Both Keynes’ and Hayek’s shared the belief that there existed a need to revisit the economic discourse that began in the thirties and involved their respective analyses of growth and the business cycle. This paper looks at these topics and discovers some of the deep methodological, cultural, substantive, and ideological roots of the chasm that existed between Keynes and Hayek. The reasons for the chasm are understood with the aid of Concordian economics, a framework of analysis through which prism both Keynesian and Austrian economists might finally have a serious conversation with one another.

Introduction

Keynes and Hayek, preeminent leaders of two schools of thought, although long gone, still dominate and divide the economic discourse. Controversies do not remain within the walls of academia but spill over into the field of economic policy.1 As a consequence, for more than a century the political discourse has been polarized between those who believe in the infallibility of The Market and those who believe in the perfectibility of The State. The current economic crisis cannot be resolved without reconciling these two divergent views.

The hope of achieving this seemingly impossible feat is rooted in a rarely acknowledged common realization: Both Keynes and Hayek expressed the need to go beyond the terms of their respective positions. A few months after the publication of the General Theory (1936), Keynes issued this warning in the Quarterly Journal of Economics, February 1937:

“I am more attached to the comparatively simple fundamental ideas which underlie my theory than to the particular forms in which I have embodied them, and I have no desire that the latter should be crystallized at the present stage of the debate.”

By the same token, Hayek (1994, p. 145) confessed:

“…one of the things I most regret is not having returned to a criticism of Keynes’s treatise.”

And in (1968 [1995], p. 49) he more fully explained:

“When I look back to the early 1930s, they appear to me much the most exciting period in the development of economic theory during this century…. [T]he years about 1931,…. and say 1936 or 1937, seem to me to mark a high point and the end of one period in the history of economic theory and the beginning of a new and very different one. And I will add at once that I am not at all sure that the change in approach which took place at the end of that period was all a gain and that we may not some day have to take up where we left off then.”

Four Flashpoints

These delayed expressions of willingness to accept criticism, whether from one another or others, give us the spur to acknowledge the numerous differences—and weaknesses—that exist within both systems of thought. We will showcase four of the most important flashpoints: (1) the methodology, (2) the culture, (3) the categories of economic thought, and (4) the ideology that infuse the respective thought processes of Keynesians and Austrians.2 These were the barriers that made Hayek and Keynes unable to listen to and talk to each other. These unbridgeable differences are better identified by going outside the straitjacket of both systems and will be resolved by calling upon the help and insights that Concordian economics uniquely provides (Anon., 2002; Gorga, 2011 and 2012).

This process is nothing but an application of one of Gödel’s incompleteness theorems, through which it has become exceedingly evident that the consistency of any system of thought cannot be identified from within the confines of any closed system. One will see weaknesses of a system only with the help of a different system of thought, Keynesian economics through Austrian economics, Austrian economics through Keynesian economics, and the weaknesses of both systems through Concordian economics. (We have to wait for the next system of thought to analyze the weaknesses of Concordian economics).

Illustration 1. John Maynard Keynes (1883-1946) Socialist Revolution

In our efforts we will be guided by this analysis by H. O. Meredith, a professor of economics at Belfast, who on 22 November 1931 put it this way to Keynes:

“It’s unfortunately true, I think, of the last fifty years that Austria has had an elaborate analysis but no machine and Cambridge a machine but an insufficiently formulated analysis” (Keynes, 1973, p. 266).

There is no extant reply from Keynes, and H. O. Meredith seems not to have been heard of again.3 The lead is slim, yet if one follows it rather relentlessly, it will be hard not to agree with H. O. Meredith.

Illustration 2. Friedrich Hayek (1899-1992) Wikipedia, CC BY-SA 3.0

Purpose

The purpose of this paper is not to renew old controversies, but to attempt to solve the current crisis in economics. The crisis is deep and widely recognized. For instance, Lawson (2001) points out that the “mainstream project” has been proved to be unrealistic, arbitrary, without clear direction, riddled with inconsistencies, in crisis, basically in a state of disarray, and ineffective in forecasting. In this paper, we will see that it is conceivably possible to solve the current economic crisis not so much because of the existence of Concordian economics as because Concordian economics is rooted in both the Cantabrigian machine and the Austrian analysis.

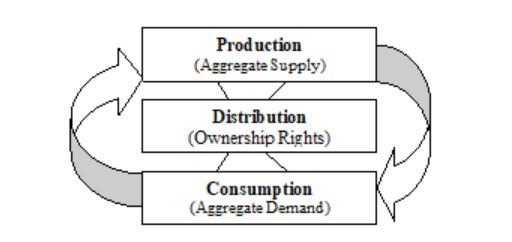

The Core of Concordian Economics

Briefly, Concordian economics is the study of the economic process. And the economic process is defined as the integration of production, distribution, and consumption of wealth. Obeying Keynes’ wishes, Concordian economics introduces two changes in the “forms” of the economics of Keynes: a restriction of the meaning of Saving to Hoarding and an enlargement of the meaning of Consumption to include all forms of expenditure.

While the mathematics of Concordian economics, which follows from there is easily duplicated, but too lengthy to be included here, its geometry is intuitive. In Concordian economics, the long line of wealth is split into two segments assigning real or physical wealth to one and monetary wealth to the other; through a Smale transformation, the segments are enlarged into rectangles so one can see what happens within them. Thus the real economy is physically separated from the monetary economy, and then the two parts are bound together again by the distribution of values of ownership rights over real and monetary wealth. The core of Concordian economics is represented in this diagram:

Figure 1. The Economic Process

Ownership Rights

When real goods and services pass from producers to consumers, monetary instruments of a corresponding value pass from consumers to producers. Both money and goods change hands. Then one cycle of the economic process is completed (in the context of this paper it is worthy of note that, before they are sold, consumer goods are part of the capital structure of the firm)—and the exchange is accompanied by the silent transferal of values of ownership rights over monetary and real wealth.

Significantly, as they are in reality, values of ownership rights are apportioned prior to the exchange, at the moment of wealth creation; namely, they automatically accrue to the owners of the entity that creates the wealth. Thus the legal economy is fully integrated into the monetary as well as the real or physical economy. In addition, attaching ownership rights to human beings and specific institutions leads to the rediscovery of the category of common goods (cf. Stavins, 2011). These are goods like air and water that belong neither to individual persons nor to the government, but to the community as a whole (Gorga, 2010a).

Illustration 3. Joseph Schumpeter (1883-1950) Wikipedia, CC BY-SA 3.0.

Schumpeter was one of the most influential economists of the early

20th century and popularized the term “creative destruction”,

which was coined by Werner Sombart.

The unit of account can be the economy of one firm, one nation, or the world. Thus one of the major clefts that plagues contemporary economic theory, the split between micro and macro economics evaporates. In macroeconomics, the exchange of Production (Aggregate Supply), Consumption (Aggregate Demand), and Distribution (Ownership Rights) occurs neither between two insignificant commodities (cf. Schumpeter, 1936) as in microeconomics, nor between any two forms of financial instruments as in the economics of Wall Street.

In macroeconomics, fully respecting both the laws of supply and demand and the laws of the land as Hayek would have demanded, the total production of real wealth is exchanged for the total availability of financial resources. This is the principle of effective demand fully enunciated and the essence of the General Theory (see Gorga, 2002, esp. pp. 165-170).

