Summary Of the Markets Today:

- The Dow closed down 58 points or 0.18%,

- Nasdaq closed up 0.40%,

- S&P 500 closed up 0.14%,

- Gold $1818 down $1.60,

- WTI crude oil settled at $77 down $1.06,

- 10-year U.S. Treasury 3.981% up 0.006 points,

- USD $106.65 up $0.04,

- Bitcoin $22,090 – 24H Change up $27.19 – Session Low $21,913

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

ADP’s February 2023 National Employment Report shows Private sector employment increased by 242,000 jobs and annual pay was up 7.2% year-over-year. Gotta wonder if Friday’s BLS employment report will also show strong gains which are inflationary. Nela Richardson, ADP’s chief economist stated:

There is a tradeoff in the labor market right now. We’re seeing robust hiring, which is good for the economy and workers, but pay growth is still quite elevated. The modest slowdown in pay increases, on its own, is unlikely to drive down inflation rapidly in the near-term.

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reported that the goods and services deficit increased by 1.6% – with exports up 3.4% and imports up 3.0%. This is a good litmus test for the economy – increases in imports generally show the US economy is growing and increases in exports generally show the global economy is growing.

The number of job openings decreased to 10.8 million on the last business day of January. Over the month, the number of hires and total separations changed little at 6.4 million and 5.9 million, respectively. Within separations, quits (3.9 million) decreased, while layoffs and discharges (1.7 million) increased. Even with the decrease in job openings this month – the number of job openings is very large and is enough to continue to fuel high employment gains.

The Federal Reserve’s Beige Book shows overall economic activity increased slightly in early 2023. Six Districts reported little or no change in economic activity since the last report, while six indicated economic activity expanded at a modest pace. On balance, supply chain disruptions continued to ease. Consumer spending generally held steady, though a few Districts reported moderate to strong growth in retail sales during what is typically a slow period. Auto sales were little changed, on balance, though inventory levels continued to improve. Several Districts indicated that high inflation and higher interest rates continued to reduce consumers’ discretionary income and purchasing power, and some concern was expressed about rising credit card debt. Travel and tourism activity remained fairly strong in most Districts. Manufacturing activity stabilized following a period of contraction. While housing markets remained subdued, restrained by exceptionally low inventory, an unexpected uptick in activity beyond the seasonal norm was seen in some Districts along the eastern seaboard. Commercial real estate activity was steady, with some growth in the industrial market but ongoing weakness in the office market. Demand for nonfinancial services was steady overall but picked up in a few Districts. On balance, loan demand declined, credit standards tightened, and delinquency rates edged up. Energy activity was flat to down slightly, and agricultural conditions were mixed. Amid heightened uncertainty, contacts did not expect economic conditions to improve much in the months ahead.

A summary of headlines we are reading today:

- The Impressive Impact Of Clean Energy Projects On Global Emissions In 2022

- Renewable Giant NextEra: Offshore Wind Is A Poor Investment

- Central Banks Continue Gold Buying Spree

- Oil Extends Losses On Fed Hawkishness

- Morgan Stanley Says Auto Demand Resilient Despite Headwinds

- The Energy Crisis Isn’t Over, Investment Firm Guggenheim Says

- Barclays Slashes Brent Oil Price Forecast To $92

- Job openings declined in January but still far outnumber available workers

- No exit ramp for Fed’s Powell until he creates a recession, economist says

- Beige Book Finds Drop In Inflation Concerns, Expectations For Continued Price, Wage Moderation

- When The Yield Curve Inverts Over 100bps “A Recession Is Already Underway Or Begins Within 8 Months”

- Key Words: DeSantis to Biden: Let Novak Djokovic play in the Miami Open

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Global Energy Squeeze Is Riskier Than We ThoughtMost people have a simple, but wrong, idea about how the world economy will respond to “not enough energy to go around.” They expect that oil prices will rise. With these higher prices, producers will be able to extract more fossil fuels so the system can go on as before. They also believe that wind turbines, solar panels and other so-called renewables can be made with these fossil fuels, perhaps extending the life of the system further. The insight people tend to miss is the fact that the world’s economy is a physics-based, self-organizing… Read more at: https://oilprice.com/Energy/Energy-General/The-Global-Energy-Squeeze-Is-Riskier-Than-We-Thought.html |

