21 May 2024 Market Close & Major Financial Headlines: Indexes Opened Fractionally Lower, Then Trended Higher, Traded Mostly Sideways Just Above The Unchanged Line, Nasdaq Recorded A New High, Indexes Closed Fractionally higher

Summary Of the Markets Today:

- The Dow closed up 66 points or 0.17%,

- Nasdaq closed up 0.22%, (Closed at 16,833, New Historic high 16,839)

- S&P 500 closed up 0.25%,

- Gold $2,428 down $10.70,

- WTI crude oil settled at $79 down $0.74,

- 10-year U.S. Treasury 4.414 down 0.023 points,

- USD index $104.64 up $0.07,

- Bitcoin $69,532 down $127 (0.18%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

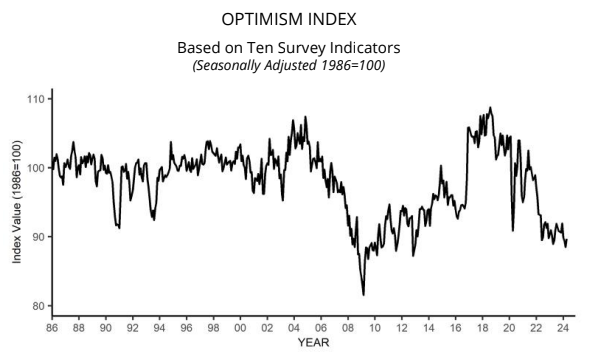

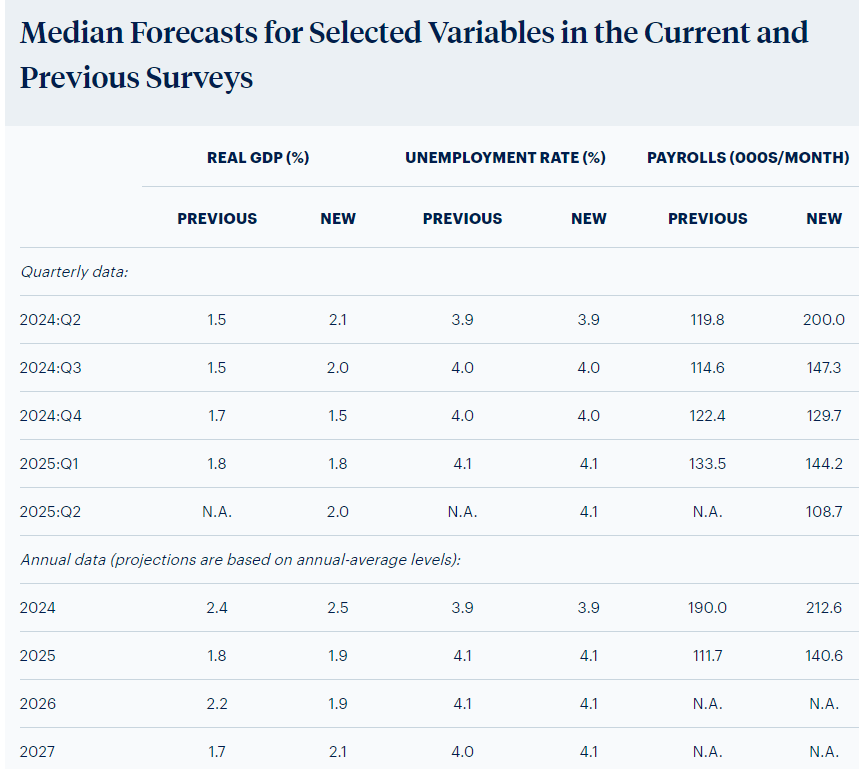

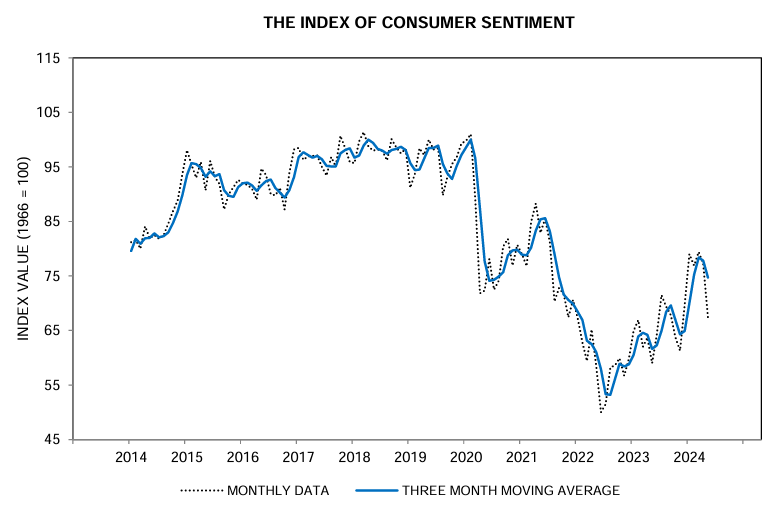

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Single-Family Rent Index (SFRI) shows single-family rent gains inched up again to 3.4% on an annual basis in March 2024, with the median monthly cost for a U.S. three-bedroom home at $2,052 in February. Of the 20 metro areas CoreLogic tracks, only six posted rental prices that were less expensive than the national average. Three metros in the South showed annual declines, while coastal job hubs again led for rent growth. This indicates that Americans who rent in expensive metros can shoulder the additional cost burden, thanks to higher wages in many job sectors and a U.S. unemployment rate that has remained below 4% for more than two years. Molly Boesel, principal economist for CoreLogic stated:

