Summary Of the Markets Today:

- The Dow closed up 101 points or 0.30%,

- Nasdaq closed up 0.28%,

- S&P 500 closed up 0.33%,

- Gold $2,009 down $7.30,

- WTI crude oil settled at $81 down $1.54,

- 10-year U.S. Treasury 3.598% up 0.076 points,

- USD $102.08 up $0.53,

- Bitcoin $29,501 down $788,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

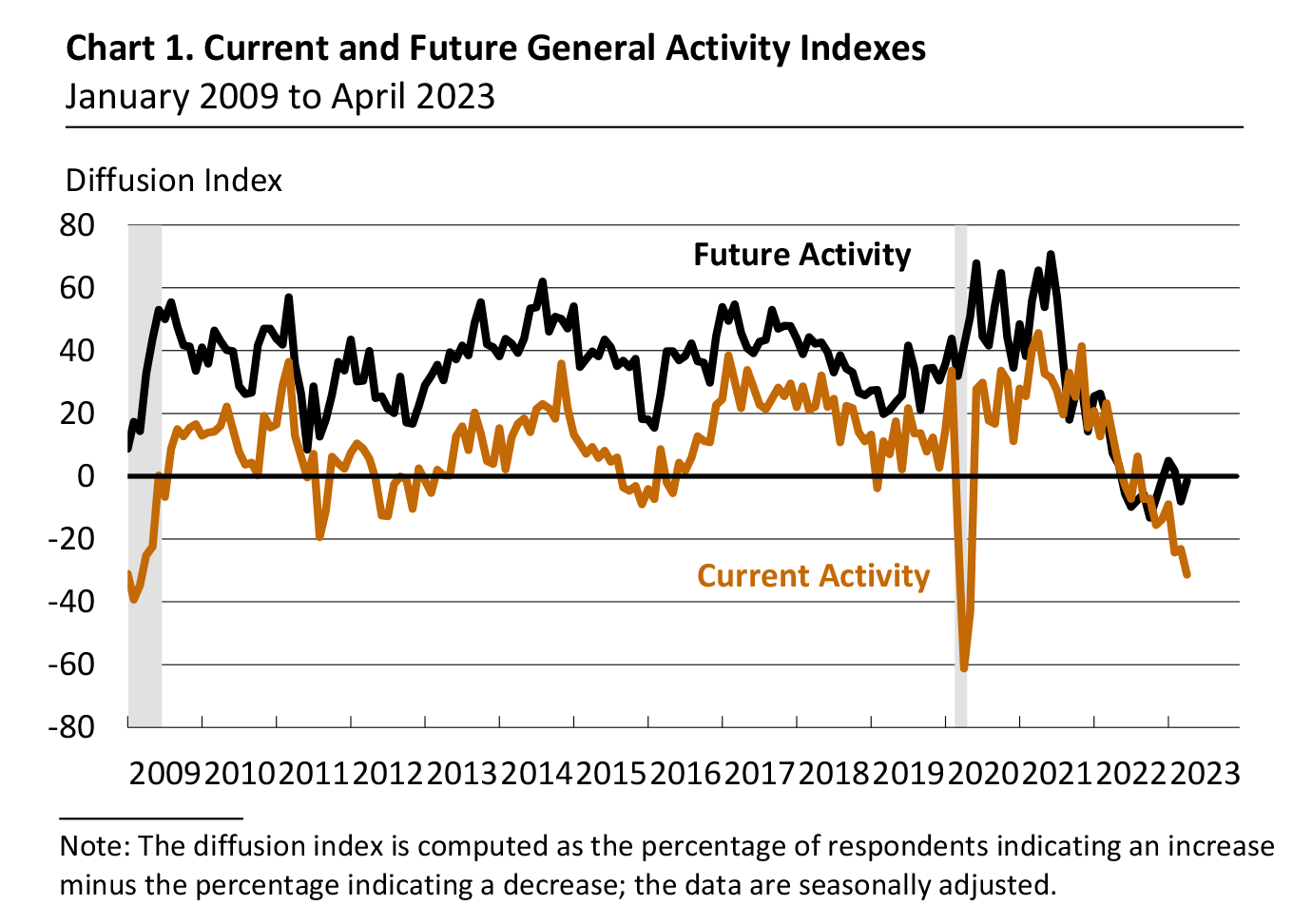

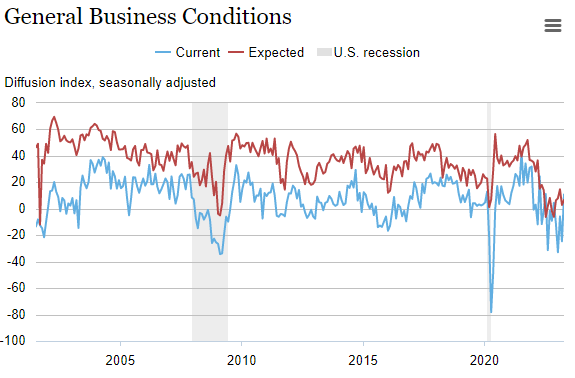

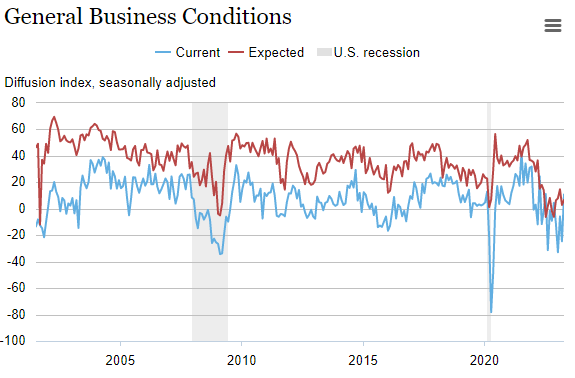

The Empire State Manufacturing Survey for April 2023 showed a significant increase in business activity, with the general business conditions index jumping 35.4 points to 10.8. This was the first month of expansion in five months, and the largest expansion in the last nine. The increase in activity was driven by a surge in new orders and shipments, as well as a pickup in delivery times and inventories. However, employment and hours worked declined for a third consecutive month. Despite the increase in activity, businesses continued to expect little improvement in conditions over the next six months. The index for future business conditions edged up to 6.6, suggesting that firms do not expect much improvement in activity over the next six months.

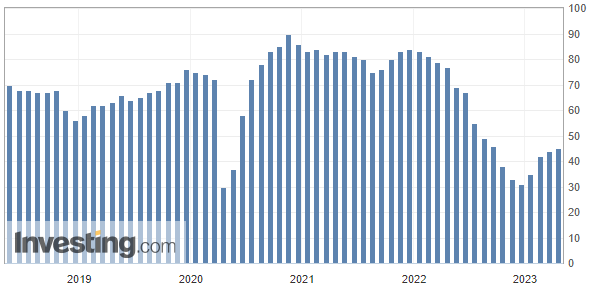

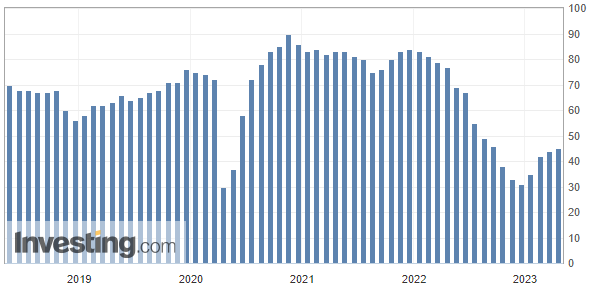

The housing market index for April 2023 rose for a fourth consecutive month, reaching 45. This was a fresh high since September 2022 and beat market expectations of 44. The gauge for current sales conditions rose to 51 from 49, sales expectations in the next six months increased to 50 from 47, and traffic of prospective buyers was unchanged at 31. Builders noted that additional declines in mortgage rates, to below 6%, will price-in further demand for housing. They also said that they are seeing more buyers coming back into the market, as affordability improves. The housing market is still facing some headwinds, such as rising inflation and interest rates. However, the overall trend is positive, and builders are optimistic about the outlook for the housing market in the coming months. Here are some additional details from the housing market index for April 2023:

