Summary Of the Markets Today:

- The Dow closed up 154 points or 0.47%,

- Nasdaq closed up 1.28%,

- S&P 500 closed up 0.99%,

- Gold $1,996 up $13.50,

- WTI crude oil settled at $70 up $1.96,

- 10-year U.S. Treasury 3.605% down 0.032 points,

- USD Index $103.55 down $0.78,

- Bitcoin $26,864 down $209,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

ADP National Employment Report from the ADP Research Institute shows private employers created 278,000 jobs in May 2023 and annual pay was up 6.5 percent year-over-year. Job growth is strong while pay growth continues to slow. But gains in private employment were fragmented last month, with leisure and hospitality, natural resources, and construction taking the lead whilst manufacturing and finance lost jobs. Strong employment gains will allow the Federal Reserve to continue to raise interest rates. Nela Richardson, ADP’s chief economist stated:

This is the second month we’ve seen a full percentage point decline in pay growth for job changers. Pay growth is slowing substantially, and wage-driven inflation may be less of a concern for the economy despite robust hiring.

According to NFIB’s monthly jobs report, 44% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down one point from April but still 20 points higher than the 49-year average reading. The percentage of owners reporting labor quality as their top small business operating problem remains elevated at 24% and 10% of owners reported labor costs as their single most important problem. NFIB Chief Economist Bill Dunkelberg stated:

The labor force participation rate remains below pre-COVID levels, which is contributing to the shortage of workers available to fill open positions. Small businesses have a record high level of job openings currently and are working hard to fill their open positions.

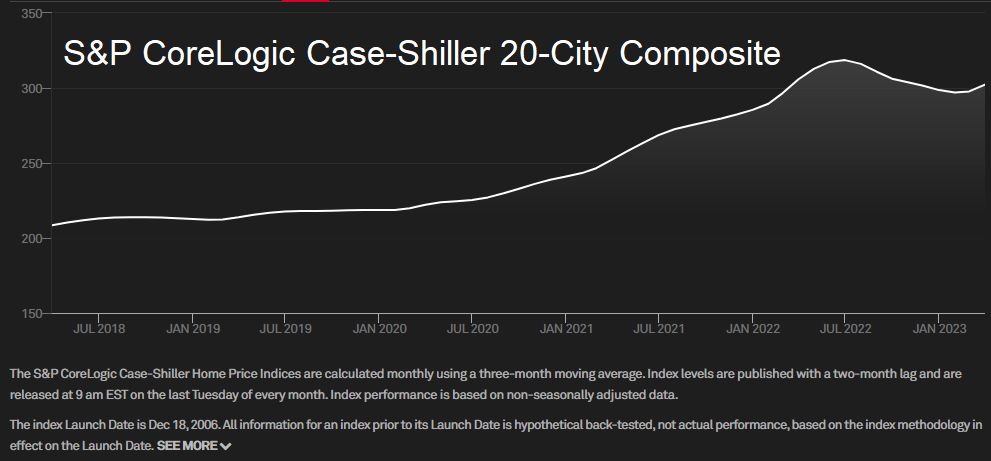

Construction spending during April 2023 was estimated at a seasonally adjusted annual rate of 7.2% above April 2022. However, when the spending is adjusted for inflation – spending declined 3.4% year-over-year. This is a sign of a weak economy.

In the week ending May 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 229,500, a decrease of 2,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 231,750 to 232,000.

Nonfarm business sector labor productivity decreased by 0.8% from the first quarter one year ago whilst labor costs increased by 3.8% in the same period. Whenever labor costs rise faster than productivity – it is not only inflationary but makes the country less competitive.

