We have found that the correlation relationships between various types of credit and inflation are variable over time. So far, the kinds of credit studied are government spending,1 consumer credit,2 mortgage debt,3 and nonfinancial corporate credit.4 Here, we address another category of credit spending, Financial Sector Debt (FSD). This series studies the correlation between changes in Financial Sector Debt and CPI inflation.

Photo by Chenyu Guan on Unsplash.

Introduction

In this project, we examine the correlation between changes in financial sector debt (FSD) and changes in inflation as measured by the Consumer Price Index (CPI5). The Federal Reserve data for FSD (1951-2022)6 is the credit data for this study.

The hypothesis we are testing is that inflation depends on consumer credit in a linear manner, expressed in the following equation:

I = mS + b

where

I = Change in CPI (the Consumer Price Index)

S = Change in FSD

The two constants, m and b, define the relationship of y, the dependent variable, to x, the independent variable. By writing the relationship in this way, we imply that CPI (y) depends on FSD (x). But this is a mere formality because the equation can be rearranged:

S = m’ I + b’

where

m’ = 1/m

b’ = -b/m

An equivalent equation implies that FSD depends on inflation without affecting results and conclusions.

Data

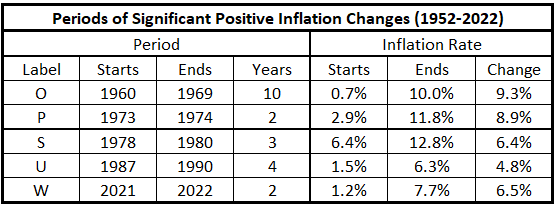

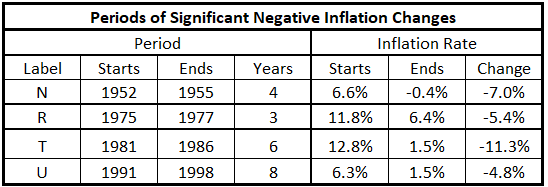

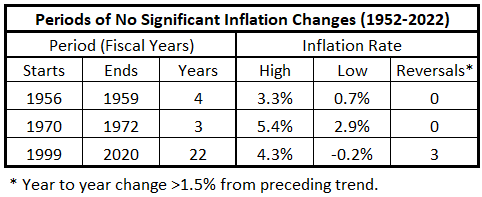

The organization of the data is similar to the federal deficit spending and consumer inflation study.1 The inflation time series has periods of inflationary surges, deflationary surges, and years when inflation/disinflation/deflation have trends with <4% change uninterrupted by countertrend moves >1.5%. The three types of inflationary periods from 1952-2022 are in Tables 1-3. For the definition of the various periods, see “Government Spending and Inflation: Reprise and Summary”.1

Table 1. Periods of Significant Increases of Inflation 1952-2022

Table 2. Periods of Significant Decreases of Inflation 1952-2022

Table 3. Periods without Significant Inflation Trends 1952-2022

Inflation Measured Quarterly

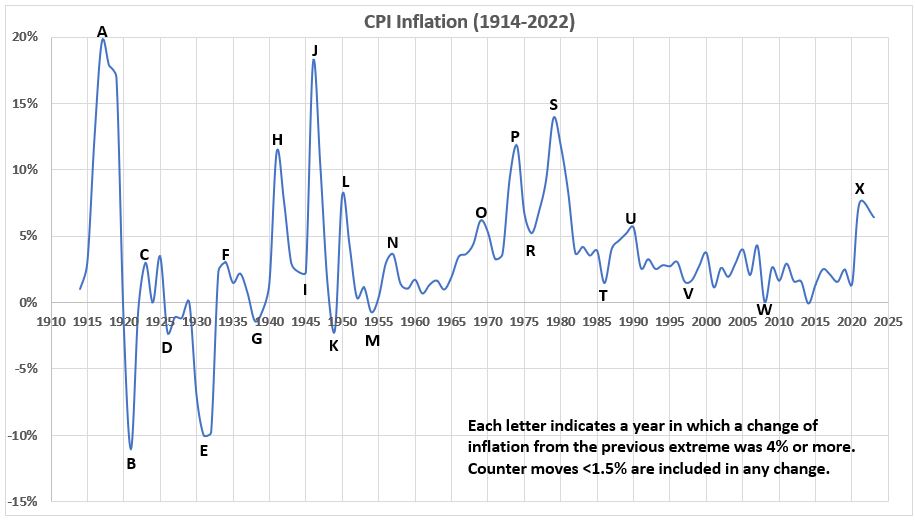

The definition of inflation above is done annually. Here, we use inflation data reported quarterly; see Appendix 2. The previous work,4 using annual data, produces the inflation time series graph shown in Figure 1.

Figure 1. CPI Annual Inflation 1914-2022 with Significant Changes in Inflation Noted

(Each letter identifies the end of a significant move.)

The data in Figure 1 produced Tables 1-3.

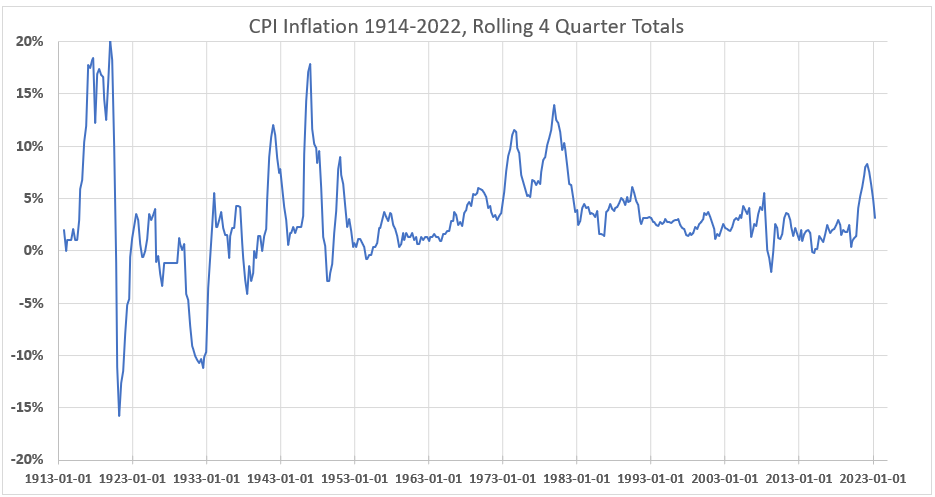

Figure 2 shows the rolling four-quarter inflation using the quarterly data used in this study. This results in four times as many data points for 12 months of inflation over the same 109 years.

Figure 2. CPI Rolling Four Quarter Inflation 1914-2022

There is much more structure in Figure 2 than in Figure 1. This may reflect noise in the Figure 2 data or be real information. The only area where this question may have importance could be the three peaks from 3Q 1917 to 1Q 1920. In Figure 1, this time period shows only a single peak with a shoulder approaching 1920. Addressing this question has no bearing on the current study, which covers the 71 years 1952-2022.

Figure 3 displays the inflation data for the study period 1952-2022.

Figure 3. CPI Rolling Four Quarter Inflation 1952-2022 with Significant Changes in Inflation Noted

(Each letter identifies the end of a significant move. An * identifies the end of an insignificant time period.)