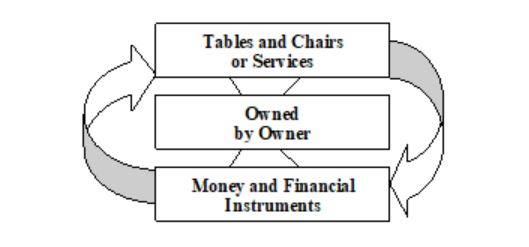

As it can be seen, in nuce this framework of analysis reconciles the macroeconomics of Keynes with the microeconomics of Hayek: the reader, quite simply, has to substitute Aggregate Demand and Aggregate Supply with demand for and supply of any item of wealth—and insert the value of ownership of the specific products or services. This way:

Figure 2. The New Microeconomics

The shape of the structure of Figure 1 and Figure 2 is self-similar; what remains is only a difference in scale. We will discover in the proceeding the specifics of the reconciliation between Hayek and Keynes at other vital points of the discourse. Depending on the preferences of the reader, once Concordian economics has performed its function it can be appreciated for its own values or it can be absorbed either into Austrian or Keynesian economics.

Some Methodological Differences

The fundamental methodological difference between Keynes and Hayek is this. Keynes and all mainstream economists rely on the standard positivist understanding that what is not verifiable or falsifiable is not amenable to scientific analysis. Thus their roots are dug deep into an objective theory of value. This is the standard scientific method, and they believe that their work stands on unshakable ground (see, e.g. Mankiw, 2006).

Indeed, they are not ready to even conceive of the possibility that they might be wrong.

However, that is the function of Hayek, and Mises, and most “Austrian” economists. Their major function is to show that the science of economics in the end is scientism (Hayek, 1955, pp. 11-102; 1974; see also Mises, 1933). However refined are the statistical tools of mainstream economics, the very precise method of mathematics is applied to a very imprecise science—Saving in mainstream economics displays 100,000 possible logical definitions (Goldsmith, 1955-1956, p. 69n)—and is deployed in the vain attempt to measure an undefined and undefinable entity, utility.

Illustration 4. Ludwig von Mises (1881-1973) Wikipedia, CC BY-SA 3.0.

von Mises is considered one of the most influential economic and political thinkers of the 20th century.

Hayek and the Austrians are not given any audience. Their objections are too subtle and too deep to be considered while involved in the busy activity of saving the world for capitalism (see, e.g., Hayek, 1948, pp. 33-56). This final aim of their respective methodologies should be a unifier.

Yet, it is not because the Austrians run to the antipodes. They reject positivism as well as materialism and propound a doctrine of methodological individualism (see Mises, 1933, esp. pp. 164-193). Naturally, they expose themselves to the debilitating objection that such a methodology does not allow for the need to aggregate the data into meaningful national and intergenerational patterns.4

There the issues stand. The positions are irreconcilable. It is only by backtracking into the history of methodology that one can resolve the differences: One then discovers the common roots of Austrian, Keynesian, and Concordian economics.

Concordian Epistemology

The epistemology of Concordian economics relies (for short) on the Kantian definition of a concept (Gorga, 2002, pp. 116-117), and on organic logic, a system composed of the integration of three fundamental principles of logic that are well-known to—mirabile dictu—both philosophers and mathematicians: (1) the principle of identity, which instructs us to give one meaning and one meaning only to each term of the discourse; (2) the principle of non-contradiction, which instructs us to give one non-contradictory meaning to each term of the conversation; and (3) the principle of equivalence, which allows us to escape the circularity of arguments inherent in only two terms—the dichotomies—of the conversation by extending the analysis to include a third term to which they both have to be equivalent (e.g., Suppes, 1957; and esp. Allen, 1970, p. 748).

Apart from Hegel and his—often unaware—followers, who argues with these principles?

The method eschews personal preferences and anyone can verify the validity of its applications. Finally, Concordian economics does something more important: Concordian economics relies on fractal geometry5 and standard mathematical procedures that are currently used by scientists and engineers (cf. Thompson, 1986). Rather than thinking in terms of points and planes (see Clower, 1960), Concordian economics prompts us to think in terms of solids moving in space (cf. Hayek, 1941, pp. 196-199).

Illustration 5. J.M.T.Thompson (1937- ) Wikipedia, CC BY-SA 4.0.

Thompson wrote the seminal book Nonlinear Dynamics and Chaos (1986)

and devoted the later years of his research to the subject.

Other Differences of Method; Differences of Ideology

A long list of other methodological differences, in the end, resulted in an inability of the two major economists of the last century to talk to each other.

- First, while Keynes, with his comparative statics analysis, did not take time into explicit account, for Hayek the passage of time was of crucial importance (see, e.g., Hayek, 1941, pp. 50-54 and esp. 65-112 and 116-121; see also 1948, p. 37).

- Second, while Keynes’ perspective was from the outside (but he never entered into the structure of the economic system), Hayek’s perspective was from the inside out.

- Third, while Keynes dealt with a “closed” system, Hayek dealt with an open system—open especially to the observation of the relationships between economics and the law, along with history and political science.

Then there were differences as to what and who was at their focus of attention: for Keynes, the object of the study was the economic system, while for Hayek it was the market; for Keynes, the subject of the study was the government, while for Hayek it was the entrepreneur.

Facts and Abstractions

Another major dichotomy can be classified as Facts vs. Abstractions. The facts are very often given by the Austrians; abstractions are generally given by the Keynesians. Two quotations might be sufficient to prove the existence of this different methodological approach. Hayek:

“To combat the depression by a forced credit expansion is to attempt to cure the evil by the very means which brought it about; because we are suffering from a misdirection of production, we want to create further misdirection—a procedure that can only lead to a much more severe crisis as soon as the credit expansion comes to an end” (1933, p. 29).

To see these facts as current facts let alone as facts of the 20s, one has to hold back the conversation about causes of these facts and solutions for the ensuing disarray (see also Hayek, 1941, p. 50). The other quotation is this. Willem Buiter, a former London School of Economics professor who is now the chief economist at Citigroup, wrote on his blog in March 2009:

“The typical graduate macroeconomics and monetary economics training received at Anglo-American universities during the past 30 years or so, may have set back by decades serious investigations of aggregate economic behavior and economic policy-relevant understanding. It was a privately and socially costly waste of time and resources.” (Quoted in Cassidy, 2011)

And, naturally, these differences yielded a different ideological approach to the purposes of economics. While for Keynes the enemy was internal and resided in the inner instability of the economic system, for Hayek the enemy was external—at least to the extent that socialism and communism could be considered external to the Western society at the beginning of the last century and had not yet fully influenced the creation of the “welfare state”.

Cultural Differences

John Maynard Keynes, though later in life he became a “Lord’’, was middle class; Friedrich von Hayek, though he lost his title to use “von” in the middle of his life, belonged to the nobility. Keynes was an optimist; Hayek tended toward pessimism. Keynes was an Englishman; Hayek was an Austrian.

