Summary Of the Markets Today:

- The Dow closed up 13 points or 0.04%,

- Nasdaq closed down 0.25%,

- S&P 500 closed down 0.01%,

- Gold $1,936 up $1.70,

- WTI crude oil settled at $87 up $0.55,

- 10-year U.S. Treasury 4.838% up 0.130 points,

- USD Index $106.19 down $0.050,

- Bitcoin $28,525 up $57,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

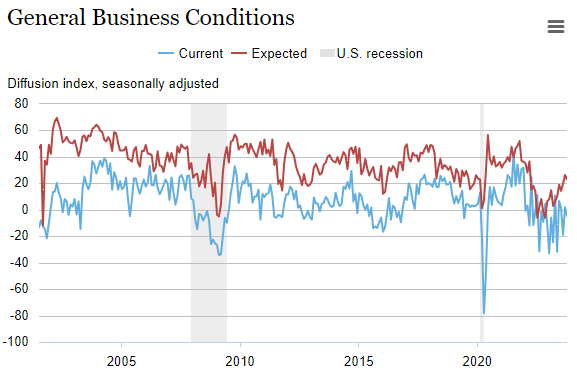

Industrial production increased in September 2023 0.1% year-over-year – the three industrial production components manufacturing (red line on the graph below), utilities (green line on the graph below), and mining (orange line on the graph below) increased -0.8%, 2.0%, and 3.4% respectively year-over-year. Overall the manufacturing component remains in a recession and does not indicate an improving trend – and manufacturing represents approximately 20% of the economy.

Advance estimates of U.S. retail and food services sales for September 2023 were up 3.4% year-over-year (blue line on the graph below – unadjusted data). If one adjusts for inflation, retail and food sales were up 1.5% (red line on the graph below). This year-over-year growth rate is similar to last month thereby showing almost no acceleration month-over-month. Please do not be fooled by the bullshit reporting throwing out “Retail sales rose 0.7% in September, more than twice what economists had expected, and close to a revised 0.8% bump in August, the Commerce Department reported Tuesday.” There is no resilience of shoppers in the U.S. considering that gas stations are over 100% of the increase in spending year-over-year.

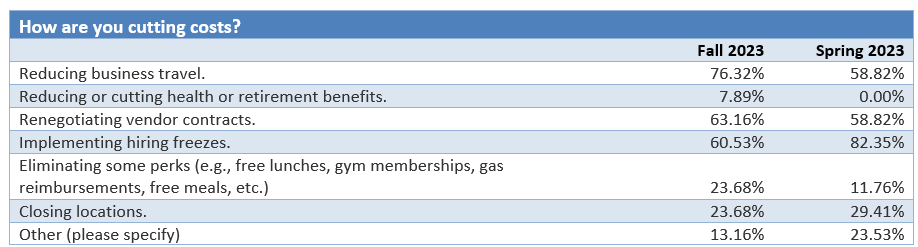

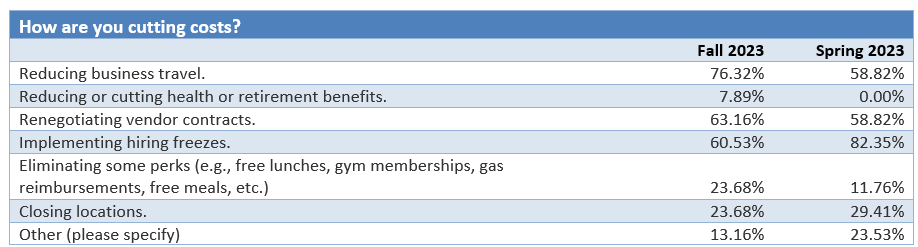

Several economic indicators suggest that while the labor market remains tight, consumers and businesses are approaching the end of the year with caution. In a new survey, 46% of companies expect a recession, with 24% actively planning for one. That number jumps to 52% for companies with more than 5,000 employees, according to new survey results released Wednesday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

CoreLogic’s Single-Family Rent Index (SFRI) shows annual U.S. single-family rent growth eased again in August 2023 but renters are still feeling the pinch. The average American renter household spends about 40% of its income on housing costs, with lower-income tenants bearing much of the brunt of inflation. The SFRI’s low tier saw the largest year-over-year rental cost gain in August (up by 4.2%), while the high tier registered a 2.4% annual increase. Molly Boesel, principal economist for CoreLogic added:

While annual single-family rent growth has returned to a moderate pace, more than three years of substantial increases will have a lasting impact on tenants’ budgets. Single-family rents grew by 30% since February 2020, and small drops in some areas barely put a dent in the overall, cumulative increase. For example, even though rents in the Miami metro area have declined by 0.5% since August 2022, they are still 51% higher than they were before the pandemic began.

Here is a summary of headlines we are reading today:

- EV Battery Costs Could Surge By 22%

- Goldman’s Grim Forecast: Shipping Industry Faces Prolonged Downturn

- Russian Oil Shipping Rates Jump As The U.S. Sanctions Price Cap Evaders

- Oil Markets Remain On Edge As Biden Heads To Israel

- Homebuilder sentiment drops to 10-month low, as mortgage rates soar

- S&P 500 closes little changed Tuesday as Treasury yields pop on hot retail sales data: Live updates

- Retail sales rose 0.7% in September, much stronger than estimate

- Wages overtake inflation for first time in nearly two years

- Market Extra: ‘Bond math’ shows traders bold enough to bet on Treasurys could reap dazzling returns with little risk

- 5 charts that show how the housing market crashed and burned in 18 months

- Shares of bankrupt Rite Aid plunge despite meme-stock chatter

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.