Summary Of the Markets Today:

- The Dow closed up 104 points or 0.31%,

- Nasdaq closed down 0.27%,

- S&P 500 closed down 0.07%,

- Gold $1939 up $9.80,

- WTI crude oil settled at $80 down $1.55,

- 10-year U.S. Treasury 3.458% down 0.065,

- USD $101.95 down $0.18,

- Bitcoin $23,018 up $15 – Session Low 22,783

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

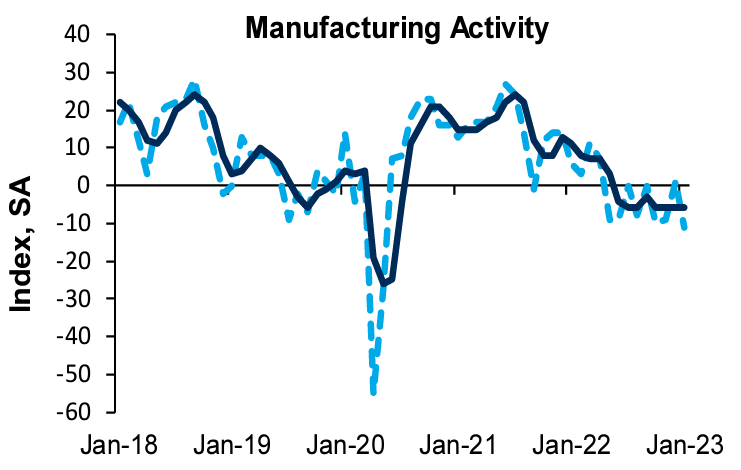

Richmond Fed manufacturing firms reported some deterioration in business conditions in January. The composite manufacturing index fell noticeably into negative territory, decreasing from 1 in December to −11 in January. Each of its three component indexes: shipments, new orders, and employment declined, with the index for new orders plummeting from −4 to −24 in January. Alongside a slightly negative employment index, the wage index increased from 37 to 41 in January. Most regional Fed manufacturing indices are in negative territory implying manufacturing activity in the U.S. is declining.

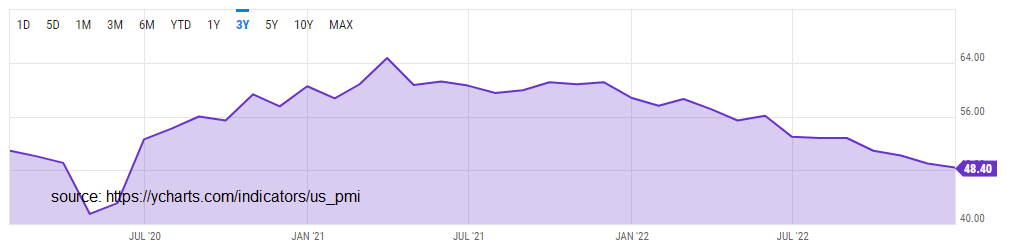

The December 2022 Institute for Supply Management (ISM) Manufacturing PMI registered 48.4 percent, 0.6 percentage points lower than the 49 percent recorded in November. Regarding the overall economy, this figure indicates contraction after 30 straight months of expansion. The Manufacturing PMI figure is the lowest since May 2020, when it registered 43.5 percent. The New Orders Index remained in contraction territory at 45.2 percent, 2 percentage points lower than the 47.2 percent recorded in November. The Production Index reading of 48.5 percent is a 3-percentage point decrease compared to November’s figure of 51.5 percent. The Prices Index registered 39.4 percent, down 3.6 percentage points compared to the November figure of 43 percent; this is the index’s lowest reading since April 2020 (35.3 percent).

A summary of headlines we are reading today:

- The Worlds Largest Metals Market May Never Return To Its Former Glory

- Germanys Electricity Subsidies Will Cost More Than $18 Billion Through May

- The Energy Crisis Is Fueling A Nuclear Energy Renaissance

- Walmart raises minimum wage as retail labor market remains tight

- Oscar nominations: ‘Everything Everywhere All at Once,’ ‘Top Gun: Maverick’ among leaders

- US Gasoline Prices Continue To Rise

- Jeremy Grantham Doubles Down On Market Apocalypse, Warns Of 17% Crash, Doesn’t Rule Out “Brutal Decline” To 2,000

- US stocks open lower as earnings roll in, chipmakers retreat

- Earnings Results: Raytheon’s profit more than doubles as Ukraine war boosts defense budgets