|

The Impressive Impact Of Clean Energy Projects On Global Emissions In 2022According to a recent International Energy Agency (IEA) report, carbon emissions in 2022 rose by less than was feared, largely thanks to a multitude of new green energy projects worldwide. Carbon dioxide emissions worldwide increased by under 1 percent in 2022, or 321 million tonnes, lower than initially anticipated, according to the IEA. This was supported by the growth in solar and wind power, EVs, and heat pumps, as well as greater efforts at increased energy efficiency. Despite a rise in coal and oil use, in response to the global… Read more at: https://oilprice.com/Energy/Energy-General/The-Impressive-Impact-Of-Clean-Energy-Projects-On-Global-Emissions-In-2022.html |

|

Renewable Giant NextEra: Offshore Wind Is A Poor InvestmentAmerican renewable energy giant NextEra (NYSE:NEE) told the CERAWeek energy conference in Houston on Wednesday that offshore wind’s capital intensive nature makes it a poor investment as the world attempts to transition to clean energy. Citing the costs of installing and maintaining infrastructure, as well as numerous complications with projects of this vast size, CEO John Ketchum told the Houston conference that NextEra–the largest producer of renewable energy in the world–finds it challenging to maintain onshore wind fleets,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Renewable-Giant-NextEra-Offshore-Wind-Is-A-Poor-Investment.html |

|

Central Banks Continue Gold Buying SpreeAfter charting the highest level of net gold purchases on record in 2022, central banks started out 2023 right where they left off. Central banks globally added another net 77 tons to their gold reserves in January, according to the latest data compiled by the World Gold Council. It was a 192% month-on-month increase from December and above the 20-60 ton range of reported purchases we’ve seen over the last 10 consecutive months of net buying. A late report of a 45-ton gold purchase by Singapore in January bumped the numbers up from the initially… Read more at: https://oilprice.com/Metals/Gold/Central-Banks-Continue-Gold-Buying-Spree.html |

|

Oil Extends Losses On Fed HawkishnessOil prices fell over 1% on Wednesday after fears of more aggressive rate hikes by the U.S. Federal Reserve continued to compound, with losses extending. On Tuesday, Federal Reserve Chairman Jerome Powell said the Fed would most likely find it necessary to raise interest more than expected to control inflation as a result of strong U.S. economic data. Fed funds futures traders interviewed by Reuters now see a 66% probability that the Fed will raise interest rates by 50 basis points at the next meeting on March 21-22. Prior to Powell’s Tuesday… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oil-Extends-Losses-On-Fed-Hawkishness.html |

|

Airlines Will Struggle To Keep Flights Costs Down This YearFlight prices have soared since the pandemic. But not everyone agrees on the outlook for 2023. Some believe high flight prices are here to stay, while others think the worst is already behind us. So, what can we expect to happen over the coming months and what are the main drivers behind these high flight prices? After strict lockdowns in 2020 and 2021, which forced travelers to stay home and sent many airlines into administration, 2022 was a totally different story. Uptake for economy seats soared as people took to the skies once again, despite… Read more at: https://oilprice.com/Energy/Energy-General/Airlines-Will-Struggle-To-Keep-Flights-Costs-Down-This-Year.html |

|

German, UAE, Egypt Consortium Signs $34 Billion Hydrogen Deal With MauritaniaIn a major move to develop hydrogen production capacity and set up a supply chain in the MENA region, Germany is now looking at a less obvious partner, Mauritania. German newspaper Frankfurter Algemeine Zeitung (FAZ) reports that a consortium made up of UAE renewable energy giant MASDAR, an Abu Dhabi state-owned company, Egyptian technology provider Infinity and German project developer Conjuncta, have signed an MOU with Mauritania to set up a $34 billion green hydrogen project. As indicated by the parties involved, the overall green hydrogen production… Read more at: https://oilprice.com/Latest-Energy-News/World-News/German-UAE-Egypt-Consortium-Signs-34-Billion-Hydrogen-Deal-With-Mauritania.html |

