Summary Of the Markets Today:

- The Dow closed up 172 points or 0.44%,

- Nasdaq closed down 0.18%,

- S&P 500 closed flat 0.00%,

- Gold $2,317 down $7.60,

- WTI crude oil settled at $79 up $0.80,

- 10-year U.S. Treasury 4.494% up 0.033 points,

- USD index $105.55 up $0.130,

- Bitcoin $62,171 down $914 (1.45%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

March 2024 sales of merchant wholesalers were up 1.4 percent year-over-year from the revised March 2023 level – down 3.6% year-over-year inflation adjusted. Total inventories of merchant wholesalers were down 2.3% from the revised March 2023 level. The March inventories/sales ratio for merchant wholesalers, except manufacturers’ sales branches and offices, based on seasonally adjusted data, was 1.35. The March 2023 ratio was 1.40. The inventory to sales ratio is healthy – and this sector has employment growth of 1.0% which suggests wholesale trade is healthier than the monetary sales figures suggest.

Here is a summary of headlines we are reading today:

- Gasoline Demand Continues To Grow Despite EV Boom

- U.S. Gasoline, Diesel Demand Hit Seasonal Low Not Seen Since COVID

- Tesla Faces DoJ Probe for Deceptive Statements on Autonomous Driving

- China Looks to Slam the Brakes on Its Battery Boom to Fight Overcapacity

- Google employees question execs over ‘decline in morale’ after blowout earnings

- Dow pops more than 150 points to notch sixth positive day and longest win streak in 2024: Live updates

- Uber reports first-quarter results that beat expectations for revenue, but posts net loss

- Major banks team up to test network for tokenized money and U.S. Treasurys: CNBC Crypto World

- Gold bars are selling like hot cakes in Korea’s convenience stores and vending machines

- Interest rates on federal student loans may increase by 1%: ‘A fairly big jump,’ expert says

- Someone Is Lying: Atlanta Fed Claims US GDP Is 4.2% While DOE Reports Lowest Gasoline, Diesel Demand Since Covid

- 10-year Treasury yield finishes higher for first time in six sessions

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Green Transition at Risk as Carbon Offset Schemes FalterCompanies worldwide are increasingly opting to use carbon credit schemes to offset their emissions, as governments urge them to decarbonise operations. While this might seem the obvious solution for hard-to-abate industries, many are failing to monitor and assess the schemes to ensure that they are working as expected and offsetting the necessary quantity of carbon to decarbonise operations. Carbon offsetting schemes are programmes introduced by a wide range of companies aimed at reducing carbon emissions through various projects, rather… Read more at: https://oilprice.com/Energy/Energy-General/Green-Transition-at-Risk-as-Carbon-Offset-Schemes-Falter.html |

|

Gasoline Demand Continues To Grow Despite EV BoomIncreased adoption of electric vehicles in the United States and China is expected to put a major dent in gasoline demand growth this year. In one of the most telling statistics about the penetration of EVs into the global market we’ve seen yet, global consultancy Wood Mackenzie projects that gasoline demand growth will reduce by half over the course of 2024. China is on a stratospheric growth trajectory in terms of EV production. 60% of all EV sales in the world are made in China, and EVs are expected to represent 40% of… Read more at: https://oilprice.com/Energy/Gas-Prices/Gasoline-Demand-Continues-To-Grow-Despite-EV-Boom.html |

|

U.S. Gasoline, Diesel Demand Hit Seasonal Low Not Seen Since COVIDDemand for gasoline and diesel in the United States has plunged to its lowest seasonally since the onset of the COVID pandemic, according to the Energy Information Administration (EIA), sparking concern that economic activity is now becoming stagnant as refining margins hit news lows not seen in months, Reuters reported. Monthly averages for the week ended May 3 show gasoline demand at 8.63 million barrels per day–a figure not seen since May 2020, at the start of the pandemic, based on EIA data. Data also showed demand for distillates… Read more at: https://oilprice.com/Latest-Energy-News/World-News/US-Gasoline-Diesel-Demand-Hit-Seasonal-Low-Not-Seen-Since-COVID.html |

