Summary Of the Markets Today:

- The Dow closed down 741 points or 2.42%,

- Nasdaq closed down 4.08%,

- S&P 500 closed down 3.25%,

- WTI crude oil settled at $117, up 1.04%,

- USD $103.61 down 1.18%,

- Gold $1854 up 2.20%,

- Bitcoin $20970 down 3.18% – Session Low 20800,

- 10-year U.S. Treasury down 0.156% / 3.239%

Today’s Economic Releases:

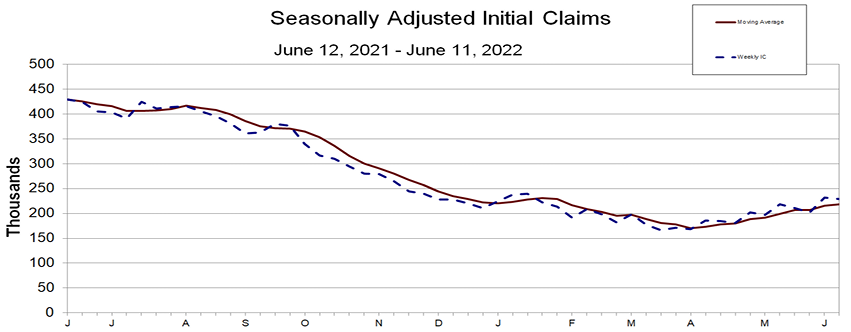

For week ending 11 June 2022, the four week moving average for weekly unemployment insurance claims continues its modest growth.

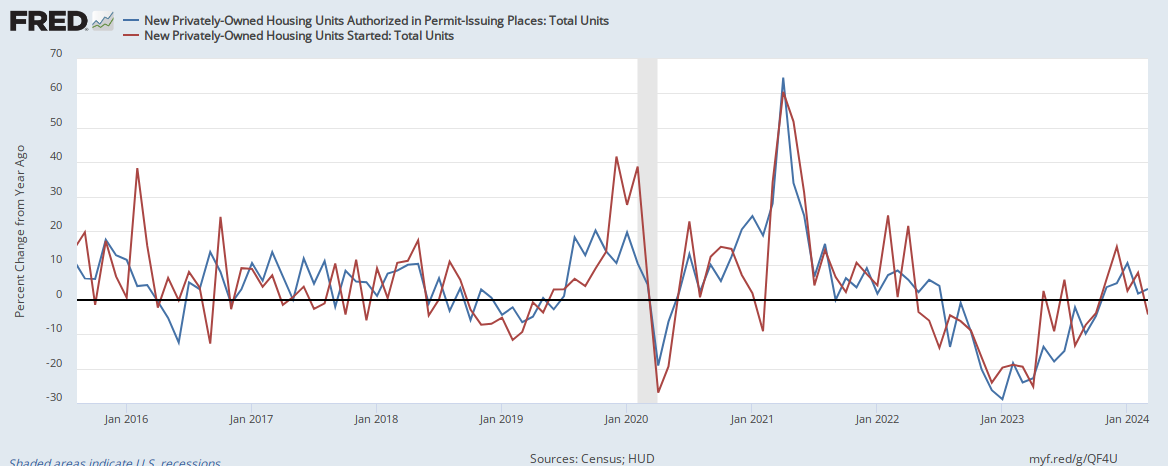

New residential building permits and construction start growth for May 2022 continued to slow year-over-year. Permits show no growth whilst starts are slightly in contraction. New residential construction is not a good predictor of recessions – except that residential construction is normally in recession when a recession hits.

