16 March 2023 Market Close & Major Financial Headlines: Closing Sharply Higher In The Green, The Dow Failed To Climb Above The 200-Day Moving Average And Remains In A Downtrend

Summary Of the Markets Today:

- The Dow closed up 372 points or 1.17%,

- Nasdaq closed up 2.48%,

- S&P 500 closed up 1.76%,

- Gold $1924 down $7.60,

- WTI crude oil settled at $68 up $0.57,

- 10-year U.S. Treasury 3.575% up 0.081 points,

- USD $104.41 down $0.24,

- Bitcoin $24.957 – 24H Change up $609.83 – Session Low $24,248

*Stock data, cryptocurrency, and commodity prices at the market closing.

** The 200-day moving average, in a technical analysis, is a widely watched metric that is used to track the average price of a security over the previous 200 trading days. When the price of a security or index falls below the 200-day moving average, it can be seen as a bearish signal by some traders and investors. The idea behind the 200-day moving average is that it can act as a support level for the price of a security or index. If the price is trading above the 200-day moving average, it is generally considered to be in an uptrend and could continue to rise. Conversely, if the price falls below the 200-day moving average, it is generally considered to be in a downtrend and could continue to fall. However, it’s worth noting that the 200-day moving average is just one of many technical indicators that traders and investors use to analyze markets, and it should not be relied on in isolation to make investment decisions. It’s important to also consider other factors such as fundamental analysis and market sentiment when making investment decisions.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

Privately‐owned housing units authorized by building permits in February 2023 were 17.9% below February 2022 (blue line in the graph below). Privately‐owned housing starts in February were 18.4% below February 2022 (red line in the graph below). Privately‐owned housing completions in February were 12.8% above February 2022 (green line in the graph below). Yup, mortgage rates continue to slow new home construction.

Prices for U.S. imports and exports have fallen and are now below the prices one year ago. Import prices are now down 1.1% year-over-year (blue line on the graph below) and export prices are down 0.8% year-over-year (red line on the graph below). Not only does this suggest a slowing US economy – but also suggests a weak global economy.

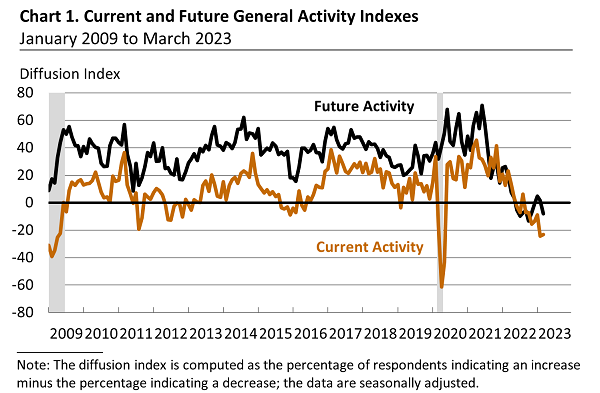

The March 2023 Manufacturing Business Outlook Survey from the Philly Fed continued to decline overall. The survey’s broad indicators for current activity were all negative. On balance, the firms also reported a decline in employment. Most future indicators weakened, suggesting that the firms continue to have tempered expectations for growth over the next six months. The diffusion index for current general activity remained negative but ticked up 1 point to -23.2, its seventh consecutive negative reading (see Chart 1 below). The New York Fed’s manufacturing survey released yesterday also was significantly negative which implies manufacturing in March will slow.

In the week ending March 11, the unemployment insurance weekly claims 4-week moving average was 196,500 – a decrease of 750 from the previous week.

A summary of headlines we are reading today:

- Proving That Magnesium Can Beat Out Lithium-ion Batteries

- Are Oil Prices Set For A Quick Comeback?

- Saudi Arabia’s Oil Exports Hit A 3-Month High In January

- Global Oil Production Dropped To A 7-Month Low In January

- Stocks close higher, Dow jumps more than 300 points as banks step in to aid First Republic: Live updates

- Wall Street rides to the rescue as 11 banks pledge First Republic $30 billion in deposits

- Accounts to buy bonds from the government jumped fivefold as yields boomed

- Bitcoin nears $25,000, and new FTX management says the firm moved billions to SBF: CNBC Crypto World

- The Liquidity Phase Of The Bank Crisis Is Over… But The Solvency Phase Is Getting Worse

- Market Snapshot: U.S. stocks up sharply as First Republic gets rescue from banks

- Distributed Ledger: Bank sector stress may provide a bullish case for cryptocurrencies. Here’s how

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows improvement in average household net worth. Our modeled “Joe Sixpack” – who owns a house and has a job, but essentially no other asset – is worse off than he was last quarter.

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows improvement in average household net worth. Our modeled “Joe Sixpack” – who owns a house and has a job, but essentially no other asset – is worse off than he was last quarter.