12 April 2023 Market Close & Major Financial Headlines: Today’s Session Resembled “The Dragon’s Breath” Roller Coaster Ride Finally Closing In A Moderate Ride In Red Ink Near Session Low Mark

Summary Of the Markets Today:

- The Dow closed down 38 points or 0.11%,

- Nasdaq closed down 0.85%,

- S&P 500 closed down 0.41%,

- Gold $2,028 up $9.30,

- WTI crude oil settled at $83 up $1.68,

- 10-year U.S. Treasury 3.402% down 0.032 points,

- USD $101.56 down $0.64,

- Bitcoin $29,845 down $300,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

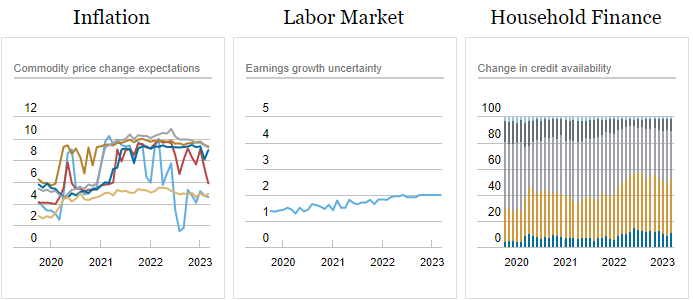

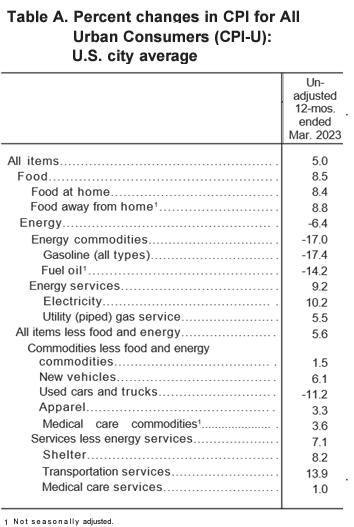

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in March 2023 but over the last 12 months, the all items index increased by 5.0% (blue line on the graph below). The index for shelter was by far the largest contributor to the monthly all-items increase. This more than offset a decline in the energy index, which decreased 3.5% over the month as all major energy component indexes declined. The all items index less food and energy index rose 5.6% over the last 12 months (red line on the graph below). The Fed looks more at inflation excluding food and energy – so in their view, the rate of inflation has little changed since January 2022.

Today, the Federal Reserve released the minutes for their FOMC meeting ending on March 22, 2023. The minutes note that some members of the Committee were concerned that the war in Ukraine could lead to a further increase in inflation. However, the Committee ultimately decided that it was important to take action to combat inflation, even in the face of uncertainty about the war. The minutes also note that the Committee is closely monitoring the labor market. The minutes state that the labor market is “tight” and that there are “signs of wage pressures.” The Committee is concerned that wage pressures could lead to a further increase in inflation. Highlights:

… In assessing the economic outlook, participants noted that since they met in February, data on inflation, employment, and economic activity generally came in stronger than expected. They also noted, however, that the developments in the banking sector that had occurred late in the intermeeting period affected their views of the economic and policy outlook and the uncertainty surrounding that outlook. …

…Participants agreed that the actions taken so far by the Federal Reserve in coordination with other government agencies, as well as actions taken by foreign authorities to address banking and financial stresses outside the U.S., had helped calm conditions in the banking sector. Even with the actions, participants recognized that there was significant uncertainty as to how those conditions would evolve. Participants assessed that the developments so far would likely lead to some weakening of credit conditions, as some banks were likely to tighten lending standards amid rising funding costs and increased concerns about liquidity. Participants noted that it was too early to assess with confidence the magnitude of the effect of a credit tightening on economic activity and inflation, and that it was important to continue to closely monitor developments and update assessments of the actual and expected effects of credit tightening. …

… participants observed that wage growth appeared to be slowing gradually amid this apparent easing in labor demand and increase in labor supply. However, participants assessed that labor demand continued to substantially exceed labor supply, and several participants pointed out that wage growth was still well above the rates that would be consistent over the longer run with the 2 percent inflation objective, given current estimates of trend productivity growth. …

… Participants generally observed that the recent developments in the banking sector had further increased the already-high level of uncertainty associated with their outlooks for economic activity, the labor market, and inflation. Participants saw risks to economic activity as weighted to the downside. …

… In their consideration of appropriate monetary policy actions at this meeting, participants concurred that inflation remained well above the Committee’s longer-run goal of 2 percent and that the recent data on inflation provided few signs that inflation pressures were abating at a pace sufficient to return inflation to 2 percent over time. Participants also noted that recent developments in the banking sector would likely result in tighter credit conditions for households and businesses and weigh on economic activity, hiring, and inflation, though the extent of these effects was highly uncertain. …

… due to the potential for banking-sector developments to tighten financial conditions and to weigh on economic activity and inflation, they judged it prudent to increase the target range by a smaller increment at this meeting.

A summary of headlines we are reading today:

- U.S. To Refill SPR This Year If Advantageous

- World’s Largest Uranium Miner Ramps Up Output To Sell To New Customers

- Oil Prices Gain 2% As Inflation Data Remains Hot

- Clean Energy Sources Produced 39% Of Global Electricity In 2022

- Fed expects banking crisis to cause a recession this year, minutes show

- Stocks fall as fear of recession weighs on investors, Dow snaps four-day win streak: Live updates

- Warren Buffett says we’re not through with bank failures

- FOMC Minutes Show Staff Expect ‘Mild Recession’, All Members Backed Continued QT, 25bps Hike

- Market Snapshot: U.S. stocks erase gains in final hour of trade after minutes show Fed officials expect banking crisis to cause economic slowdown this year

- Bond Report: Two- and 10-year Treasury yields drop by most in a week after Fed minutes, March inflation report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.