|

Steel Industry Collaboration Ushers in a New Era of Eco-Friendly ManufacturingVia Metal Miner ThyssenKrupp recently announced plans to create a 50/50 joint steel manufacturing venture with the Czech Republic’s EP Corporate Group and ThyssenKrupp Steel (TKS). According to the German group, talks are now ongoing between the two parties for the sale of an additional 30% stake in the steelmaker, following an April 26 announcement that EP would initially acquire a 20% stake in TKS. However, ThyssenKrupp did not indicate a prospective timeline for a planned sale of the additional stake. The two parties also agreed not to… Read more at: https://oilprice.com/Energy/Energy-General/Steel-Industry-Collaboration-Ushers-in-a-New-Era-of-Eco-Friendly-Manufacturing.html |

|

Canadian Utilities Ltd. Plans Billion-Dollar Alberta PipelineCanadian Utilities Ltd has announced it will build a billion-dollar pipeline in Alberta to transport natural gas as demand soars amid industrial expansion in the province, Reuters reports. Construction is expected to begin on the new Yellowhead Mainline natural gas pipeline, which will feed a provincial petrochemicals plant and other industrial facilities, in 2026, with completion the following year, according to Reuters. The project requires regulatory approval and a final investment decision before proceeding. The 124-mile pipeline… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadian-Utilities-Ltd-Plans-Billion-Dollar-Alberta-Pipeline.html |

|

Why Germany is Choosing Natural Gas Over Nuclear PowerThe world is experiencing a nuclear renaissance. Uranium prices are soaring as the world snaps up nuclear fuel, public favor for nuclear power is at a 10-year high in the United States, Russia is busily expanding its own nuclear energy empire in emerging economies in Africa, and even Japan is moving back to the carbon-free energy source 13 years after the Fukushima nuclear disaster. All told, approximately 60 new nuclear reactors are currently under construction around the globe, and another 110 are in planning… Read more at: https://oilprice.com/Energy/Energy-General/Why-Germany-is-Choosing-Natural-Gas-Over-Nuclear-Power.html |

|

Russia Launches New Wave of Attacks on Ukrainian EnergyRussia advanced into eastern Ukraine, taking two villages in two regions, Moscow said on Wednesday, in the aftermath of over 70 drone and missile attacks that targeted Ukrainian energy infrastructure overnight. The barrage of drones and missiles fired early on Wednesday, including Iranian-made Shahed drones, was Moscow’s retaliation for Kyiv’s targeting of Russian refineries. Russia has also reportedly taken control of two villages, one in the Kharkiv region and another in the Donetsk region, Reuters reports, without independent… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russia-Launches-New-Wave-of-Attacks-on-Ukrainian-Energy.html |

|

Tesla Faces DoJ Probe for Deceptive Statements on Autonomous DrivingIn what appears to be just the latest ‘lawfare’ angle of attack against Elon Musk (and his freedom of speech enabling platform), President Biden’s Department of Justice is examining whether Tesla committed securities or wire fraud by misleading investors and consumers about its electric vehicles’ self-driving capabilities. Tesla’s Autopilot and Full Self-Driving systems assist with steering, braking and lane changes – but are not fully autonomous – and Reuters reports that, according to three people familiar with the matter, the DoJ… Read more at: https://oilprice.com/Energy/Energy-General/Tesla-Faces-DoJ-Probe-for-Deceptive-Statements-on-Autonomous-Driving.html |

|

Norway Expands Arctic Acreage for Oil and Gas Drilling in Mature AreasNorway is expanding the acreage in the Barents Sea and the Norwegian Sea, for which companies vying for licenses in mature areas can bid this year, the energy ministry of Western Europe’s largest oil and gas producer said on Wednesday. Following the ministry’s announcement, the annual rounds of awards in predefined areas (APA), which give oil companies the opportunity to gain access to attractive acreage in the mature areas of the Norwegian shelf, will include a further 37 blocks—three… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norway-Expands-Arctic-Acreage-for-Oil-and-Gas-Drilling-in-Mature-Areas.html |

