The full data sets for the 56 years from 1966 to 2022 show no discernable association patterns (correlations) for U.S. federal deficit spending growth and inflation changes.1 This post continues that analysis by looking specifically at the various regimes of inflation change during the 56-year timeline.

From a photo by Giorgio Trovato on Unsplash

Introduction

The 71 years from 1952 to 2022 are divided into three types of inflationary behavior:1

- Significant inflation increases;

- Significant inflation decreases;

- No significant inflation changes.

An inflation change is significant if it is ≥4.0% with no intervening countertrend change >1.5%.

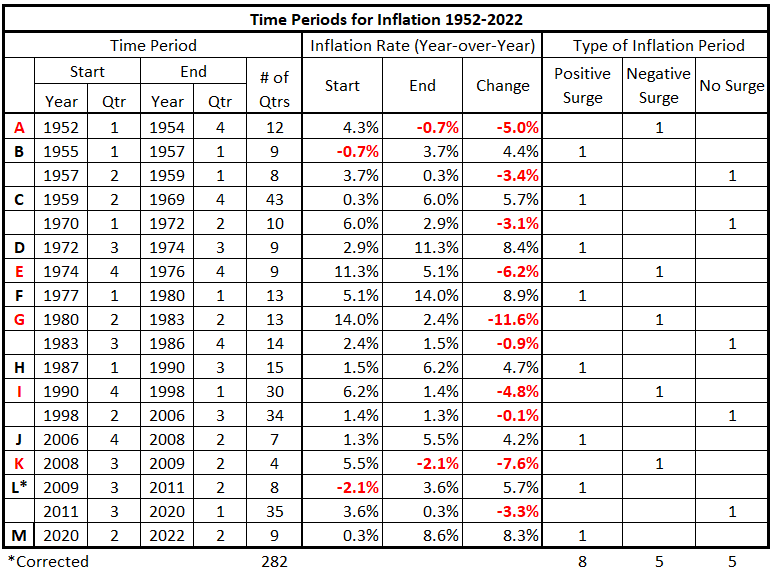

Previously, we defined the partitioning of inflation into the pattern in Table 1.

Table 1. Timeline of Inflation Data 1952-2022 (Previously Table 4*.1)

Since quarterly data for federal deficit spending was unavailable before 1965, analysis can only be done for the latter part of data set C and later. We will examine each category of inflation behavior separately. In this piece, we analyze the significantly positive periods of inflation (positive inflation surges).

Data

The data is from Tables 5-17, prepared previously.1

There are 13 quarterly timeline alignments:

- Federal Deficit Spending and CPI Inflation quarters are coincident.

- Federal Deficit Spending leads and lags CPI Inflation by one quarter (±3 months)

- Federal Deficit Spending leads and lags CPI Inflation by two quarters (±6 months)

- Federal Deficit Spending leads and lags CPI Inflation by three quarters (±9 months)

- Federal Deficit Spending leads and lags CPI Inflation by four quarters (±12 months)

- Federal Deficit Spending leads and lags CPI Inflation by six quarters (±18 months)

- Federal Deficit Spending leads and lags CPI Inflation by eight quarters (±24 months)

Analysis

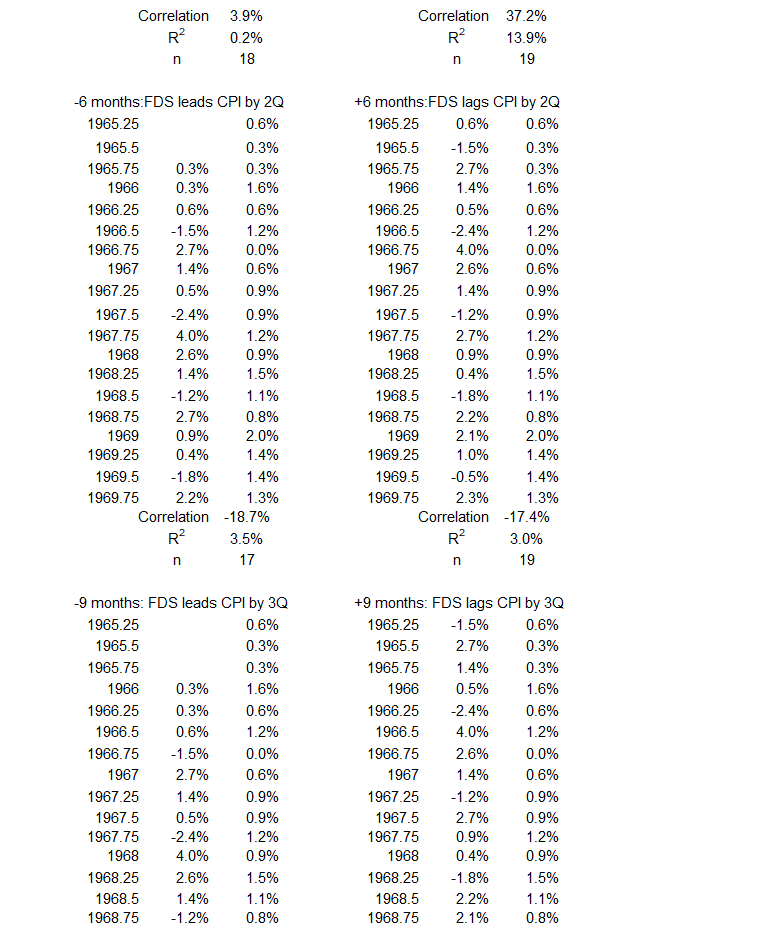

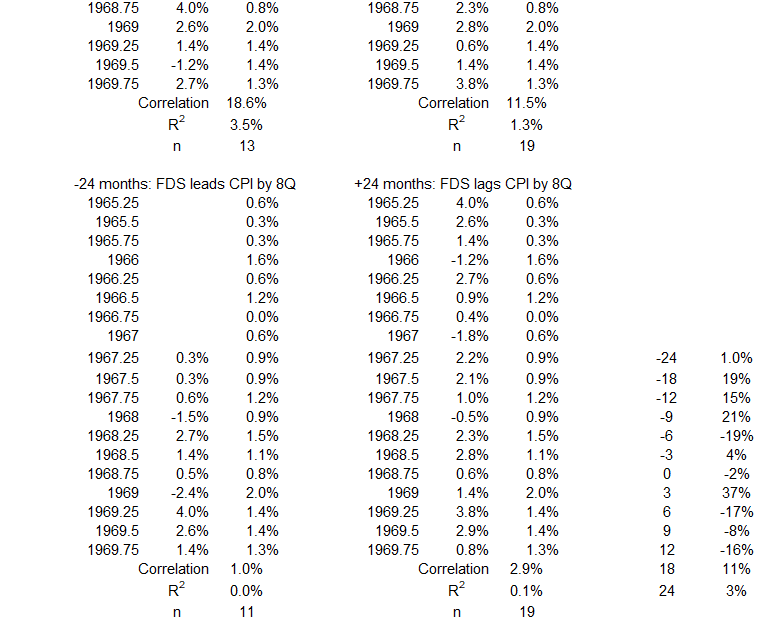

3Q 1965 – 4Q 1969

By our definition, the period from 1959 to 1969 constitutes a period of inflation growth—inflation growing by 4% or more without a pullback greater than 1.5%. However, the decade can be divided into slower inflation growth (1959-1964) and more rapid growth (1965-1969). Therefore, we analyzed the association between nonfinancial corporate credit and inflation in these periods. There is no quarterly data for deficit spending for the earlier period. Thus, only the second period is analyzed.