- The index for current sales conditions rose to 51 from 49, indicating that more builders view sales conditions as good than poor.

- The index for sales expectations in the next six months increased to 50 from 47, indicating that builders are more optimistic about the outlook for the housing market over the next six months.

- The index for the traffic of prospective buyers was unchanged at 31, indicating that the level of buyer interest remains stable.

Overall, the housing market index for April 2023 suggests that the housing market is continuing to improve. Builders are more optimistic about the outlook for the housing market, and more buyers are coming back into the market. However, the housing market is still facing some headwinds, such as rising inflation and interest rates.

A summary of headlines we are reading today:

- Hedge Funds Dropping China Stocks For American Oil

- Exxon Faces Shareholder Scrutiny Over Unclear Decommissioning Plans

- Can Technology Really Solve Our Climate Problems?

- Russia’s Seaborne Crude Oil Exports Rebound To Above 3 Million Bpd

- Natural Gas Prices Jump 8% On Colder-Than-Expected Weather Forecast

- Electric Vehicle Market Share Continues To Grow

- Lithium Prices Could Start To Rebound Soon

- S&P 500 closes higher Monday to kick off a busy earnings week: Live updates

- Bitcoin dips below $30,000, and backlash brews as SEC moves toward DeFi oversight: CNBC Crypto World

- US Banks Lost Money On Mortgages For The First Time Since The MBA Began Keeping Records

- “Does Not Appear Sustainable”: The US Budget Deficit Is Unexpectedly Soaring Again And It’s About To Get Much Worse

- Market Snapshot: Dow turns positive in afternoon trade with earnings season set to pick up steam

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.