|

Morgan Stanley Says Auto Demand Resilient Despite HeadwindsThe latest note from Morgan Stanley analyst Adam Jonas does anything to instill confidence in an auto industry that, as we have been noting, has been part and parcel to a tidal wave of rising consumer debt. The note, released Tuesday morning, notes that “auto loan delinquencies have moved through pre-COVID and GFC highs, yet US auto demand remains extremely resilient on an adjusted basis”. First, the note says that unit sales have been depressed, with Jonas writing: “US light vehicle sales are materially off their pre-COVID highs. Trailing… Read more at: https://oilprice.com/Energy/Energy-General/Morgan-Stanley-Says-Auto-Demand-Resilient-Despite-Headwinds.html |

|

First Crude Oil Draw In 2023 Pushes Oil Prices HigherCrude oil prices moved up today after the U.S. Energy Information Administration estimated an inventory draw of 1.7 million barrels for the week to March 3. This compared with a build of 1.2 million barrels for the previous week. At 478.5 million barrels, crude oil inventories are 7 percent above the five-year seasonal average. The latest estimate follows a string of substantial inventory builds that have pressured prices and that the EIA blamed on production underreporting from the industry and crude oil blending. To remedy matters, the agency… Read more at: https://oilprice.com/Energy/Crude-Oil/Small-Draw-In-Crude-Inventories-Pushes-Oil-Prices-Higher.html |

|

The Energy Crisis Isn’t Over, Investment Firm Guggenheim SaysEnergy markets appear to be in a precarious balance, but the energy crisis is not over, Michael LaMotte, senior managing director at investment firm Guggenheim Partners, said at the CERAWeek energy conference in Houston this week. “We may have gotten through this winter surprisingly well, but I don’t think we’re out of the woods yet,” LaMotte said, as carried by Reuters. “And things actually could get worse before they get better,” the investment banker added. Uncertainties about supplies related to the Russian invasion of Ukraine and tight oil… Read more at: https://oilprice.com/Latest-Energy-News/World-News/The-Energy-Crisis-Isnt-Over-Investment-Firm-Guggenheim-Says.html |

|

Germany May Not Use All Its New LNG Capacity, But It Is Still NecessaryGermany may end up using less LNG import capacity than it has planned to roll out this decade, but better safe than sorry, the chief executive of the top German utility, RWE, said in an interview with German business magazines Der Stern and Capital. “It may be the case that the LNG terminals are not fully utilized. But you need them as an insurance premium,” RWE’s CEO Markus Krebber said in the interview published on Wednesday. RWE is leading the project for one of the floating storage and regasification units (FSRUs) that German… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-May-Not-Use-All-Its-New-LNG-Capacity-But-It-Is-Still-Necessary.html |

|

Barclays Slashes Brent Oil Price Forecast To $92Brent Crude prices are expected to average $92 per barrel this year, Barclays said on Wednesday, slashing an earlier forecast by $6 a barrel due to a more resilient Russian oil supply than previously thought. The UK bank also cut its average 2023 WTI Crude forecast by $7 per barrel, to $87. Barclays sees prices next year averaging slightly higher, at $97 a barrel Brent and $92 per barrel WTI. Currently, the oil market is in a surplus of around 800,000 barrels per day (bpd), the bank has estimated, and expects the surplus to turn into a 500,000… Read more at: https://oilprice.com/Energy/Energy-General/Barclays-Slashes-Brent-Oil-Price-Forecast-To-92.html |

|

Turkey Proposes Reform To Advance Plans For Natural Gas HubThe ruling party in Turkey on Wednesday proposed a reform of the natural gas market to make it competitive and diversified in a move to advance its plan to become a natural gas hub. The ruling AK Party submitted a bill to Parliament today that would allow both state firm BOTAS and foreign companies to trade and import natural gas, Reuters reports. The bill also proposed a spin-off of the gas supply and gas infrastructure operations of BOTAS, in a bid to encourage free trade and competition. Turkey currently imports all the natural gas it needs… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Turkey-Proposes-Reform-To-Advance-Plans-For-Natural-Gas-Hub.html |