Figure 1. Federal Deficit Spending and Inflation 2Q 1965– 4Q 1969

The quarterly changes in FDS were larger, both positive and negative, in the middle of this period than at the beginning and the end. The trend for CPI is for changes to increase with time for the most part. There is a bump to larger changes in the first three quarters of 1966. The volatility for FDS changes in much greater than for inflation.

Figure 2. Quarterly Changes in Federal Deficit Spending (x) vs. CPI Inflation (y) 2Q 1965 – 4Q 1969

This scatter diagram shows a negligible association for the coincident timeline data. R = –2.2%, R2 = 0.05%.

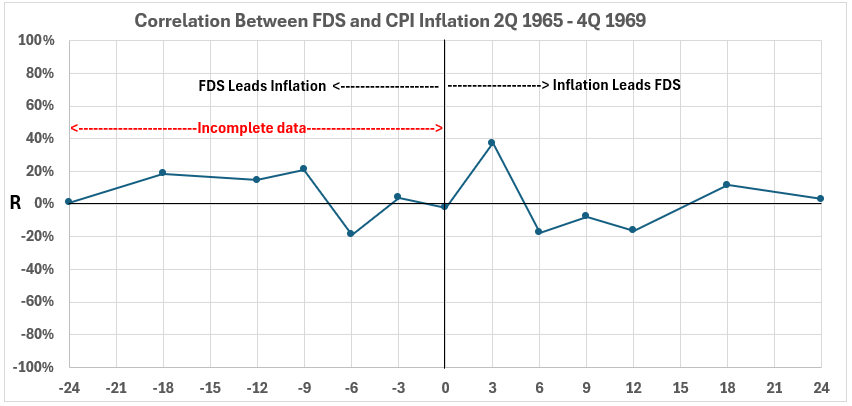

Figure 3. Correlation Between Federal Deficit Spending and CPI Inflation 2Q 1965 – 4Q 1965

The two variables had very weak and negligible associations during this period. The strongest association occurred for inflation occurring three months before deficit spending: R = 37% and R2 = 14%. All the other data points have R2 ≤ 4.5%. There are no appreciable probabilities (>15%) for cause-and-effect between deficit spending and inflation during this period.

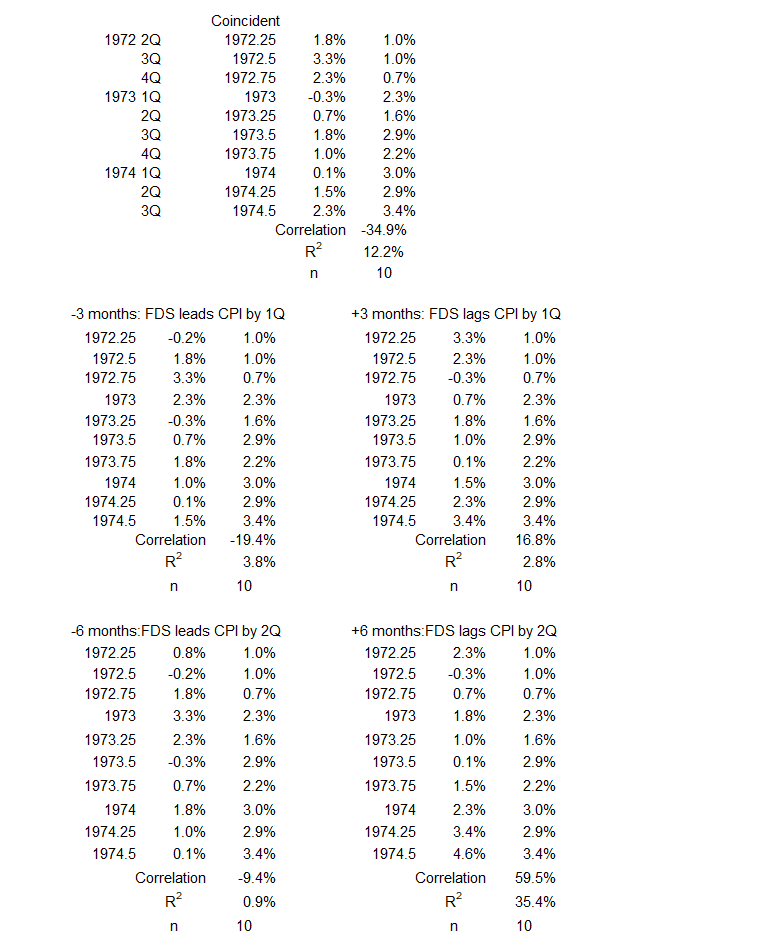

3Q 1972 – 3Q 1974

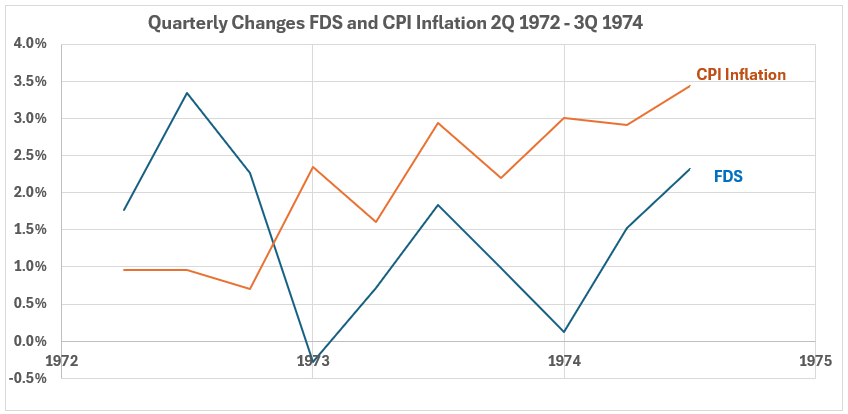

Figure 4. Federal Deficit Spending Debt and Inflation 2Q 1972 – 3Q 1974

The trend for deficit spending is down for most of this period, with an uptick for the final quarter. The trend for CPI changes is up. Though not as remarkable as for the period 1965-1969, FDS volatility is still larger than for CPI.

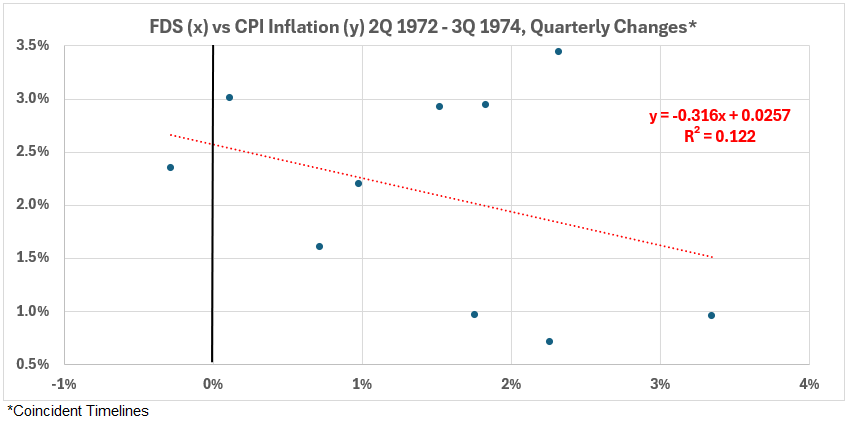

Figure 5. Quarterly Changes in Federal Deficit Spending (x) vs. CPI Inflation (y) 2Q 1972 – 3Q 1974

The coincident timelines data shows a weak negative association (R = –35% and R2 = 12%).