|

Oil Stabilizes on Small Crude DrawCrude oil prices recovered lost territory today after the U.S. Energy Information Administration reported an inventory draw of 1.4 million barrels for the week to May 3. This compared with a build of 7.3 million barrels estimated for the previous week that pressured prices last week. On Tuesday, the American Petroleum Institute estimated crude oil inventories had added a modest half a million barrels in the week to May 3. The EIA, for its part, also reported small inventory builds in gasoline and middle distillate inventories for… Read more at: https://oilprice.com/Energy/Crude-Oil/Oil-Stabilizes-on-Small-Crude-Draw.html |

|

Nigeria Launches Oil and Gas Licensing RoundNigeria launched this week a new oil and gas licensing round, inviting bids for as many as 12 onshore and offshore blocks and promising transparency in the bidding process. At the ongoing Offshore Technology Conference (OTC) in Houston, Texas, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) announced the start of the 2024 Licensing Round. During his speech at OTC to announce the bidding round, the commission’s chief executive Gbenga Komolafe “reiterated Nigeria’s commitment to advancing its oil and gas… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Nigeria-Launches-Oil-and-Gas-Licensing-Round.html |

|

China Looks to Slam the Brakes on Its Battery Boom to Fight OvercapacityThe Chinese authorities have issued draft guidance on new rules for the domestic battery industry, which appear to be targeting to address the current overcapacity in the sector. China’s Ministry of Industry and Information Technology unveiled on Wednesday a new set of draft rules that lay out minimum energy density standards and stricter battery specifications, as well as advise that companies should refrain from the construction of new plants that “simply expand production capacity,” Bloomberg reports. The proposal and… Read more at: https://oilprice.com/Energy/Energy-General/China-Looks-to-Slam-the-Brakes-on-Its-Battery-Boom-to-Fight-Overcapacity.html |

|

BP Hints That Its Goal to Cut Oil and Gas Output Could Be FlexibleAs BP looks to please shareholders with higher returns and stock valuations, the UK-based supermajor is suggesting that a previous goal to reduce its oil and gas production by 2030 is now flexible and would depend more on returns rather than on volumes. BP has to decide in the coming years whether to proceed with more than 30 planned projects across its businesses, new CEO Murray Auchincloss told Reuters this week. “And as we make those decisions on a returns-based approach, that will help inform what we think our production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Hints-That-Its-Goal-to-Cut-Oil-and-Gas-Output-Could-Be-Flexible.html |

|

ADNOC Signs New LNG Supply Deal With German FirmAbu Dhabi’s national oil company ADNOC has signed a new deal to supply LNG from a planned large export facility to a German firm. ADNOC announced on Wednesday the signing of a 15-year LNG agreement with EnBW Energie Baden-Württemberg AG (EnBW), one of the largest energy companies in Germany, for the delivery of 0.6 million metric tons per annum (mmtpa) of LNG from the Ruwais LNG project, which is currently under development in Al Ruwais Industrial City, Abu Dhabi. Deliveries from the project are expected to begin in 2028, once… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ADNOC-Signs-New-LNG-Supply-Deal-With-German-Firm.html |

|

Poland Set to Accelerate Energy TransitionThe biggest state utilities in Poland are preparing for a surge in clean energy investments in 2025, hoping that the government would move ahead with a plan to spin off coal assets that have been restricting the companies’ access to financial markets, executives told Bloomberg this week. “My dream is to agree on the whole carve-out model this year and carry it out the next year,” Grzegorz Lot, CEO at one of these utilities, Tauron Polska Energia SA, told Bloomberg in an interview. The government has been planning to lift… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Poland-Set-to-Accelerate-Energy-Transition.html |

|

Google employees question execs over ‘decline in morale’ after blowout earningsAt an all-hands meeting last week, Google executives responded to employee questions about declining morale even with financial performance improving. Read more at: https://www.cnbc.com/2024/05/08/google-staffers-question-execs-over-decline-in-morale-after-earnings.html |