There is in Nietzsche, a German, a delightful confession of his cultural modus operandi that seems to fit the exchanges between Keynes and Hayek like a hand in glove:

The first stimulus to publish something of my hypothesis concerning the origin of morality was given to me by a lucid, tidy, clever, even precocious little book in which for the first time I clearly ran into a topsy-turvy and perverse type of genealogical hypothesis—a genuinely English style. It drew me with that power of attraction that everything opposite, everything antipodal contains. The title of this booklet was The Origin of the Moral Feelings. Its author was Dr. Paul Rée, and it appeared in the year 1877. It’s likely I have never read anything which I would have denied, statement by statement, conclusion by conclusion, as I did with this book, but without any sense of annoyance or impatience. (1887, p. 5)

That is what seems to have happened between Keynes and Hayek. It might appear that each one of them would say tit for any tat by the other. But it is not so. It was the logic of their respective systems that led each one of them to take diametrically opposite positions.

It was not only the difference in methodology but the very goal that each was trying to reach. Keynes wanted the economic system to maximize utility, Hayek wanted the economic system to create value—one wanted to enrich the nation; the other wanted to enrich each individual human being.

Both are valid goals; both are valid values; but just because they were “values” neither one of the two protagonists could lead himself to discuss them openly. Take, for instance, aristocratic vs. democratic values. No one can get to the bottom of these values in a hurried and heated conversation.

Dreams of Reason

Leaving the specific details of each case well aside, why such actions and reactions, which were not all necessarily conscious? The reason lies in the fact that both the Keynesian and the Austrian are systems of thought, rational systems of thought to be precise; to use Goya’s expression, they are dreams of reason. Even more specifically, they are complementary systems of thought.

As we shall shortly see, one cannot exist without the other. One is primarily concerned with macroeconomics; the other with microeconomics. Also, one is primarily concerned with the workings of the system as a whole (“the machine”); the other is primarily concerned with the atomistic behavior of prices in a free market as transmitters of information and coordinators of human action. One is a-historical; the other is steeped in history. Finally, one is deductive, the other is inductive.

Singly, they do not stand to scrutiny. They need to be fused into one coherent organic system. To foster this fusion is a function that has fallen by default upon the framework of Concordian economic analysis because it applies the laws of supply and demand to macroeconomics and by so doing it captures the essence of Keynes’ General Theory; equally, it integrates the institution of property rights into the structure of economic theory and captures the essence of the Hayek’s vast body of work. Concordian economics enlarges the Cantabrigian machine, while fully respecting the rigor of the Austrian method of analysis.

Different Categories of Economic Thought

The methodology of Concordian economics allows us to make some startling observations about the categories of economic thought as they exist in both Keynesian and Austrian economics. Let us start at the beginning. The Keynesian categories are highly aggregated, but so reductive that they substantively appear as one category, money; yet, money is never defined. And money is not defined in Austrian thought either.

Both systems run to the list of functions that money performs, and never ascertain what money is. Nor can they. This is because the Keynesians are trapped in the conceit of being pure scientists, whereby economics is assumed to be an autonomous discipline. In contrast, the Austrians are trapped in their anti-statist ideology, whereby they cannot accept money as a creature of the state (see, e.g., Mises, 1912; Hayek, 1976).

In Concordian economics, money is defined as a contract between the holder of the money and society (Gorga, 2002, p. 222). Thus money is a representation of real wealth. It is a legal institution that performs economic functions. As we have seen, Concordian economics is privileged to observe the legal economy as an integral part of economic theory; and we shall see that the legal institution of economic rights and economic responsibilities is an integral part of the transmission belt that moves from economic theory to economic policy and practice.

Two categories of thought are presented on page 63 of the General Theory: Consumption is arbitrarily truncated to mean an item of expenditure on consumer goods and Saving is syllogistically set to be equal to Investment—all are defined in relation to each other, not in themselves. Nor could they be defined in themselves because of Goldsmith’s specification that Saving can assume 100,000 logically tenable meanings in mainstream economics.

Quantitative Descriptions

To repeat, all Keynesian categories are reductively defined exclusively in monetary terms. With the Hicksian IS/LM model the number of categories is doubled. But their substance remains identical to one value, money. Even time and space that exist between supply and demand are conflated into one because, as Lawrence R. Klein explained (1970, p. 143), there is a technical relationship between the two whereby what is demand by one person is supply for the other.

In aggregate demand and aggregate supply analysis, the items on the list might variously multiply but the linear production function, as pointed out by Georgescu-Roegen, remains “jejune” (1971, p. 241). The application of the apparatus of the laws of supply and demand to the categories of Keynesian thought is undifferentiated, arbitrary, and meaningless—as Schumpeter (1936) exploded. These categories were organized by Keynes in a model that is so ingenious and so fertile that gave rise to most economic theory of the past three-quarter century. The structure of Concordian economics, admittedly, duplicates the structure of Keynes’ original model.

Illustration 6. Nicholas Georgescu-Roegen (1906-1994)

Vanderbilt University, Public Domain.

Georgescu-Roegen wrote the seminal The Entropy Law and the Economic

Process, which was instrumental in establishing ecological economics.

In Austrian analysis, the categories are complex and differentiated: the demand and supply of “production goods” is taken into consideration, in real time, in relation to the demand and supply of “consumer goods” and in response to a panoply of forces such availability of factors of production, technological change, consumer preferences, interest rates, expectations of future price, and the like.

Price interactions among these functions determine the level of future income as well as fluctuations in the long-term business cycle. In Austrian economics, the application of the apparatus of the laws of supply and demand is continuous and, being related to differentiated goods and services, is complete and detailed (Hayek, 1941, pp. 113-138).

The Engine of the Economic System

Perhaps the most fundamental difference between the two systems is centered on their respective understanding of the ”engine” of the economic system. The very use of different words to identify the same economic reality is telling: Keynesians use the word investment; Austrians use the word capital.

One is a flow, the other is a stock. One is discreet and homogeneous and construed as being immensely affected by expectations of future events and current uncertainty of information and knowledge: crudely put, for the Keynesians, investment is money—even when it is called capital and is distinguished between fixed and circulating capital.

The other, squarely called capital, for the Austrians is discontinuous and heterogeneous and is governed by information carried through the price system posited in a free market economy.

Capital has the ability to reproduce itself and generally leaves something else behind: in real terms, the machine remains in existence for some time, and in the meantime, it produces all the gadgets it was designed to produce; in financial terms, capital reproduces itself and leaves a surplus—a profit behind (see, e.g., Hayek, 1941, pp. 29, 41, 47-49, and 294-305).

Unfortunately, Hayek’s analysis is less complex than it is required—and more complex than it can ever be explained in pure verbal expressions (see, e.g., 1941, pp. 56-64). To top this discussion off, it is enlightening to notice that, due to the long memory of relationships between nobility and slavery, business and profit for most Keynesians become dirty words.

A Communication Chasm

Here all the issues meet head-on as a set of major dichotomies. The chasm between the different conceptions and functions of categories of thought makes communication impossible. (How easy is it to build a bridge across “the saving, investment, and consumption” [Hayek, 1941, pp. 334-353]—of capital?)

To achieve the same goal of a turnaround from any downward spiral in the economy, Keynes, believing in a deficiency of effective demand, relied on the power of the government to fill the slack; Hayek, instead, believing in an overshoot of the financial system combined with the infinite power and adaptability of the market to correct itself, relied on the entrepreneur acting on information provided by the price system to fix the imbalance—all in good time.