Figure 6. Correlation Between Federal Deficit Spending and CPI Inflation 2Q 1972 – 3Q 1974

There are weak and negligible negative associations for deficit spending coming before inflation (left side of Figure 6). This indicates there is no possibility that deficit spending could have caused inflation during this CPI spike.

On the right side of Figure 6, a moderate association exists between CPI and FDS six months later. R = 60% and R2 = 36%. Then, there are strong associations between CPI and FDS 9, 12, and 18 months later, all R > 71% and R2 > 50%. This indicates that rising inflation might have caused increased future federal deficit spending.

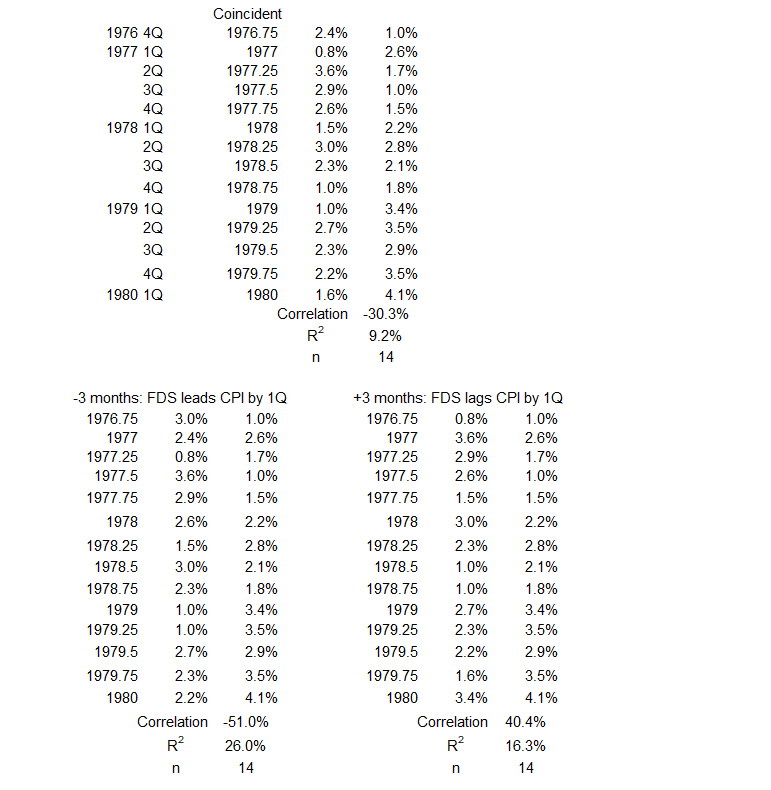

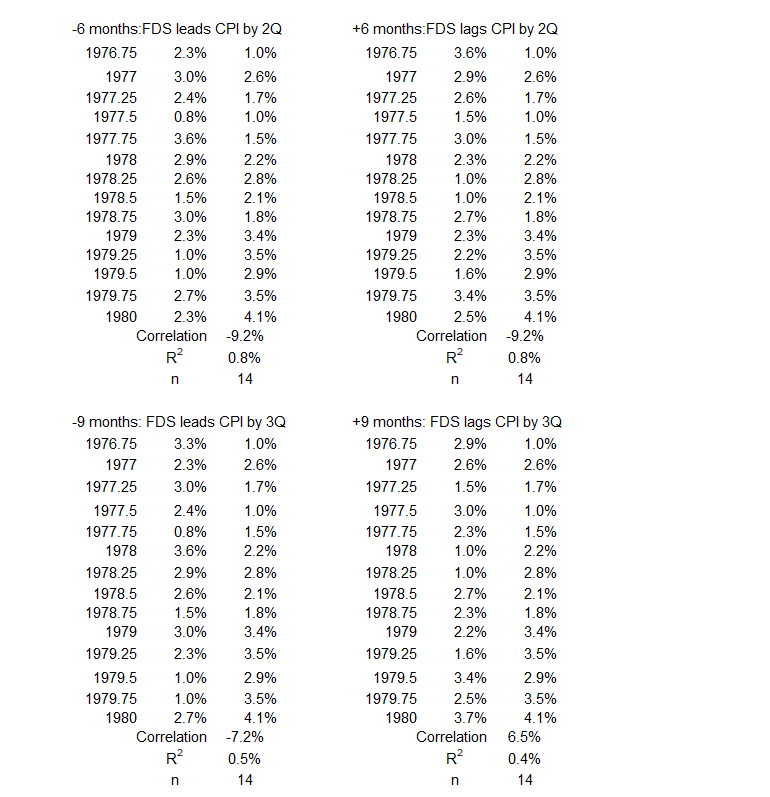

1Q 1977 – 1Q 1980

Figure 7. Federal Deficit Spending and Inflation 4Q 1976 – 1Q 1980

Figure 7 shows FDS changes mostly in a downtrend. CPI Inflation changes are in an uptrend. Volatilities for the two variables are comparable.

Figure 8. Quarterly Changes in Federal Deficit Spending (x) vs. CPI Inflation (y) 4Q 1976 – 1Q 1980

The association between the two variables with coincident timelines is very weakly negative. R = –30% and R2 = 9%.

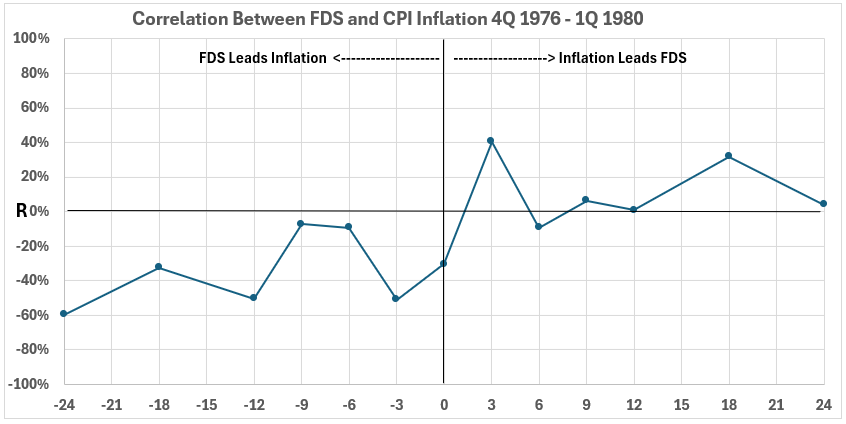

Figure 9. Correlation Between Federal Deficit Spending and CPI Inflation 4Q 1976 – 1Q 1980

Figure 9 shows that there were no positive associations between deficit spending and subsequent inflation (left side of the graph). Thus, FDS cannot have caused any of the inflation in this period.

The right side indicates that there was only a limited association between inflation and subsequent deficit spending here. For inflation occurring three months before the deficit spending increase, R = 40% and R2 = 16%. That means that 84% or more of the deficit spending increase came from something other than inflation. And when inflation occurred 18 months before the deficit spending increase, R = 32% and R2 = 10%. Thus, 90% or more of the deficit spending increase was caused by something other than inflation.

