Ballroom Dancing and America

Ballroom (BR) dancing is a thriving industry in America. But what is it and how well does it mirror America?

Ballroom (BR) dancing is a thriving industry in America. But what is it and how well does it mirror America?

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

224 PM EST Wed Feb 22 2023Valid 00Z Thu Feb 23 2023 – 00Z Sat Feb 25 2023

…Significant coast-to-coast winter storm will continue to produce

widespread heavy snow and blizzard conditions across portions of the West

and the Northern Plains……A swath of heavy snow and locally significant ice will stretch from the

Upper Midwest to the Northeast……Strong to locally severe thunderstorms, and heavy rainfall will impact

portions of the Midwest through tonight…...Record-breaking warmth expected over the East going through Thursday as

extreme cold hits the Northern Plains and the Intermountain West…

*Stock data, cryptocurrency, and commodity prices at the market closing.

Existing-home sales fell for the twelfth straight month in January – slid 0.7% from December 2022 to a seasonally adjusted annual rate of 4.00 million in January. Year-over-year, sales retreated 36.9% (down from 6.34 million in January 2022). NAR Chief Economist Lawrence Yun stated:

Home sales are bottoming out. Prices vary depending on a market’s affordability, with lower-priced regions witnessing modest growth and more expensive regions experiencing declines.

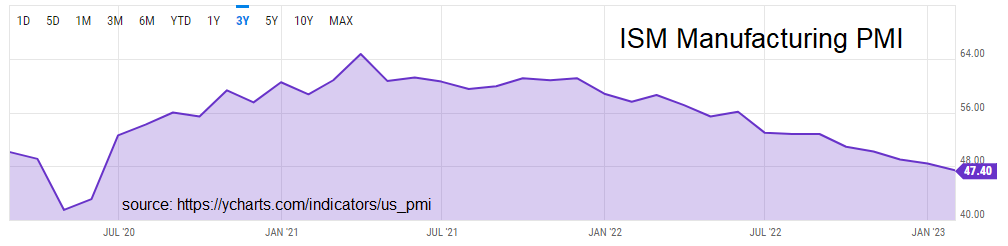

The January Manufacturing PMI registered 47.4%, 1 percentage point lower than the seasonally adjusted 48.4% recorded in December. Regarding the overall economy, this figure indicates a second month of contraction after a 30-month period of expansion. The Manufacturing PMI figure is the lowest since May 2020, when it registered a seasonally adjusted 43.5%. The New Orders Index remained in contraction territory at 42.5%.

CoreLogic’s Single-Family Rent Index (SFRI) shows rental price growth rose by 6.4% year over year in December 2022, compared with the 12.1% gain recorded in December 2021. Rental price gains have risen by about an average of $300 over the past two years.

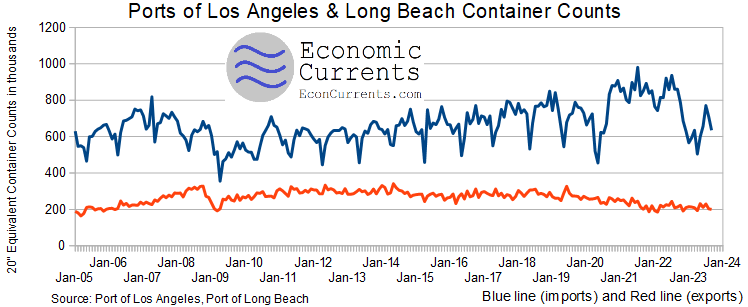

Container exports and imports into the Ports of Los Angeles and Long Beach in January 2023 continued their decline with imports falling 22% year-over-year (down from -20% last month) and exports falling -6% year-over-year (down from +15% last month). Imports declines are normally a negative economic signal – but a good portion of the decline can be attributed to port congestion one year ago where a ship waited months for offloading and elevated traffic above normal. Currently, port congestion has subsided. In my estimation, the amount of traffic going through the ports is not recessionary.

A summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

259 PM EST Tue Feb 21 2023Valid 00Z Wed Feb 22 2023 – 00Z Fri Feb 24 2023

…A major winter storm is expected to deliver a large swath of heavy snow

from the West Coast to the Northeast through Thursday; freezing rain from

the upper Midwest through the lower Great Lakes into Nee England……Widespread very strong, gusty winds expected across the West and

adjacent High Plains……Heavy rain with the potential for scattered flash flooding and severe

weather for the Midwest and Plains Wednesday……Widespread record-breaking warmth expected in the East and much below

average cold in the West through mid-week…

The stock markets are closed today for President’s Day but there is still news. Click on the “Read More” below to read all the headlines we are following today.

None

A summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Japan Agency for Marine-Earth Science and Technology, or JAMSTEC, is a Japanese national research institute for marine-earth science and technology

From the JAMSTEC Discussion:

“The SINTEX-F ensemble mean predicts that the La Niña-like state will gradually decay and an El Niño will occur in May. However, there is a large uncertainty in the predictions of the amplitude. In particular, the ensemble mean of the SINTEX-F2-3DVAR version predicts a relatively weak El Niño.”

Although it is a World forecast, it includes a forecast for North America since North America is part of the World.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

300 PM EST Mon Feb 20 2023Valid 00Z Tue Feb 21 2023 – 00Z Thu Feb 23 2023

…A major winter storm will spread a large swath of heavy snow from the

West Coast to the Northeast through Thursday……Clipper system to bring light to moderate snow to the Upper Midwest,

Great Lakes and interior Northeast……Widespread record breaking cold in the West and record breaking warmth

in the East are possible on Wednesday and Thursday…

I realize that we are past mid-Februray and I recently presented the NOAA Seasonal Outlook, but it makes sense to review January of this year. In this article, I will first take a global perspective and here I rely on the large volume of information that is issued by NOAA (NCEI Div) and then I will take a look at the state rankings in January. The state rankings look at how each state’s January 2023 temperature or precipitation fits in terms of its 129 years of recent history.

Although NCEI seems to think that the important information about January is that it was the seventh warmest on record, that may fall into the category of a given and we will discuss that at the beginning of the article. What I found most interesting was the information on sea ice.

U.S. and Global Weather were very different in January of 2023

This post will address how data sampling affects the analysis results for correlations between U.S. deficit spending and inflation. In Part 11of this series, it was seen that there is significant variability in this correlation over time. It is essential to know whether that variability is affected by changing the data sampling structure. If changes are connected to data treatment, care must be taken to ensure conclusions are fundamental to the overall data and not an artifact of how it is organized.

Image credit: Gerd Altmann from Pixabay2

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

307 PM EST Sun Feb 19 2023Valid 00Z Mon Feb 20 2023 – 00Z Wed Feb 22 2023

…Clipper system to bring light to moderate snow to the Upper Midwest,

Great Lakes and interior Northeast……Winter storm will bring heavy snow and strong winds to much of the

West, the Northern/Central Plains and Upper Midwest through Midweek…