26Jan2023 Market Close & Major Financial Headlines: Wall Street Closes Moderately Higher As GDP Comes In Strong

Summary Of the Markets Today:

- The Dow closed up 206 points or 0.61%,

- Nasdaq closed up 1.76%,

- S&P 500 closed up 1.10%,

- Gold $1930 down $12.60,

- WTI crude oil settled at $81 up $0.90,

- 10-year U.S. Treasury 3.495% up 0.033 points,

- USD $101.81 up $0.18,

- Bitcoin $23,024 up $87 – Session Low 22,899

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

Unfortunately, I do not think GDP came in strong as the headline suggests. Real gross domestic product (GDP) increased at an annual rate of 2.9% in the fourth quarter of 2022, after increasing by 3.2% in the third quarter. GDP in the fourth quarter primarily reflected increases in inventory investment and consumer spending that were offset by a decrease in housing investment. EconCurrents does not use quarter-over-quarter growth to evaluate GDP – but uses year-over-year growth to view GDP. 4Q2022 continued the downward slope of GDP growth showing 1.0% growth year-over-year, down from 3Q2022 1.9% year-over-year (see graph below).

The Real gross domestic product (GDP) release includes the inflation adjuster (deflator). This deflator (green line on graph below) shows continued moderation of inflation from 7.1% for 3Q2022 to 6.3% for 4Q2022.

In the week ending January 21, the advance figure for seasonally adjusted unemployment insurance weekly initial claims 4-week moving average was 197,500, a decrease of 9,250 from the previous week’s revised average. The previous week’s average was revised up by 750 from 206,000 to 206,750.

New orders for manufactured durable goods improved in December 2022 to 11.9% year-over-year – up from last month’s 6.9% year-over-year. If one inflation adjusts this data, the December improvement was 6.7%. This is particularly strong growth and not indicative of a slowing economy. Much of this increase was driven by civilian aircraft orders.

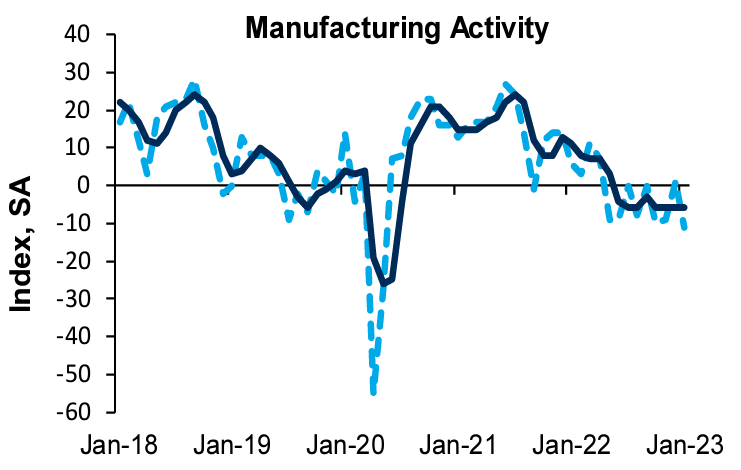

My favorite coincident indicator, the Chicago Fed National Activity Index (CFNAI), showed three of the four broad categories of indicators used to construct the index made negative contributions in December – but the negative elephant in the room was industrial production. The index’s three-month moving average, CFNAI-MA3, decreased to –0.33 in December from –0.14 in November. According to the authors of the index, this means the economy did not expand in December 2022. The graph below shows the historical values of the CFNAI-MA3 (which is used for economic forecasting) – and the red line shows the value that the authors of the index believe is the recession line.

Sales of new single‐family houses in December 2022 were 26.6% below December 2021. An estimated 644,000 new homes were sold in 2022 which is 16.4% below the 2021 figure of 771,000. The median sales price of new houses sold in December 2022 was $442,100. The average sales price was $528,400. The seasonally‐adjusted estimate of new houses for sale at the end of December was 461,000. This represents a supply of 9.0 months at the current sales rate. The graph below shows the year-over-year change in houses sold (blue line) and the median sales price (red line). In other words, home prices continue to rise even while sales volumes fall.

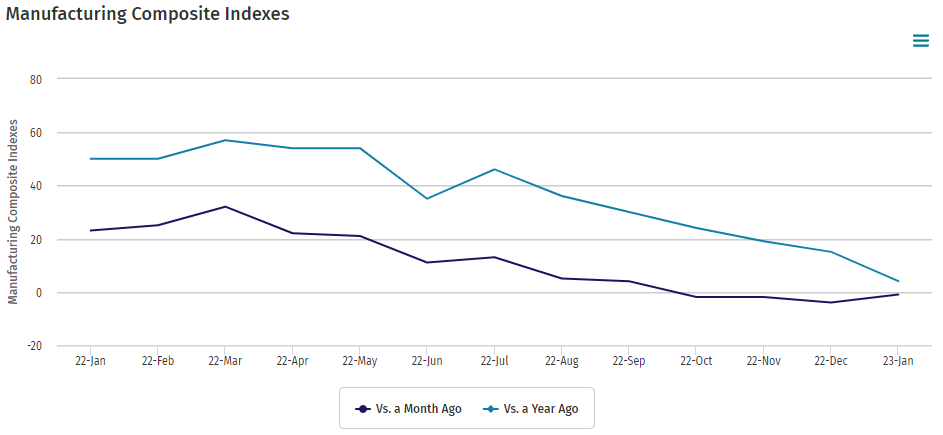

Regional factory activity for the Kansas City Fed was basically flat in January 2023. The month-over-month composite index was -1 in January, up slightly from -4 in December and -2 in November However, expectations for future activity were still positive, and many firms expected employment levels to increase over the next six months. Most regional Fed manufacturing indices are weak or in negative territory. One would expect poor manufacturing new orders and shipments in January.

A summary of headlines we are reading today:

- Soaring Food Prices Prompt Eurasian Nations To Ban Food Exports

- Bed Bath & Beyond shares plunge after retailer warns it doesn’t have the cash to pay down debts

- Southwest forecasts lingering losses as bookings slow in wake of holiday meltdown

- Chipotle seeks to hire 15,000 restaurant workers ahead of busy spring months

- Walmart-owned Sam’s Club plans to open about 30 new stores over next five years

- Comcast beats expectations even as broadband growth slows, Peacock racks up losses

- Stock Warnings Get Louder With Estimates Falling

- Lawrence G. McMillan: The S&P 500 is trying to top 4100, and the odds favor that happening by the end of January.

These and other headlines and news summaries moving the markets today are included below.