Summary Of the Markets Today:

- The Dow closed up 337 points or 1.07%,

- Nasdaq closed up 2.25%,

- S&P 500 up 1.63%,

- WTI crude oil settled at $85 down $0.05,

- USD $110.89 down $1.11,

- Gold $1658 up $4.10,

- Bitcoin $20,1151 up 4.12% – Session Low 19,249,

- 10-year U.S. Treasury 4.069% down 0.155%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

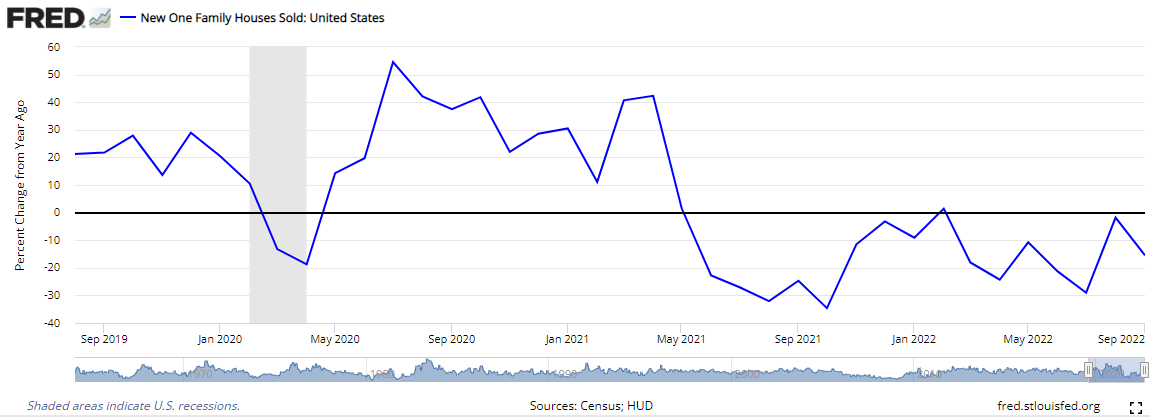

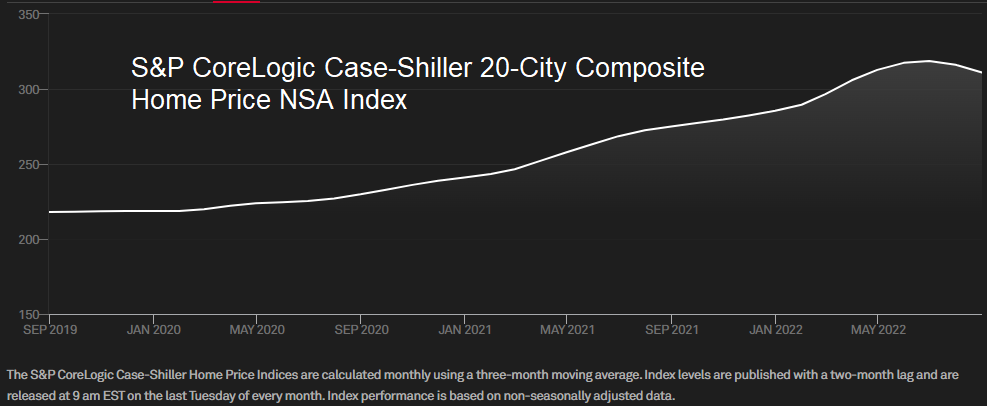

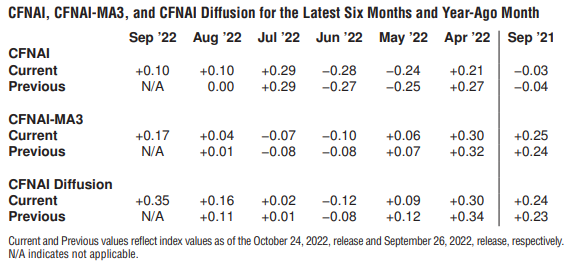

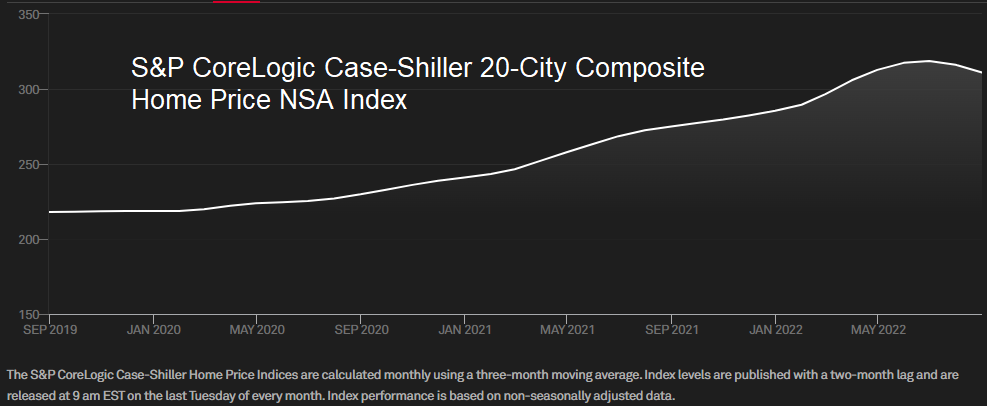

The S&P CoreLogic Case-Shiller 20-City Composite posted a 13.1% year-over-year gain, down from 16.0% in the previous month. CoreLogic Deputy Chief Economist Selma Hepp stated:

While the CoreLogic S&P Case-Shiller Index retracts rapidly amid surging mortgage rates — up 13% in August— a handful of markets located in Southeast and South continue to see over 20% annual gains, with Miami and Tampa topping the list. In contrast, Phoenix, Las Vegas and Dallas have now joined the other West Coast cities that are rapidly slowing since the spring peak in home price growth. At this pace, CoreLogic’s Home Price Index forecast suggests annual home price growth will slow to 9% by December, and further down to less than 1% by the end of the first quarter 2023.