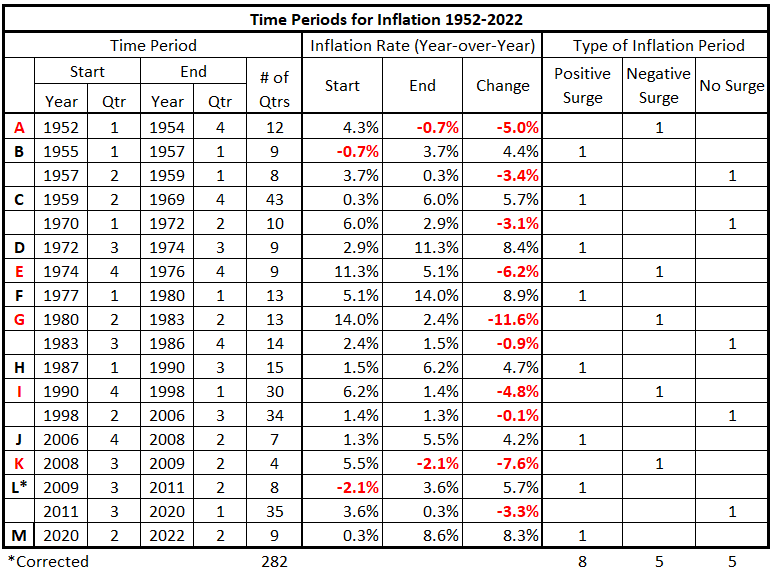

A summary of the data in Figure 3 is in Table 4.

Table 4. Timeline of Inflation Data 1952-2022

The quarterly data displays more information than the yearly data used previously.

- Table 4 shows eight periods with positive inflation surges over the 70-year period, while the previous study defined only 5.

- There are five negative inflation surges in Table 4, one more than in the previous study.

- Table 4 also shows five time periods with insignificant inflation changes, while the previous study had only three.

- Significant inflationary periods are identified here for 2006-08 and 2009-11 with the quarterly data. A significant deflationary period was identified for 2008-09.

- There were 3 1/2 years 1983-86 with no significant inflation changes not identified previously.

Note: 1999-2020 was previously identified as a 22-year period with no significant inflationary trends. The quarterly data found two significant inflationary trends and one significant deflationary trend within the interval.

Using the quarterly data gives a better resolution of inflationary and deflationary periods than was obtained with the annualized data. Whether or not this is useful remains to be seen with further analysis.