All the other data points on the right side of Figure 9 are negligible.

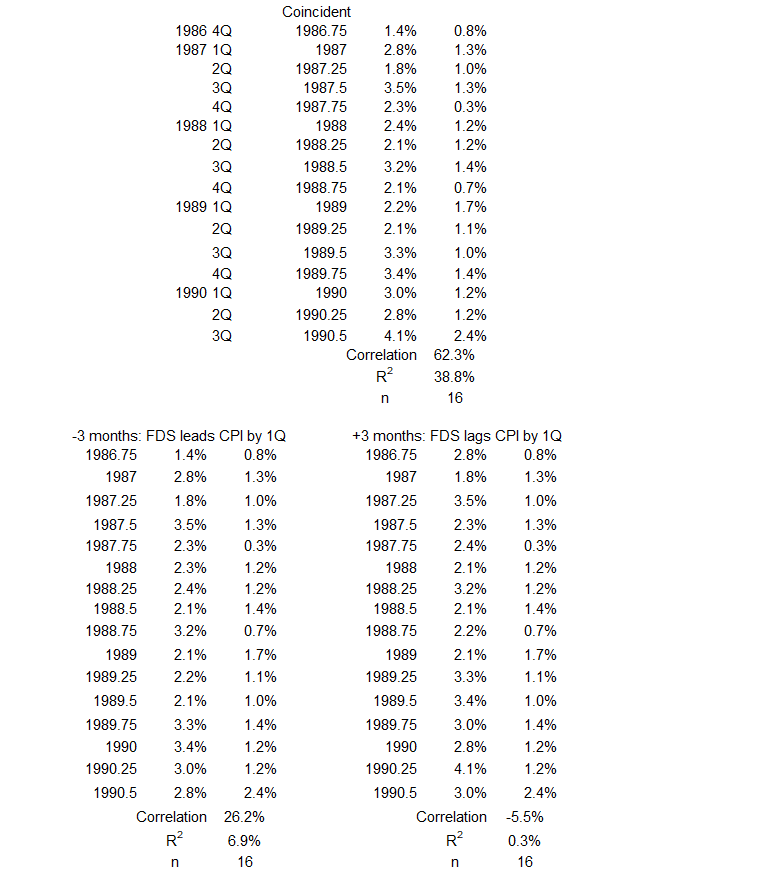

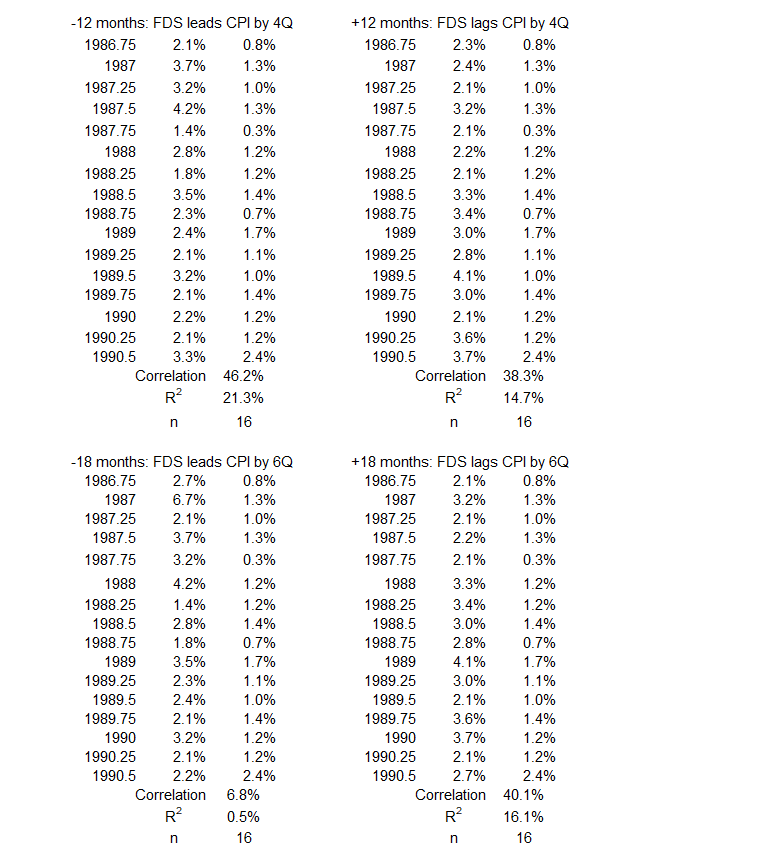

1Q 1987 – 3Q 1990

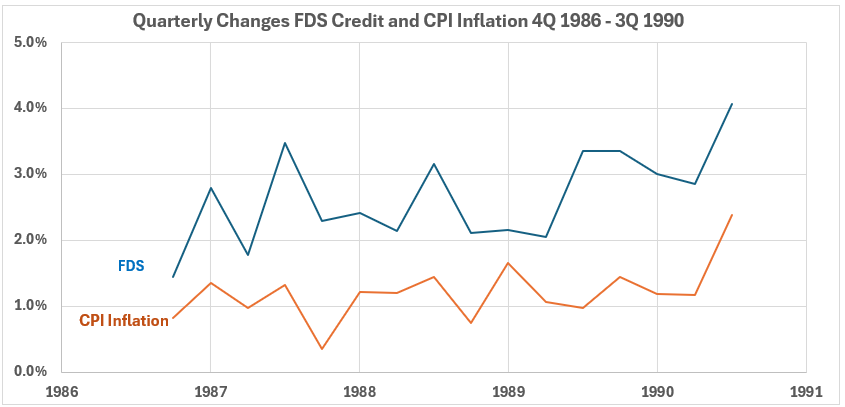

Figure 10. Federal Deficit Spending and Inflation 4Q 1986 – 3Q 1990

Figure 10 shows gradual uptrends in quarterly changes for both deficit spending and inflation. Volatilities for the two variables are similar.

Figure 11. Quarterly Changes in Federal Deficit Spending (x) vs. CPI Inflation (y) 4Q 1986 – 3Q 1990

Figure 11 data set shows a moderate positive association between the coincident timeline data sets, R = 63% and R2 = 39%.

Figure 12. Correlation Between Federal Deficit Spending and CPI Inflation 4Q 1986 – 3Q 1990

The left side of Figure 12 shows two weak associations between FDS and CPI. R = 46% and R2 = 21% when deficit spending changes came 12 months before inflation changes, and R = 38% and R2 = 15% when FDS changes preceded CPI changes by six months. This result indicates that federal deficit spending might have caused as much as 21% of inflation.

The right side of the graph shows that inflation might have caused deficit spending to increase 12 and 18 months later. However, the associations are weak: R = 38% and R2 = 15% and R = 40% and R2 = 16%, respectively.

The strongest association occurred for coincident FDS and CPI changes. There R = 63% and R2 = 39%. This creates the possibility that federal deficit spending might have caused up to 39% of inflation or vice versa.

