09Sep2022 Market Close & Major Financial Headlines: Week Ends On A High Note For The Markets

Summary Of the Markets Today:

- The Dow closed up 377 points or 1.19%,

- Nasdaq closed up 2.11%,

- S&P 500 up 1.53%,

- WTI crude oil settled at $86 down 3.21%,

- USD index $109.99 down 0.65%,

- Gold $1727 up 0.4%,

- Bitcoin $21,249 up 9.98%,

- 10-year U.S. Treasury 3.317% little changed

Today’s Economic Releases:

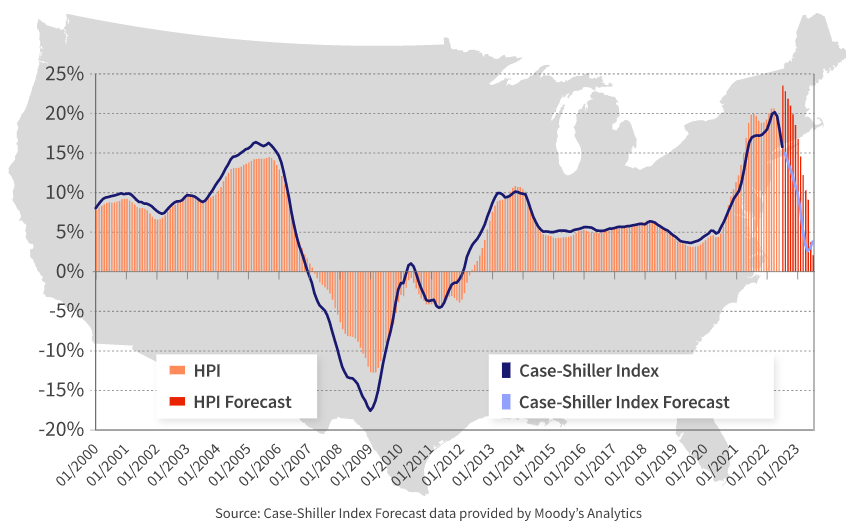

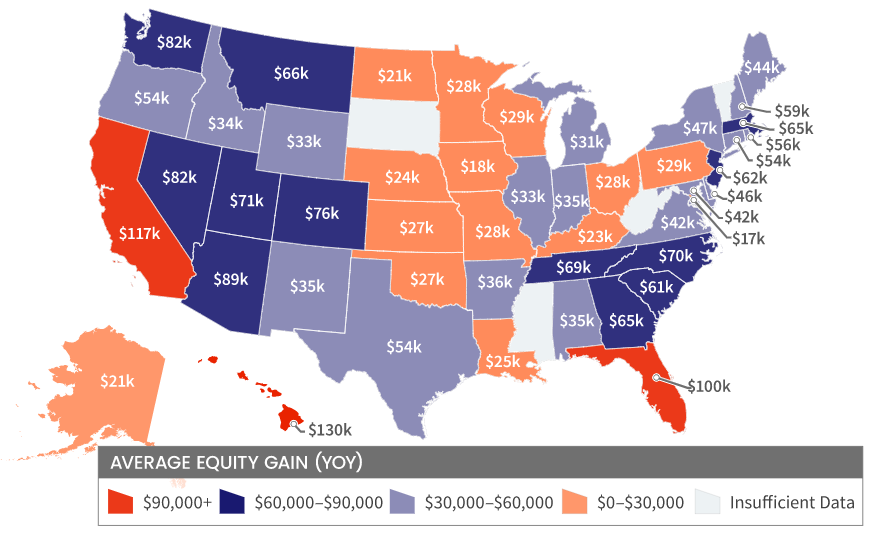

Total Average Equity Per Homeowner Hits a Record High of $300,000 in Q2 per CoreLogic. Homeowners with mortgages gained a collective $3.6 trillion year over year in the second quarter of 2022. The following graph shows the average equity gain by state.

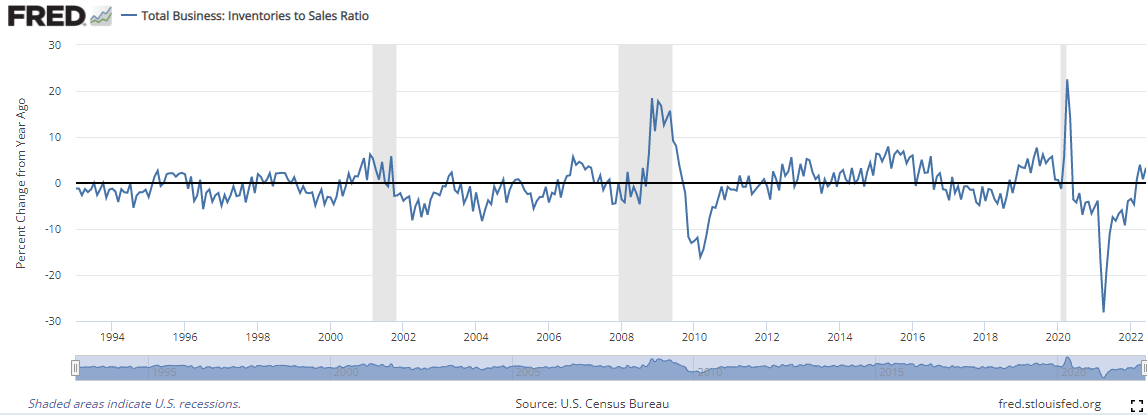

July 2022 sales of merchant wholesalers were down 1.4% from last month but was up 15.3% from July 2021. As the numbers are not inflation adjusted, the inventory-to-sales ratio YoY change is the best way to look at the data – and this data shows that the inventory is modestly shrinking with respect to sales which somewhat indicates a modestly growing economy (see graph below).

- Magnetic Breakthrough Could Help Save Electricity

- EU Energy Ministers Divided On Russian Natural Gas Price Cap

- Oil Rig Count Slides In Tough Week For Crude

- Burger King unveils $400 million plan to revive U.S. sales with investments in renovations and advertising

- GM is betting on its electric Equinox, starting at $30,000, to kick-start ‘massive adoption’ of EVs

- “Yellen Was Massively Blind” – RH CEO Routs ‘Slow & Wrong’ Policymakers For Making Things Worse

- Greece Informs Allies Of Ukraine-Style War Looming With Turkey

These and other headlines and news summaries moving the markets today are included below.