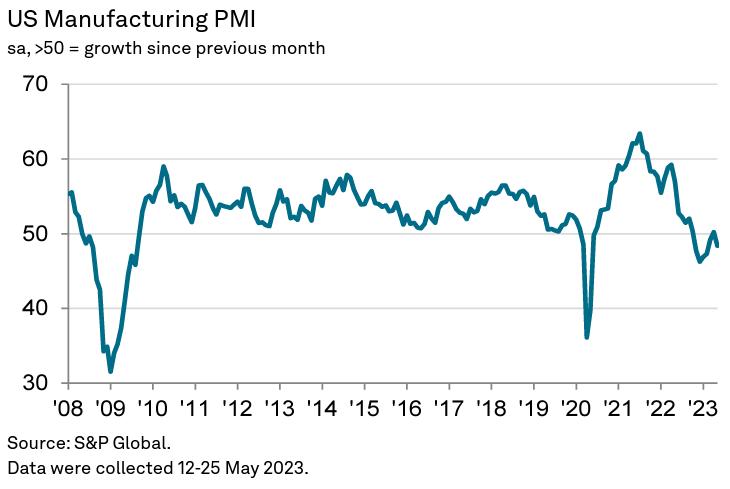

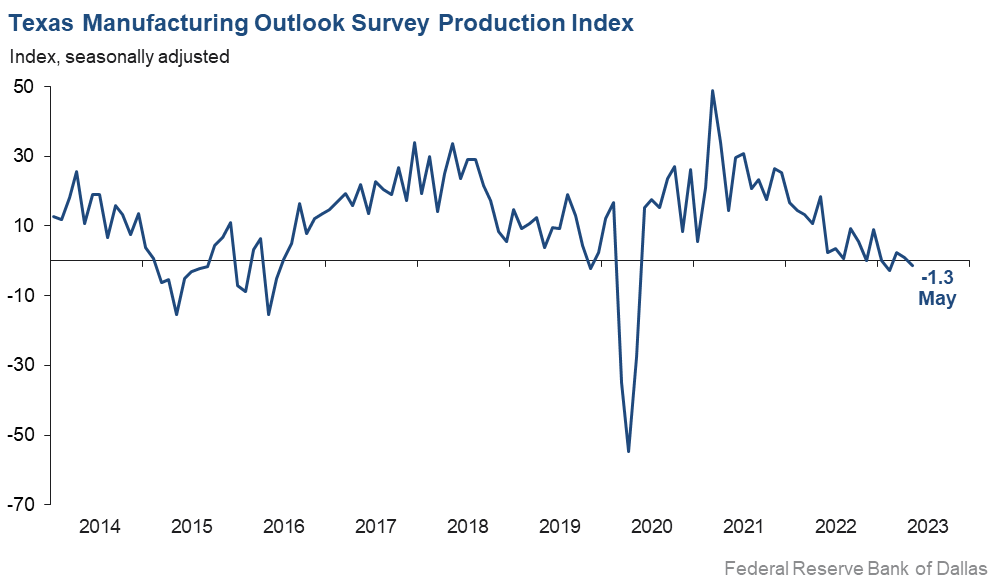

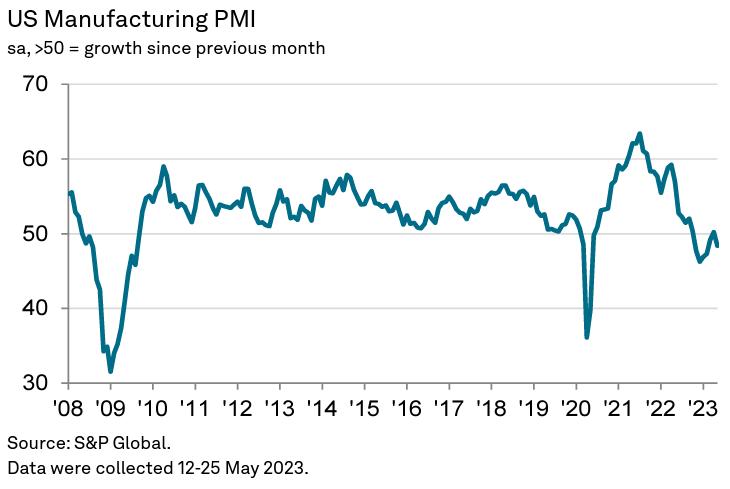

The seasonally adjusted S&P Global US Manufacturing Purchasing Managers’ Index™ (PMI™) posted 48.4 in May, down from 50.2 in April, but broadly in line with the earlier released ‘flash’ estimate of 48.5. The latest figure indicated the fastest deterioration in operating conditions since February. Contributing to the latest overall decline was a renewed and solid fall in new orders at manufacturing firms in May. The decrease was the sharpest in three months. Lower new sales were often attributed to sufficient inventory levels at customers and previous hikes in selling prices which served to dampen demand conditions. F

The May Manufacturing PMI® registered 46.9%, 0.2 percentage point lower than the 47.1 percent recorded in April. Regarding the overall economy, this figure indicates a sixth month of contraction after a 30-month period of expansion.

U.S.-based employers announced 80,089 job cuts in May, a 20% increase from the 66,995 cuts announced one month prior. It is 287% higher than the 20,712 cuts announced in the same month in 2022. So far this year, companies have announced plans to cut 417,500 jobs, a 315% increase from the 100,694 cuts announced in the same period last year. It is the highest January-May total since 2020.

Here is a summary of headlines we are reading today:

- The Grid Needs A $20 Trillion Upgrade To Support Energy Transition

- Copper Prices Trounced By Falling Demand

- WTI Screams Back Up Past $70 Despite Crude Inventory Builds

- Natural Gas Prices Plunge Further Amid Rise In U.S. Stockpiles

- Why Apple’s VR headset could succeed where every similar product has failed

- Defense spending levels threaten to delay Senate plan to fast-track debt ceiling bill

- Stocks jump Thursday, Nasdaq pops 1% as traders cheer advancement of debt ceiling bill: Live updates

- Bitcoin suffers worst month of 2023, Circle cuts U.S. bonds on debt ceiling doubt: CNBC Crypto World

- Wage hikes may have been a key driver of inflation. They may now be fueling mass layoffs

- Planned Layoffs Are Up Fourfold So Far This Year

- Dell stock jumps after early earnings release shows largest sales decline on record, but still beats expectations

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.