|

Dow pops more than 150 points to notch sixth positive day and longest win streak in 2024: Live updatesThe Dow Jones Industrial Average traded higher Wednesday, trying to extend its winning streak to six days straight. Read more at: https://www.cnbc.com/2024/05/07/stock-market-today-live-updates.html |

|

AI needs to keep cool—literally. That’s driving demand for these infrastructure companiesThe advent of AI has skyrocketed demand for data centers and industrial components to keep all the AI chips from overheating. Read more at: https://www.cnbc.com/2024/05/08/ai-needs-to-keep-cool-driving-demand-for-these-industrials.html |

|

Applebee’s owner Dine Brands wants to steal fast-food customers with its dealsLow-income consumers visited less frequently and spent more carefully when they did eat out in the first quarter, Dine Brands CEO John Peyton said. Read more at: https://www.cnbc.com/2024/05/08/applebees-owner-dine-brands-targets-fast-food-customers.html |

|

These stocks struggling over the past month are primed for a comebackA slate of names that have suffered recently could be poised for a rebound. Read more at: https://www.cnbc.com/2024/05/08/these-stocks-struggling-over-the-past-month-are-primed-for-a-comeback.html |

|

Uber reports first-quarter results that beat expectations for revenue, but posts net lossUber beats expectations for revenue but falls short of estimates for gross bookings. Read more at: https://www.cnbc.com/2024/05/08/uber-uber-q1-2024-earnings.html |

|

Shopify shares plunge 19% on weak guidanceThe Canadian e-commerce company beat on the top and bottom line, but it gave downbeat guidance for the second quarter. Read more at: https://www.cnbc.com/2024/05/08/shopify-shares-plunge-18percent-on-weak-guidance.html |

|

Former MGM Grand casino president to be sentenced for failing to report bookie’s betsProsecutors and defense lawyers for Scott Sibella have suggested that a judge place the former MGM Grand casino president on probation in the criminal case. Read more at: https://www.cnbc.com/2024/05/08/former-mgm-grand-casino-president-to-be-sentenced-over-illegal-bets.html |

|

Major banks team up to test network for tokenized money and U.S. Treasurys: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Alma Angotti, partner and global legislative and regulatory risk leader at the consulting firm Guidehouse, weighs in on recent actions by the SEC, including the Wells Notice sent to Robinhood over its crypto operations. Read more at: https://www.cnbc.com/video/2024/05/08/major-banks-test-tokenized-asset-settlement-network-crypto-world.html |

|

Georgia appeals court will hear Trump bid to disqualify D.A. Fani Willis in election caseA Georgia appeals court agreed to hear a bid by Donald Trump to disqualify Fulton County District Attorney Fani Willis from his election interference case. Read more at: https://www.cnbc.com/2024/05/08/georgia-appeals-court-will-hear-trump-bid-to-disqualify-da-fani-willis-in-election-case.html |

|

Gold bars are selling like hot cakes in Korea’s convenience stores and vending machinesThe country’s largest convenience store chain, CU, has been collaborating with the Korea Minting and Security Printing Corporation to offer customers mini gold bars. Read more at: https://www.cnbc.com/2024/05/08/gold-is-selling-like-hot-cakes-in-koreas-convenience-stores-vending-machines.html |

|

Summer box office bust? This season’s movie slate could put up the lowest haul in decadesThis summer’s box office, hampered by dual Hollywood labor strikes, could have the lowest movie ticket haul since 2000. Read more at: https://www.cnbc.com/2024/05/08/summer-box-office-preview-movie-slate-lacks-franchise-hits.html |

|

Interest rates on federal student loans may increase by 1%: ‘A fairly big jump,’ expert saysThe interest rates on federal student loan rates will likely rise by about 1% in the 2024-2025 academic year. Here’s what to know. Read more at: https://www.cnbc.com/2024/05/08/interest-rates-on-federal-student-loans-may-increase-by-1percent.html |