In simpler terms, Keynes looked at the economic system from the point of view of the government, or from the top down; Hayek looked at the same entity from the point of view of the entrepreneur, or from the bottom up. In other words, Hayek remained enclosed in the world of microeconomics, while Keynes remained enclosed in the world of macroeconomics. The views do not meet, because they are divergent.

If these fundamental issues are not yet settled, no matter the detailed studies and the brain power brought to bear on them, it must mean that the two sets of theories contain fundamental truths that no faction can honestly abandon. The truth is that the two theories need each other. They are complementary and ought to be fused into one. Concordian economics is a framework in which this seemingly impossible dream can be realized. This framework extends and clarifies both the Keynesian and the Austrian analysis.6

A Convergence on the Substance of the Economic Discourse

All questions of methodology touched upon so far converge on a different approach to the correction of a downward spiral in the economy. The core of the respective economic discourse can be reduced to this dichotomy: Government Support of Effective Demand vs. Reliance on Market Prices. Keynes called upon the government to sustain effective demand through an array of measures such as low interest rates, expansion of money supply, tax cuts, and ultimately direct government expenditures.

Hayek, on the other hand, insisted:

“The only way permanently to ‘mobilize’ all available resources is, therefore, not to use artificial stimulants—whether during a crisis or thereafter—but to leave it to time to effect a permanent cure by the slow process of adapting the structure of production to the means available for capital purposes” (1931, p. 185).

Keynes shot back:

“In the long run we are all dead.”

Concordian economics succeeds in making these views convergent by placing antagonistic policies in the full context of society at large.

Different Conceptions of Social Organization

All the differences in methodology, culture, and categories of economic thought are reinforced by casting two diametrically opposed conceptions of social organization. For the Austrians, society is a self-organizing entity; for the Keynesians, society depends on government bureaucracy to be organized. It is only natural that Keynesians would favor planning to achieve the summum bonum of eliminating poverty in the midst of plenty (Keynes, 1936, p. 30) while Austrians would be adamantly opposed to top-down planning. Rarely is it emphasized that Hayek was not indiscriminately against all planning: on the contrary, he favored “planning for competition” (1944, p. 42).

Potential agreement lies below the surface of these antagonistic positions.

Without planning or foresight, it is in the field of economic policy, more clearly than in any other field perhaps, that Concordian economics meets the expectations of both schools of thought. In order to see these relationships clearly, we have to start from far afield. We have to ask ourselves what appears to be a daunting question: Does society exist?

Does Society Exist?

On the face of it, the question is preposterous. And yet, today all wrapped up in the wreckage caused by Bentham, Ayn Rand, Lady Margaret Thatcher, and a few followers who perhaps do not understand the implications of their position, the question arises and must be answered. Through this investigation, the existence of the community is not only substantively recovered from the wreckage created by the utilitarians, but it is recognized as a sovereign entity in its own right and with its own rights.

To answer the question properly, one must remember that, as Alasdair McIntyre points out, the word individual did not exist five hundred years ago. We must remember that Byzantine icons were never signed by their creators. We must remember that even Leonardo was such an integral part of his community that he was identified as coming from Vinci.

Reactionary thinkers have ever since been focusing their attention with increasing intensity on individuals apart from their community until the opposite pole has been reached: society does not exist; only the individual does.7 Number One is all that counts.

Assigning undisciplined freedom to a few individuals, these revolutionary reactionaries have trampled upon the rights of We the People. And 99% of the people are rising up in anger everywhere in the world these days. Outraged protesters shout against the circle of corruption that has been created among the oligarchs, the politicians, and the bureaucrats.

The Enemy

We are due for a correction, a correction that involves 100% of the population. The enemy is not the remaining 1% of the population; the enemy is the set of wrong ideas that lately have influenced our universities and our democratic institutions.

The first question to ask is this: even though your father might be an individual in a white coat who is fooling around with beakers in a sterilized laboratory, do you have a mother? The case is rested. You are an individual who issued from a woman, your mother. You therefore always and everywhere have, and even if you are the last person on earth, you always will have at least two people on earth: you and me; you and the other—two people and the relationships between them, from indifference to love to hate, subject to a variety of organizing principles from self-government, or spontaneous order, to elitist organizing factors. Such is society!

You simply have to do the multiplication of “yous” and “mes” to identify the current population of your country.

Reality is composed of individuals, society, and the relationships among men and women that form a community.8 It is with this understanding that we can rebuild community within society. The context has perhaps to be made explicit: extremists on the political right deny the existence of society; extremists on the political left have traditionally denied the importance of the individual. Words have consequences; they have enormous consequences: it is on the basis of the rationalizations that some extremists on the left send human beings to the Gulag and some extremists on the right leave human beings to die from hunger.

Under the prodding of Peter J. Bearse, while writing this paper, I have perhaps clarified the issues through the establishment of a formal equivalence relationship:

Individual ↔ Community ↔ Society

Once this relationship is cast into familiar diagrammatic forms, self-similar, modular, and ever larger set of relationships among economics, justice, and politics might become more intuitively evident. These relationships can be diagrammed in a conical and/or concentric fashion in accordance with our vertical or horizontal perspective.

Cast in this framework of analysis, it might become clearer that what has collapsed during the last five hundred years is community; we have lost the sense of community. Society, although perhaps in an ever-increasing dysfunctional form, has always been with us.

Let us get away from the crazies, far away from extremists who believe they are “conservatives” while actually and historically they are revolutionary reactionaries. We might then go through an intellectual (r)evolution from the center: the parenthetical “r” is by Peter Bearse. The word I prefer is revolution stripped of its violent connotations. In the beginning, there used to be nothing revolutionary in revolution. On this basis, we can eventually have a serious conversation about the proper role of the government and the proper role of the entrepreneur in society (see, e.g., Baumol, 1994, 2004, 2010; Bearse, 1986 and 1987; see also Guyon, 2005).

What is the framework within which this search for the integration of the proper role of the entrepreneur and the government in society can be conducted to achieve a balanced running of economic affairs?

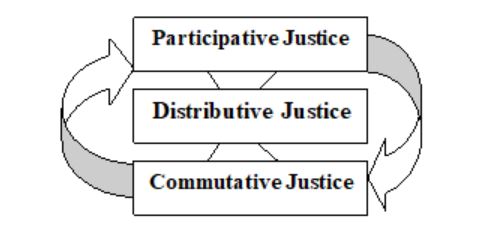

The Framework of Economic Justice

Concordian economics offers a framework within which many issues of economics are settled. This is the framework of economic justice. There are three component elements to this framework: participative justice, which suggests that it is just to participate in the economic process; distributive justice, which suggests that the fruits of labor ought to be distributed justly; and commutative justice, which suggests that what is given ought to be in a just relation to what is received. The three principles clearly reinforce each other and each is instrumental to the proper actualization of the others. The three component parts can be diagrammatically reduced to this figure:

Figure 3. Economic Justice

The reason why this theory is an integral part of Concordian economics is that economic justice is the mirror image of the economic process: see Figure 1. The two can be separated from each other only at great peril to the economic system. Besides, principles of economic justice offer an inestimable guide to clear thinking.