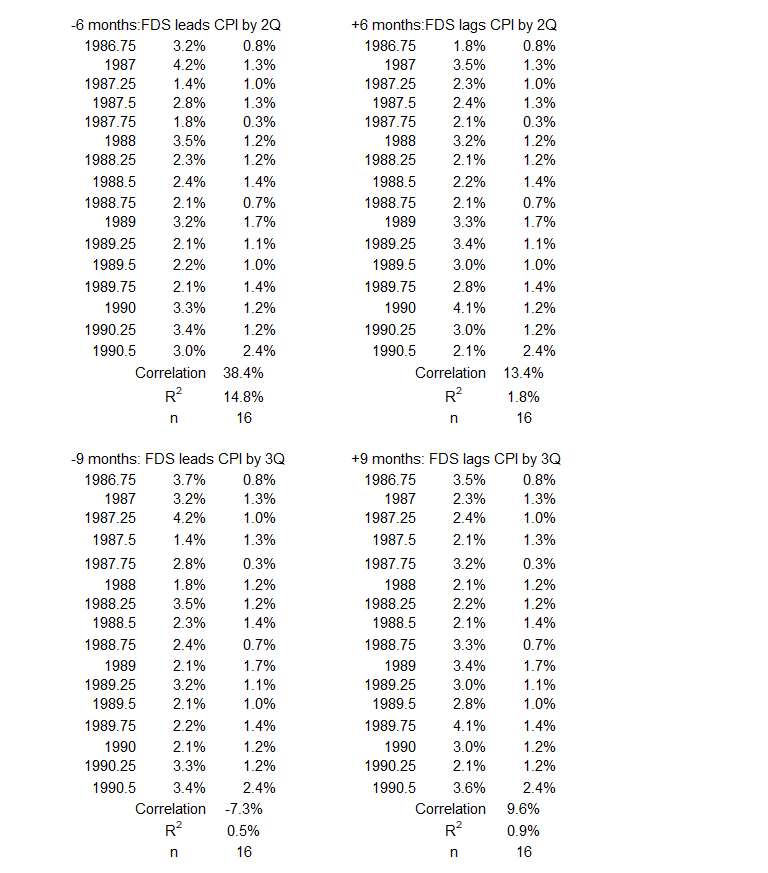

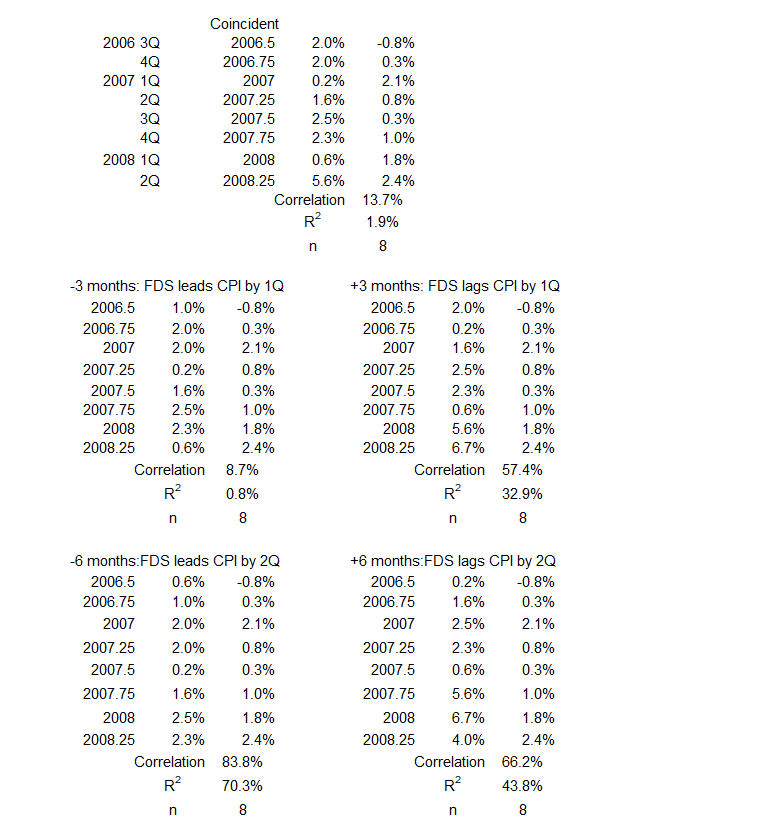

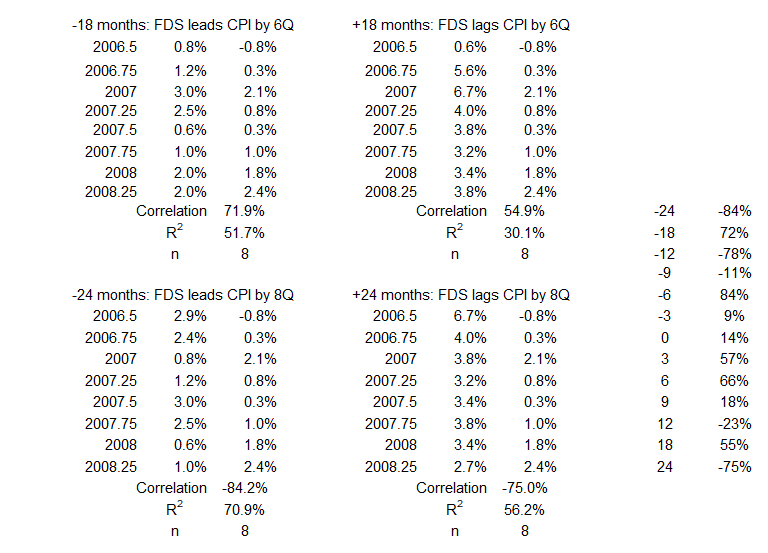

4Q 2006 – 2Q 2008

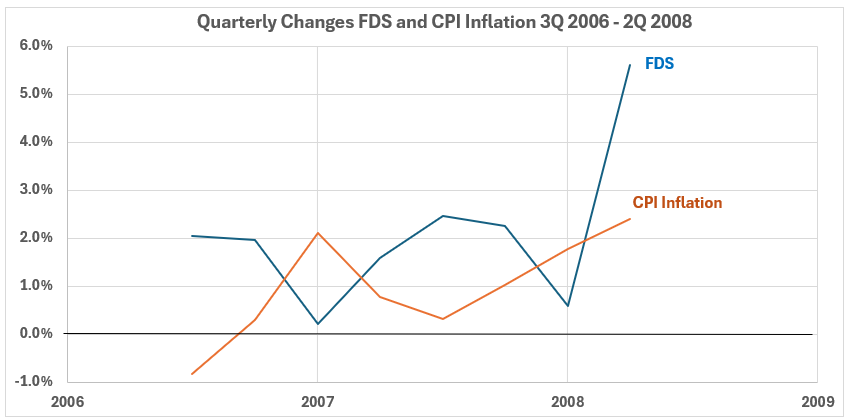

Figure 13. Federal Deficit Spending and Inflation 3Q 2006 – 2Q 2008

This period covers the end of the housing bubble peak and the start of the stock market decline that was part of the Great Financial Crisis of 2008-09. Here, we see an uptrend for quarterly inflation changes with a level trend for federal deficit spending changes until the large spike up in the second quarter of 2008.