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Banks Haven’t Lost Their Appetite For Fossil Fuels Just YetFollowing the signing of the Paris Agreement by 193 states and the EU and after the COP27 climate summit in 2021, several major financial institutions came under fire for their continued support of fossil fuel companies. As governments worldwide introduce new climate policies and put pressure on oil and gas firms to improve operations and curb their carbon emissions, international organization and environmentalists are asking that increased pressure be put on banks to cut funding for fossil fuel projects in favor of low-emissions alternatives. Read more at: https://oilprice.com/Energy/Energy-General/Banks-Havent-Lost-Their-Appetite-For-Fossil-Fuels-Just-Yet.html |

|

Georgia Think Tank: Little Progress Is Being Made In EU BidGeorgia’s government says the country has made important progress towards meeting the European Union’s conditions to become a membership candidate, but critics say Brussel’s key demands remain unmet. Last summer, while granting Ukraine and Moldova candidate status, the EU promised Georgia the same only after it met 12 conditions laid out by the European Commission. Half a year later, many acknowledge progress on some reforms, but there is disagreement on whether this will be enough to reverse the previous failure. “There is clearly Read more at: https://oilprice.com/Latest-Energy-News/World-News/Georgia-Think-Tank-Little-Progress-Is-Being-Made-In-EU-Bid.html |

|

The World’s Largest Metals Market May Never Return To Its Former GloryVia AG Metal Miner Doomsters have predicted the end of the LME before. Still, after 146 years and counting, the LME is still with us and the go-to nickel price point. However, volumes have tanked since the LME nickel debacle in March of 2022. In fact, the problems no longer relate just to nickel, but the entire non-ferrous metals spectrum. The suspension of LME nickel trading and the decision to cancel trades remains the catalyst. According to Reuters, volumes continue to fall every month year-over-year. Core activity on the LME contracted Read more at: https://oilprice.com/Metals/Commodities/The-Worlds-Largest-Metals-Market-May-Never-Return-To-Its-Former-Glory.html |

|

Germany’s Electricity Subsidies Will Cost More Than $18 Billion Through MayGermany will spend more than $18 billion on its lavish electricity price cap and transmission network subsidies through May of this year, a German government document seen by Reuters has shown. Germany’s electricity price cap will cost it considerably, estimated at $14.5 billion euro, or $15.75 billion, and that’s just the cost through May. In addition to those charges, Germany will spend an additional 2.14 billion euros on subsidizing transmission network costs over the next two months alone, Finance State Secretary Florian Toncar Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germanys-Electricity-Subsidies-Will-Cost-More-Than-18-Billion-Through-May.html |

|

The Energy Crisis Is Fueling A Nuclear Energy RenaissanceIs this the dawn of a new nuclear era? Across the world, there are rumblings of a new push for nuclear as a solution to decarbonizing global energy production, even from environmentalist groups, representing a stark turnaround for many. Even the most anti-nuclear countries, such as Germany and Japan, have been extending the lives of their existing nuclear plants, flying in the face of their previous pledges to phase out the divisive technology altogether. While nuclear power never died in some key economies, such as China and Russia, more influential Read more at: https://oilprice.com/Alternative-Energy/Nuclear-Power/The-Energy-Crisis-Is-Fueling-A-Nuclear-Energy-Renaissance.html |

|

200,000 Bpd Angola Oilfield To Be Offline For More Than A MonthThe Dalia offshore oilfield in Angola, which pumps 200,000 barrels per day (bpd), is set to undergo planned maintenance for more than a month beginning on February 20, a spokesperson for the operator of the field, French supermajor TotalEnergies, told Reuters on Tuesday. The maintenance, which is expected to last for 35 days, will significantly reduce oil supply from Angola to the international markets. Only 30 cargoes an unusually low number are set to depart from Angola in March, according to Reuters. Angola may not export any Read more at: https://oilprice.com/Latest-Energy-News/World-News/200000-Bpd-Angola-Oilfield-To-Be-Offline-For-More-Than-A-Month.html |

|

Walmart raises minimum wage as the retail labor market remains tightThe nation’s largest private employer is hiking its minimum wage to $14 an hour for store employees. Read more at: https://www.cnbc.com/2023/01/24/walmart-raises-minimum-wage-as-retail-labor-market-remains-tight.html |

|

Chewy’s push into pet telehealth runs into regulatory hurdles, skeptical veterinariansChewy wants to grow its veterinary telehealth service, Connect With a Vet, as part of an overall push into health care. Read more at: https://www.cnbc.com/2023/01/24/chewy-connect-with-a-vet-regulatory-hurdles-skepticism.html |

|

Senators slam Live Nation over Ticketmaster’s dominance, botched Taylor Swift saleCriticism of Live Nation, which owns Ticketmaster, intensified after a botched sale of tickets to Taylor Swift’s Eras Tour. Read more at: https://www.cnbc.com/2023/01/24/senate-committee-live-nation-ticketmaster-hearing.html |

|

SpaceX completes major Starship test in prep for rocket’s first orbital launch attemptSpaceX announced it completed a major test of its latest Starship prototype, as the company prepares for the first orbital launch of the towering rocket. Read more at: https://www.cnbc.com/2023/01/24/spacex-completes-starship-rocket-test-in-prep-for-first-orbital-launch.html |