Comparing Financial Sector Debt Growth to Inflation

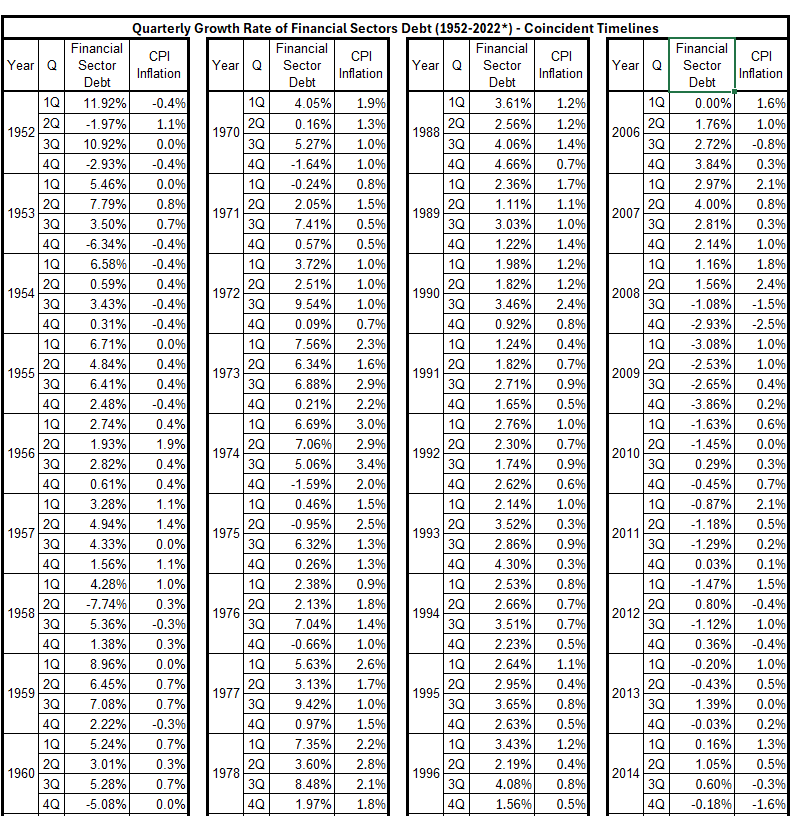

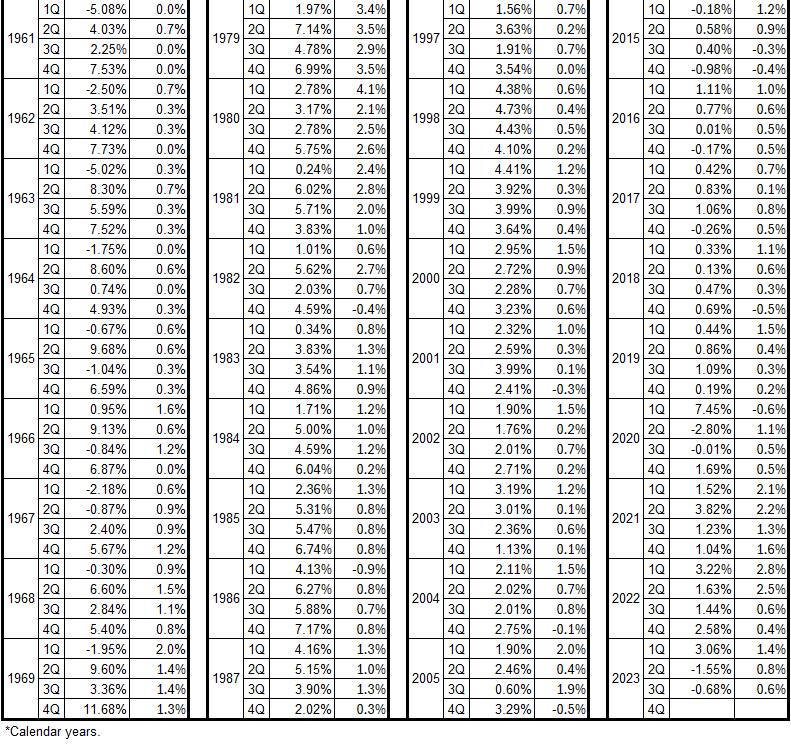

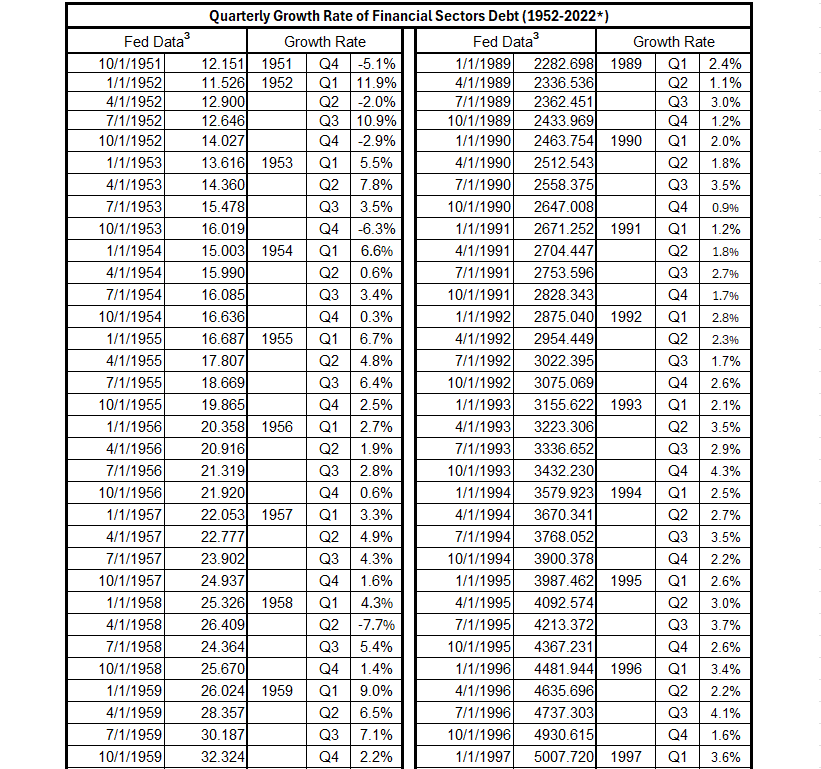

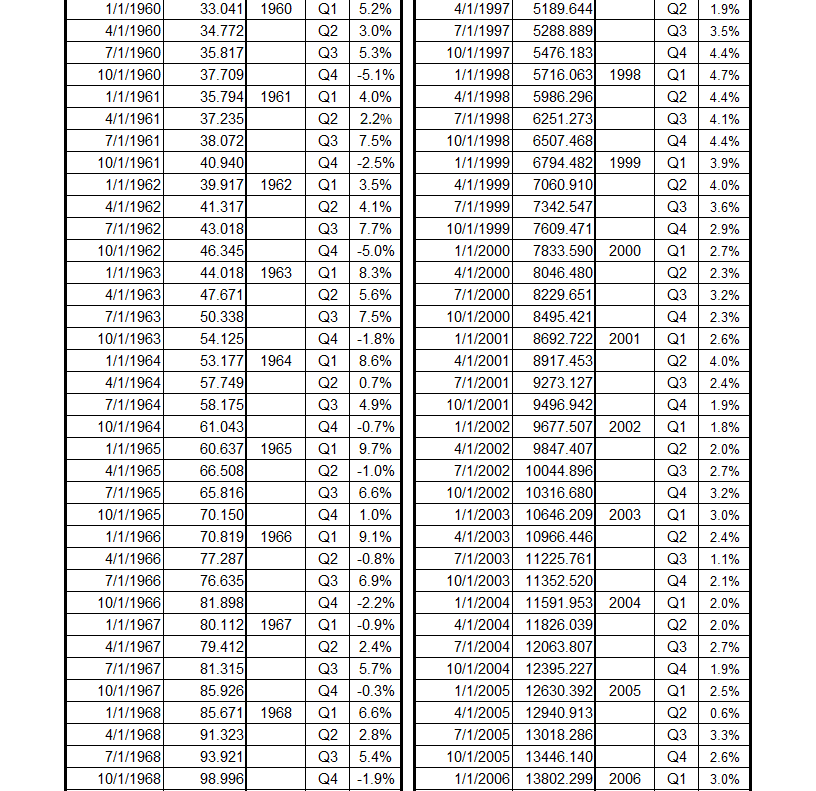

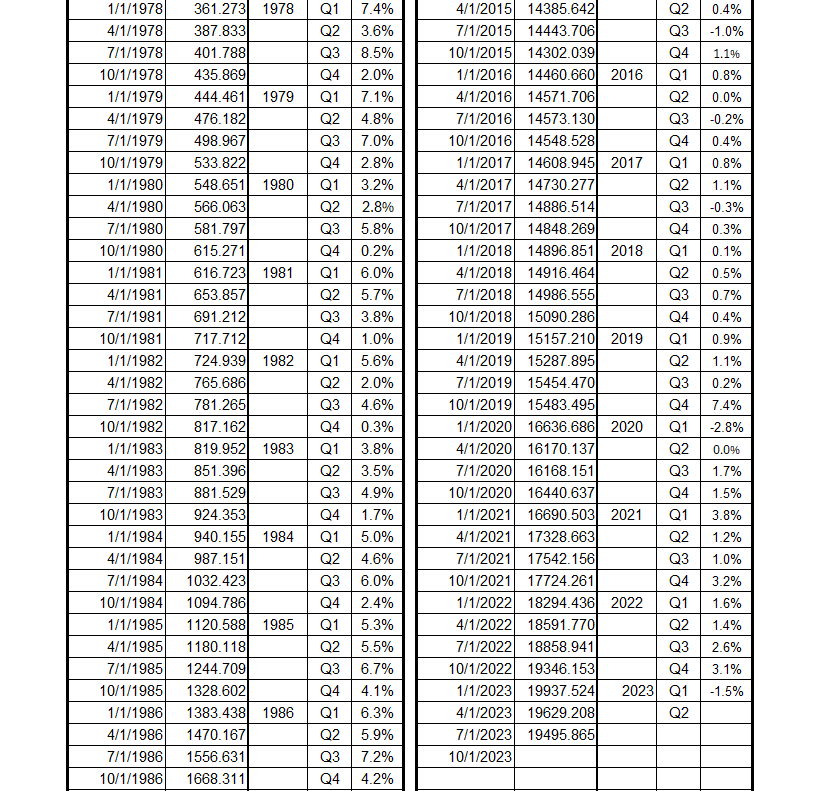

Appendix 1 shows how the FSD growth rate is determined by calendar year quarters. Tables comparing credit growth with inflation are constructed below from that growth rate data.

As in previous studies,1,2,3,4 we use the Consumer Price Index (CPI) to calculate the inflation rate. However, the data here for inflation growth is organized by calendar year quarters, as shown in Appendix 2.

