17June2022 Market Close & Major Financial Headlines: Wall Street Seesaws Through Friday’s Session And Closes In The Green, We’re Off This Monday For The Juneteenth Freedom Day Holiday

Summary Of the Markets Today:

- The Dow closed down 42 points or 0.14%,

- Nasdaq closed up 1.43%,

- S&P 500 closed up 0.21%,

- WTI crude oil settled at $110, down 6.33%,

- USD $104.80 up 1.00%,

- Gold $1838 down 2.20%,

- Bitcoin $20475 down 2.00% – Session Low 20232,

- 10-year U.S. Treasury down 0.07% / 3.335%

- Baker Hughes Rig Count: U.S. +7 to 740 Canada +15 to 156

Today’s Economic Releases:

Industrial Production grew 5.8% year-over-year in May 2022 – down slightly from last month’s 6.3% year-over-year growth. The manufacturing portion of industrial production growth likewise slowed.

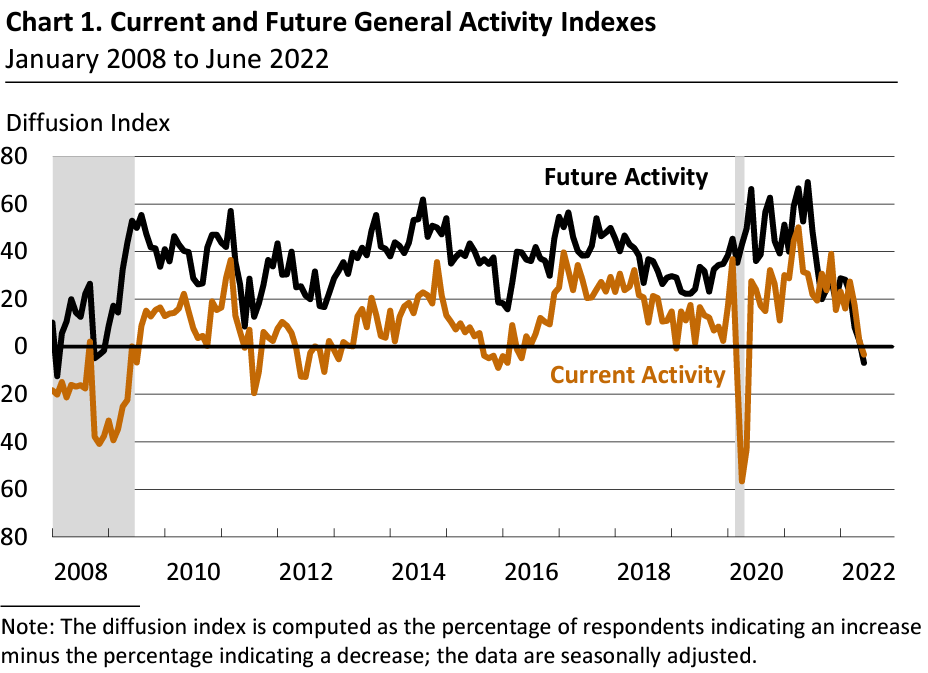

The Philadelphia Fed’s Livingston Survey is published twice a year, in June and December – and is the oldest survey of economists’ expectations. The June 2022 survey forecasts a much lower rate of economic growth.

A summary of headlines we are reading today:

- U.S. Drillers Add 7 Rigs Amid Oil Price Slide

- SpaceX fires at least 5 employees over an internal letter criticizing CEO Elon Musk

- Hawkish Fed Sparks Dow’s Worst Streak Ever; Crypto, Crude, & Credit Crushed

- Kemp: White House Tries To Blame US Refiners For Its Own Overheating Error

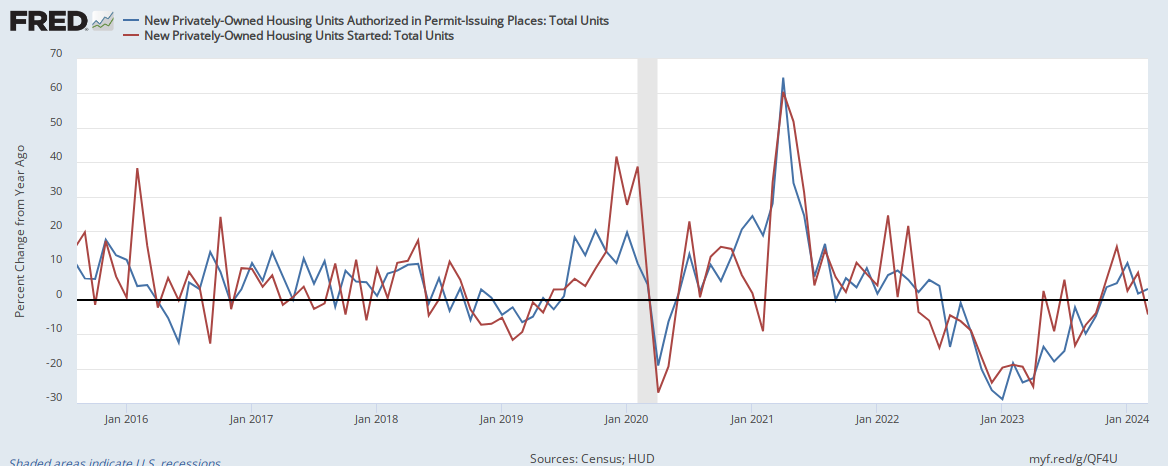

- Housing Crash Imminent: As Mortgage Rates Explode Price Cuts Soar And Buyer Demand Collapses

These and other headlines and news summaries moving the markets today are included below.