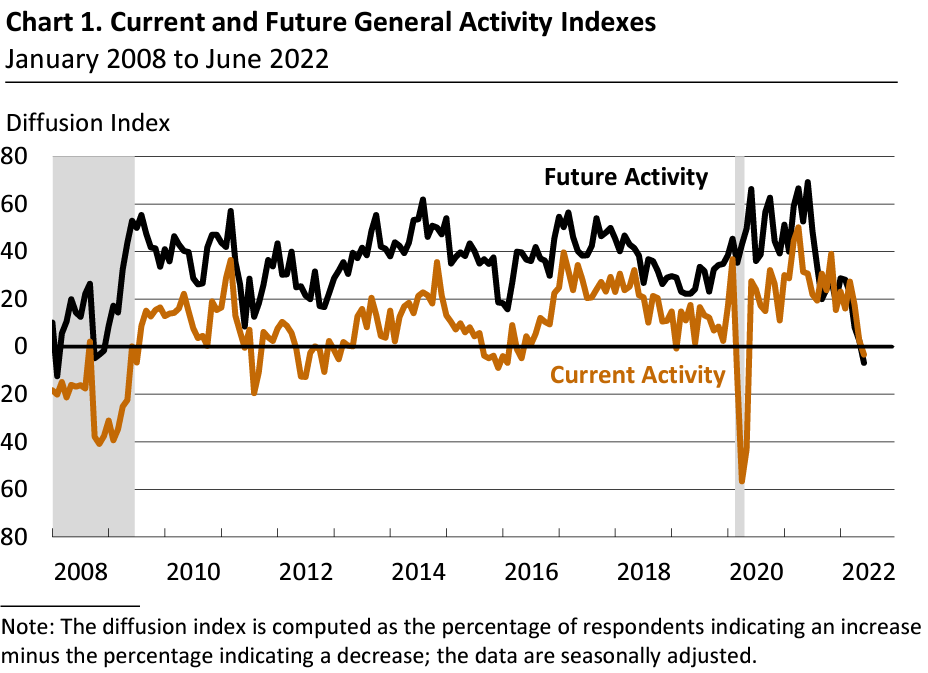

The Philadelphia Fed’s manufacturing survey for Jun 2022 is now in contraction – and this is the third consecutive month of decline.

A summary of headlines we are reading today:

- Europe Follows U.S. Fed With Record-Breaking Rate Hikes

- Airline stocks tumble as economic concerns overshadow travel surge

- Cosmetics giant Revlon files for Chapter 11 bankruptcy protection

- Environmental groups sue Biden to block 3,500 oil and gas drilling permits

- Dow Dumps Below 30k As Huge OpEx Looms; Gold Gains, Greenback Gags

- One Bank Throws Up All Over The Fed’s Latest Laughable Forecast

- Market Extra: U.S. inflation expected to keep running hot: Traders see 4 straight months of roughly 9% or higher CPI readings

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Gold And Silver Prices Slip Despite Soaring InflationThe Automotive MMI (Monthly Metals Index) experienced a slight decline from May into June. The 30-day price change was roughly -9.55, a -6.52% drop. As with last month, multiple crises impacted the marketplace’s overall health. Among them are an ongoing microchip shortage and COVID-19 lockdowns. Below, we’ll discuss if and when we can expect normalization. Inflation Causing Precious Metals to Become a Bit Less Precious Gold, silver, platinum, and palladium all experienced drops this month as U.S. Treasury yields soared Read more at: https://oilprice.com/Metals/Gold/Gold-And-Silver-Prices-Slip-Despite-Soaring-Inflation.html |

|

OPEC+ Is 2.7 Million Bpd Below Oil Production TargetThe OPEC+ group was falling behind its overall crude oil production target by a massive 2.695 million barrels per day (bpd) in May due to Western sanctions on Russia and capacity constraints at several other producers unable to pump to quotas, a document from OPEC+ seen by Reuters showed on Thursday. Last month saw a larger gap in the overall production at OPEC+ members compared to the group’s target, according to estimates from secondary sources cited by the OPEC+ document. Compliance with the cuts jumped to 256% n May, up from Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Is-27-Million-Bpd-Below-Oil-Production-Target.html |

|

The UK Is Prioritizing Energy Security Over Climate PledgesThe U.K. appears to be doing a 180 on its climate promises, as the government shows significant support for ongoing oil and gas operations and several new fossil fuel projects. Despite pumping millions into renewable energy developments, Prime Minister Boris Johnson has continued to back North Sea oil and has even shown interest in extending coal plant operations, having previously vowed to end coal production earlier than anticipated by 2024. Coming out of the COP26 climate conference last November, president of the summit Alok Sharma said Read more at: https://oilprice.com/Energy/Energy-General/The-UK-Is-Prioritizing-Energy-Security-Over-Climate-Pledges.html |

|

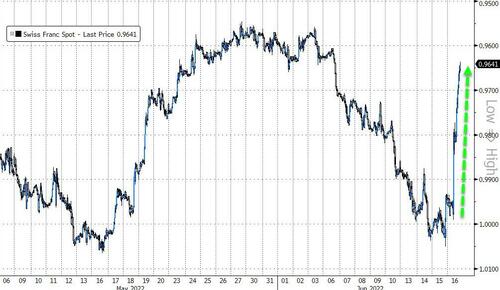

Europe Follows U.S. Fed With Record-Breaking Rate HikesFollowing the U.S. Feds biggest rate hike since 1994 on Wednesday, which brought oil prices down 1%, central banks across Europe on Thursday raised interest rates by record amounts in an effort to rein in inflation as energy prices soar. The biggest shocks came from the Swiss National Bank and the National Bank of Hungary. The Swiss National Bank made its first interest rate hike since 2007, increasing rates by 50 basis points, from -0.75% to -0.25%, sending the Swiss franc surging higher. We came to a conclusion Read more at: https://oilprice.com/Latest-Energy-News/World-News/Europe-Follows-US-Fed-With-Record-Breaking-Rate-Hikes.html |

