Summary Of the Markets Today:

- The Dow closed up 3 points or 0.01%,

- Nasdaq closed up 0.76%,

- S&P 500 closed up 0.36%,

- Gold $2,023 down $12.50,

- WTI crude oil settled at $81 down $0.06,

- 10-year U.S. Treasury 3.298% up 0.11 points,

- USD $101.91 up $0.05,

- Bitcoin $28,017 down $150,

- Baker Hughes Rig Count: U.S. -4 to 751 Canada -12 to 127

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

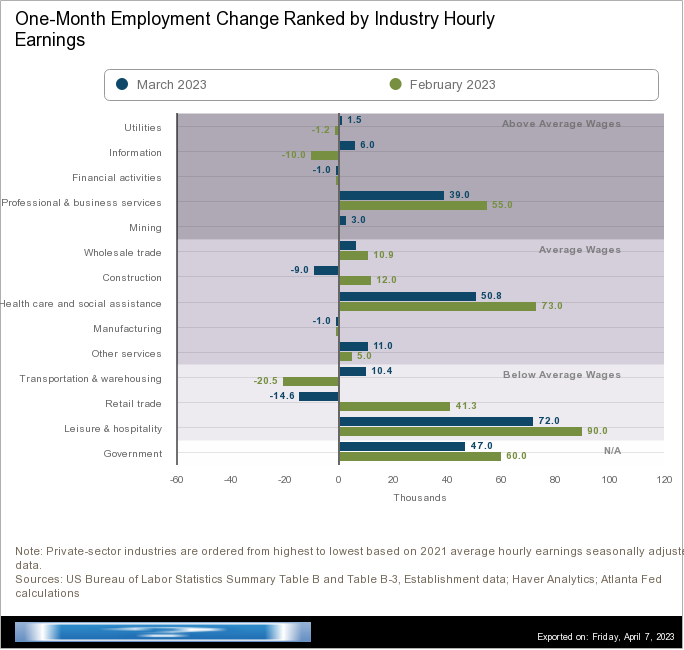

U.S.-based employers announced 89,703 cuts in March, up 15% from the 77,770 announced in February. It is up 319% from the 21,387 cuts announced in the same month in 2022. March’s total marks the third time this year that cuts were higher than the corresponding month a year earlier. Employers announced 270,416 cuts in the first quarter, a 396% increase from the 55,696 cuts announced in the same period one year prior. It is the highest first-quarter total since 2020, when 346,683 cuts were announced from January to March. It is the highest quarterly total since the third quarter of 2020 when 497,215 cuts were recorded.

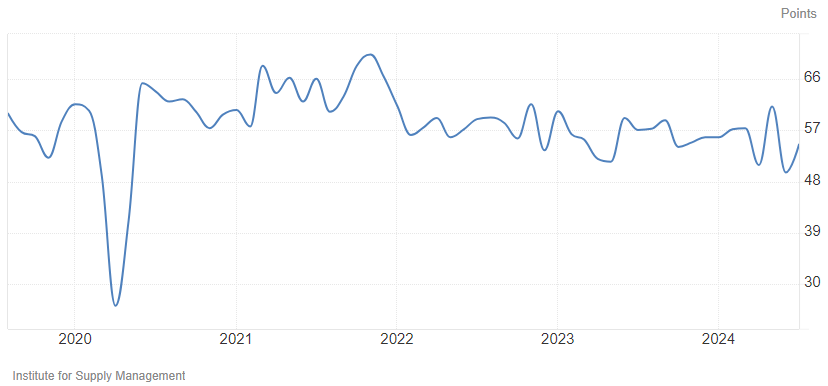

In the week ending April 1, unemployment insurance initial claims‘ 4-week moving average was 237,750, a decrease of 4,250 from the previous week’s revised average. The previous week’s average was revised up by 43,750 from 198,250 to 242,000. !!! This massive change is explained that they have significantly revised their methodology for seasonal adjusting. Their description of the changes is convoluted but now there is a definite trend of growing unemployment.

A summary of headlines we are reading today:

- Can Renewable Energy Save America’s Coal Communities?

- Tokyo Scientists Unveil Solid-State Battery Breakthrough

- North Sea Oil Production Could Fall By 80% By 2030

- Vogtle Nuclear Unit Begins Producing Power

- Drilling Activity Continues To Fall In The U.S.

- Tesla’s Pivot Away From Rare Earths Could Push Other Automakers To Follow Suit

- S&P 500 ends Thursday higher, but suffers its first down week in four: Live updates

- Key inflation data and earnings reports loom as labor market signals a slowing U.S. economy

- Bed Bath & Beyond proposes reverse stock split as it struggles to avoid bankruptcy

- Earnings Outlook: Banks on the line for deposit flows and margin pressure in Q1 updates as they reel from banking crisis

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.