Summary Of the Markets Today:

- The Dow closed up 186 points or 0.56%,

- Nasdaq closed up 1.01%,

- S&P 500 up 0.70%,

- WTI crude oil settled at $75 up 0.43,

- USD $103.28 up $0.28,

- Gold $1882 up $4.10,

- Bitcoin $17,472 up $277.80 – Session Low 17,152,

- 10-year U.S. Treasury 3.613% up 0.094 points

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

November 2022 sales of merchant wholesalers were up 8.7% from the revised November 2021 level. Total inventories of merchant wholesalers were up 20.9% from the revised November 2021 level. The November inventories/sales ratio for merchant wholesalers was 1.35. The November 2021 ratio was 1.21. All this data has not been adjusted for inflation – however, the inventory/sales ratio negates the need for inflation adjustment and is the most important data point. The graph below shows this ratio, and generally, a high or rising ratio (like what is shown on this graph) is indicative of a slowing economy.

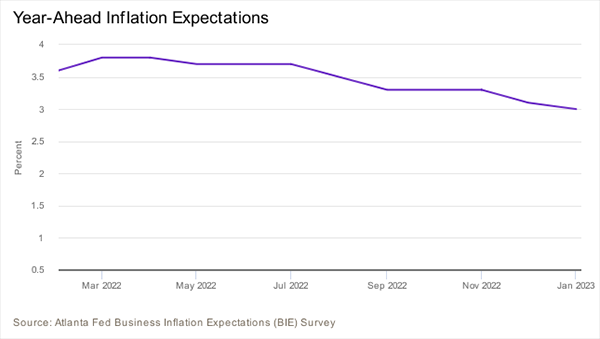

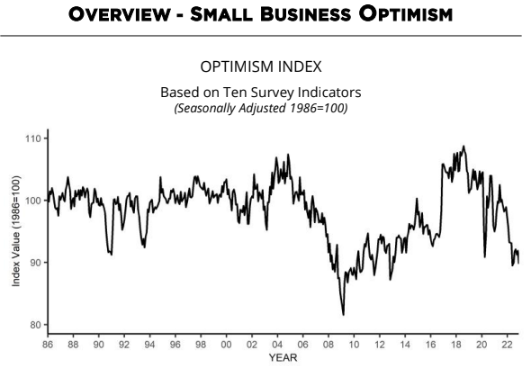

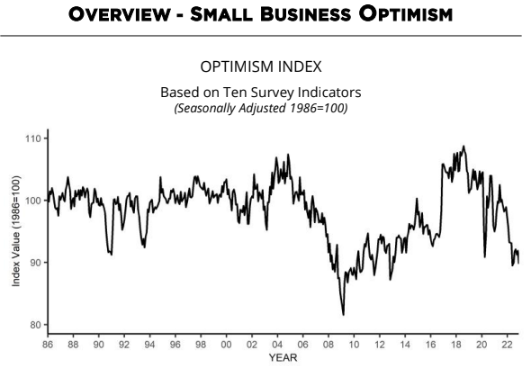

The NFIB Small Business Optimism Index declined 2.1 points in December to 89.8, marking the 12th consecutive month below the 49-year average of 98. Owners expecting better business conditions over the next six months worsened by eight points from November to a net negative 51%. Inflation remains the single most important business problem with 32% of owners reporting it as their top problem in operating their business.

The federal budget deficit was $418 billion in the first quarter of the fiscal year 2023, the Congressional Budget Office estimates—$41 billion more than the shortfall recorded during the same period last year. Revenues were $26 billion (or 2 percent) lower and outlays were $15 billion (or 1 percent) higher from October through December 2022 than they were in the first quarter of the prior fiscal year.

A summary of headlines we are reading today:

- Barclays Sees $15-$25 Barrel Downside If Manufacturing Activity Slows

- Biofuel Production Is Set To Soar In The U.S.

- U.S. Congress To Vote On Ending SPR Oil Sales To China

- Oil Steady Ahead Of Fed Rate Hike Decision

- Bed Bath & Beyond reports wider-than-expected loss as possible bankruptcy looms

- Powell reiterates Fed is not going to become a ‘climate policymaker’

- House Republicans vote to strip IRS funding, following pledge to repeal nearly $80 billion approved by Congress

- The Tell: Goldman sees lower rents pulling a key core inflation gauge below 3% this year

These and other headlines and news summaries moving the markets today are included below.