U.S. single-family rent growth strengthened overall in March, though some weaknesses are revealed in the latest numbers. Overbuilt areas, such as Austin, Texas continued to soften, decreasing by 3.5% annually in March. And for the first time in 14 years, single-family, attached properties posted a year-over-year decline. The continued strength in single-family detached rents indicates that potential homebuyers who are priced out of the home-purchase market are choosing to rent similar alternatives.

Here is a summary of headlines we are reading today:

- China’s Solar Executives Fear Western Trade Barriers Could Jeopardize Exports

- U.S. Department of Energy to Release 1 Million Barrels of Gasoline from Northeas

- Net-Zero Comes With Insane $215 Trillion Price Tag

- Are Hybrids and EVs Incompatible?

- Americans Set for Near-Record Summer Road Trips as Gasoline Prices Fall

- South Africa Is Set to Run Coal Power Plants for Longer Than Planned

- S&P 500, Nasdaq rise on Tuesday to close at fresh records: Live updates

- Pixar is laying off 14% of its workforce as Disney scales back content

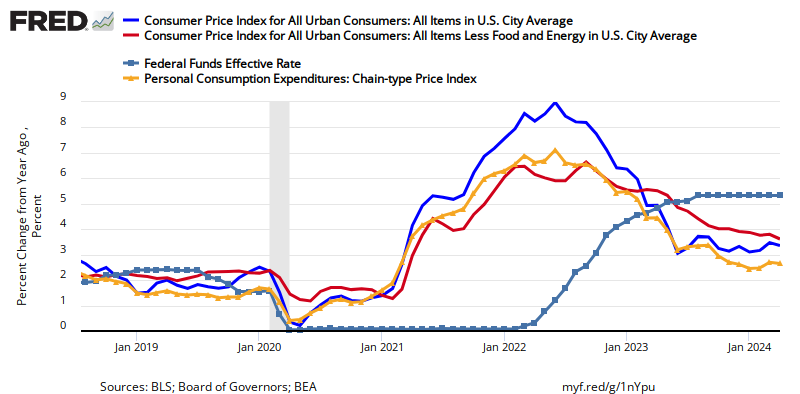

- Fed Governor Waller wants ‘several months’ of good inflation data before lowering rates

- EPA’s Clean Power Plan Rule Prioritizes Net-Zero Over Grid Reliability

- Biden Drains Entire Northeast Gasoline Reserve In Bid To Lower Gas Prices As He Trails Trump By Double Digits

- California Governor Escalates War On Gasoline Impacting Neighboring States

- Comcast says its new ‘StreamSaver’ bundle will save customers close to $100 a year — here’s how

- Bond king Jeffrey Gundlach still sees a U.S. recession coming. Here’s when.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.