Summary Of the Markets Today:

- The Dow closed down 58 points or 0.18%,

- Nasdaq closed down 1.19%,

- S&P 500 down 0.42%,

- WTI crude oil settled at 91 down 0.2%,

- USD $106.36 down 0.01%,

- Gold 1811 up 0.33%,

- Bitcoin $23,123 down 3.51% – Session Low 22,940,

- 10-year U.S. Treasury 2.781 up 0.18%

Today’s Economic Releases:

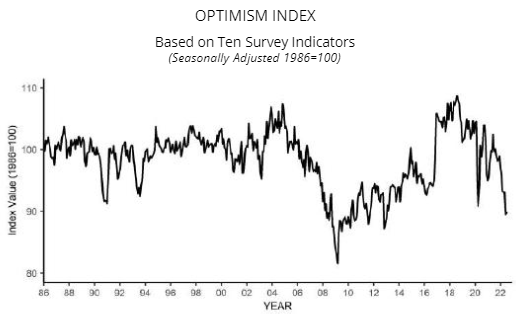

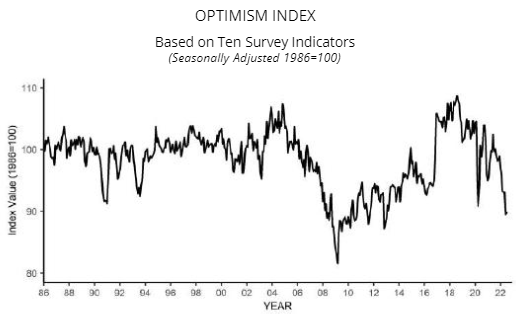

NFIB’s Small Business Optimism Index rose 0.4 points in July to 89.9, however, it is the sixth consecutive month below the 48-year average of 98. Thirty-seven percent of small business owners reported that inflation was their single most important problem in operating their business, an increase of three points from June and the highest level since the fourth quarter of 1979. Bill Dunkelberg, NFIB Chief Economist stated:

The uncertainty in the small business sector is climbing again as owners continue to manage historic inflation, labor shortages, and supply chain disruptions. As we move into the second half of 2022, owners will continue to manage their businesses into a very uncertain future.

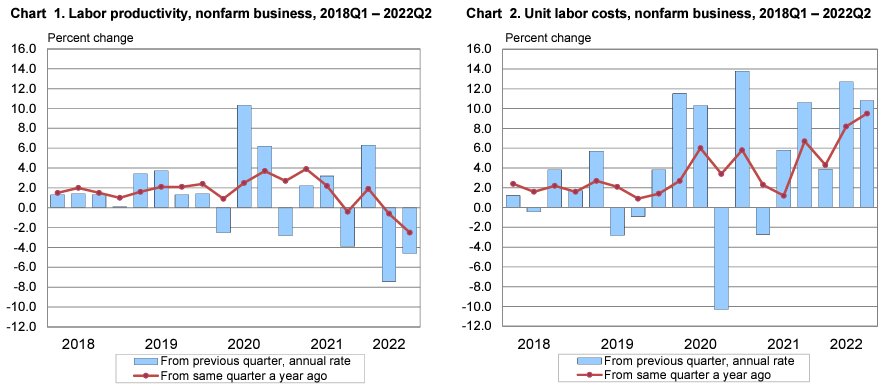

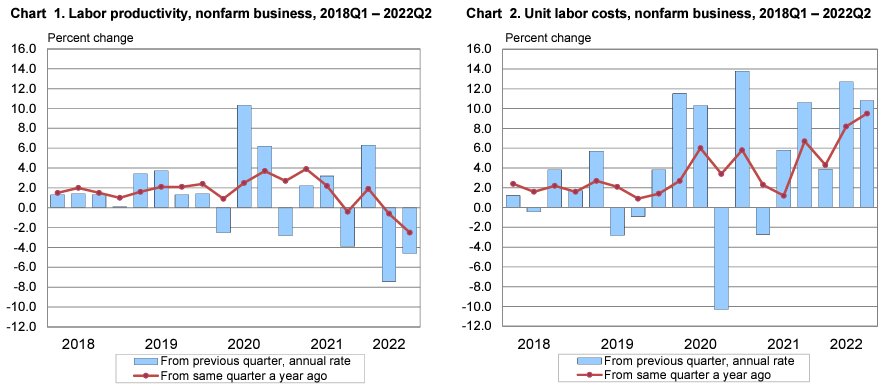

Nonfarm business sector labor productivity decreased 4.6 percent in the second quarter of 2022. From the same quarter a year ago, nonfarm business sector labor productivity decreased 2.5 percent, reflecting a 1.5-percent increase in output and a 4.1-percent increase in hours worked. The 2.5-percent decline in labor productivity from the same quarter a year ago is the largest decline in this series, which begins in the first quarter of 1948. Unit labor costs in the nonfarm business sector increased 10.8 percent in the second quarter of 2022, This is the largest four-quarter increase in this measure since a 10.6-percent increase in the first quarter of 1982.

In May 2022, 2.7% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 2-percentage point decrease in the overall delinquency rate compared with May 2021.

A summary of headlines we are reading today:

- EIA Lowers U.S. Oil Production Forecast

- An Iran Nuclear Deal Could Send Oil Prices Tumbling Towards $80

- Germany May Consider Lifting Its Ban On Fracking Amid Energy Crisis

- Copper Prices Slide Sideways As Bulls And Bears Battle It Out

- Northrop Grumman moves Antares rocket work to U.S. from Russia and Ukraine with Firefly partnership

- Inflation Reduction Act extends ‘pass-through’ tax break limits for 2 more years. Here’s what that means for entrepreneurs

- With 87,000 new agents, here’s who the IRS may target for audits

These and other headlines and news summaries moving the markets today are included below.