meeting, from a 50bp to a 75bp hike. The meeting was just days away and markets were priced for 50bp. But we felt the Fed needed to show urgency after the magnitude of the May inflation surprise and would make a statement move. One hurdle in moving so sharply, of course, was that markets would promptly price in 75bp in future meetings, pushing the Fed into a corner. But we believed that was not enough to stop the central bank from … Read more at: https://www.zerohedge.com/markets/bank-which-first-correctly-called-75bps-hike-now-sees-50bps-july-due-economic-slowdown |

|

Anthony Fauci Has COVIDThe nation’s top infectious disease specialist, Anthony Fauci, has contracted Covid-19.

Fauci, who is fully vaccinated and twice boosted, is experiencing mild symptoms according to a Wednesday statement from the NIH. “Dr. Fauci will isolate and continue to work from home,” reads the statement, which adds “He has not recently been in close contact with President Biden or other senior government officials.”

Fauci, Biden’s chief … Read more at: https://www.zerohedge.com/covid-19/anthony-fauci-has-covid |

|

NFIB Survey Rings Recession Alarm BellsAuthored by Lance Roberts via The Epoch Times, The National Federation of Independent Business (NFIB) signals a recession is coming—again. The reason I say “again” is because, in September 2019, we discussed these same signals:

Of course, we now know the recession hit just five months later.

Today, we see many indications of economic … Read more at: https://www.zerohedge.com/markets/nfib-survey-rings-recession-alarm-bells |

|

Passengers told not to travel by train during rail strikesOnly a fifth of train services are due to run during next week’s strike action. Read more at: https://www.bbc.co.uk/news/business-61808898?at_medium=RSS&at_campaign=KARANGA |

|

The US makes biggest interest rate rise in almost 30 yearsThe US central bank raises rates by 0.75 percentage points as it scrambles to contain soaring prices. Read more at: https://www.bbc.co.uk/news/business-61804877?at_medium=RSS&at_campaign=KARANGA |

|

Weak pound puts the squeeze on holiday spendingThe Sterling has been sliding against the dollar and euro making overseas travel budgets tighter. Read more at: https://www.bbc.co.uk/news/business-61809589?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms small bearish candle; 15,670 level remains key supportAnalysts said the index has been respecting its support of 15,671 on a closing basis and as long as it keeps respecting that, chances of some bounce cannot be ruled out. They see support shifting to 15,400-300 levels, if the level is breached. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-small-bearish-candle-15670-level-remains-key-support/articleshow/92230996.cms |

|

Blinkit deal a ‘poison pill’ for Zomato? Here’s what global brokerages sayThe brokerage highlighted that Zomato has to attempt to build its grocery business closer to the middle of this framework and leverage technology to design and manage its dark stores to offer 4,000-5,000 stock-keeping units with a 10-60 minutes delivery turnaround time. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/blinkit-deal-a-poison-pill-for-zomato-heres-what-global-brokerages-say/articleshow/92228888.cms |

|

Over 50% upside potential! Should you buy the dip in this PSU bankThe PSU bank reported a 41.27 percent YoY jump in standalone net profit at Rs 9,113.53 crore for the March quarter, up from Rs 6,450.75 crore in the year-ago quarter. NIM was stable sequentially at 3.12 percent. Gross non-performing assets (NPAs) were at 3.97 percent of the total assets, down from 4.50 percent sequentially and 4.98 percent year-on-year. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/over-50-upside-potential-should-you-buy-the-dip-in-this-psu-bank/articleshow/92225156.cms |

|

The Margin: ‘Most trusted brands’ in the U.S. are Band-Aid, Clorox, and CVS, poll showsMany of the most trusted brands in the U.S. are companies that sell everyday household items. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E95-EFEE801E7F95%7D&siteid=rss&rss=1 |

|

Bond Report: 2-year Treasury yield has biggest one-day drop in two years after Fed projections point to a pullback in interest rates in 2024Treasury yields are broadly lower on Wednesday after Federal Reserve policymakers release their latest Summary of Economic Projections. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E8F-487579096FCF%7D&siteid=rss&rss=1 |

|

FDA committee recommends two COVID-19 vaccines for young childrenThe Food and Drug Administration is now expected to authorize two COVID-19 vaccines for children as young as six months old. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E9A-B7552C540D18%7D&siteid=rss&rss=1 |