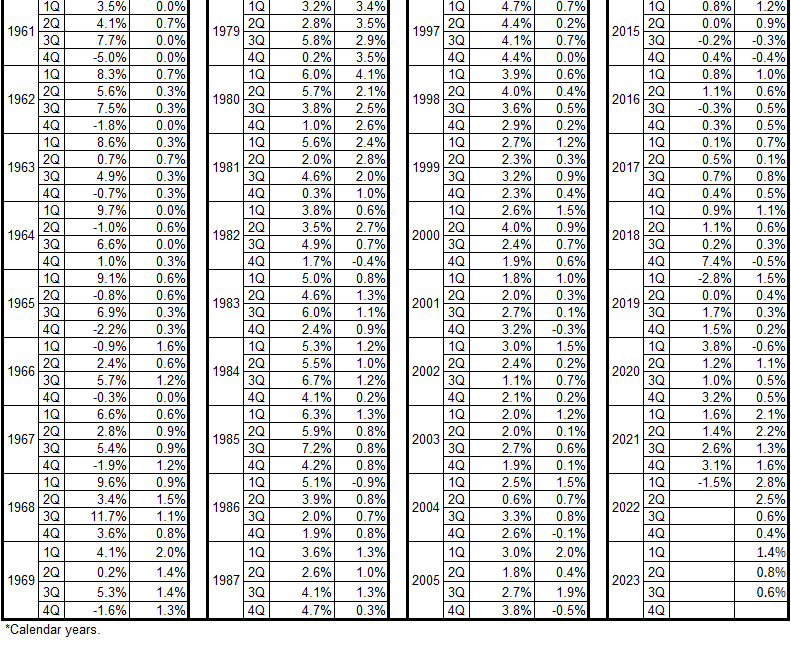

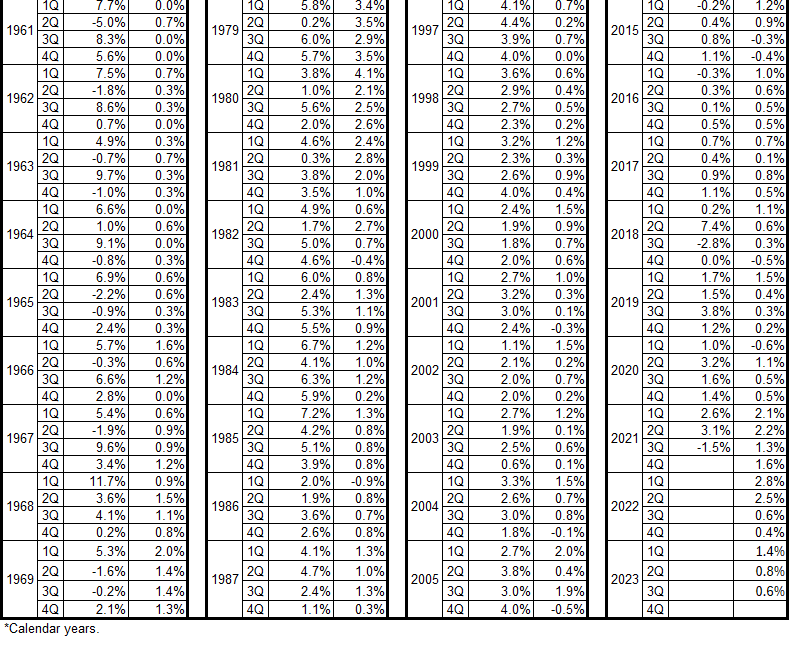

Table 5. FSD Growth and Inflation (CPI), Coincident Data, 1952-2022*

Table 6. FSD Growth and Inflation (CPI), FSD Leads by 3 Months, 1952-2022*

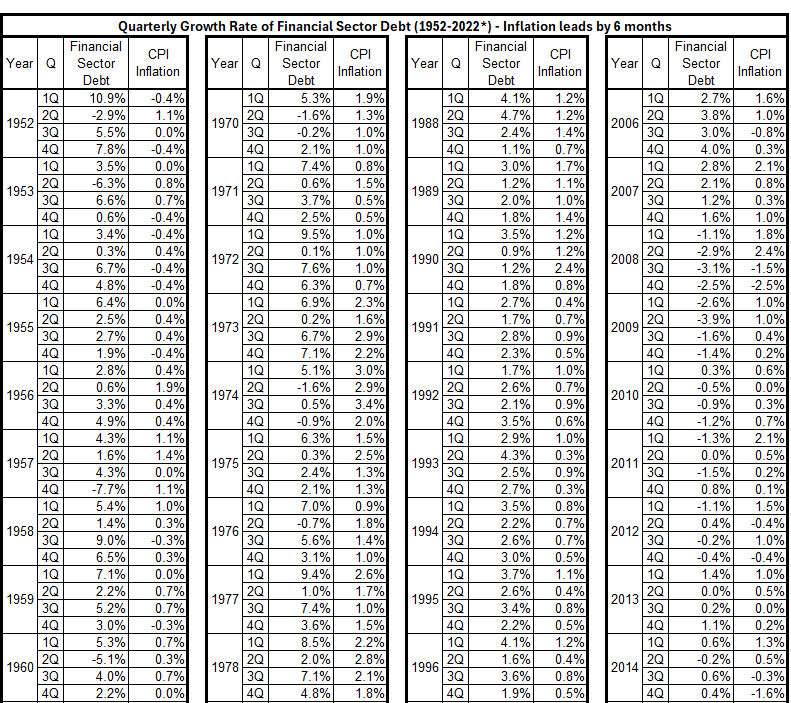

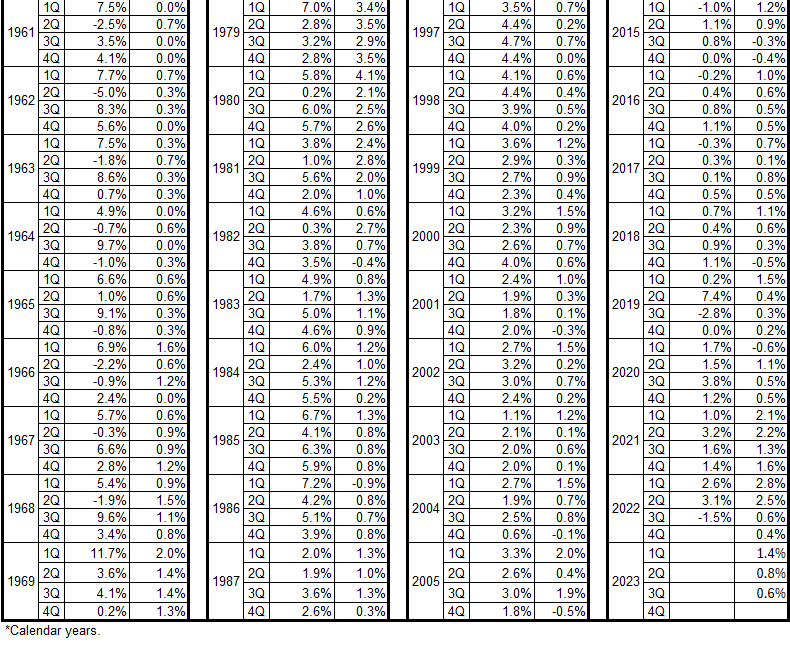

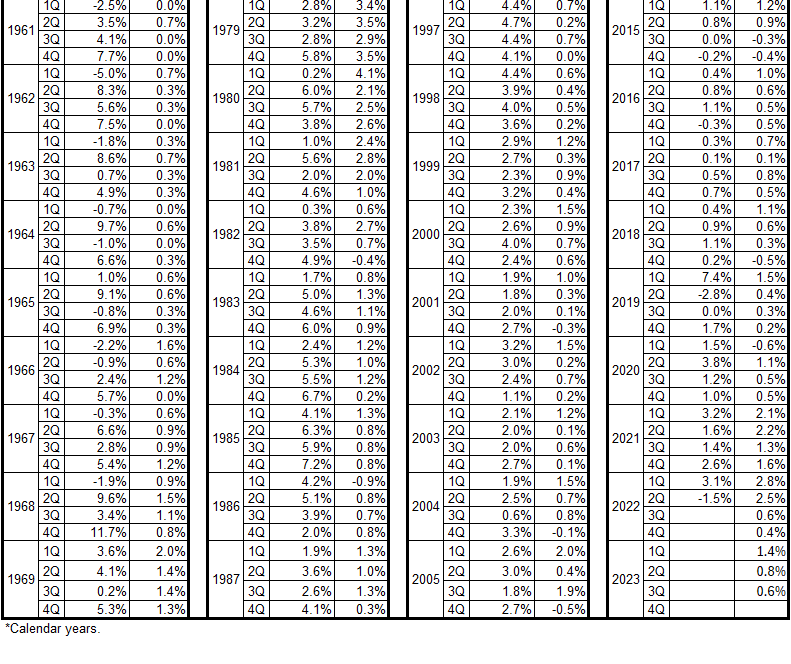

Table 7. FSD Growth and Inflation (CPI), FSD Leads by 6 Months, 1952-2022*

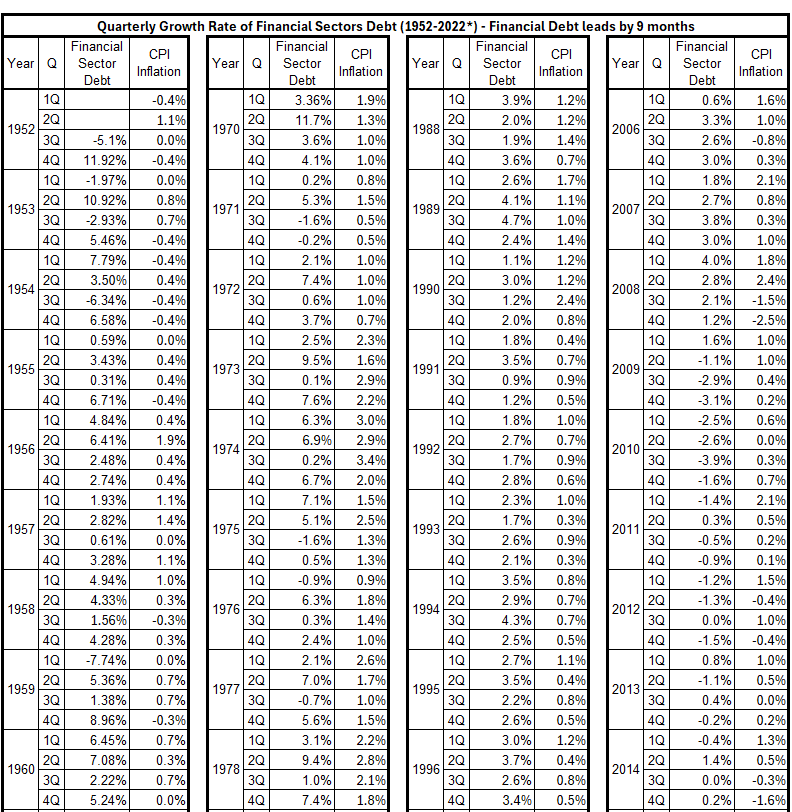