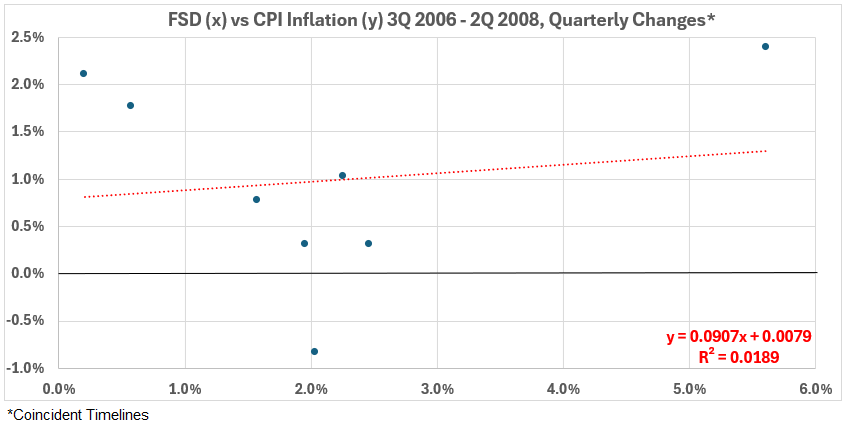

Figure 14. Quarterly Changes in Federal Deficit Spending (x) vs. CPI Inflation (y) 3Q 2006 – 2Q 2008

The coincident data sets show a weak positive correlation, R = 14% and R2 = 1.9%.

Figure 15. Correlation Between Federal Deficit Spending and CPI Inflation 3Q 2006 – 2Q 2008

Figure 15 shows some wild variations. On the left side, we see two strong positive and one strong negative association. Interpretation is problematic. Can changes in FDS possibly cause more than half of the changes in inflation in the same direction while also possibly causing more than half of the changes in the opposite direction within a twelve-month interval? This question makes this result one that will be put aside for the time being.

The results are not as problematic on the right side of Figure 15. Three data points, 3, 6, and 18 months, show a moderate association between CPI increases and FDS increases. 60% ≥ R ≥ 55% and 36% ≥ R2 ≥ 30% for these three points. This suggests that up to 36% of increases in federal deficit spending might have been caused by previous inflation increases during this period.

