NOAA Updates their Mid-Month Forecast for November 2024 on October 31, 2024 – Major Changes. – Posted on November 1, 2024

At the end of every month, NOAA updates its Outlook for the following month which in this case is November of 2024. We are reporting on that tonight. In this article, I refer to November, 2024 as “The New Month”.

There have been significant changes in the Outlook for the new month and these are addressed in the NOAA Discussion so it is well worth reading. We provided the prior Mid-Month Outlook for the new month for comparison. It is easy to see the substantial changes in the weather outlook by comparing the Mid-Month and Updated Maps.

The article includes the Drought Outlook for the new month. NOAA also adjusted the previously issued three-month Drought Outlook to reflect the changes in the new month’s Drought Outlook. We also provide the Week 2/3 Tropical Outlook for the World. The Tropical Outlet includes both direct and indirect potential impacts to the Southern Tier of CONUS. We also include a whole set of the forecasts for parts of the new month. These are both useful and provide a crosscheck on the validity of the new month’s Outlook. The whole should be equal to the sum of its parts.

The best way to understand the updated outlook for the new month is to view the maps and read the NOAA discussion. I have highlighted the key statements in the NOAA Discussion.

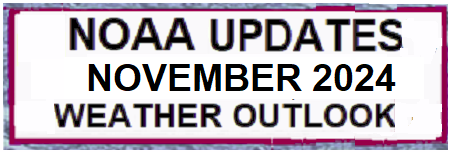

Here is the updated Outlook for November 2024.

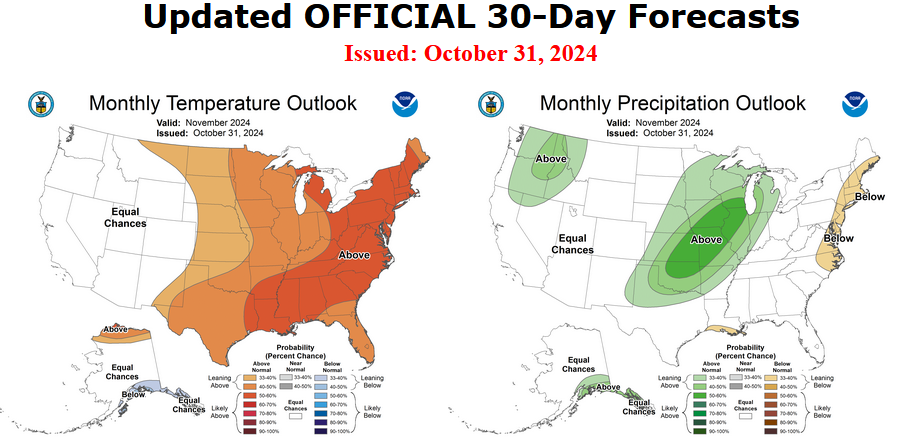

For Comparison Purposes, Here is the earlier Mid-Month Outlook for November

| It is important to remember that the maps show deviations from the current definition of normal which is the period 1991 through 2020. So this is not a forecast of the absolute value of temperature or precipitation but the change from what is defined as normal or to use the technical term climatology.

It is a substantial change from what was issued on October 17, 2024. Remember, it is the first set of maps that are the current outlook for November which is the new month. One expects some changes 14 days later. However, the changes to the updated new month Outlook are very significant. This then gives us some reason to question the (October 17, 2024) three-month NDJ temperature and precipitation Outlooks which are shown in the following graphic. |

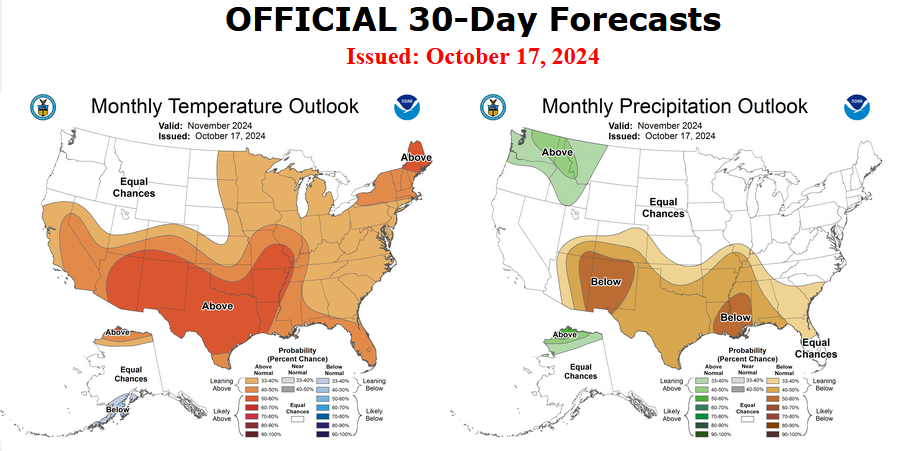

NOAA provided a combination of the Updated Outlook for the New Month and the Three-Month Outlook.

The top pair of maps are again the Updated Outlook for the new month. There is a temperature map and a precipitation map. The bottom row shows the three-month outlooks which includes the new month. I think the outlook maps are self-explanatory.

To the extent that one can rely on a forecast, we would conclude that December and January will be very different than November. You can subtract November from the three-month Outlook and divide by two to get a combined December/January Outlook.However given the major change in the new Outlook outlook from what was issued on October 17, 2024, we might not trust the three-month Outlook issued on October 17, 2024. Something to think about. But the major factor is the projected slower onset of La Nina. Thus this change may be consistent with the pattern the NOAA has been predicting although they have been playing catch-up. I am still not convinced that there will be a La Nina Winter. Thus I am somewhat skeptical about the NOAA Outlooks. |