05 June 2023 Market Close & Major Financial Headlines: Wall Street Opened Fractionally Higher, Trended Lower, Finally Closing Moderately Lower In The Red

Summary Of the Markets Today:

- The Dow closed down 200 points or 0.59%,

- Nasdaq closed down 0.09%,

- S&P 500 closed down 0.20%,

- Gold $1,978 up $8.40,

- WTI crude oil settled at $72 up $1.84,

- 10-year U.S. Treasury 3.695% up 0.002 points,

- USD Index $104.01 down $0.01,

- Bitcoin $25,632 down $1,559,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

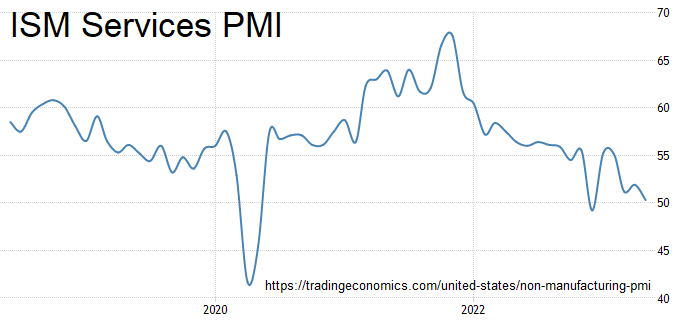

In May 2023, the ISM Services PMI® registered 50.3%, 1.6 percentage points lower than April’s reading of 51.9%. The composite index indicated growth in May for the fifth consecutive month after a reading of 49.2% in December, which was the first contraction since May 2020 (45.4%). A reading under 55% is not only indicative of an economy barely growing but also in the recession warning zone.

New orders for manufactured goods in April, up four of the last five months, increased $2.6 billion or 0.4 percent to $577.5 billion. However, growth was down 1.1% year-over-year – and there is no question that the manufacturing sector is in a recession.

Here is a summary of headlines we are reading today:

- Oil Majors Keen On Libya’s Untapped Potential

- New Car Sales In UK Drive Forward For The Tenth Month

- Blurred Battle Lines: Drone Strikes Stoke Russia-Ukraine Conflict

- China’s Economic Rebound Reshapes Emerging Markets

- Goldman Sachs Warns ESG Investors Against Rushing To Divest From Oil And Gas

- S&P 500 closes slightly lower on Monday after touching highest level since August: Live updates

- Bitcoin drops below $26,000 after SEC sues crypto exchange Binance

- History Suggests VIX Is Poised For Sharp Reversal

- Brett Arends’s ROI: The S&P 500 is ridiculous. Here’s why.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.