|

Gazprom Lowers Gas Flows To Italy Even MoreItaly’s Eni is only receiving 65% of requested volumes of gas from Russia, the state-run company said on Thursday, after Russia’s Wednesday announcement that it would cut natural gas flows to Italy by 15%. Gazprom also warned Italy that the volumes could fall even further up to suspending all flows on additional delays in repair work. On Wednesday, Eni confirmed that Gazprom said it would cut natural gas flows to Italy, without detailing the reasons why. Then, Gazprom had explained volumes would be just 15% lower. Thursday, however, Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gazprom-Lowers-Gas-Flows-To-Italy-Even-More.html |

|

Energy Transition Goals At Risk As EU May Label Lithium As ToxicA potential European Commission (EC) act to classify lithium as a Category 1A reproductive toxin in this year’s fourth quarter could undermine the European Union’s (EU)s attempt to create and support a domestic battery materials supply chain. The EU currently relies heavily on imports of lithium to supply its nascent electric vehicle (EV) production sector and the classification may increase its reliance on other regions, at a time when the union is focused on energy security and reducing emissions. Europe has announced plans to expand Read more at: https://oilprice.com/Energy/Energy-General/Energy-Transition-Goals-At-Risk-As-EU-May-Label-Lithium-As-Toxic.html |

|

‘Lightyear’ bans over same-sex kiss are unlikely to have a major impact on the Pixar film’s global box office“Lightyear” is the fifth film in Pixar’s Toy Story franchise. Chris Evans voices the lead character, legendary space ranger Buzz Lightyear. Read more at: https://www.cnbc.com/2022/06/16/lightyear-movie-ban-wont-have-major-impact-on-global-box-office.html |

|

Airline stocks tumble as economic concerns overshadow travel surgeInflation and recession concerns are pressuring airline shares despite a strong summer. Read more at: https://www.cnbc.com/2022/06/16/travel-demand-is-surging-but-stocks-are-tanking.html |

|

In-demand teen workers are winning higher pay and more flexibility this summerThirty percent fewer teenage workers secured jobs in May than during the same month in 2021. Read more at: https://www.cnbc.com/2022/06/16/teen-summer-workers-are-winning-higher-pay-and-more-flexibility-this-year.html |

|

Cosmetics giant Revlon files for Chapter 11 bankruptcy protectionRevlon filed for Chapter 11 bankruptcy protection on Wednesday evening as it grappled with a cumbersome debt load and a snarled supply chain. Read more at: https://www.cnbc.com/2022/06/16/cosmetics-giant-revlon-files-for-chapter-11-bankruptcy-protection.html |

|

Netflix’s binge-release model is under new scrutiny as the streaming giant strugglesNetflix disrupted traditional TV by releasing entire seasons of shows all at once. Now, the model is under scrutiny as the streamer deals with big losses. Read more at: https://www.cnbc.com/2022/06/15/will-netflix-stop-binge-releases-experts-weigh-in.html |

|

Fanatics hires former Dick Clark Productions CEO to lead its collectibles businessFanatics has tapped former Dick Clark Productions CEO Mike Mahan to lead its trading cards and digital collectibles business, including Candy Digital and Topps. Read more at: https://www.cnbc.com/2022/06/16/fanatics-hires-former-dick-clark-ceo-for-topps-digital-collectibles.html |

|

Environmental groups sue Biden to block 3,500 oil and gas drilling permitsThe groups said the burning of fossil fuels from oil drilling is heating the planet and damaging imperiled species like Hawaiian songbirds and polar bears. Read more at: https://www.cnbc.com/2022/06/16/environmental-groups-sue-biden-to-block-oil-and-gas-drilling-permits.html |

|

TikTok exec: We’re not a social network like Facebook, we’re an entertainment platformAs Facebook looks to copy more features from TikTok, the popular short video service says it’s not a social network Read more at: https://www.cnbc.com/2022/06/16/tiktok-were-an-entertainment-app-not-a-social-network-like-facebook.html |