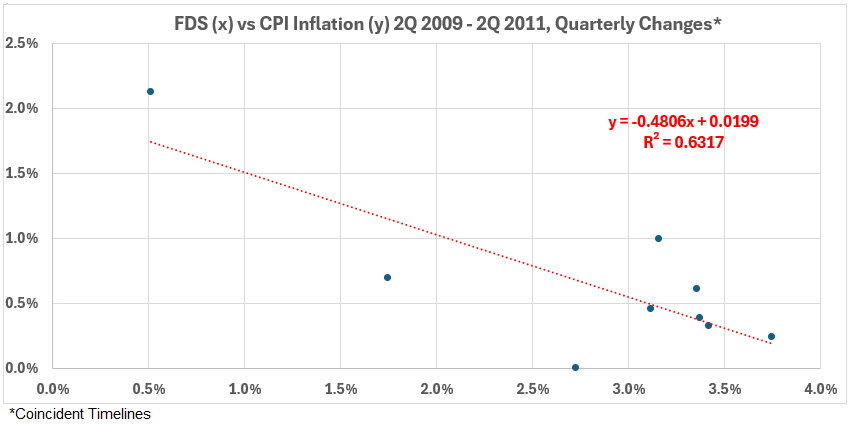

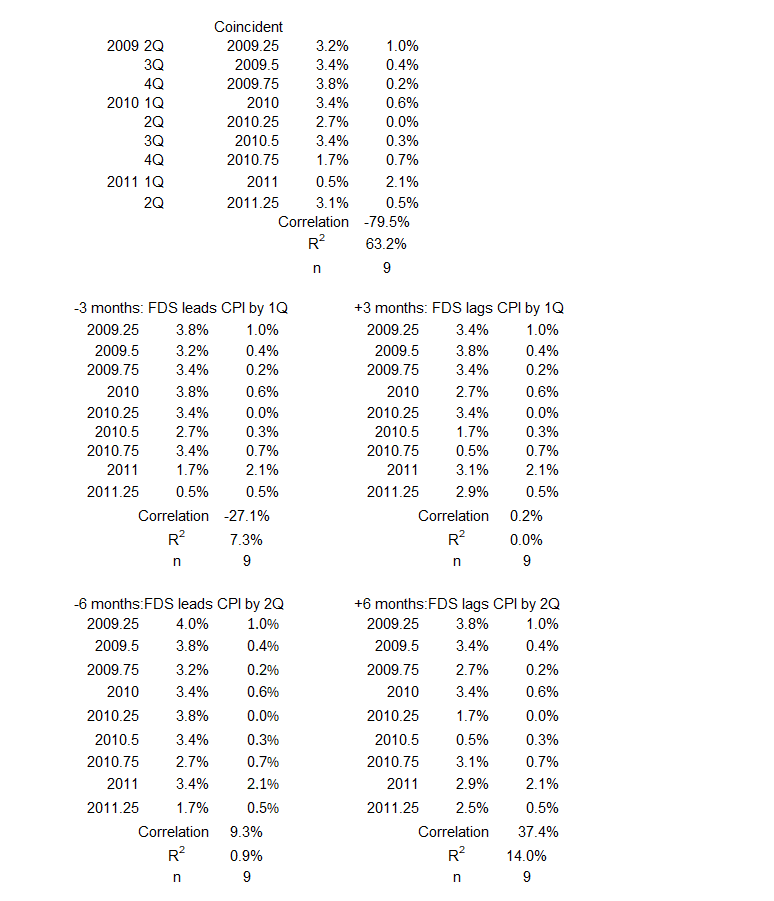

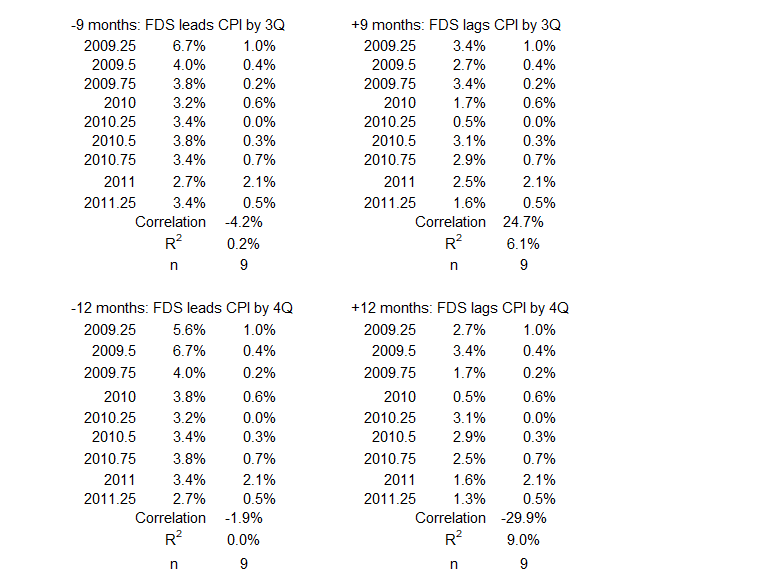

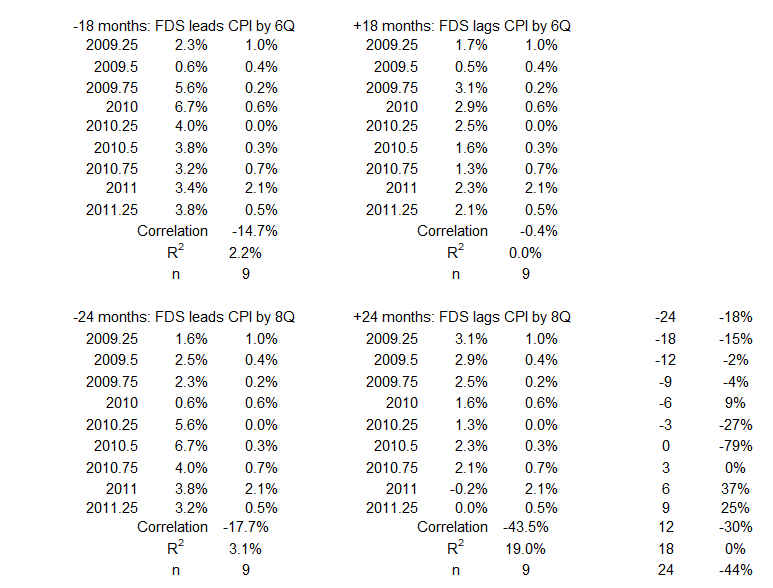

3Q 2009 – 2Q 2011

Figure 16. Federal Deficit Spending and Inflation 2Q 2009 – 2Q 2011

In this period, FDS changes initially increase and then trend downward before spiking up in the final quarter. CPI changes vary in exactly the opposite pattern.

Figure 17. Quarterly Changes in Federal Deficit Spending (x) vs. CPI Inflation (y) 2Q 2009 – 2Q 2011

A strong negative association exists for the coincident timelines data, R = 80% and R2 = 63%.

Figure 18. Correlation Between Federal Deficit Spending and CPI Inflation 2Q 2009 – 2Q 2011

Based on the left side of Figure 18, it is unlikely that deficit spending increases contributed to inflation increases during this inflation spike.

As noted above, the data shows a strong negative association, R = 80% and R2 = 63%, for coincident changes in the two variables. Since this is a period with spiking inflation, that infers that up to 63% of inflation increases might have been caused by deficit spending decreases. That is not a credible conclusion.

The right side of Figure 18 indicates that up to 14% of deficit spending increases might have been caused by inflation increases six months earlier.

