Summary Of the Markets Today:

- The Dow closed up 1,201 points or 3.70%,

- Nasdaq closed up 7.35%,

- S&P 500 up 5.54%,

- WTI crude oil settled at $86 up $0.45,

- USD $107.81 down $2.73,

- Gold $1758 up $44.10,

- Bitcoin $18,010 up 11.52% – Session Low 15,684,

- 10-year U.S. Treasury 3.826% down 0.316%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

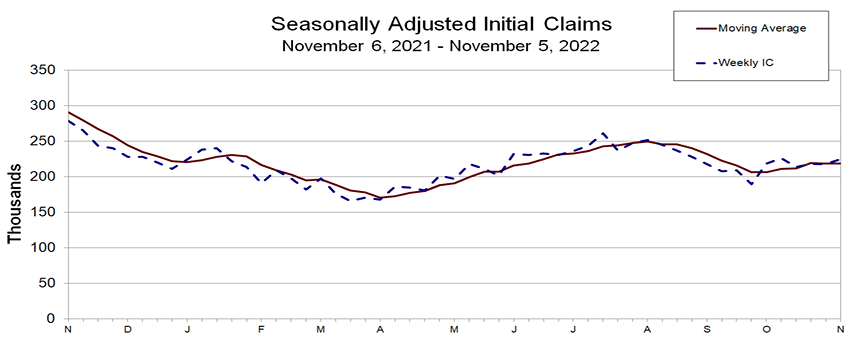

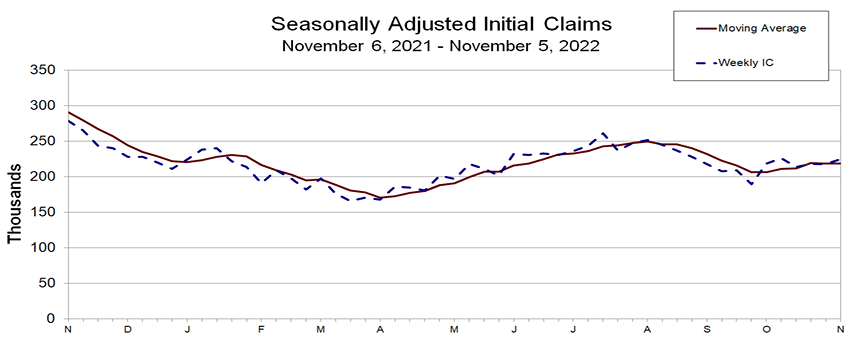

In the week ending November 5, the unemployment insurance weekly claims 4-week moving average was 218,750, a decrease of 250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 218,750 to 219,000.

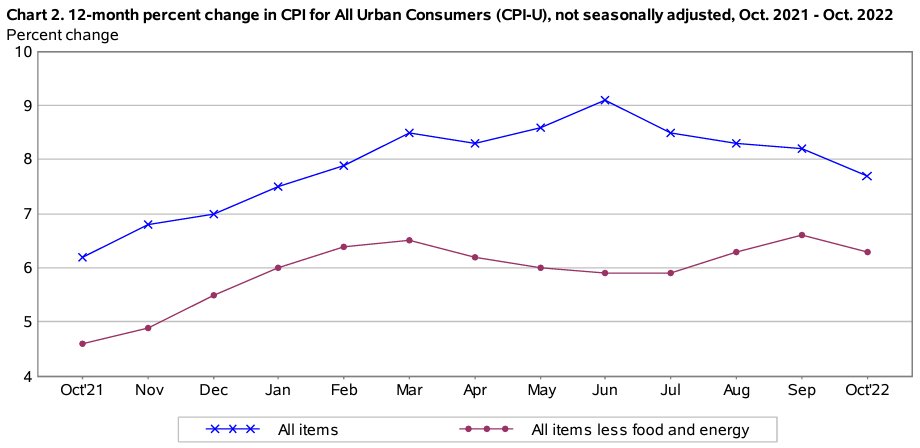

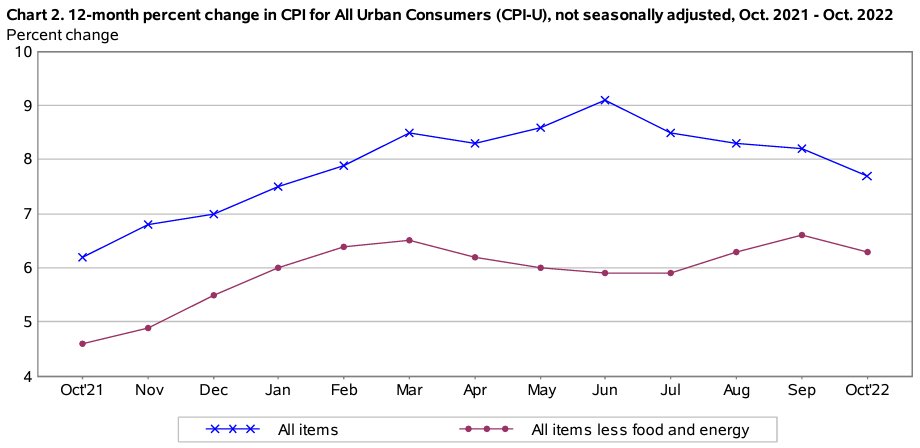

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% in October 2022 – the same increase as in September. Over the last 12 months, the CPI-U increased 7.7%. Shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. Inflation still is running hot, and it paves the way for the Fed to continue raising the federal funds rate.

A summary of headlines we are reading today:

- Worlds Top Chipmaker Eyes Arizona For New $12 Billion Semiconductor Plant

- Steel Giant ArcelorMittal Faces Growing Economic Headwinds

- Mortgage rates fall sharply to under 7% after inflation eases

- Juul reaches financing deal, plans to cut 30% of jobs to dodge bankruptcy

- Massachusetts voters approve ‘millionaire tax.’ What it means for the wealthy

- The End Of World Dollar Hegemony: Turning The US Into Weimar Germany

- Market Explosion Sends CTAs Into Short Covering Frenzy: $79BN To Buy

- In One Chart: ‘We’ve seen this before,” warns BofA. Why inflation could take until 2024 to fall to 3% and weigh on stocks.

These and other headlines and news summaries moving the markets today are included below.