|

Amid record inflation, 36% of employees earning $100,000 or more say they are living paycheck to paycheckThe share of workers earning at least $100,000 a year who report being cash-strapped is double what it was three years ago. Read more at: https://www.cnbc.com/2022/06/16/more-high-earners-are-living-paycheck-to-paycheck.html |

|

Chipotle testing cauliflower rice in select locations after item drew in customers last yearChipotle is bringing Mexican cauliflower rice to select restaurants in Arizona, Southern California, and Wisconsin. Read more at: https://www.cnbc.com/2022/06/16/chipotle-tests-cauliflower-rice-at-select-stores-in-arizona-california-and-wisconsin.html |

|

WWE board investigates secret $3 million hush payment by CEO Vince McMahon, report saysA WWE spokesman told The Wall Street Journal that the company is cooperating with the board’s investigation into the alleged McMahon payment. Read more at: https://www.cnbc.com/2022/06/15/wwe-board-investigates-secret-3-million-hush-payment-by-vince-mcmahon.html |

|

These could be the next hot food and drink trendsThe Summer Fancy Food Show returned for the first time since 2019. It has gained a reputation for being the place to spot the next big flavors and foods. Read more at: https://www.cnbc.com/2022/06/15/these-could-be-the-next-hot-food-and-drink-trends.html |

|

GM investing $81 million to hand build ultra-exclusive Cadillac Celestiq electric carsThe decision marks the first time GM will build a vehicle for commercial sales at its massive tech campus in Warren, Michigan. Read more at: https://www.cnbc.com/2022/06/15/gm-investing-81m-to-hand-build-luxury-cadillac-celestiq-electric-cars.html |

|

Dow Dumps Below 30k As Huge OpEx Looms; Gold Gains, Greenback GagsDow Dumps Below 30k As Huge OpEx Looms; Gold Gains, Greenback GagsThe SNB stole the jam out of The Fed’s donut overnight as it became obvious that many investors in the world had no idea just how many billions in US mega-cap tech the Swiss National Bank owned… and was standing ready to liquidate.

The unexpected 50bps hike sent Swissy soaring higher…

Source: Bloomberg And Swiss 10Y yields spiked to 11 year highs… Read more at: https://www.zerohedge.com/markets/swiss-spark-fed-hangover-stocks-huge-opex-looms-gold-jumps-dollar-dumps |

|

One Bank Throws Up All Over The Fed’s Latest Laughable ForecastOne Bank Throws Up All Over The Fed’s Latest Laughable ForecastWhile Bank of America’s chief economist agrees with the Fed’s decision to hike 75bps (as it conforms with the bank’s philosophy of moving faster and catching up to the curve), Ethan Harris strongly disagrees with the Fed’s growth and inflation forecasts, which have already received a dollop of criticism for being anything between too optimistic to just outright stupid. The problem, as Harris notes, is that markets should be bracing for both weaker growth and higher inflation than the Fed is willing to acknowledge. Indeed, while Powell described the economy as still “strong” (it isn’t) after a 1.4% drop in 1Q, the Atlanta Fed now holds Q2 at just 0.0% and today’s barrage of economic misses, especially in the housing sector which has been crushed by soaring mortgage rates, assures that a negative print is coming, effectively triggering a technical recession. But even more perplexing (read wrong) was the way the Fed presents the link between growth and inflation. As Harris reminds us, recall that in the run-up to the current period the Fed argued that a hot economy has very little impact on inflation, hence the Fed does not need to be “preemptive” – it can hike after inflation arrives rather than in anticipation of inflation (thanks Average Inflation Targeting and MMT). This was the logic of the Fed’s “team transitory” – the idea that almost all of the inflation is due to temporary commodity and supply chain shocks. Their models said a tight labor market has very little inflation impact, so all this other stuff must be to blame. Well, there is now compelling evidence that … Read more at: https://www.zerohedge.com/economics/one-bank-throws-all-over-feds-latest-laughable-forecast |