Table 8. FSD Growth and Inflation (CPI), FSD Leads by 9 Months, 1952-2022*

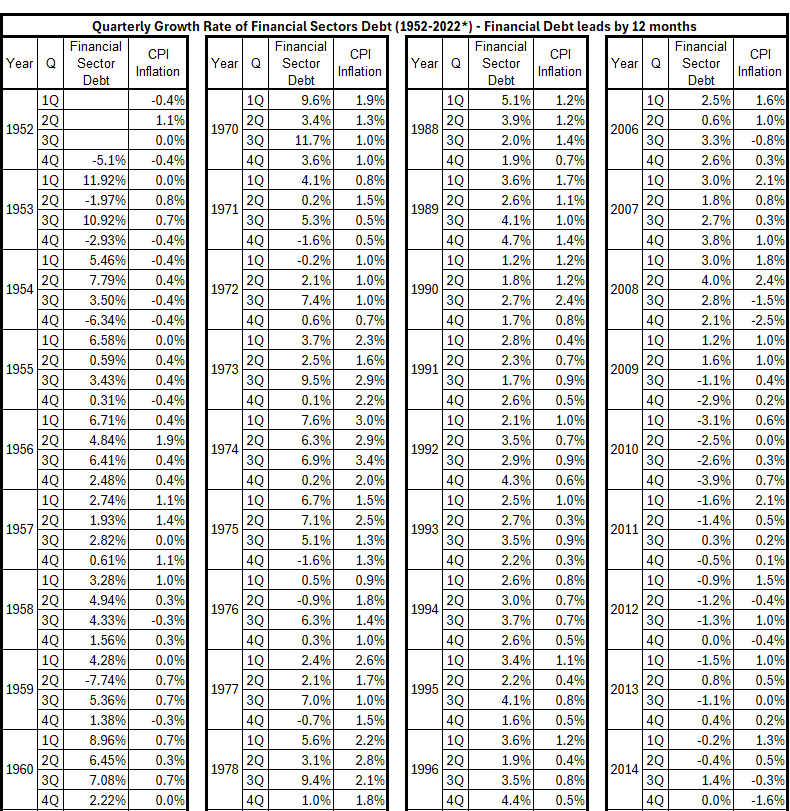

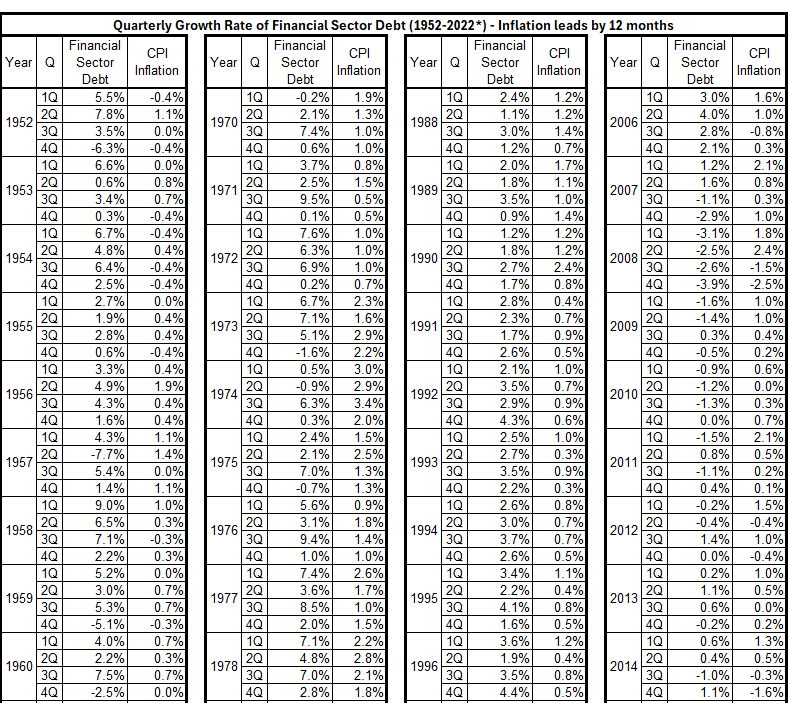

Table 9. FSD Growth and Inflation (CPI), FSD Leads by 12 Months, 1952-2022*

Table 10. FSD Growth and Inflation (CPI), FSD Leads by 18 Months, 1952-2022*

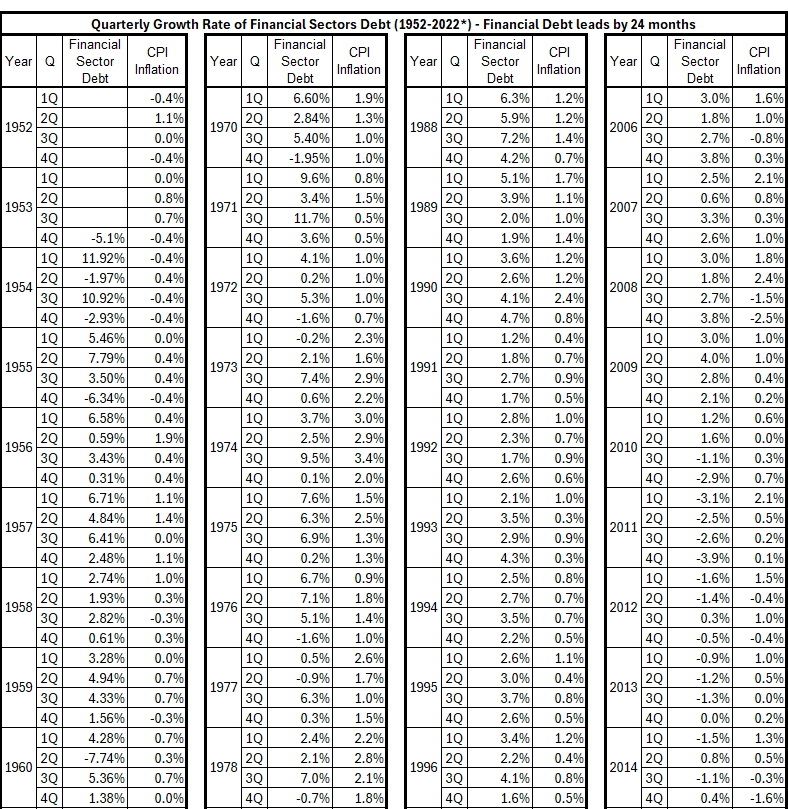

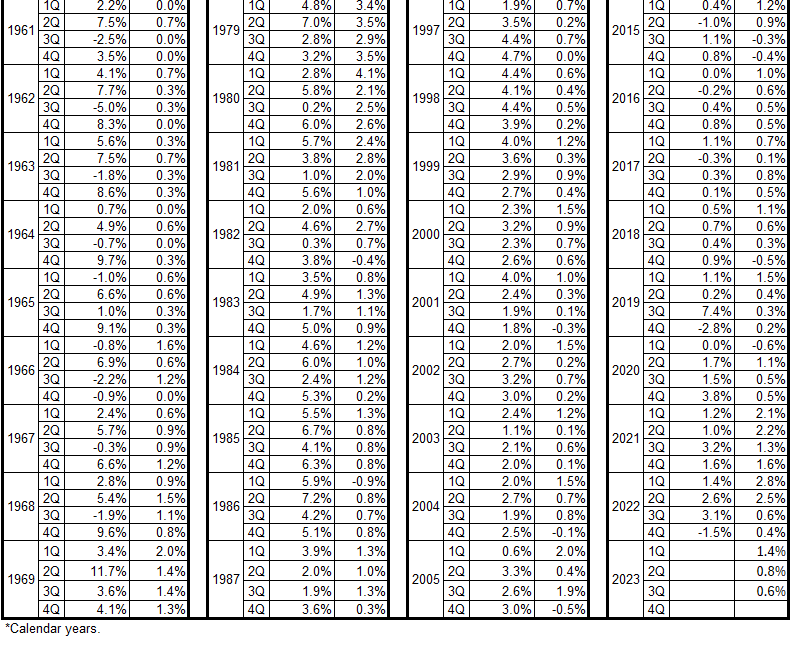

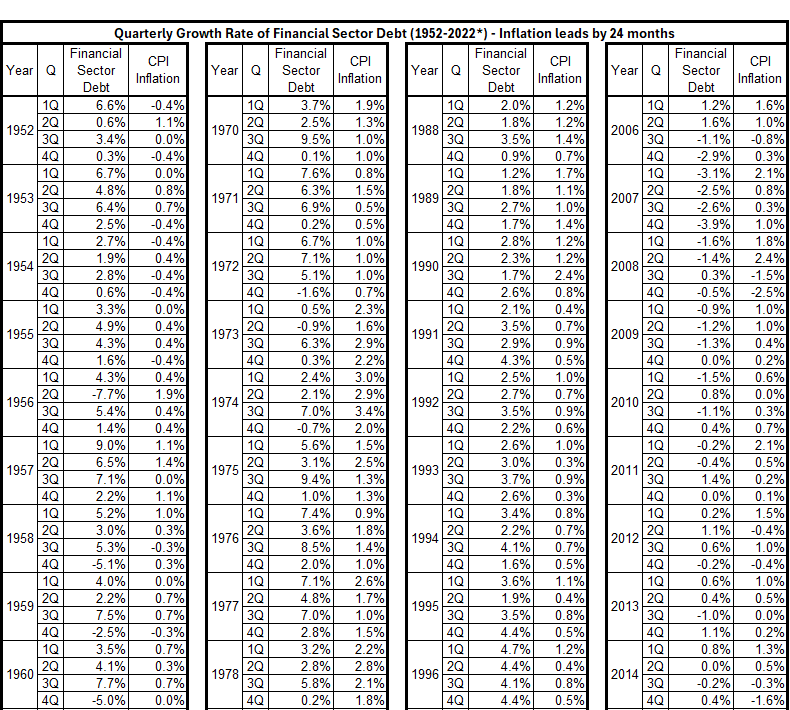