|

European Energy Prices Spike On Cold Weather And Nuclear Power WoesElectricity and natural gas prices in Europe jumped on Wednesday amid a cold spell in northwest Europe that could be prolonged and renewed concerns about nuclear power generation in France. The European benchmark gas price at the TTF hub rose by 1.7% to $46.50 (44.13 euros) per megawatt-hour (MWh) by 11:45 a.m. in Amsterdam, and British wholesale prices also rose. Natural gas prices were up for a second consecutive day, due to cold weather in the UK and parts of northwestern Europe, as well as fresh concerns about corrosion at… Read more at: https://oilprice.com/Energy/Energy-General/European-Energy-Prices-Spike-On-Cold-Weather-And-Nuclear-Power-Woes.html |

|

OPEC Is Cautiously Optimistic About China’s 2023 Oil DemandOPEC is cautiously optimistic about China’s oil demand this year, expecting consumption growth of between 500,000 barrels per day (bpd) and 600,000 bpd in 2023 compared to 2022, OPEC’s Secretary General Haitham Al Ghais said at the CERAWeek energy conference in Houston on Tuesday. “With China opening up, we are quite optimistic, cautiously,” Al Ghais said, as carried by Reuters. OPEC expects global oil demand to rise by 2.3 million bpd this year, its secretary general said, reiterating an earlier OPEC forecast from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Is-Cautiously-Optimistic-About-Chinas-2023-Oil-Demand.html |

|

Job openings declined in January but still far outnumber available workersThe Labor Department’s Job Openings and Labor Turnover Survey showed there are 10.824 million openings, down some 410,000 from December. Read more at: https://www.cnbc.com/2023/03/08/job-openings-declined-in-january-but-still-far-outnumber-available-workers.html |

|

Dow finishes slightly lower as traders consider a faster Fed tightening cycle: Live updatesThe Dow Jones Industrial Average fell Wednesday as Wall Street assessed the potential of higher rates for longer. Read more at: https://www.cnbc.com/2023/03/07/stock-market-today-live-updates.html |

|

ChatGPT is being used to automatically write emails: Microsoft, Salesforce and TikTok creators are hopping on the trendA viral TikTok video showed how AI chatbots can be used to send email pitches. Microsoft and Salesforce announced new products with that exact feature. Read more at: https://www.cnbc.com/2023/03/08/chatgpt-is-being-used-to-write-emails-big-companies-are-embracing-it.html |

|

No exit ramp for Fed’s Powell until he creates a recession, economist saysThe U.S. Federal Reserve is likely to hike interest rates to at least 6.5% if the economy does not enter a mid-year recession, according to TS Lombard Chief U.S. Economist Steven Blitz. Read more at: https://www.cnbc.com/2023/03/08/no-exit-ramp-for-feds-powell-until-he-creates-a-recession-economist-says.html |

|

These stocks are winning even as Fed hikes rates — and Wall Street sees the gains continuingCNBC screened for some of the stocks that can continue to gain even as the Fed continues with interest rate hikes. Read more at: https://www.cnbc.com/2023/03/08/these-are-stocks-the-street-thinks-will-keep-winning-as-rates-rise.html |

|

WWE in talks with state gambling regulators to legalize betting on scripted match resultsWWE is in talks with state gambling regulators in Michigan and Colorado to legalize betting on high-profile matches. Read more at: https://www.cnbc.com/2023/03/08/wwe-betting-scripted-match-results.html |

|

Ukraine war live updates: Top U.S. spies warn Russia is boosting nuclear capabilities; UN and Ukraine discuss renewing grain dealThe battle of Bakhmut continues to dominate news out of Ukraine this week, with all eyes on the fate of the city in Donetsk in eastern Ukraine. Read more at: https://www.cnbc.com/2023/03/08/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Want a risk-free 5% return? How to buy a 3-month TreasuryEven the most boring investments are exciting as yields on short-term Treasury pop. Read more at: https://www.cnbc.com/2023/03/08/want-a-risk-free-5percent-return-how-to-buy-a-3-month-treasury.html |

|

Russia tried to influence U.S. elections in 2022 and will do it again, nation’s top intel agency saysMoscow will also work to “strengthen ties” to Americans in media and politics to carry out “future influence operations,” the nation’s top spy agency assessed. Read more at: https://www.cnbc.com/2023/03/08/russia-tried-to-influence-us-elections-in-2022-and-will-do-it-again-intel-agency-says.html |

|

Union warns it has been left without enough workers to install new rail safety measuresRails want to deploy heat detectors as part of safety plan after Norfolk Southern derailments, but a union says it lacks workers for the job after recent cuts. Read more at: https://www.cnbc.com/2023/03/08/union-warns-it-lacks-the-workers-for-new-freight-rail-safety-measures.html |

