Summary Of the Markets Today:

- The Dow closed down 367 points or 1.08%,

- Nasdaq closed down 1.08%,

- S&P 500 closed down 1.16%,

- Gold $2,026 up $34.10,

- WTI crude oil settled at $72 down $4.03,

- 10-year U.S. Treasury 3.426% down 0.148 points,

- EUR/USD $1.100 up $0.003,

- Bitcoin $28,718 up $863,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

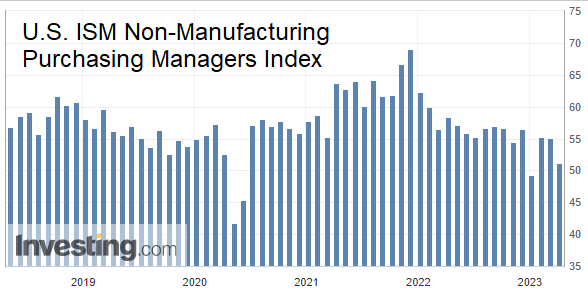

The U.S. Bureau of Labor Statistics (BLS) reported today that job openings decreased to 9.6 million on the last business day of March, a decrease of 632,000 from the previous month. The decline was driven by a decrease in openings in professional and business services, health care and social assistance, and transportation and warehousing. The decline in job openings is a sign that the labor market is cooling. This is likely due to a number of factors, including rising inflation, concerns about a recession, and the war in Ukraine. Note that the number of job openings per unemployed person has significantly declined (see graph below)

New orders for manufactured goods in March increased by $4.9 billion or 0.9% month-over-month to $539.0 billion (1.3% year-over-year gain). This follows two consecutive monthly decreases. The increase was driven by a rise in demand for transportation equipment, which increased by $4.4 billion or 5.4%. Excluding transportation equipment, new orders increased by 0.3%. Excluding defense, new orders increased by 1.0%. If one inflation adjusts this data, new orders declined 0.2% year-over-year.

A summary of headlines we are reading today:

- Tesla Hikes Prices Of Model 3, Model Y In The U.S. And China

- Platinum May Soon Be In Short Supply

- Oil Prices Unlikely To Get Support From Rising Jet Fuel Demand

- WTI Crude Falls 4% As Economic Fears Trigger Selloff

- Diamondback Energy Misses Q1 Forecasts As Oil Prices Slide

- BP Beats Q1 Profit Forecast With “Exceptional” Oil And Gas Trading

- Dow tumbles more than 300 points as banking sector worries reignite before Fed rate decision: Live updates

- Drugs, guns and crypto seized, 288 arrested, in ‘unprecedented’ dark web crackdown

- Job openings fell more than expected in March to lowest level in nearly two years

- Washington Watch: Debt-ceiling standoff: Here’s what’s next, as U.S. faces potential default on June 1

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.