Hayek (1960), for instance, called for the establishment of “general abstract rules” for the proper organization of society. The principles of economic justice are indispensable in this search. Our focus is on the use of these principles to determine the proper role of the entrepreneur as well as the proper role of the government in society.

What Is the Proper Role of the Entrepreneur?

The question as to who is the entrepreneur was settled long ago by Ralph Waldo Emerson (1860). This uncommon man from the village of Concord admonished us that:

“Every man is a consumer, and ought to be a producer. He fails to make his place good in the world, unless he not only pays his debts, but also adds something to the common wealth.”

Everyone is a potential entrepreneur (see Bearse, 1976, 1982, and 1999). The needs of the entrepreneur are our common needs.

The question about the proper role of the entrepreneur can then be properly answered if it is placed within the context of the principle of participative justice. In response to the needs for access to classical factors of production, the abstract Hayekian search, as emerging from Concordian economics, is transformed into the following set of four concrete economic rights and economic responsibilities:

- First, The Right of Access to Land and Natural Resources, with the attendant responsibility to pay taxes on that portion of land and natural resources, which, through the medium of private property rights, is appropriated for the personal benefit of an individual human being.

- Second, The Right of Access to National Credit, the credit of each nation, to be used exclusively for the creation of new wealth and expansion of private ownership as well as public infrastructure, and to be transformed into loans at cost, with the attendant responsibility to repay the loan thus secured;

- Third, The Right to Own the Fruits of One’s Labor, with the attendant responsibility, if working with and for others, to offer services commensurate with the value of the reward received in form of stocks—eventually, no longer wages; and

- Fourth, The Right to Protect One’s Wealth, with the attendant responsibility to respect the wealth of others.

Preliminary analyses of these four economic rights and economic responsibilities are provided in Gorga (1991, 1994, and 1999) as well as in Gorga and Kurland (1987) and Gorga and Weeks (1997). Undoubtedly, much more work needs to be done. Perhaps, this work will be more passionately carried out if it is placed in the context of the following distinction: Rights can be identified as the conditions for exercising economic freedom, and responsibilities as the conditions for exercising economic justice. It is thus that the two engines of the economic system, freedom and justice, are linked together.

The Right of Access and Property Rights

A major consideration. The right of access to land and national credit today is acquired on the basis of property rights, which in economic parlance is translated as pre-existing possession of savings. Yet the roots of these rights are not clearly established in contemporary jurisprudence. Hence, we all participate in the economic process on the basis of privileges—not rights. And property rights are exposed to attack and are being gradually eviscerated. Hence, we are not secure in our own rights and the system is not stable. To avoid these major legal, economic, and moral bottlenecks, Concordian economics realizes that economic rights are acquired through the exercise of corresponding economic responsibilities.

Keeping in mind that justice is a virtue, the implementation of these four economic rights and responsibilities will not only assure that we receive justice; it will also assure that we individually grant justice to others. The exercise of the above responsibilities will gradually make it possible for everyone to have rights. Thus economic freedom will be assured for all.

Illustration 7. Henry George (1839-1897) Wikipedia, Public Domain.

George promoted the belief that people should own the value

they produce themselves, but that the economic value of land

(including natural resources) should belong equally to all members of society.

The reasons for this self-assurance are found in a variety of past experiences. Practically, economic rights and responsibilities in their implementation will function as Gladwell’s (2000) “tipping points”; intellectually, they will perform functions expected of mechanisms outlined in the conception of “general abstract rules” by Hayek (1960), the “original position” by Rawls (1971), or the “reverse theory” by Nozick (1974). Ultimately, the reason for this self-assurance lies in the truth of the intuition of Vincent Ferrini (2002), the first Gloucester poet laureate, who caught its essence when he expounded that Concordian economics has “the answers to universal poverty and the anxieties of the affluent.”

What Is the Proper Role of the Government?

Once the proper role for the entrepreneur is found, the proper role for the government automatically ensues. Assuming that the first cycle of the economic process is run by implementing the dictates of participative, distributive, and commutative justice, how can the cycle be repeated in a way that the system becomes stable—while remaining just? Recognizing that the controller who directs the economic system is the entrepreneur, Concordian economic policy takes the lead from the analysis made by the Classics and matches the four major needs of the economic enterprise: Land, Labor, and Capital—in its financial and physical form. Following exactly the same train of thought as before but deductively now, the Hayekean search can be brought onto a just and sustainable platform that is composed of the following four fundamental national economic policies:

a. A Taxation Policy for Land and Natural Resources

b. A Wealth-Creating Monetary Policy

c. An Expanded Ownership Policy; and

d. A Pro-Competition Policy.

Roots of these policies

The roots of these policies can be found in the thought of four powerful American thinkers: Benjamin Franklin (1729), Henry George (1879), Louis D. Brandeis (1913, 1914, and 1934), and Louis O. Kelso (1957, 1958, and 1967). Four coordinated marginal changes in existing practices can be expressed as follows:

1. Increase taxes on land and natural resources (while gradually reducing taxes on buildings and income);

2. Restrict access to national credit, the credit of a nation, solely for the creation of new wealth—rather than using it to buy consumer goods, goods to be hoarded, or paper instruments; issue credit at cost; and coordinate credit creation with expansion of ownership through individual proprietorships, employee stock ownership plans (ESOPs), and cooperatives; extend this opportunity to governing bodies with taxing powers for the purpose of creating real wealth in the form of public infrastructure—and not for covering administrative expenses that ought to be subjected to the stricter oversight of public taxation;

3. Own what you create; and

4. Respect other people’s wealth.

These four economic policies are made concrete and specific in Concordian economics. Their reasonably gradual translation into practice is entrusted to the transmission belt of the four corresponding economic rights and responsibilities mentioned above. These economic rights and economic responsibilities are the conditions for economic freedom for all. Time should not wait. The sooner they are implemented, the better.

Illustration 8. Louis Brandeis (1856-1941) Wikipedia, Public Domain.

Brandeis’ book entitled Other People’s Money and How the Bankers Use It,

suggested ways of curbing the power of large banks and money trusts.

He fought against powerful corporations, monopolies, public corruption,

and mass consumerism, all of which he felt were detrimental to American

values and culture. He served as Associate Justice of the Supreme Court of the United States from 1916-1939.

Basic rationale for the four macro policies.

A fiscal policy integrated into a land and natural resources policy.

In Concordian economics, the responsibility of the landlord is to pay taxes on land and natural resources; only then does the owner/entrepreneur acquire the right to use that land in a legitimate way. Taxes on land ought to be established, not through whim, but through economic reasoning, which has this to suggest: The value of any land is created both by nature and by human improvements. These improvements can then be recognized as values brought about by private personal improvements from the landowner or by community improvements such as a road, a museum, and varied public investments. It is a portion of the value of the latter improvements that is proper to tax and return to the community.

A labor policy.

The case is straightforward. The owner of labor has the responsibility to work—and the right to receive full compensation for the value s/he has contributed to the enterprise.

A few specifications

The term “owner of labor” means precisely what it says; a person is an owner, not a worker. To recognize this existential reality on a national scale, workers have to be brought into the legal structure of the corporation through cooperatives and ESOPs. Individual entrepreneurship accomplishes the same goal. The speediest way to reach this goal is for unions to struggle, not for a living wage—an indefinable goal that might result in self-defeating “cost-push” inflation—but for equity sharing.