|

This woman gave up law to start a restaurant — and turned it into a successful street food chainIndian street food chain Mowgli now has almost twenty branches across the U.K. Its founder, Nisha Katona, has some advice for women entrepreneurs. Read more at: https://www.cnbc.com/2023/03/08/meet-the-woman-who-gave-up-law-to-start-a-restaurant-chain.html |

|

Investing is ‘a must’ for women to achieve a secure retirement, advisor says. These 3 steps can helpAs more women expand their investment horizons, taking these steps now can make a difference 40 years from now, one advisor says. Read more at: https://www.cnbc.com/2023/03/08/investing-is-a-must-for-women-to-achieve-a-secure-retirement-advisor.html |

|

Oklahoma Republican tells Teamsters president ‘shut your mouth’ in terse exchange at Senate hearingThe tense back-and-forth between O’Brien and Sen. Markwayne Mullin, R-Okla., escalated into a screaming match. Read more at: https://www.cnbc.com/2023/03/08/oklahoma-republican-tells-teamsters-president-shut-your-mouth-in-terse-exchange-at-senate-hearing.html |

|

Beige Book Finds Drop In Inflation Concerns, Expectations For Continued Price, Wage ModerationThere wasn’t too much excitement in the latest Fed Beige Book report which was based on information collected on or before February 27, 2023: it found that overall economic activity increased slightly since the previous, Jan 18, 2023 report: Six Districts reported little or no change in economic activity since the last report, while six indicated economic activity expanded at a modest pace. Looking ahead, the mood remained listless with contacts “not expecting economic conditions to improve much in the months ahead.” That said, if one reads between the lines, the impression on gets is of consumers who are once again maxing out their credit cards just to keep pace with inflation; meanwhile even thought the Beige Book did not dwell on housing weakness, it noted growing weakness in the office market.

|

|

Real Estate Markets Are Addicted To Easy MoneyAuthored by Ryan McMaken via The Mises Institute, On Friday, residential real estate brokerage firm Redfin released new data on home prices, showing that prices fell 0.6 percent in February, year over year. According to Redfin’s numbers, this was the first time that home prices actually fell since 2012. The year-over-year drop was pulled down by especially large declines in five markets: Austin (-11%), San Jose, California (-10.9%), Oakland (-10.4%), Sacramento (-7.7%), and Phoenix (-7.3%). According to Redfin, the typical monthly mortgage payment is now at a record high of $2,520.

The Redfin numbers come a few days new numbers from the Case-Shiller home price index showing further slowing in home prices growth since late last year. The market’s expectation December’s Read more at: https://www.zerohedge.com/personal-finance/real-estate-markets-are-addicted-easy-money |

|

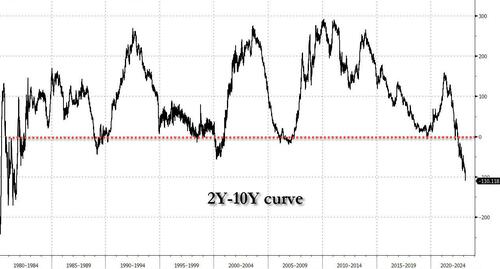

When The Yield Curve Inverts Over 100bps “A Recession Is Already Underway Or Begins Within 8 Months”Yesterday, the spread between 2- and 10-year yields rose above 1% (and in the past 24 hours yield curve has blown out another 10bps to 110bps) for the first time since 1981, when Paul Volcker was engineering hikes that broke the back of double-digit inflation at the cost of a lengthy recession and millions of unemployed workers.

