09 Feb2023 Market Close & Major Financial Headlines: Crazy Wall Street Opens Moderately Higher, Trends Downward, Closes Moderately In The Red

Summary Of the Markets Today:

- The Dow closed down 249 points or 0.73%,

- Nasdaq closed down 1.02%,

- S&P 500 closed down 0.88%,

- Gold $1873 down $18.15,

- WTI crude oil settled at $78 down $0.80,

- 10-year U.S. Treasury 3.667% up 0.031 points,

- USD $103.26 down $0.14,

- Bitcoin $21,950 – 24H Change down $910.28 – Session Low $21,880

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

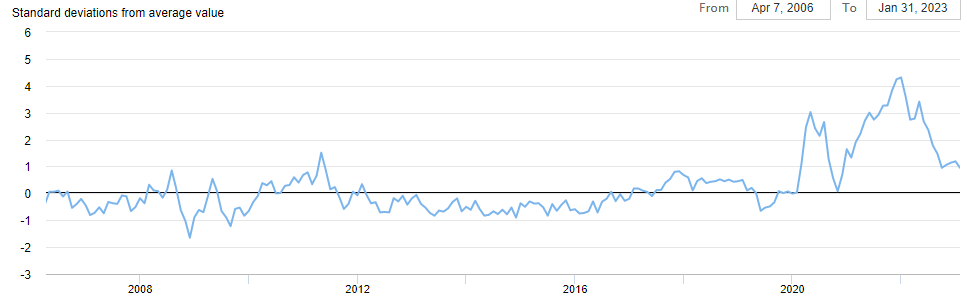

The Atlanta Fed’s Wage Growth Tracker Was 6.1 Percent in January, the same as in December. For people who changed jobs, the Tracker in January was 7.3 percent, compared to 7.7 percent in December. For those not changing jobs, the Tracker was 5.4 percent, compared to the 5.3 percent reading in December.

In the week ending February 4, the unemployment insurance weekly initial claims 4-week moving average was 189,250, a decrease of 2,500 from the previous week’s unrevised average of 191,750.

A summary of headlines we are reading today:

- U.S. Slaps Sanctions On Firms Selling Iranian Oil Products In Asia

- Exxon Unveils New Trading Division To Compete With Shell And BP

- Tesla’s Huge Model 3 Discounts Lift Car Sales In China

- Oil Prices Continue To Slide On Rising US, EU Inventories

- Dow closes nearly 250 points lower, Nasdaq sheds 1% as Alphabet shares slide: Live updates

- Yahoo to lay off 20% of staff by year-end, beginning this week

- Bitcoin slips further below $23,000, and judge extends SBF’s bail restrictions: CNBC Crypto World

- Beware: The Fed Thinks It’s Different This Time

- Cryptos Tumble After Kraken Agrees To Shutter Crypto-Staking Ops To Settle SEC Charges

- Market Extra: Retail investors are more bullish on stocks than at any point since the Fed started hiking rates. Here’s why that could be a problem.

These and other headlines and news summaries moving the markets today are included below.