Vietnam – a curious American darling!

The US needs to temper its dreams of a love affair with Vietnam helping its geopolitical contest with China.

The US needs to temper its dreams of a love affair with Vietnam helping its geopolitical contest with China.

The post is informative but the Further Reading links in the post are probably even more informative.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

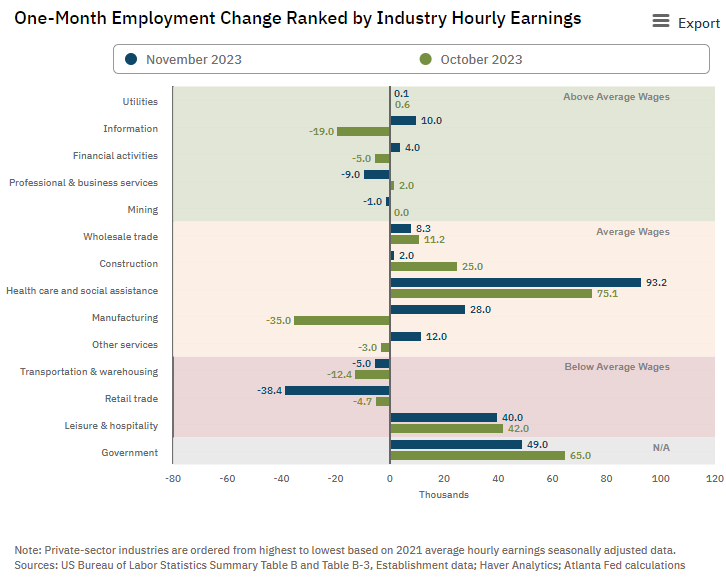

Total nonfarm payroll employment increased by 199,000 in November 2023, and the unemployment rate edged down to 3.7 percent. Job gains occurred in healthcare (almost half of the new jobs were in healthcare) and government (1/4 of new jobs were in government). Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined significantly. The household survey shows an additional 747,000 were employed in November than October – and this is well over 3 times more than the headline 199,000 in the establishment survey.

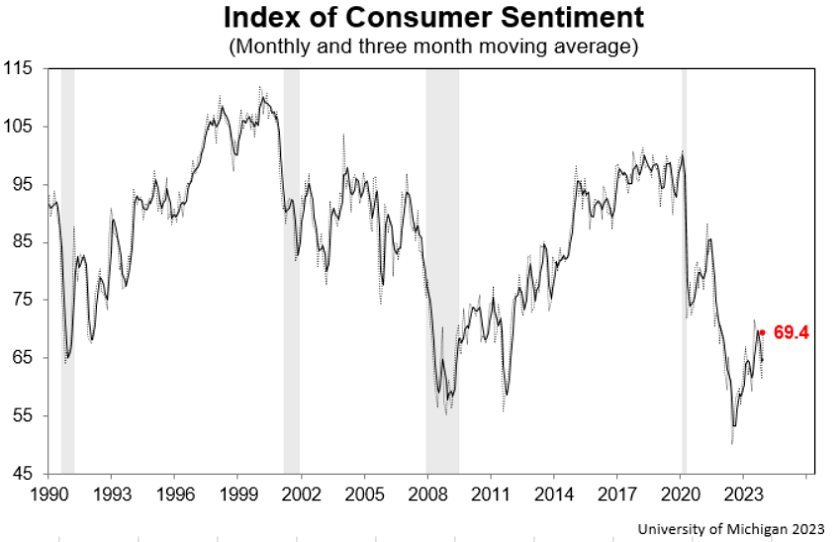

The University of Michigan Consumer sentiment soared 13% in December 2023, erasing all declines from the previous four months, primarily on the basis of improvements in the expected trajectory of inflation. Sentiment is now about 39% above the all-time low measured in June of 2022 but still well below pre-pandemic levels. All five index components rose this month, led by surges of over 24% for both the short and long-run outlook for business conditions. There was a broad consensus of improved sentiment across age, income, education, geography, and political identification. A growing share of consumers—about 14%—spontaneously mentioned the potential impact of next year’s elections. Sentiment for these consumers appears to incorporate expectations that the elections will likely yield results favorable to the economy.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

October 2023 sales of merchant wholesalers were down 0.4% from the revised October 2022 level. Total inventories of merchant wholesalers were down 2.3% from the revised October 2022 level. The October inventories/sales ratio for merchant wholesalers was 1.34. The October 2022 ratio was 1.37. As I have been saying, I know the wholesaling sector is in flux – and IMO you cannot say the sector is contracting as the scope is different. The sales-to-inventory levels (green line on the graph below) do not indicate an inventory build which historically has been an indicator of a pending recession.