Once this is done, the issue is no longer the granting of a just wage, a millenarian dream that has proved to be impossible for fulfillment, but the right to apportionment of profits—a right exercised on the basis of the right of ownership in relation to the fruits of the operation as well as the growth of value of the enterprise over time: net capital appreciation.

A bottom-up monetary policy.

The right of access to financial capital is gained through access to national credit, which is the power of a nation to create money.

(Bankers have arrogated to themselves the privilege to create money as debt.) At its origin, at the level of national credit, money is a pool of common resources, because the value of money is given by the sweat and tears of all the people in a nation. Once “earned,” through loans that have been repaid, money becomes a private good. Thus, as Steve Kurtz recognized long ago, money is created as an asset—not as debt.

Illustration 9. Benjamin Franklin (1706-1790) Wikipedia Public Domain.

Franklin is arguably the preeminent authority on paper money in

America (state letters of credit) in the 18th century. See here.

Again a few specifications

Does this policy politicize the process of capital formation? In Concordian economics it is suggested that access to national credit be granted to an entrepreneur as a right, which means that the state and the political process will not interfere with the distribution of credit. The Federal Reserve System will reserve to itself only the right of refusal if and when the economy becomes so heated that an addition to the money supply will create the near certainty of inflation. Access to national credit is granted as a loan, therefore there has to be reasonable assurance of repayment of the debt, namely replenishment of the pool of common wealth. The repayment of the debt has the implicit advantage of destroying the money supply that remains in circulation; hence the danger of inflation is significantly abated.

The loan has to be issued at cost: it would be opprobrious for any public agency administering national credit to make a profit on such a basic operation, which is vital to the welfare of the nation. And the loan has to be issued for the benefit of all: hence, the loan is issued to single entrepreneurs, cooperatives, and corporations that have an ESOP in their constitution.

Government entities with taxing powers—through which they can repay the loans—should also have such access, only for wealth-creating projects, not to cover administrative expenses. As David Goran Shedlack puts it, don’t give money to the bankers: give money to the entrepreneur, with conditions.

There is no compulsion in this policy of Concordian economics: those who do not want to accept such restrictions are free to access the private financial market.

An industrial policy

The right of access to physical capital can be gained by being secure in one’s possessions. Hence, this right is secured by accepting the responsibility of respecting the wealth of others. Physical capital today is concentrated into a few hands through what can be called the “trustification process,” namely the process of mergers and acquisitions of more and more corporations. In Concordian economics, the right of access to physical capital is secured by the ex-ante prohibition of growth-by-purchase—imposing this restriction on the largest corporations first, and then gradually extending the prohibition to the corporations on the lower tier until one reaches the level of corporations doing business only within the confines of any single state or region. Also in this set of rights and responsibilities, there is no compulsion because corporations are left free to grow internally as large as they can.

Illustration 10. Louis O. Kelso (1913-1991) Intercentar.

Kelso is the inventor and pioneer of the employee stock ownership plan (ESOP).

A general observation. The fundamental difference that results from this conception of economic rights and economic responsibilities is that human beings are not commodities subject to the blind rules of the laws of supply and demand but are the owners of the wealth they produce. And since their wealth is acquired through the exercise of rights and responsibilities, they can rest assured in the enjoyment of the wealth they create. Neither Socialism nor Capitalism is capable of extending this assurance to every citizen of a nation; thus, neither is capable of recognizing and respecting the dignity of each and every human being—which does not mean that, especially due to the influence of the ideals of the free enterprise system, one cannot find sporadic examples of extraordinary respect for human beings, within and without the corporation.

A Program of Action for the Short-term Cure of Current Ills

If we believe that in the end both Keynes and Hayek would agree that money to sustain failed businesses is ill-spent and that injection of tremendous amounts of money into the economy has the potential of creating hyper-inflation (see esp. Hayek, 1941, p. 300), then here is a program of action for the short-term cure of current ills. Rooted in the wisdom of Concordian economics, the program is designed to avoid both severe dangers—at no cost to taxpayers, without further loss in the value of current wealth, and without intervention by the government.

Let the corporations distribute to the rightful owners, their stockholders and bondholders, the stashes of cash that are gumming up the smooth functioning of the economic process (as Mario Rizzo [2010] points out, these stashes “whether in cash or in idle balances” were clearly identified by Hayek as money hoarded, but were passed under silence by Keynes). Let individual stockholders and bondholders spend all they reasonably can without fanning the flames of inflation. Finally, let those with surplus cash invest their financial resources into community interdependence funds,9 which will, in turn, lend money to local business people, artists, and inventors who are full of ideas and short of cash.

Conclusion

Concordian economics might be called the reconciliation of the macroeconomics of Keynes with the microeconomics of Hayek. Intellectually, Concordian economics suggests that if the right economic policies are implemented, dynamic equilibrium in the macro economy is achieved, as Keynes desired. Societal equilibrium in the micro economy is obtained, not through bureaucratic planning, but in an organic fashion through the day-to-day, voluntary implementation of the above economic rights and economic responsibilities (once the corresponding macro policies are understood and, whenever and wherever necessary, put in place), as Hayek desired. The full reconciliation between the thought of Keynes and that of Hayek occurs by realizing that the engine of this structure is not the government, but the private Schumpeterian entrepreneur.

This program of action is clearly advocated by no less notable a person than Carlos Slim, the richest man in the world. Here are his terse sentences, as quoted by the noted economist Robert Frank (2011):

One: “The monetary and the fiscal policies, which are very aggressive, should go more to the real economy.”

Two: “The structural change will come from more investment in the private sector”.

Three: “Instead of stopping the investment in the public sector and creating austerity programs, which creates unemployment, it’s better to rely on a development program financed by the private sector.”

Evidently, there is much to be done. The work ahead has to proceed along many roads. One road involves the transformation of Concordian economics into Concordian econometrics. As pointed out in Gorga (2012), two topics are especially challenging in this field: a method or methods have to be developed to operationally separate monetary values from real values, and a method has to be adopted to measure the value of real goods—especially goods hoarded. Let us keep in mind that physicists spend much time in dark caverns these days measuring infinitely more complex and less palpable objects than goods hoarded.

Objective

The aim of this investigation is not so much to verify whether, with the analytical engine of Concordian economics ”put through its paces”, it will be objectively demonstrated that a just economic system is a dynamically stable system. The aim of this investigation is especially to speed up the desire and the pace and the expertise necessary for the implementation of the overall program of action.

The other road to travel is broader than the one we have been able to follow in this paper. Here we have tried to confine our observation to the relationships between Keynes and Hayek. The full task is much broader than that. The task is to evaluate what is living and vital in the enormous economic literature that has been accumulated over the centuries and in many cultures and determines whether it can indeed be poured into the structure of Concordian economics to create something that might be called the Summa Economica.

Notes

1 Mario Rizzo (2010) puts it in a straightforward way: “… the issues (treated by Keynes and Hayek in the 30s) are basically the same today. The positions of the opposing sides are also the same. As I have said many times before, the great debate is still Keynes versus Hayek. All else is a footnote.”

