08 March 2023 Market Close & Major Financial Headlines: Markets Closed Mixed With The Dow Closing In The Red

Summary Of the Markets Today:

- The Dow closed down 58 points or 0.18%,

- Nasdaq closed up 0.40%,

- S&P 500 closed up 0.14%,

- Gold $1818 down $1.60,

- WTI crude oil settled at $77 down $1.06,

- 10-year U.S. Treasury 3.981% up 0.006 points,

- USD $106.65 up $0.04,

- Bitcoin $22,090 – 24H Change up $27.19 – Session Low $21,913

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

ADP’s February 2023 National Employment Report shows Private sector employment increased by 242,000 jobs and annual pay was up 7.2% year-over-year. Gotta wonder if Friday’s BLS employment report will also show strong gains which are inflationary. Nela Richardson, ADP’s chief economist stated:

There is a tradeoff in the labor market right now. We’re seeing robust hiring, which is good for the economy and workers, but pay growth is still quite elevated. The modest slowdown in pay increases, on its own, is unlikely to drive down inflation rapidly in the near-term.

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reported that the goods and services deficit increased by 1.6% – with exports up 3.4% and imports up 3.0%. This is a good litmus test for the economy – increases in imports generally show the US economy is growing and increases in exports generally show the global economy is growing.

The number of job openings decreased to 10.8 million on the last business day of January. Over the month, the number of hires and total separations changed little at 6.4 million and 5.9 million, respectively. Within separations, quits (3.9 million) decreased, while layoffs and discharges (1.7 million) increased. Even with the decrease in job openings this month – the number of job openings is very large and is enough to continue to fuel high employment gains.

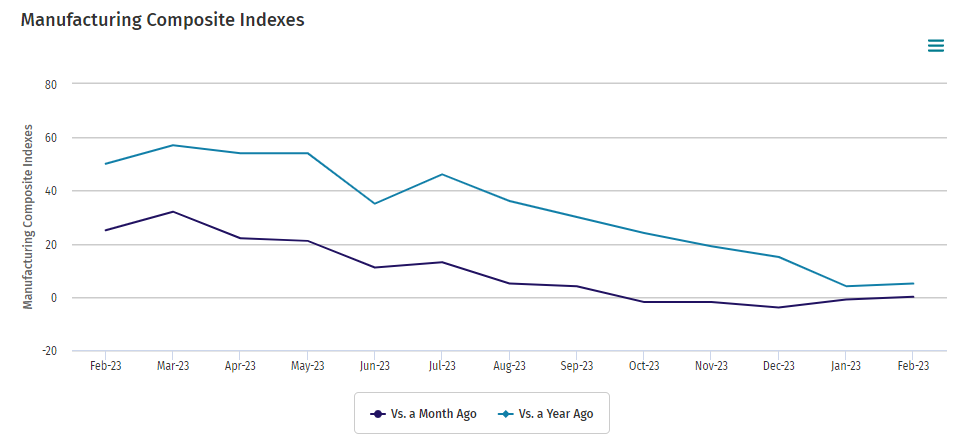

The Federal Reserve’s Beige Book shows overall economic activity increased slightly in early 2023. Six Districts reported little or no change in economic activity since the last report, while six indicated economic activity expanded at a modest pace. On balance, supply chain disruptions continued to ease. Consumer spending generally held steady, though a few Districts reported moderate to strong growth in retail sales during what is typically a slow period. Auto sales were little changed, on balance, though inventory levels continued to improve. Several Districts indicated that high inflation and higher interest rates continued to reduce consumers’ discretionary income and purchasing power, and some concern was expressed about rising credit card debt. Travel and tourism activity remained fairly strong in most Districts. Manufacturing activity stabilized following a period of contraction. While housing markets remained subdued, restrained by exceptionally low inventory, an unexpected uptick in activity beyond the seasonal norm was seen in some Districts along the eastern seaboard. Commercial real estate activity was steady, with some growth in the industrial market but ongoing weakness in the office market. Demand for nonfinancial services was steady overall but picked up in a few Districts. On balance, loan demand declined, credit standards tightened, and delinquency rates edged up. Energy activity was flat to down slightly, and agricultural conditions were mixed. Amid heightened uncertainty, contacts did not expect economic conditions to improve much in the months ahead.

A summary of headlines we are reading today:

- The Impressive Impact Of Clean Energy Projects On Global Emissions In 2022

- Renewable Giant NextEra: Offshore Wind Is A Poor Investment

- Central Banks Continue Gold Buying Spree

- Oil Extends Losses On Fed Hawkishness

- Morgan Stanley Says Auto Demand Resilient Despite Headwinds

- The Energy Crisis Isn’t Over, Investment Firm Guggenheim Says

- Barclays Slashes Brent Oil Price Forecast To $92

- Job openings declined in January but still far outnumber available workers

- No exit ramp for Fed’s Powell until he creates a recession, economist says

- Beige Book Finds Drop In Inflation Concerns, Expectations For Continued Price, Wage Moderation

- When The Yield Curve Inverts Over 100bps “A Recession Is Already Underway Or Begins Within 8 Months”

- Key Words: DeSantis to Biden: Let Novak Djokovic play in the Miami Open

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.