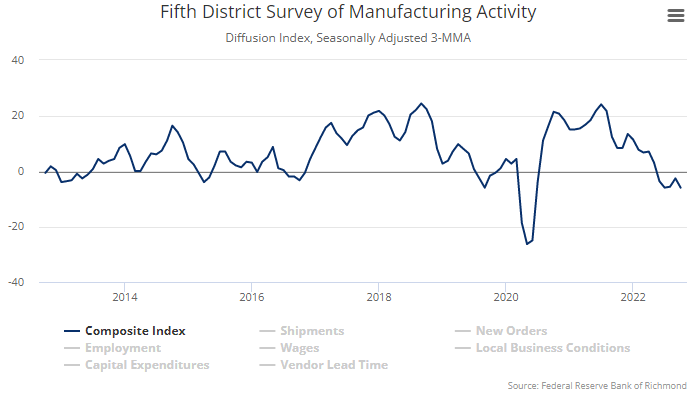

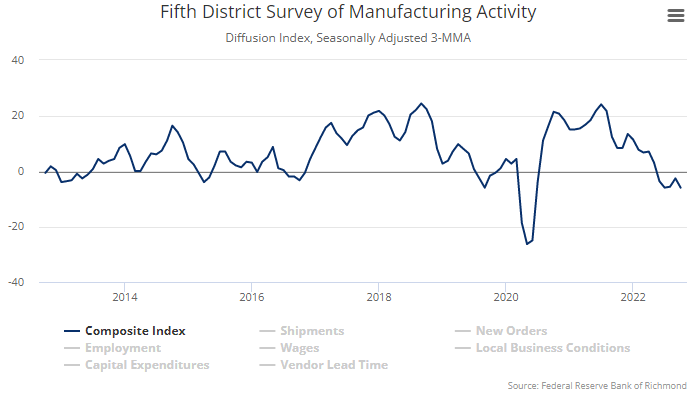

The Richmond Fed Manufacturing Survey reported weaker conditions in October 2022. The composite manufacturing index fell from 0 in September to −10 in October, dipping below its August level. Two of its three component indexes deteriorated notably: the indexes for shipments and volume of new orders fell from 14 and −11 in September to −3 and −22 in October, respectively. The third component, the employment index, remained unchanged at 0 in October, as hiring challenges persisted.

A summary of headlines we are reading today:

- Nanotech Breakthrough Sets World Record For Solar Cell Efficiency

- Battery Makers Can’t Escape Rising Nickel Costs

- General Motors posts big third-quarter earnings beat but holds full-year guidance steady amid ‘headwinds’

- Your last chance to secure 9.62% annual interest for Series I bonds is Oct. 28

- With Recession And Mass Layoffs Imminent, Dems Throw Fed’s Powell Under-The-Bus For “Risking Millions Of Livelihoods”

These and other headlines and news summaries moving the markets today are included below.