2 Hayek (1941, pp. 206-207) prepared a detailed list of many such differences.

3 Apart from one more entry in Keynes (1973), he does not even appear once in Schumpeter (1954).

4 Private, personal values, as Mises (1933, pp. 216 and 217), forcefully insisted, are graded, not measured. And that is sufficient as a starting point to build a subjective micro theory of the market. However, public or social values of real wealth are different. They need to be measured if we want to know where the macro economy stands. Problems of measurement of values of real wealth, ancient problems of imputation, still remain with us. They were recognized by Keynes as well as by Hayek; but their suggested solutions (wage units and amount of input) were unsatisfactory (cf. Keynes, 1936, pp. 37-45; Hayek, 1941, pp. 202-215). These practical problems are not yet solved in Concordian economics, either. They are simply identified and suggestions for solutions are offered; but notorious problems of measurement are only intellectually resolved in Concordian economics (Gorga, 2012).

5 Advances in the field are so rapid that I have yet to see these differences pointed out: While in Euclidean geometry parallel lines do not meet, in imaginary geometry parallel lines do meet—and in fractal geometry parallel lines do not exist.

6 Through a Poincaré section of the rectangle of production in Figure 1, Concordian economics yields the following categories of real wealth: (1) stocks of capital goods, (2) consumer goods, and (3) goods hoarded.

Through the same procedure applied to the rectangle of consumption, Concordian economics obtains the following categories of monetary wealth: in addition to money directly hoarded, there are stocks of various forms of financial instruments used to buy consumer goods, capital goods, and goods hoarded as well as stocks to buy one another in the alternative structures of risk and rewards that are expressed in the form of short, medium, and long term financial investment (cf. Mandelbrot, 2008, p. 262).

Correspondingly, the disaggregation of the category of distribution yields the value of ownership rights over each one of the categories of monetary and real wealth listed here.

Concordian analysis only becomes more complex than the Austrian analysis, first, because these categories of wealth are taken into account from the point of view of supply as well as demand, and, second, because once stocks are seen in action they transform themselves into flows of values that interact among themselves to produce, over time, economic growth and business cycles. The analysis is further refined by noticing that economic categories (not only markets) behave differently at different stages of the business cycle and that such stages often overlap. Finally, all these analyses have to be integrated into one comprehensive understanding of the economic system as a whole in which all agents with their property, controlling or being controlled by all these categories of thought, are not presented as lifeless lists but are put in functional relations with each other (see Gorga, 2012).

7 In a detailed essay titled “Individualism: True and False” Hayek (1948) took great pains to distinguish between two antipodal strains that exist in this tradition.

8 I have abbreviated this long sentence into one word: somism (Gorga, 2010c).

9 For the design of community investment funds, please see http://www.somist.org/id30.htm

References

Allen, R. G. D. 1970. Mathematical Economic, second ed., London and New York: Macmillan, St. Martin’s.

Anon. 2002. “The Economic Process: An Instantaneous Non-Newtonian Picture. By Carmine Gorga” (Annotated Listing of New Books). J. Econ. Lit. 40:4, p. 1306.

Baumol, W, J, Entrepreneurship, Management, and the Structure of Payoffs. Cambridge, MA: The MIT Press, 1994.

_____. The Free-Market Innovation Machine: Analyzing the Growth Miracle of capitalism. Princeton, NJ: Princeton University Press, 2004.

_____. The Microtheory of Innovative Entrepreneurship. Princeton, NJ: Princeton University Press, 2010.

Bearse, Peter J. 1976. “Government as Innovator: A New Paradigm for State Economic Development”. The New England Journal of Business and Economics. 2(2): 37-57. ____.1982. Mobilizing Capital: Program Innovation and the Changing Public/Private Interface in Development Finance. New York. NY: Elsevier.

____.1986. “Entrepreneurship ≠ Small Business”. White Houser Conference on Small Business. Washington Hilton, Washington, DC (August 21).

____.1987. Ecology of Enterprise, A Paper Prepared at the North East Meeting of the Regional Science Association, Binghamton (May 29). ____. 1999. “The Fractal Revolution.” At http://www.spectacle.org/999/bearse.html.

Brandeis, Louis D. 1913. Other People’s Money and How the Bankers Use It. NY: Frederick A. Stokes Company (1932).

_____ . 1914. Business a Profession. Boston: Small, Maynard and Company.

_____ . 1934. The Curse of Bigness. NY: The Viking Press.

Cassidy, John. 2011. Rational Irrationality. At http://www.newyorker.com/online/blogs/johncassidy/ (October 12).

Clower, Robert. 1960. “Keynes and the Classics: A Dynamical Perspective,” Quarterly Journal of Economics, 74:2. p. 323.

Emerson, Ralph Waldo. (1860 [2006]. The Conduct of Life: Part 3, Wealth. Lanham, Md. and Oxford: U. Press of America.

Ferrini, Vincent. 2002. “Gorga worthy of note.” Gloucester Daily Times. December 11, A6.

Frank, Robert. 2011. “World’s Richest Man Attacks Wall Street Bailouts: Carlos Slim says the U.S. government should be spending more on Main Street and less on Wall Street.”. WSJ Blogs: THE WEALTH REPORT (October 25). At http://blogs.wsj.com/.

Franklin, Benjamin. 1729. “A Modest Enquiry Into the Nature and Necessity of a Paper-Currency”. Reprinted in Andrew MacFarland Davis, ed. Colonial Currency Reprints, Vol. II, pp. 336-57. 1910. Boston, MA: Prince Society Publications.

George, Henry. 1879. Progress and Poverty. NY: Robert Schalkenbach Foundation (1979).

Georgescu-Roegen, Nicholas. 1971. The Entropy Law and the Economic Process. Cambridge, MA; Harvard U. Press.

Gladwell, Malcolm. 2000. The Tipping Point: How Little Things Can Make a Big Difference. NY: Little, Brown & Company.

Goldsmith, Raymond W. 1955-1956. A Study of Saving in the United States, 3 Vols. Princeton: Princeton U. Press.

Gorga, Carmine. 1991. “Bold New Directions in Politics and Economics,” The Human Economy Newsletter, 12:1, pp. 3-6, 12.

_____ . 1994. “Four Economic Rights: Social Renewal Through Economic Justice for All,” Social Justice Rev. 85:1-2, pp. 3-6.

_____ . 1999. “Toward the Definition of Economic Rights,” J. Markets and Morality, 2:1, pp. 88-101.

_____ . 2002. The Economic Process: An Instantaneous Non-Newtonian Picture. Lanham, Md. and Oxford: U. Press of America.

____. 2010a. “The unconstitutionality of federal fishing law.” Gloucester Daily Times (January 8). The series reprinted at http://carmine3.newsvine.com/.

_____ 2010b. The Economic Process: An Instantaneous Non-Newtonian Picture, Lanham, Md. and Oxford: University Press of America. An expanded edition.

_____ 2010c. “Somism: Beyond Individualism and Collectivism Toward a World of Peace and Justice,” October. Available at SSRN: http://ssrn.com/author=856905.

____. 2012. “Beyond Keynes: Towards Concordian Econometrics”, International Journal of Applied Economics and Econometrics, Vol. 20, No. 2, April-June 2012, pp. 248-277.

