Summary Of the Markets Today:

- The Dow closed down 391 points or 1.14%,

- Nasdaq closed up 0.14%,

- S&P 500 down 0.20%,

- Gold $1911 down $10.50,

- WTI crude oil settled at $81 up $1.29,

- 10-year U.S. Treasury 3.557% up 0.04 points,

- USD $102.38 up $0.17,

- Bitcoin $21,295 up $185 – Session Low 20,970

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

CoreLogic’s latest Single-Family Rent Index (SFRI) shows that single-family rental price increases dropped to 7.5% year over year in November 2022, with all four tracked price tiers posting lower gains than a year earlier. November marked the seventh consecutive month of annual deceleration, and while Florida metro areas continued to post the nation’s highest rental cost gains, other Sun Belt cities such as Phoenix and Las Vegas which formerly showed the highest rent increases are now at the bottom. CoreLogic expects that rental price growth, along with home price appreciation, will continue to level off during the first part of 2023.

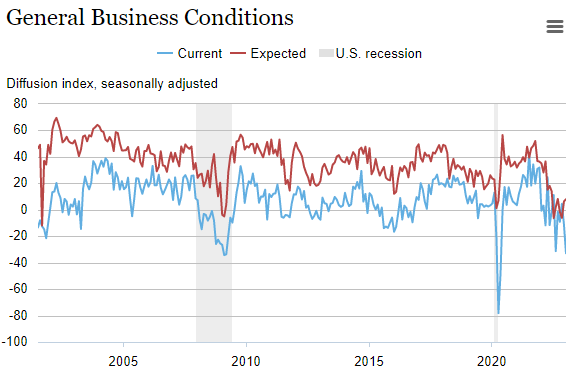

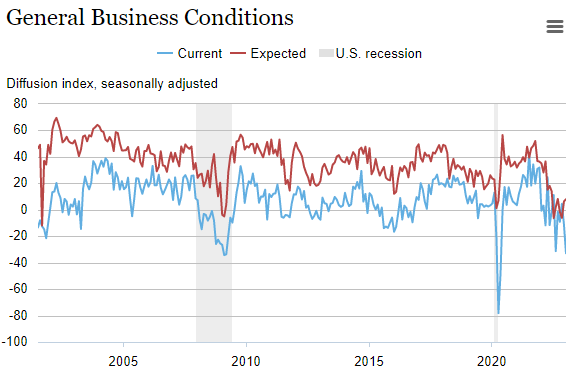

Manufacturing activity contracted sharply in New York State, according to firms responding to the January 2023 Empire State Manufacturing Survey. The headline general business conditions index fell twenty-two points to -32.9. New orders and shipments declined substantially. Delivery times held steady, and inventories edged higher. Employment growth stalled, and the average workweek shortened. Input price increases slowed considerably, and selling price increases also moderated. Looking ahead, firms expect little improvement in business conditions over the next six months.

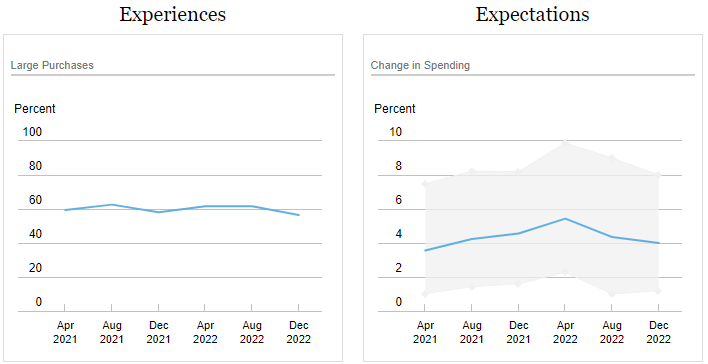

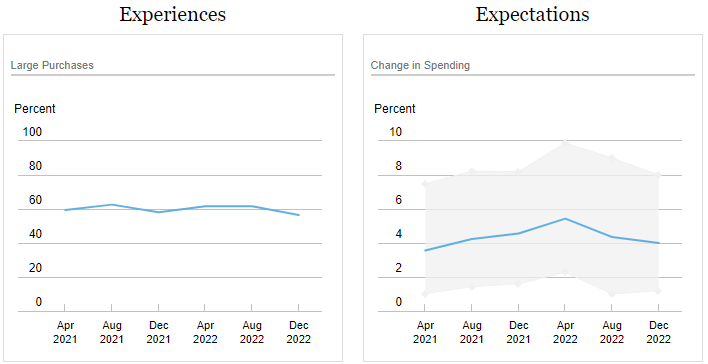

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the December 2022 Survey of Consumer Expectations (SCE) Household Spending Survey, which provides information on individuals’ experiences and expectations regarding household spending. The survey shows a recent decline in monthly household spending growth, even though spending growth remains well above pre-pandemic levels. The share of households that report making a large purchase during the past four months fell compared to August 2022 and December 2021 levels, although it increased for home repairs, electronics, and furniture. The share reporting purchasing a vehicle declined to its lowest level since August 2020.

Elliott Wave International is kicking off 2023 with a bumper FREE event! Jan. 16 – Feb. 3, get access to the latest issue of Global Market Perspective. Global stocks, bonds, FX, Bitcoin + cryptos, gold, oil, and more — see Elliott wave forecasts and analysis for 50+ major global markets. Get your FreePass now at elliottwave.com >>

A summary of headlines we are reading today:

- How Long Can Russia Afford To Continue Its War In Ukraine?

- Emerging Markets Look To Capitalize On Shifting Supply Chains

- U.S. Gasoline Prices Continue To Rise Even As Demand Slumps

- U.S. Lithium Production Is Set To Explode

- Gen Z is driving luxury sales as wealthy shoppers get younger

- The zero-fare public transit movement is picking up momentum

- Stocks Tank After US Regulator Threatens To Break-Up ‘Too Big To Manage’ Banks

- US stocks open lower Goldman Sachs misses profit estimates

- Futures Movers: Oil prices end higher as investors weigh China demand outlook

These and other headlines and news summaries moving the markets today are included below.

}

}