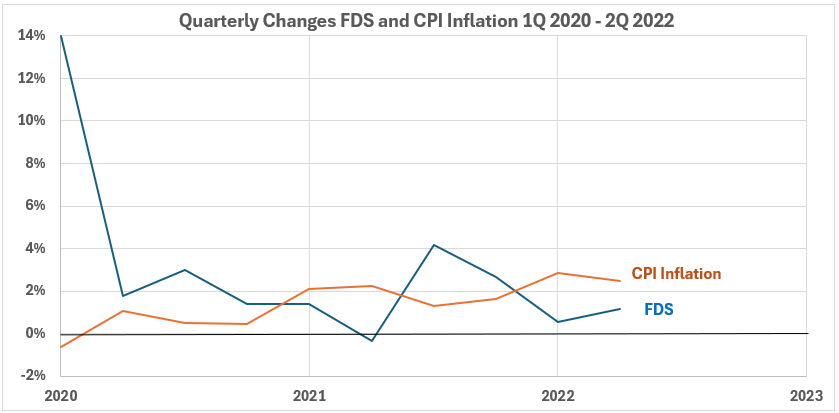

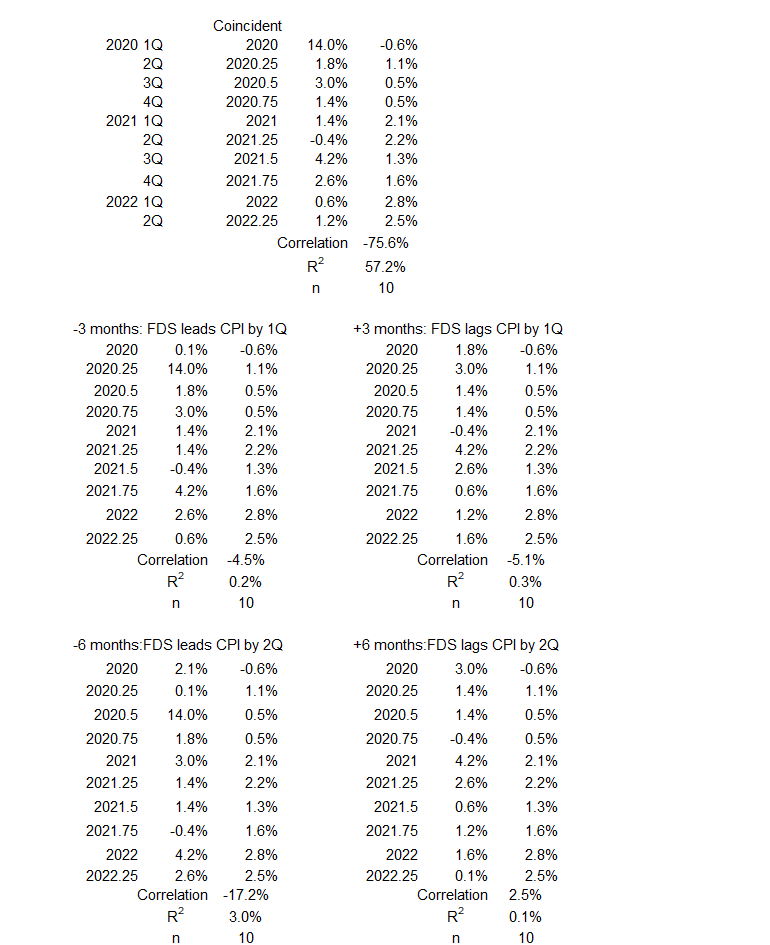

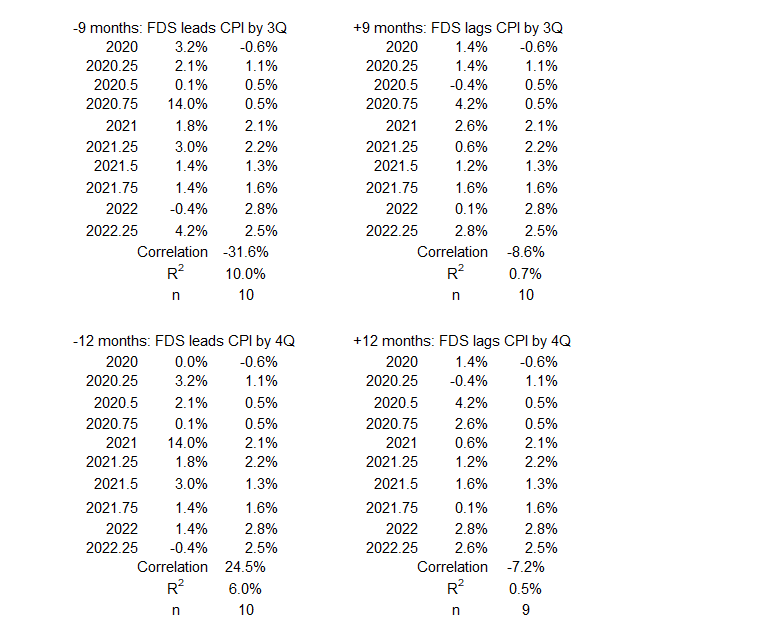

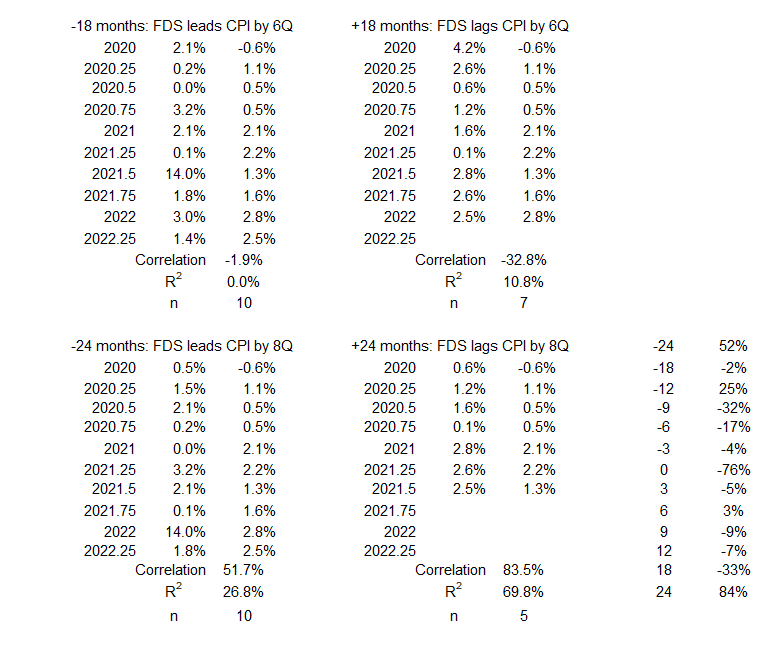

2Q 2020 – 2Q 2022

Figure 19. Federal Deficit Spending and Inflation 1Q 2020 – 2Q 2022

During most of this period (first quarter excepted), both deficit spending and inflation changes were in fairly close agreement in magnitude and trend.

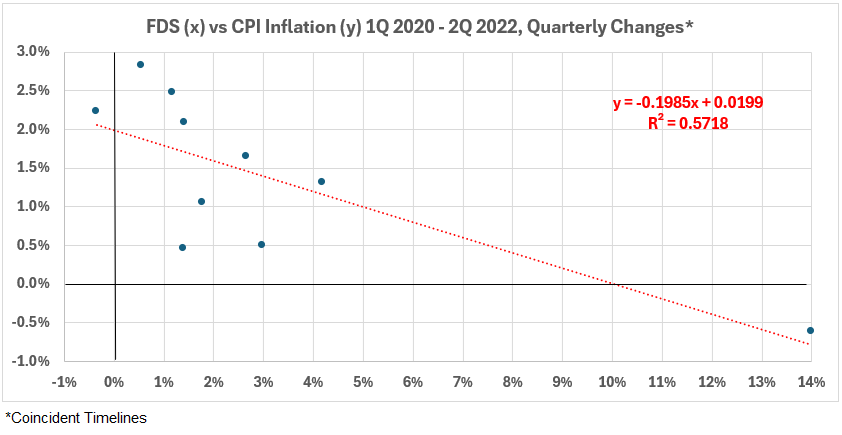

Figure 20. Quarterly Changes in Federal Deficit Spending (x) vs. CPI Inflation (y) 1Q 200 – 2Q 2022

We see a negative association for the concurrent timeline data sets. R = –79% and R2 = 57%.

Figure 21. Correlation Between Federal Deficit Spending and CPI Inflation 1Q 2020 – 2Q 2022

Here, we will ignore the —24-month data point since it appears to be an outlier. It is not reasonable that a change two years offset from an event should have an impact greater than all the changes with less lead time. With that proviso, increasing deficit spending can cause increased inflation by no more than 6% (—12-month data point).

The right side of Figure 21 shows no possibility that increasing inflation caused increasing deficit spending.

The coincident data shows R =—79% and R2 = 57%. Since this is a period with spiking inflation, this infers that up to 57% of inflation increases might have been caused by deficit spending decreases. That is not a credible conclusion.

Conclusion

Does government deficit spending cause inflation? The answer is no for six of the seven inflationary periods in the U.S. since 1965. In the inflationary period from 1986-1990, it is possible that deficit spending might have contributed up to 39% of the inflation. For the other six inflationary periods, the possible contributions were zero in three cases, less than 6% in two cases, and indeterminate in one case.

Is inflation the cause of increased government deficit? The answer is no in one case: the inflation spike of 2020-2022. There, the possible contribution of inflation to deficit spending is zero. In three other inflationary periods, the maximum possible contribution of inflation to deficit spending was less than 16%.

The possible contribution of inflation to increased deficit spending in the three other inflation spikes was greater. In 1986-1990 the contribution might have been up to 39%. In 2006-2008, the contribution might have been up to 36%. And 1972-1974, the contribution of inflation to increased federal deficits might have been greater than 50%.

Note: Throughout this article, bold has been used to emphasize possibilities. These possibilities are based on correlations that establish limits. Remember, correlation does not prove causation; it merely indicates the limits of causation. R2 = 57% indicates a maximum probability of 57% for cause-and-effect. The minimum probability for causation is 0, absent any other information.

Further conclusions will be discussed after we have the data for the deflationary surges and the periods with more stable inflation for the 1952-2011 period. More results there next week.

Appendix

Below are the data sets for each period of surging inflation. They come from the tables of timeline alignments1 (Federal Deficit Spending (Quarterly) and Inflation, Part 1).

3Q 1965 – 4Q 1969

3Q 1972 – 3Q 1974

1Q 1977 – 1Q 1980

1Q 1987 – 3Q 1990

4Q 2006 – 2Q 2008

3Q 2009 – 2Q 2011

1Q 2020 – 2Q 2022

Footnotes

1. Lounsbury, John, “Federal Deficit Spending (Quarterly) and Inflation. Part 1″, EconCurrents, April 7, 2024. https://econcurrents.com/2024/04/07/federal-deficit-spending-quarterly-and-inflation-part-1/.

2. Lounsbury, John, “Government Spending and Inflation. Reprise and Summary”, EconCurrents, August 20, 2023. https://econcurrents.com/2023/08/20/government-spending-and-inflation-reprise-and-summary/.

3. Lounsbury, John, “Consumer Credit and Inflation: Part 4”, EconCurrents, September 23, 2023. https://econcurrents.com/2023/09/23/consumer-credit-and-inflation-part-4/.

4. Lounsbury, John, “Mortgage Debt and Inflation: Part 4”, EconCurrents, October 22, 2023. https://econcurrents.com/2023/10/22/mortgage-debt-and-inflation-part-4/.

5. Lounsbury, John, “Nonfinancial Corporate Credit and Inflation: Part 4”, EconCurrents, March 3, 2024 https://econcurrents.com/2024/03/03/nonfinancial-corporate-credit-and-inflation-part-4/.

6. Freedman, David, Pisani, Robert, and Purves, Richard, Statistics, Fourth Edition, W.W. Norton & Company (New York) and Viva Books (New Delhi), 2009. See Chapters 8 & 9 for an explanation of how normal distributions relate to determining correlation coefficients. See p. 147 for a discussion of football-shaped scatter diagrams.