Gorga, Carmine and Norman G. Kurland. 1987. “The Productivity Standard: A True Golden Standard”. In Every Worker An Owner: A Revolutionary Free Enterprise Challenge to Marxism, D. M. Kurland, ed. Washington, DC: Center for Economic and Social Justice.

_____ and Stuart B. Weeks. 1997. Fisheries Renewal: A Renewal of the Soul of Business. Catholic Social Science Rev. 2, pp. 145-161.

Guyon, J. 2005. “The Soul of a Moneymaking Machine,” Fortune (October 3): 113-120.

Hayek, Friedrick A. 1960. The Constitution of Liberty. Chicago: U. Chicago Press. Quoted in Bruce Caldwell, Hayek’s Challenge: An Intellectual Biography of F. A. Hayek. Chicago: U. Chicago Press, 2004, 293.

____. 1994. Hayek on Hayek: An Autobiographical Dialogue. Stephen Kresge and Leif Wenar, eds. Chicago: University of Chicago Press. Quoted in Bruce Caldwell, Hayek’s Challenge: An Intellectual Biography of F. A. Hayek. Chicago: U. Chicago Press, 2004, p. 401.

____. (1931 [2008]). Prices and Production and Other Works. Auburn, Al: Ludwig von Mises Institute.

____. (1941 [2009]). The Pure Theory of Capital. Auburn, Al: Ludwig von Mises Institute.

____.1944. The Road to Serfdom. Chicago, IL: University of Chicago Press.

____. 1948. Individualism and Economic Order. Chicago, Il: University of Chicago Press.

____. 1955. The counter-revolution of science; studies on the abuse of reason. New York, NY: The Free Press.

____. 1974. “The Pretence of Knowledge”. “Friedrich August von Hayek – Prize Lecture”. Nobelprize.org. 22 Oct 2011 http://www.nobelprize.org/nobel_prizes/economics/laureates/1974/hayek-lecture.html

____. (1976 [2009]). Denationalisation of Money—The Argument Refined. An Analysis of the Theory and Practice of Concurrent Currencies. Auburn, Al: Ludwig von Mises Institute.

Kelso, Louis O. 1957. “Karl Marx: The Almost Capitalist.” American Bar Association Journal, 43. pp. 235-38, 275-79. ____and Mortimer J. Adler. 1958. The Capitalist Manifesto. NY: Random House.

_____ and Patricia Hetter. 1967. Two-Factor Theory: The Economics of Reality. NY: Vintage Books.

Keynes, J. Maynard. 1936. The General Theory of Employment, Interest, and Money. NY: Harcourt.

_____. 1937. “The General Theory of Employment,” Quarterly Journal of Economics, Vol. LI (February, 1937), pp. 211-12.

_____. 1973. The Collected Writings of John Maynard Keynes, D. E. Moggridge, ed., Vol. XIV (London, New York and Toronto: Macmillan, St. Martin’s), pp. 47, 150.

Klein, Lawrence R. 1970. “The Use of Econometric Models as a Guide to Economic Policy,” in Selected Readings in Econometrics. Cambridge, Massachusetts and London: The M.I.T. Press.

Lawson, Tony. 2001. “Two Responses to the Failings of Modern Economics: the Instrumentalist and the Realist.” Review of Population and Social Policy, 10, pp. 155-181.

Mandelbrot, Benoit B. and Richard L. Hudson (2008 [2004]). The (Mis)Behavior of Markets: A Fractal View of Financial Turbulence. New York, NY: Basic Books.

Mankiw, Gregory N.. 2006. “The Macroeconomist as Scientist and Engineer”. Journal of Economic Perspectives, 20(4): 29-46.

Mises, Ludwig. (1933 [2003]) Epistemological Problems of Economics. Auburn, Al: Ludwig von Mises Institute.

_____. (1912 [2009]). The Theory of Money and Credit. Auburn, Al: Ludwig von Mises Institute.

Nietzsche, Friedrich. (1887 [2009]). On the Genealogy of Morals. New York, NY: Oxford University Press.

Nozick, Robert. 1974. Anarchy, State, and Utopia. NY: Basic Books.

Rawls, John. 1971. A Theory of Justice. Cambridge, MA: Harvard U. Press. Rizzo, Mario. 2010. “Keynes versus Hayek: Past is Prologue.” At ThinkMarkets.com (June 10).

Schumpeter, Joseph A. 1936. “The general theory of employment, interest and money,” J. Amer. Statistical Assoc. 31, pp. 791-95.

____ . 1954. History of Economic Analysis. NY: Oxford U. Press.

Stavins, R. N. 2011. “The Problem of the Commons: Still Unsettled after 100 Years,” American Economic Review (101): 81-108.

Suppes, Patrick. 1957. Introduction to Logic. Princeton: van Nostrand.

Thompson, J. M. T. 1986. Nonlinear Dynamics and Chaos, Geometric Methods for Engineers and Scientists. NY: Wiley.

Acknowledgments

This work is due in an especial way to assistance from Professor Franco Modigliani and Professor M. L. Burstein respectively for 27 and 23 years. David Goran Shedlack, David S. Wise, and Peter J. Bearse have contributed powerfully to sharpening the formal presentation of this paper.

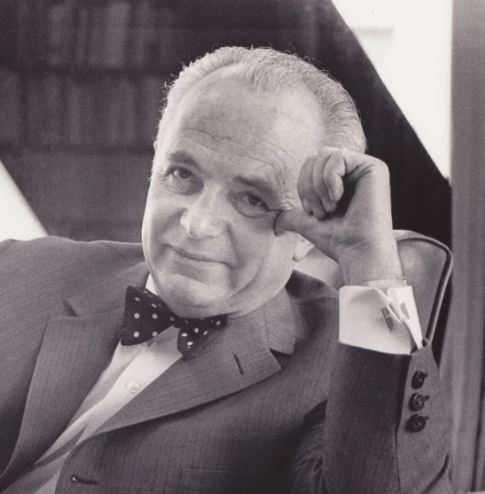

Illustration 11. Franco Modigliani (1918-2003) Wikipedia, www.nobelprize.org/.

Modigliani was awarded the 1985 Nobel prize in Economics

for his pioneering analyses of saving and of financial markets.

This article was adapted from the International Journal of Applied Economics & Econometrics, Bangalore, India Vol. XX, No. 3, July-September 2012, PP. 358-387.

The illustrations of leading figures for the context of this discussion were added at the suggestion of John Lounsbury who provided editorial support for the current article.

This article has long been published (2012). I don’t think the author would be inclined to make any changes to his thinking from my comments. It would thus be a huge waste of my time to offer any comments besides pointing out that the real problem, that of understanding classical economics from Adam Smith, J.-B. Say, David Ricardo, and John Stuart Mill, is overlooked by Carmine Gorga.

Dear Professor Ahiakpor,

Thank you for your comments. Before we engage in discussion, let me assert my position about critics. My motto is: “Thank God for the critics; they can save you years of error.”

So, I am eagerly awaiting your criticism.

Also, let me emphasize that I do not hold mainstream economics in particular esteem; Concordian economics is based on years of fundamental criticism of mainstream economics.

Hi Carmine,

You have written an article with enough material to comprise a two-semester course. I would like to discuss it with you.