|

“The Country Is Going To Learn That A Recession Is Worse For Votes Than High Inflation”By Peter Tchir of Academy Securities Be Careful What You Wish For. The market basically begged the Fed to hike 75 bps (to prove that they are fighting inflation) and hoped Powell would be just dovish enough during the press conference to alleviate some fears in risk assets. The market got what it wanted and responded accordingly, finishing near the best levels of the day. We wrote to fade that, though how quickly the sell-off hit and ugly it is, surprised us. In any case, the market got what it wished for, but maybe, just maybe, hiking 75 bps into a rapidly weakening economy isn’t the best idea. Last weekend’s T-report moved our economic outlook to DEFCON3, I expect to make it worse in this weekend’s report (DEFCON2). A few quick things making me particularly nervous: 75 bps will hit earnings, will hit adjustable-rate mortgages, etc. The ECB, for anyone who lived through the European debt crisis, only acts, once it has failed to act repeatedly and markets hold their feet to the fire to the point that the smell of burning flesh nauseates those holding their flesh to the fire. (they seem to be leaning towards selling some assets to buy Italian bonds, certainly not the bazooka the market was hoping for after an emergency meeting). The wealth destruction has been enormous. Stocks in general h … Read more at: https://www.zerohedge.com/markets/country-going-learn-recession-worse-votes-high-inflation |

|

The Perfect Storm: Abbott Baby Formula Plant Halts Production After 9 Days Due To FloodingThe company at the center of the ongoing baby formula shortage, Abbott, has once again halted production at its Sturgis, Michigan plant after severe storms caused flooding inside the facility, the company said in a statement.

According to the statement, production and distribution will be delayed “for a few weeks.” The news comes less than two weeks after the plant, which makes EleCare formula, restarted after a months-long closure over contaminated equipment, combined with a slow response from the Biden administration once the problem was solved. “Severe thunderstorms and heavy rains came through southwestern Michigan on Monday evening, resulting in high winds, hail, power outages, and flood damage throughout the area,” Abbott said in a Wednesday night statement.”As … Read more at: https://www.zerohedge.com/political/perfect-storm-abbott-baby-formula-plant-halts-production-after-9-days-due-flooding |

|

UK interest rates raised to 1.25% by Bank of EnglandThe Bank of England increases rates to 1.25% and forecasts inflation could surpass 11% this year. Read more at: https://www.bbc.co.uk/news/business-61801362?at_medium=RSS&at_campaign=KARANGA |

|

Rail strikes will drive passengers away, Grant Shapps saysLosing passengers will endanger thousands of rail jobs, the transport secretary says. Read more at: https://www.bbc.co.uk/news/business-61825019?at_medium=RSS&at_campaign=KARANGA |

|

Gazprom: Russian gas boss says ‘our product, our rules’ in supply rowIt comes after energy firms in Germany, Italy and Austria report big falls in Russian gas supply. Read more at: https://www.bbc.co.uk/news/business-61830551?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty50 falls below key support, trend negativeDuring the day, the 50-pack index could not hold its key support levels as it entered the oversold territory, as suggested by the 14-day relative strength index. While the trend broadly stays positive, some bounce after the steep fall is likely. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-falls-below-key-support-trend-negative/articleshow/92255024.cms |

|

Chart Check: Down 30% from highs! This insurer is showing signs of bullish reversalThe Relative Strength Index or RSI is mid-range and is near oversold levels. RSI is 37.4, RSI below 30 is considered oversold and above 70 overbought, Trendlyne data showed.The Money Flow Index (MFI) uses price and volume data for identifying overbought or oversold signals is at 28.4. MFI below 30 is considered oversold. This implies that stock may rebound, added the report. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/chart-check-down-30-from-highs-this-insurer-is-showing-signs-of-bullish-reversal/articleshow/92245540.cms |

|

Go Green! 3 power stock ideas for your long-term portfolioThe ‘grey to green’ theme is gaining pace in India as the renewable energy sector is set to increase four times by 2030. As India aims to meet 50 per cent of its energy requirement from renewable energy by 2030 and reduce its carbon emission by 45 per cent, domestic brokerage firm HDFC Securities finds money-making opportunities in three power stocks for long-term investors. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/go-green-3-power-stock-ideas-for-your-long-term-portfolio/articleshow/92246135.cms |

|

The Margin: A new four-day work week experiment is underway in the U.K. — here’s what to knowAt 70 U.K. companies, 3,300 employees will participate in the program and test working four days a week instead of five. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E2A-AB1D17E258D9%7D&siteid=rss&rss=1 |

|

Market Extra: U.S. inflation expected to keep running hot: Traders see 4 straight months of roughly 9% or higher CPI readingsThe U.S. inflation outlook is worsening in one obscure part of the market. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7EA6-928087C172F7%7D&siteid=rss&rss=1 |

|

: Chase is giving customers one extra day before charging overdraft fees, which still yield billions of dollars for banksJPMorgan Chase is among several big banks that are changing how they charge overdraft fees amid pressure from the Consumer Financial Protection Bureau Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7E99-1BC804E9B92E%7D&siteid=rss&rss=1 |