Table 11. FSD Growth and Inflation (CPI), FSD Leads by 24 Months, 1952-2022*

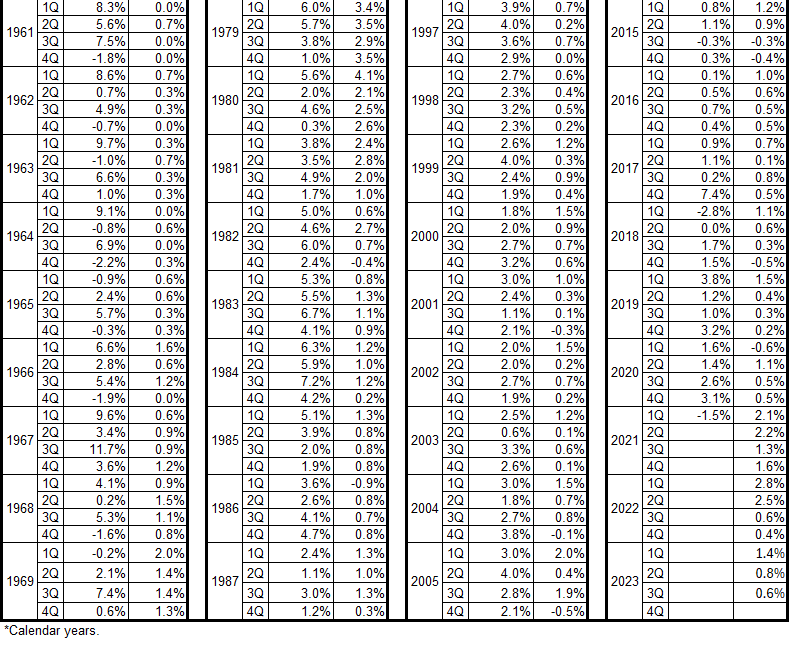

Table 12. FSD Growth and Inflation (CPI), FSD Lags by 3 Months, 1952-2022*

Table 13. FSD Growth and Inflation (CPI), FSD Lags by 6 Months, 1952-2022*

Table 14. FSD Growth and Inflation (CPI), FSD Lags by 9 Months, 1952-2022*

Table 15. FSD Growth and Inflation (CPI), FSD Lags by 12 Months, 1952-2022*

Table 16. FSD Credit Growth and Inflation (CPI), FSD Lags by 18 Months, 1952-2022*