A similar dynamic is unfolding now, according to Ken Griffin, the chief executive officer and founder of hedge fund giant Citadel. “We have the setup for a recession unfolding” as the Fed responds to inflation, Griffin told Bloomberg in an interview in Palm Beach. “Every time they take the foot off the brake, or the market perceives they’re taking their foot off the brake, and the job’s not done, they make their work even harder,” Griffin said. What does the the historical record say? One question history can help answer, is how long th … Read more at: https://www.zerohedge.com/markets/when-yield-curve-inverts-over-100bps-recession-already-underway-or-begins-within-8-months |

|

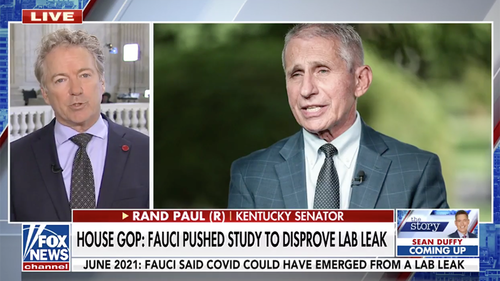

Watch: Rand Paul Accuses Fauci Of “Elaborate Cover-Up” Of COVID Lab LeakAuthored by Steve Watson via Summit News, Senator Rand Paul asserted Tuesday that Anthony Fauci, along with other scientists working with him at the National Institutes Of Health engaged in an “elaborate cover-up” of the lab origin of the coronavirus pandemic in order to hide their own involvement.

“The reason Dr. Fauci didn’t want any attention drawn to this or to his funding of the lab is that ultimately he would have culpability,” Paul said in a Fox News interview. “There’s a responsibility – because for years he had advocated for gain-of-function research. He’s even quoted as saying in 2012, if a pandemic should occur, if a scientist should be bitten by an animal and the virus gets out of the lab, it would be worth the knowledge,” Paul added. The Senator conti … Read more at: https://www.zerohedge.com/political/watch-rand-paul-accuses-fauci-elaborate-cover-covid-lab-leak |

|

Hopes of end to rail strike row as workers vote on pay offerThe new offer equates to a pay rise of up to 14.4% for the lowest-paid workers. Read more at: https://www.bbc.co.uk/news/business-64883158?at_medium=RSS&at_campaign=KARANGA |

|

Budget 2023: ‘My energy bills have doubled to £3,000 in a year’A florist in Slough warned now is not the time to scale back support with energy bills. Read more at: https://www.bbc.co.uk/news/business-64874571?at_medium=RSS&at_campaign=KARANGA |

|

Adidas unsure what to do with €1.2bn Yeezy goodsAdidas could sell products left from its former deal with Kanye West, known as Ye, and donate the profits. Read more at: https://www.bbc.co.uk/news/business-64892898?at_medium=RSS&at_campaign=KARANGA |

|

Promoters pledge additional shares of Adani Transmission, Adani Green with SBI TrusteeIn Adani Green Energy, 1,56,65,500 shares or 0.99% more stake has been pledged. With this, a total 2% stake is pledged with SBI Trustee. In Adani Transmission, 85,26,000 shares or 0.76% stake has been pledged. With this, a total 1.32% stake is pledged with the trustee Read more at: https://economictimes.indiatimes.com/markets/stocks/news/promoters-pledge-additional-shares-of-adani-transmission-adani-green-with-sbi-trustee/articleshow/98501659.cms |

|

Decoded ! 7 steps involved in theIPOprocess>> For more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/decoded-7-steps-involved-in-the-ipo-process/articleshow/98500753.cms |

|

SBI raises Rs 3,717 cr via third Tier 1 bond issue of FY23The latest issue will SBI diversify and raise long-term capital with call option of more than 10 years, helping the bank in managing its capital adequacy effectively Read more at: https://economictimes.indiatimes.com/markets/stocks/news/sbi-raises-rs-3717-cr-via-third-tier-1-bond-issue-of-fy23/articleshow/98500637.cms |

|

Key Words: DeSantis to Biden: Let Novak Djokovic play in the Miami OpenDjokovic has never been vaccinated against COVID-19, and U.S. policy currently requires foreigners to be vaccinated before entering the country. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AE-9FC9960A141B%7D&siteid=rss&rss=1 |

|

International Women’s Day: Here’s what women want from their homes (it’s not always the same as men)American women with children want bigger family rooms and better equipped kitchens, and place greater value towards wellness features, a new report says. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AE-A5D08332E76E%7D&siteid=rss&rss=1 |

|

The Moneyist: ‘She is a grifter’: My father set up a $500,000 trust for my troubled sister, and asked me to be trustee. What are the risks involved in being a trustee?‘Can you help me understand the risks involved in being a trustee?’ Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71AC-5B0F41C6CCF4%7D&siteid=rss&rss=1 |