U.S.-based employers announced 45,510 job cuts in November 2023, a 24% increase from the 36,836 cuts >announced one month prior. It is 41% lower than the 76,835 cuts announced in the same month in 2022, and marks the first time cuts were lower than the corresponding month a year ago since July. So far this year, companies have announced plans to cut 686,860 jobs, a 115% increase from the 320,173 cuts announced in the same period last year. It is the highest January-November total since 2020, when 2,227,725 cuts were recorded. Andrew Challenger, labor expert and Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

The job market is loosening, and employers are not as quick to hire. The labor market appears to be stabilizing with a more normal churn, though we expect to continue to see layoffs going into the New Year.

In the week ending December 2, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 220,750, an increase of 500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 220,000 to 220,250.

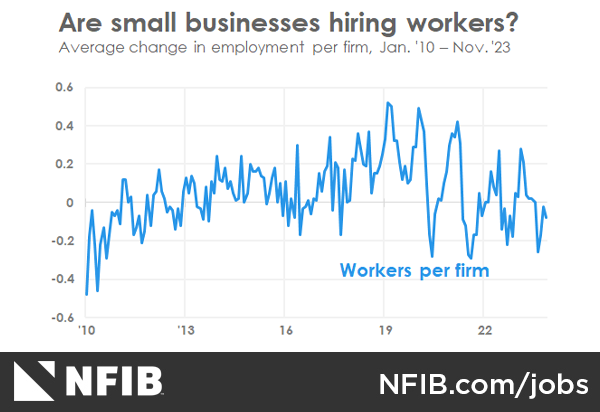

According to NFIB’s monthly jobs report, 40% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down three points from October. The percent of small business owners reporting labor quality as their top small business operating problem remains elevated at 24%. Labor costs reported as the single most important problem for business owners decreased one point to 8%, five points below the highest reading of 13% reached in December 2021. NFIB Chief Economist Bill Dunkelberg stated:

Despite the slight decline in November, small business job openings remain stuck in historical territory. For owners across the country, there are not enough workers to maintain current operations for small businesses, much less chase new opportunities. As we near the end of the year, small business owners continue to raise compensation in order to attract and retain qualified employees.

In October 2023, the Federal Reserve’s headline consumer credit increased at a seasonally adjusted annual rate of 1.2 percent. Revolving credit increased at an annual rate of 2.7 percent, while nonrevolving credit increased at an annual rate of 0.7 percent. I hate interpreting the volatile extrapolation of a single month’s change – and prefer to look at year-over-year change. The year-over-year growth in consumer credit was 3.1% which is the blue line on the graph below (1.6% inflation-adjusted – red line on the graph below). The bottom line is that consumer credit growth is slowing – and this is usually associated with a slowing economy.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Private sector employment increased by 103,000 jobs in November 2023 and annual pay was up 5.6 percent year-over-year, according to the November ADP® National Employment Report. This increase is relatively weak and is lower than the gains necessary for new entrants to the workforce. The graph below compares ADP with BLS jobs growth. Nela Richardson, chief economist, ADP stated:

Restaurants and hotels were the biggest job creators during the post-pandemic recovery. But that boost is behind us, and the return to trend in leisure and hospitality suggests the economy as a whole will see more moderate hiring and wage growth in 2024.

Nonfarm business sector labor productivity increased 2.4% year-over-year in the third quarter of 2023, whilst unit labor costs are up 1.6% year-over-year. These are revised numbers.

Inflation-adjusted October 2023 exports were up 6.2% year-over-year whilst imports were down 1.2% year-over-year. The trade deficit is improving and was down 18.0% year-over-year.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.