|

The Three Reasons People Hate Trump…Authored by Brent Hamacheck via American Greatness, In my recently published book, Dissidently Speaking: Change the Words. Change the War: I use both logic and empiricism to prove (I do mean prove) that there is absolutely no such thing as “right wing-left wing” as we use the terms in this country. They are nothing more than non-defined terms used to characterize and label people with whom we don’t agree. I will go so far as to say that the terms are a socially acceptable form of hate speech. When we say that “the left hates Donald Trump,” it isn’t just mistaken; it’s fallacious. Since there is no such thing as “left-right,” as we use the terms, there is no possible way for the “left” to hate Trump. But he is hated by many, and there are three reasons why. If you are a Trump supporter, there is some good news to be found in this article. It will give you a way to potentially break through and change the minds of people in two of the three groups, and it will also help you to focus whatever hostile energy you need to dispense upon the third group, one that you cannot change and one that poses a threat to what some ignorantly label as our democracy but is more correctly understood as our republic. Since people like acronyms, catchy abbreviations, and words that can be turned into hashtags, I will frame Read more at: https://www.zerohedge.com/political/three-reasons-people-hate-trump |

|

Someone Is Lying: Atlanta Fed Claims US GDP Is 4.2% While DOE Reports Lowest Gasoline, Diesel Demand Since CovidOn one hand, the Atlanta Fed triumphantly blasted earlier today that Bidenomics is the greatest thing since sliced bread, helping push its Q2 GDP Nowcast to a whopping 4.2%, up from its latest estimate of 3.3%.

On the other hand, Biden’s own DOE – in its latest attempt to slam oil, gas and diesel prices because nothing will crush Biden’s re-election chances faster than an oil price spike in the summer – reported that demand for gasoline and diesel in the United States has plunged to its lowest seasonally since the onset of the COVID pandemic, “sparking concern that economic activity is now becoming stagnant as refining margins hit news lows not seen in months”, Reuters reported. As shown in the chart below, monthly averages for the week ended May 3 show gasoline demand at 8.63 million barrels per day–a figure not seen since May 2020, at t … Read more at: https://www.zerohedge.com/energy/someone-lying-atlanta-fed-claims-us-gdp-42-while-doe-reports-lowest-gasoline-diesel-demand |

|

Creditors Of Bankrupt FTX To Receive As Much As 142% Of What They Are OwedBack in March, when eyeing the tremendous rebound in the crypto space, we joked that creditors in Sam Bankman-Fried’s bankrupt exchange, FTX, would recover 200% of their claims.

Well, as so often happens in the “new abnormal”, it turns out that we were not joking, because according to the latest reorg plan filed by the bankrupt FTX on Tuesday, most – or roughly 98% of its creditors – would get back 118% of what they had on the FTX platform the day the company entered Chapter 11 bankruptcy. Amazingly, some creditors will recover as much as 142% of what they are owed. Claims will be repaid in cash within 60 days of court approval, although payouts are likely several months away, as FTX winds its way through the final stages of the bankruptcy case. Under the plan, other non-governmental creditors would get back 100% of their claims plus up to 9% interest to compensate them “for the time value of their investments.” The arrangement is still subject to approval by the Delaware bankruptcy court overseeing the bankruptcy case. As Coindesk report Read more at: https://www.zerohedge.com/crypto/creditors-bankrupt-ftx-receive-much-142-what-they-are-owed |

|

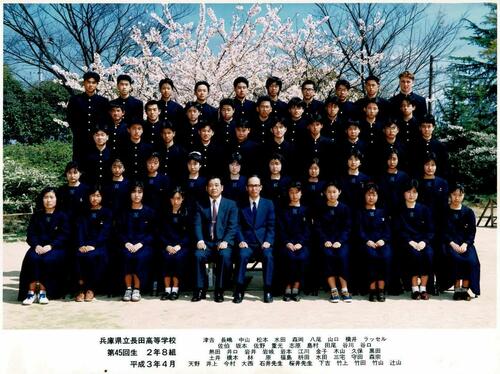

Japan Is Now Caught In A Doom LoopBy Russell Clark, author of the Capital Flows and Asset Market substack Japan and TreasuriesMy interest in Japan dates from 1991 when I was fresh faced high school exchange student in Kobe. There are no prizes for finding me in the above photo. I was the only “foreigner” in the school, and would go days without seeing anyone else that looked like me or even speaking English. I managed to combine my knowledge and experience in Japan with my other love, economics. I don’t think its too much of an exaggeration to say I owe my career and wealth through studying the Japan experience carefully and then applying those lessons to the rest of the world.