Table 17. FSD Growth and Inflation (CPI), FSD Lags by 24 Months, 1952-2022*

Analysis

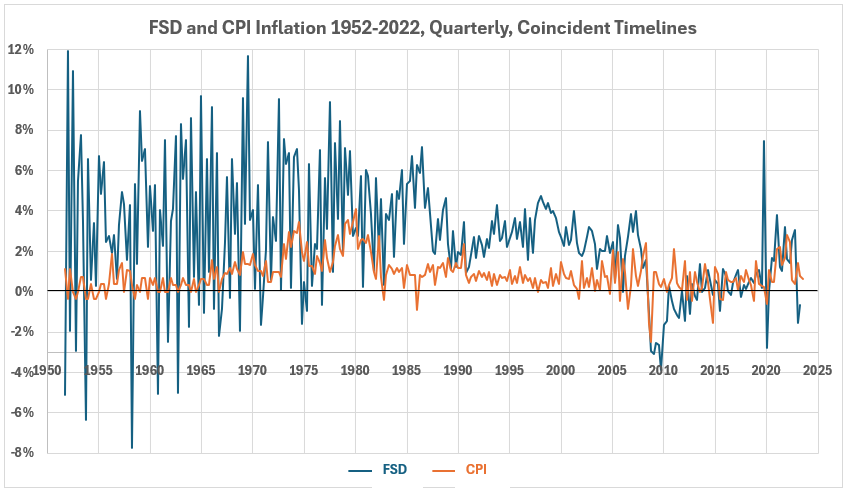

Figure 4 shows the quarterly changes for both FSD and CPI from 1952 through 2022.

Figure 4. Quarterly Changes for FSD and CPI 1952-2022

The changes are much more volatile for financial sector debt than for inflation. There is no obvious correlation between the two variables by visual inspection.

Figure 5 shows the scatter plot diagram for FSD-CPI data pairs for the 282 quarters in this study from 1952 to 2022.

Figure 5. Quarterly Changes in Financial Sector Debt (x) vs. CPI Inflation (y) 1952-2022

A weak positive association exists between FSD and CPI over the 282 quarters studied, R = 20.6% and R2 = 4.3%. These data pairs are for coincident timelines. A more complete analysis involves comparisons of associations (correlations) when the timelines are offset quarterly for up to two years.

We see no potential for useful correlation analysis in the entire data set. Further work will study what happens with the analysis of shorter time periods within the 71-year time frame.

Conclusion

The fine data granularity (more than 280 data point pairs) may provide useful information when analyzing various time periods. We will look at the time periods for each of the three inflation behaviors shown in Table 4. As done before,1,2,3,4 timeline shifts will be examined to see if any information can be determined about possible cause-and-effect relationships. The next step in this process will be to analyze the positive inflation surges during the time interval 1952-2022.

Appendix 1

The Household and Nonfinancial Corporate (NFC) Credit data is from the Fed database.5 The table below shows the conversion of the Fed data to growth rate by quarter.

Table A1. Growth Rate of FSD 1952-2022* (Quarter-over-Quarter)