|

Oscar nominations: ‘Everything Everywhere All at Once,’ ‘Top Gun: Maverick’ among leadersThe Academy Awards ceremony will be held on March 12. Read more at: https://www.cnbc.com/2023/01/24/oscar-nominations-list.html |

|

FDA proposes new lead limits for baby food to reduce potential risks to children’s healthLead exposure can impair brain development and the nervous system, resulting in learning disabilities, lower IQ and behavioral difficulties. Read more at: https://www.cnbc.com/2023/01/24/fda-proposes-new-lead-limits-for-baby-food.html |

|

Oscar-nominated ‘Everything Everywhere All At Once’ features an IRS ordeal, but here’s what really happens in an audit, according to tax prosThe Oscar-nominated film “Everything Everywhere All at Once” includes a tax audit at an IRS office. But experts say actual IRS exams are not like in the movies. Read more at: https://www.cnbc.com/2023/01/24/what-to-expect-during-an-irs-audit-according-to-tax-pros.html |

|

Danaher’s stock drop looks like a buying opportunity after it reported a solid quarterWe attribute Tuesday’s 3% decline in DHR to management already preannouncing and shares making a large move into the print. Read more at: https://www.cnbc.com/2023/01/24/danaher-stock-drop-looks-like-a-buy-opportunity-after-a-solid-quarter.html |

|

M&M’s pulls ‘spokescandies’ amid right-wing outrage, before Super Bowl ad starring Maya RudolphCandy maker Mars said it is replacing its M&M’s “spokescandies” with actress Maya Rudolph after facing right-wing criticism. Read more at: https://www.cnbc.com/2023/01/23/mms-pulls-spokescandies-in-the-wake-of-right-wing-outrage.html |

|

In the fight against slowing growth, Netflix and its rivals are all in this togetherNetflix shares jumped after hours after beating subscriber estimates, and that’s good news for its legacy media competitors such as Disney. Read more at: https://www.cnbc.com/2023/01/19/netflix-rivals-fight-slow-growth.html |

|

Making salary ranges public may shrink pay gaps but slow wage growthPay transparency laws benefit marginalized workers, but economists warn they could also diminish the negotiating power of the labor force at large. Read more at: https://www.cnbc.com/2023/01/24/making-salary-ranges-public-may-shrink-pay-gaps-but-slow-wage-growth.html |

|

Jim Cramer’s Investing Club meeting Tuesday: J&J, Danaher, AMDThe Investing Club holds its “Morning Meeting” every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2023/01/24/jim-cramers-investing-club-meeting-tuesday-jj-danaher-amd.html |

|

‘Avatar: The Way of Water’ is the third James Cameron movie to gross $2 billionDisney’s “Avatar: The Way of Water” has topped $2 billion at the global box office, marking the third James Cameron film to reach this benchmark. Read more at: https://www.cnbc.com/2023/01/22/avatar-the-way-of-water-tops-2-billion-at-the-global-box-office.html |

|

US Gasoline Prices Continue To RiseAuthored by Julianne Geiger via OilPrice.com, AAA: gasoline prices continue to climb throughout the U.S. Gasoline prices are up 11.8 cents over a week ago. Gasoline prices are rising along with the rise in WTI crude oil prices, which are up $3 per barrel from a week ago. Gasoline prices continue to climb for the fourth straight week, rising 32.7 cents over the last month as crude oil prices rise, data from AAA showed on Monday.

Gasoline prices are up 11.8 cents over a week ago and are 9.4 cents higher than they were a year ago, before Russia’s “special military operation” in Ukraine. Gasoline prices are rising along with the rise in WTI crude oil prices, which are up $3 per barrel from a week ago, and up $2 per barrel from a month ago… and given the lags of the supply chain, pump prices are set … Read more at: https://www.zerohedge.com/energy/us-gasoline-prices-continue-rise |

|

Battle Tanks For Ukraine Approved On Same Day Doomsday Clock Hits Closest Point To Midnight In HistoryUpdate(1412ET): The Biden administration has said it will send 30 M1 Abrams tanks to Ukraine, in a significant breakthrough and escalation after weeks of debate, as well as division over the issue within the NATO alliance. Politico’s national security correspondents Alex Ward and Hans von der Burchard are further reporting that with the US ready to pull the trigger, Scholz’s Germany has followed by approving Leopard 2 main battle tanks. Germany is planning to send 14 of its Leopard 2 A6 tanks to Ukrainian forces.