One of the most fascinating things about Japanese, economically speaking, is that almost its entire foreign reserves are made up of US treasuries, with almost no gold. As the right hand side column … Read more at: https://www.zerohedge.com/markets/japan-now-caught-doom-loop |

|

E-gate outage lessons ‘must be learnt’The airport technology failure means the government has to “learn lessons”, Lord Foster of Bath says. Read more at: https://www.bbc.com/news/articles/ck5k0z2706xo |

|

Top lawyer denies turning blind eye on Post OfficeA top barrister admitted that the Post Office should have disclosed certain information to subpostmasters. Read more at: https://www.bbc.com/news/articles/cld0rewpy01o |

|

Fraud victim’s 18-month fight for £80,000 refundAhead of new rules coming in designed to better protect fraud victims, one woman tells of her fight to get her money back. Read more at: https://www.bbc.co.uk/news/business-68846176 |

|

7 stocks from Nifty Next 50 index that have surged up to 379% from their lowsAccording to Prabhudas Lilladher, these emerging giants hold immense potential. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/7-stocks-from-nifty-next-50-index-that-have-surged-up-to-379-from-their-lows/slideshow/109955520.cms |

|

To build a corpus of Rs 5.3 crores in 30 years, one needs to invest Rs 17,000 per month“There are 4 pillars of retirement income namely, social security, employment-based plans, personal retirement assets and family / social structure. Social security in India is not as developed or as widespread as the ones in advanced countries. Only people working in the organized sector and for the government are eligible for employment-based pension plans,” says Suresh Soni, CEO, Baroda BNP Paribas Mutual Fund. Read more at: https://economictimes.indiatimes.com/mf/analysis/to-build-a-corpus-of-rs-5-3-crores-in-30-years-one-needs-to-invest-rs-17000-per-month/articleshow/109943414.cms |

|

Tech View: Nifty form high wave type candle pattern. What traders should do on ThursdayThe positive chart pattern like higher tops and bottoms is intact as per daily time-frame chart and presently the market is in an attempt of new higher bottom formation. The short-term trend remains weak, but the market is showing signs of higher bottom formation around 22,200 levels. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-looks-oversold-zone-on-hourly-charts-what-traders-should-do-on-thursday/articleshow/109952741.cms |

|

10-year Treasury yield finishes higher for first time in six sessionsYields on U.S. government debt closed higher on Wednesday after lackluster demand at a 10-year-note auction left the Treasury market’s selling momentum intact. Read more at: https://www.marketwatch.com/story/ten-year-treasury-yields-rise-after-falling-five-days-in-a-row-a6a550f5?mod=mw_rss_topstories |

|

Oil prices end higher after dipping to eight-week lows as U.S. crude supplies fallOil futures settled higher on Wednesday, finding support after a brief dip to their lowest levels in about eight weeks, as U.S. government data showed an unexpected weekly decline in domestic crude inventories. Read more at: https://www.marketwatch.com/story/oil-prices-slump-after-industry-data-shows-rise-in-u-s-crude-inventories-770e4e90?mod=mw_rss_topstories |

|

Price of engineered-wood siding soars 38%, fueling earnings beat for LP BuildingLP Building’s stock took flight Wednesday toward a fresh record close, after the wood building products maker beat first-quarter earnings expectations and raised its full-year outlook. Read more at: https://www.marketwatch.com/story/price-of-engineered-wood-siding-soars-38-fueling-earnings-beat-for-lp-building-3580794a?mod=mw_rss_topstories |