Appendix 2

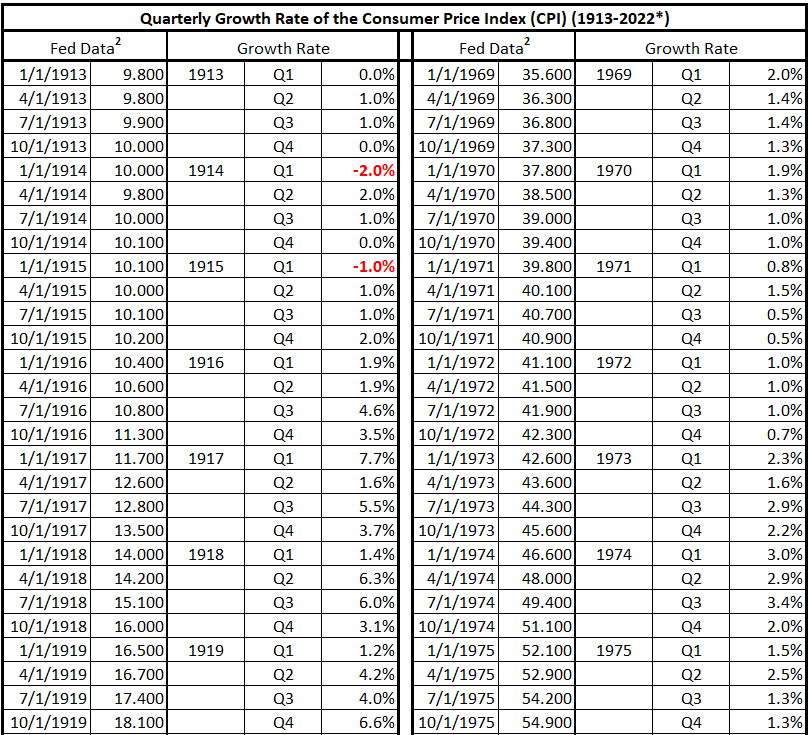

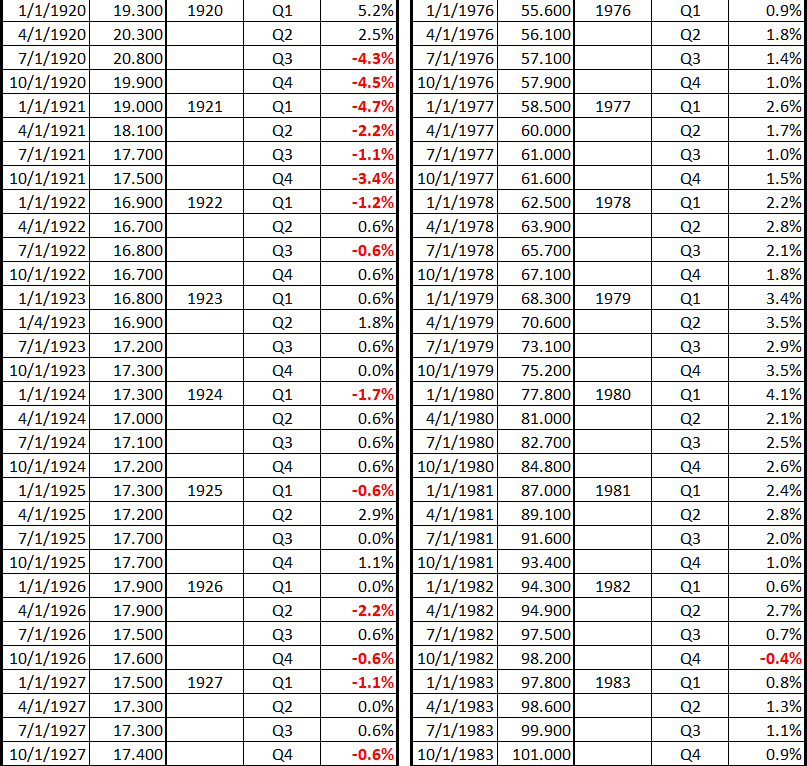

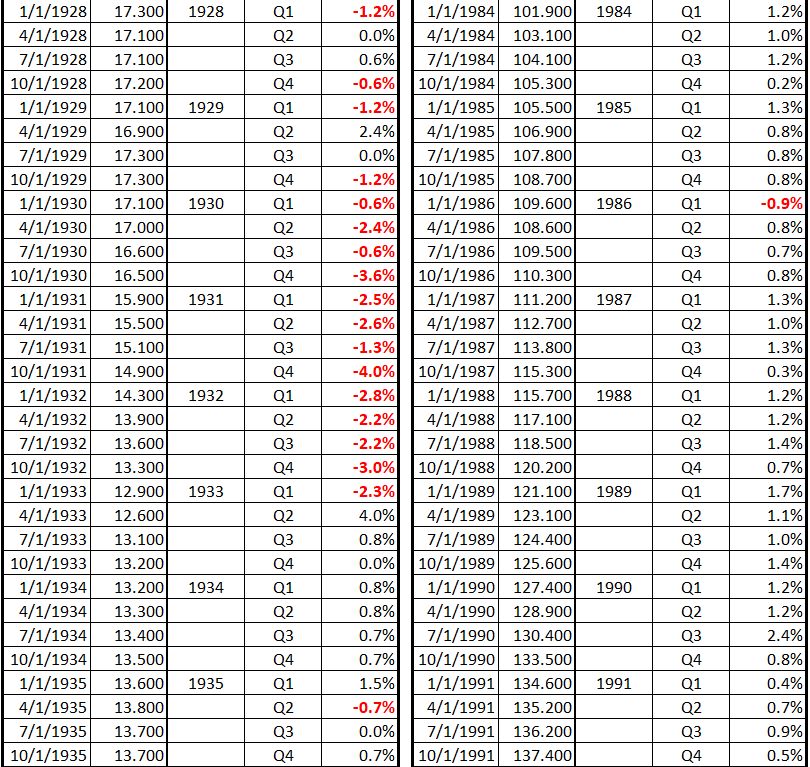

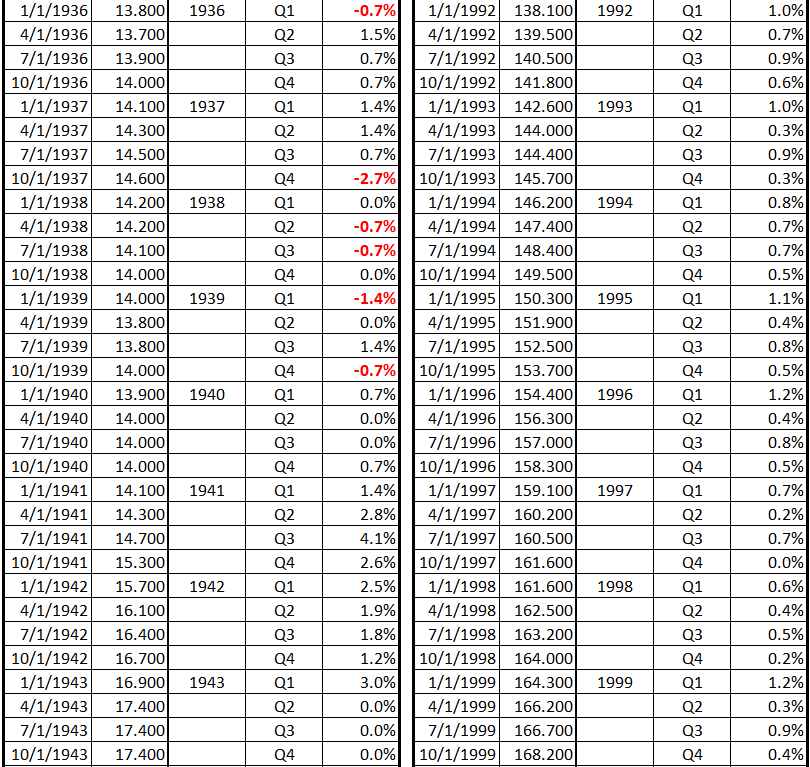

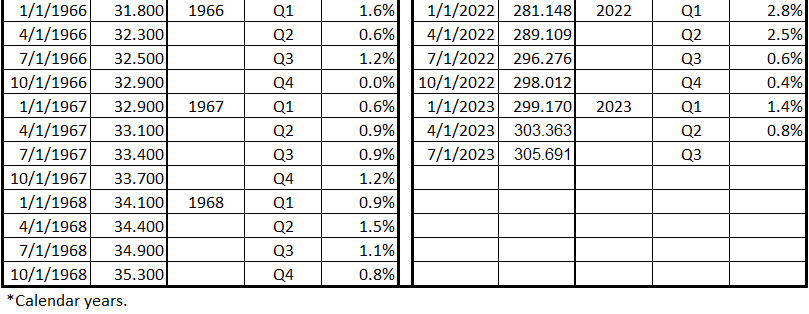

The Consumer Price Index (CPI) data is from the Fed database.5 The table below shows the conversion of the Fed data to growth rate by quarter.

Table A2. Growth Rate of CPI 1913-2022* (Quarter-over-Quarter)

Footnotes

1. Lounsbury, John, “Government Spending and Inflation. Reprise and Summary”, EconCurrents, August 20, 2023. https://econcurrents.com/2023/08/20/government-spending-and-inflation-reprise-and-summary/.

2. Lounsbury, John, “Consumer Spending and Inflation. Part 4., EconCurrents, September 23, 2023. https://econcurrents.com/2023/09/23/consumer-credit-and-inflation-part-4/.

3. Lounsbury, John, “Mortgage Debt and Inflation. Part 4., EconCurrents, October 22, 2023. https://econcurrents.com/2023/10/22/mortgage-debt-and-inflation-part-4/.

4. Lounsbury, John, “Nonfinancial Corporate Credit. Part 4., EconCurrents, March 3, 2024. https://econcurrents.com/2024/03/03/nonfinancial-corporate-credit-and-inflation-part-4/.

5. Federal Reserve Economic Data, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, Index 1982-1984=100, Monthly, Not Seasonally Adjusted. https://fred.stlouisfed.org/graph/?id=CPIAUCNS.

6. Federal Reserve Economic Data, Domestic Financial Sectors; Debt Securities and Loans; Liability, Level, Billions of Dollars, Quarterly, Seasonally Adjusted. https://fred.stlouisfed.org/series/DODFS.

7. Freedman, David, Pisani, Robert, and Purves, Richard, Statistics, Fourth Edition, W.W. Norton & Company (New York) and Viva Books (New Delhi), 2009. See Chapters 8 & 9 to explain how normal distributions relate to determining correlation coefficients. See p. 147 for a discussion of football-shaped scatter diagrams.