21July2022 Market Close & Major Financial Headlines: Morning Financial Calendar Posted Poor Numbers Which Investors Eventually Ignored. Initial Jobless Claims Rose Whilst Philly Fed Business Conditions Fell Sharply.

Summary Of the Markets Today:

- The Dow closed up 162 points or 0.51%,

- Nasdaq closed up 1.36%,

- S&P 500 up 0.99%,

- WTI crude oil settled at $96 down 3.39%,

- USD $106.86 down 0.16%,

- Gold $1718 up 0.17%,

- Bitcoin $23,086 up 0.68% – Session Low 22,783,

- 10-year U.S. Treasury 2.906% down 0.13%

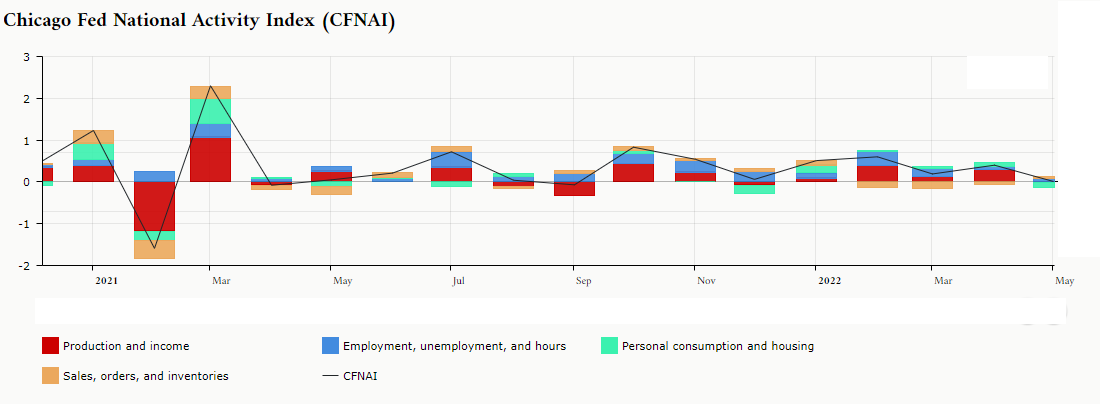

Today’s Economic Releases:

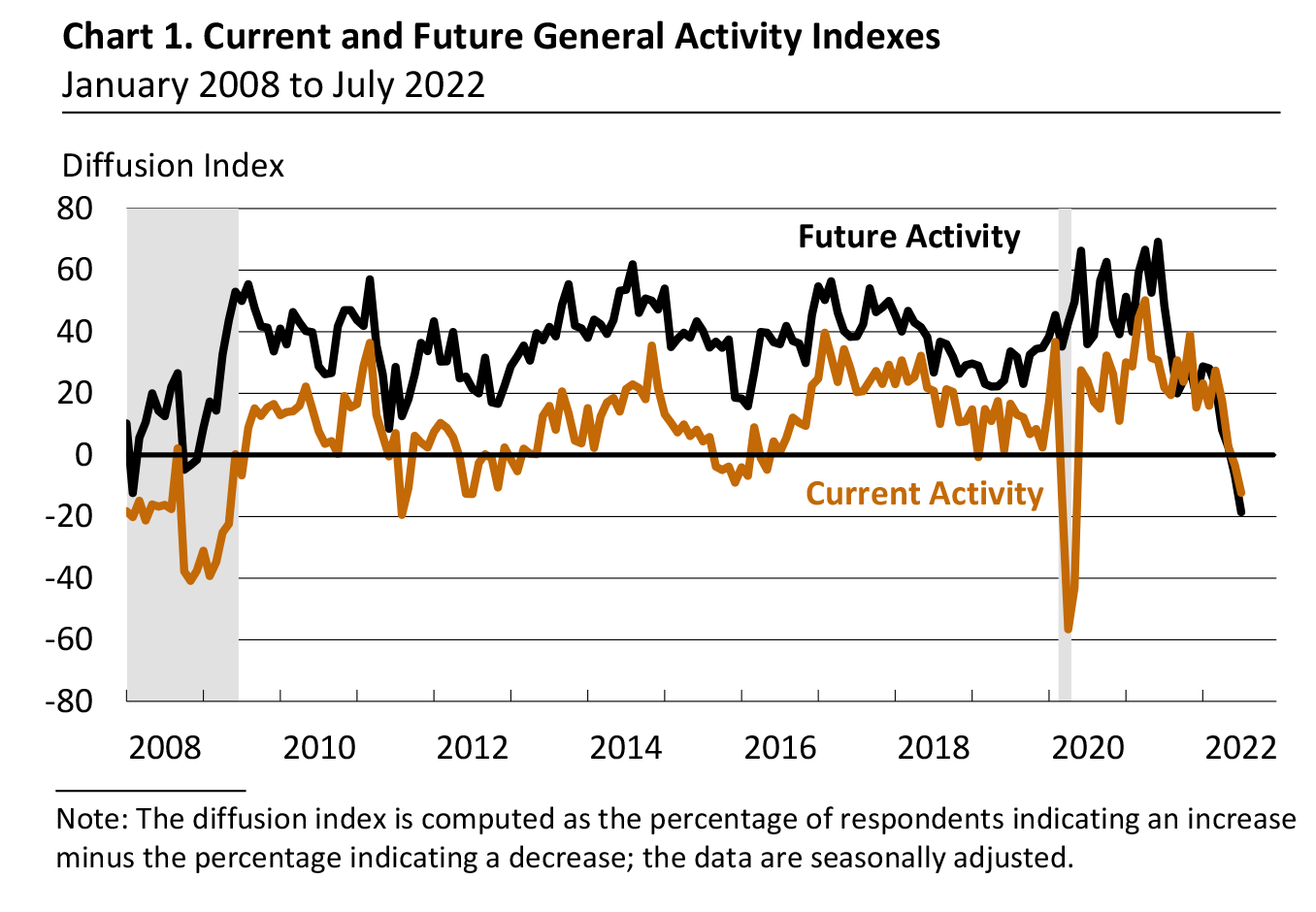

Manufacturing activity declined for the firms in the Philadelphia Fed’s district according to the July 2022 Manufacturing Business Outlook Survey. Note that historically the Philly Fed’s survey cannot be relied upon as an indicator of a recession.

According to Macro Charts, there are a record number of short positions which normally correlate to a return to a bull market.

source: @MarcoCharts

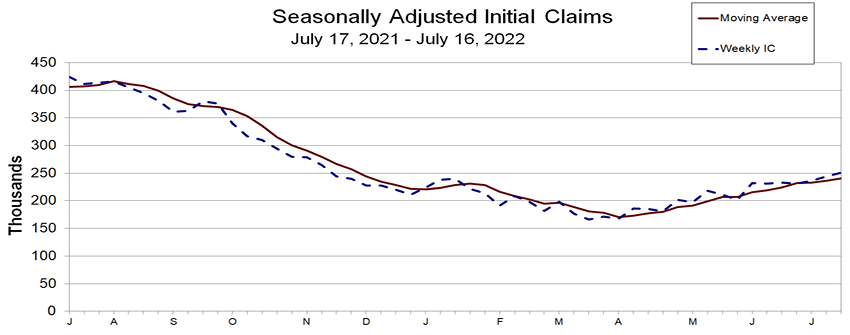

The four-week moving average of initial unemployment claims continues to moderately increase.

A summary of headlines we are reading today:

- IEA Chief: Europe Must Cut Gas Usage 20% To Survive Winter

- Airlines temper flying ambitions after chaotic — but profitable — travel rebound

- AT&T shares fall after company says later payments, higher spending are hurting cash flow

- Dems Openly Admit Gun Control Bill Will Confiscate Firearms In “Common Use”

- Job Listings Starting To Trend Lower

- Bond Report: Treasury yields drop by most since June on signs of slowing U.S. economy, Biden’s positive COVID test

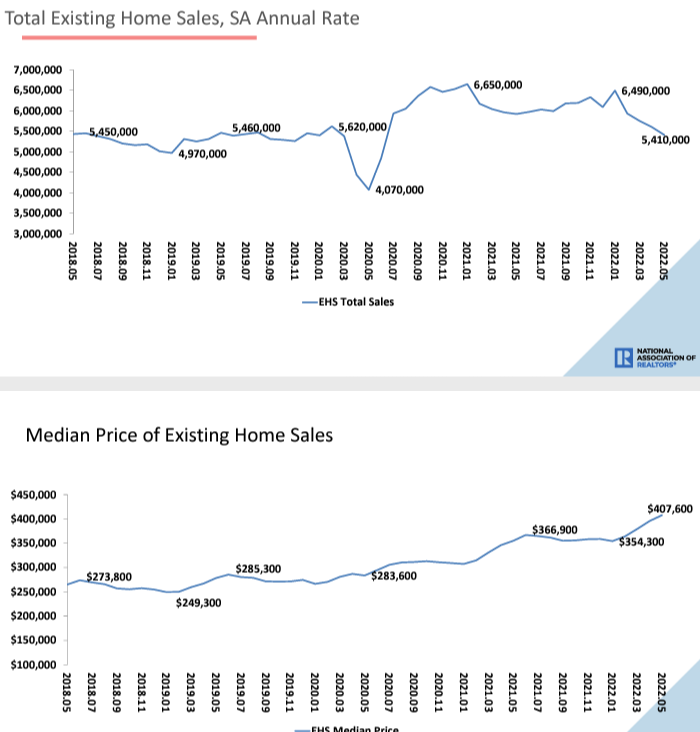

- Rex Nutting: Almost all the economic numbers are aligned: A U.S. recession is now likely

These and other headlines and news summaries moving the markets today are included below.