Ominously, this comes on the very same day that the war in Ukraine has pushed the Doomsday Clock to its closest point to midnight in history, as The Hill details:

|

|

Jeremy Grantham Doubles Down On Market Apocalypse, Warns Of 17% Crash, Doesn’t Rule Out “Brutal Decline” To 2,000It was several years ago when Jeremy Grantham quietly turned from stock bull to vocal permabear, and while his market notes turned breathlessly alarmist (if only to those who were long his multi-billion fund GMO), such as this from June 2020 “Stock-market legend who called 3 financial bubbles says this one is the ‘Real McCoy,’ this is ‘crazy stuff’”, it wasn’t until early 2021 that Grantham’s warnings of an imminent crash became especially shrill… and wrong. Recall, back in January 2021, Grantham wrote that “Bursting Of This “Great, Epic Bubble” Will Be “Most Important Investing Event Of Your Lives”, which was followed by warnings of a “Spectacular” Crash In “The Next Few Months.” Needless to say, no crash followed as the Fed and other central banks went all in on stabilizing the market, resulting in an epic year for risk assets which closed 2021 at all-time highs, while GMO suffered not only steep losses but also substantial redemptions, a humiliating outcome for Grantham who had previously called the bursting of both the dot com and housing bubbles, but failed to account for just how determined the Fed is to avoid another bubble bursting. Grantham then tried his market- … Read more at: https://www.zerohedge.com/markets/jeremy-grantham-doubles-down-market-apocalypse-warns-17-crash-doesnt-rule-out-brutal |

|

Pardon Or Prosecute? The 2024 Election & The “Get Out Of Jail Free” VoteAuthored by Jonathan Turley, Below is my column in the Hill on how the two criminal investigations over classified documents could create an unprecedented constitutional conflict in 2024. We are likely to have two candidates with their own respective special counsels. One or both could be indicted. Either way, the election could protect the winner practically from prosecution either due to a self-pardon or an internal Justice Department rule. A vote for Biden or Trump could therefore literally prove to be a “get out of jail free” card.

Here is the column: President Biden has declared that the criminal investigation into his possession of classified material ultimately will fizzle out because “there is no ‘there’ … Read more at: https://www.zerohedge.com/political/pardon-or-prosecute-2024-election-get-out-jail-free-vote |

|

National Grid plan: ‘We should earn £10 by turning everything off’Some people can cut back on electricity to get a bonus payment, but some will earn very little. Read more at: https://www.bbc.co.uk/news/business-64384200?at_medium=RSS&at_campaign=KARANGA |

|

Royal Mail boss accused of giving inaccurate evidenceSimon Thompson will be quizzed again by MPs after “hundreds” of complaints about his earlier testimony. Read more at: https://www.bbc.co.uk/news/business-64390623?at_medium=RSS&at_campaign=KARANGA |

|

US accuses Google of ‘driving out’ ad rivalsA federal lawsuit alleges the tech giant’s anti-competitive actions mean more websites need paywalls. Read more at: https://www.bbc.co.uk/news/technology-64393868?at_medium=RSS&at_campaign=KARANGA |

|

Colgate-Palmolive Q3 Results: Net profit dips 4% YoY to Rs 243 croreThe company is focussed on its key strategic pillars of building oral care habit in India, driving innovation and renovation through science-led products and premiumisation,” Colgate-Palmolive (India) Managing Director Prabha Narasimhan said. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/colgate-palmolive-q3-results-net-profit-dips-4-to-rs-243-crore/articleshow/97278158.cms |

|

Bottom fishing? Mutual funds lapped up 7 stocks in bear grip in DecemberIt seems the institutions are trying to bring their average price down as most of the stocks they have been buying have been underperformers and more importantly, the outlook does not give many reasons for a fresh buy, independent market expert Ambareesh Baliga told ETMarkets.com. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/bottom-fishing-mutual-funds-lapped-up-7-stocks-in-bear-grip-in-december/articleshow/97274040.cms |

|

US stocks open lower as earnings roll in, chipmakers retreatThe Dow Jones Industrial Average fell 184.84 points, or 0.55%, at the open to 33,444.72 Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-stocks-open-lower-as-earnings-roll-in-chipmakers-retreat/articleshow/97285455.cms |

|

Key Words: GE has seen only 1 thing that warns of falling demand in 2023GE saw changes in only one demand indicator that suggests the economy is slowing, but it was enough to provide a downbeat 2023 profit outlook Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7184-C31BF604CE5D%7D&siteid=rss&rss=1 |

|

Earnings Results: Raytheon’s profit more than doubles as Ukraine war boosts defense budgetsRaytheon’s strong profit offset a slight shortfall in sales. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7184-ECCC2C3AFD3D%7D&siteid=rss&rss=1 |

|

The Tell: Jeremy Grantham says ‘easiest leg’ of stock-market bubble burst is over. Here’s what’s next.Longtime stock-market bear Jeremy Grantham says the “easiest” part of the U.S. stock-market bubble burst is over. Investors should brace for a rough ride. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7184-FA0E66471D26%7D&siteid=rss&rss=1 |