26Dec2023 Market Close & Major Financial Headlines: Santa Claus Rally Continues With Major Indices Up

Summary Of the Markets Today:

- The Dow closed up 159 points or 0.43%,

- Nasdaq closed up 0.54%,

- S&P 500 closed up 0.42%,

- Gold $2078 up $9.40,

- WTI crude oil settled at $75 up $1.60,

- 10-year U.S. Treasury 3.895% down 0.013 points,

- USD index $101.46 down $0.24,

- Bitcoin $42,146 down $1,404

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

CFNAI-MA3 above –0.70.

The S&P CoreLogic Case-Shiller U.S. National Home Price 20-City Composite posted a year-over-year increase of 4.9%, up from a 3.9% increase in the previous month. CoreLogic Chief Economist Dr. Selma Hepp stated:

The 2023 housing market closed on a considerably lighter note than expected only one month ago. With mortgage rates dropping, demand for homes in early 2024 is likely to be strong and will again put pressure on prices, similar to trends observed in early 2023. As a result, home price gains in the CoreLogic S&P Case-Shiller Index have increased by 7% since the beginning of the year and are 1% higher than at the peak in 2022, recovering all losses recorded in the second half of 2022. In addition, given the stronger seasonal gains seen in early 2023, annual home price appreciation should accelerate this winter before slowing again next year. Still, most markets will continue to reach new home price highs over the course of 2024.

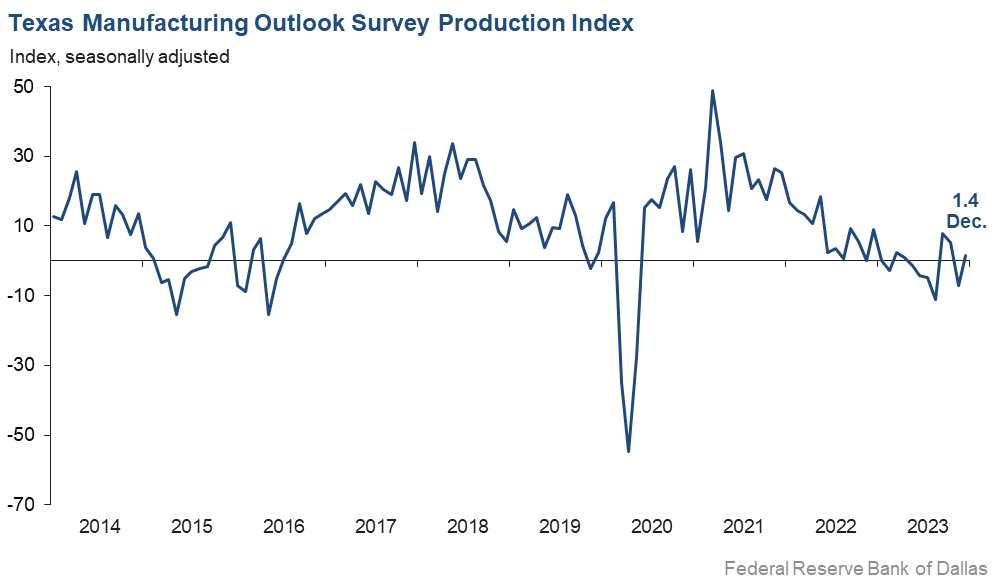

The Texas Manufacturing Outlook Survey‘s production index, a key measure of state manufacturing conditions, pushed up nine points to 1.4, with the near-zero reading indicating little change in manufacturing output from November. The new orders index remained negative but moved up from -20.5 to -10.9 in December. The shipments index posted a 12th consecutive negative reading but rose four points to -5.3.

- Taliban’s Energy Project Threatens Pakistan’s Water Supply

- U.S. Shatters Oil Production Records in 2023

- Car Ownership is More Expensive Than Ever

- Is the ESG Investment Bubble Bursting?

- Copper Prices Waver as Global Supply Faces New Challenges

- The U.S. avoided a recession in 2023. What’s the outlook for 2024? Here’s what experts are predicting

- Blinken’s Visit To Mexico Focuses On Optics As Migration Crisis Hits Biden’s Polls

- This Year, Americans Have Become Hungrier, Lonelier And More Desperate

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 26, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 25, 2023

Click HERE for the 10-Day Forecast for North Pole Alaska.

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

23 States File an Amici Curiae Brief Objecting to the Intervention of the United States in the Supreme Court Case: Texas, Plaintiff v. New Mexico and Colorado: Article Posted December 24, 2023

What is the meaning of this and what are the Implications?

The case is No. 220141

| Texas, Plaintiff v. New Mexico and Colorado |

|

| Docketed: | January 10, 2013 |

You can track the filings HERE and perhaps better yet HERE.

It is winding to a close and in my opinion the only result is that two Special Masters and a lot of attorneys have made a lot of money. But that is a different topic and I will write an article on the case when the Supreme Court makes its final decision.

The topic of this article is the Amici Curiae (Amici is the plural of Amicus) Brief by 23 states which is presented in its entirety in the body of this article. Some may have to click on “read more” to access the body of the article with the full filing.

Normally under Article III, Section 2, Clause 2 of the U.S. Constitution. only states are parties to a dispute among states.

In all Cases affecting Ambassadors, other public Ministers and Consuls, and those in which a State shall be Party, the supreme Court shall have original Jurisdiction.

Due to what IMO was a misstep by the New Mexico Attorney General, The U.S. Solicitor General was asked to comment on whether the Supreme Court should give Texas the right to bring this case and this then led to the U.S. requesting the right to be an Intervenor and that right was granted.

Intervening is entry into a lawsuit by a third party into an existing civil case that was not named as an original party but has a personal stake in the outcome. The non-party who intervenes in a case is called an intervenor. But they are not a party to the case. It is a subtle difference but an important difference.

Recently the Parties to this case agreed on a settlement but the the U.S., an intervenor has objected to the settlement. The disposition of that objection has yet to be decided.

23 States not involved in the litigation have submitted an Amici Curiae Brief sharing with the court their belief that the objections of the U.S. should be rejected.

So this raises two questions among others:

A. Why do they care?

B. What are the implications of their objection being accepted or rejected?

I am not an attorney. The full Amici Curiae brief is in the body of this article. But I will try to extract from that brief some of the objections raised to the U.S. intervening in disputes among states especially when they involve river compacts. The quotes below in many cases are from within a paragraph in the Brief so the line breaks may be different than in the Brief.

If a dispute arises regarding an interstate water

compact, the state parties to thecompact have the

authority to resolve these disputes among themselves.

State sovereignty and principles offederalism prevent

undue interference from theUnited States when the

United States is not a party to the compact.The United States asserts an expanded federal

role in interstate water compact disputes

that, if accepted by the Court, would result

in the ability of the United States to insert itself into

the equitable apportionment and governance of water

among the States. Amici States have a strong interest

in avoiding that result.States entering into compacts must have the abil-

ity to comply with, interpret, enforce, and defend their

negotiated agreements on behalf of their citizens with-

out undue interference from the United States.

The United States has no role in the

administration of state water to meet compact

obligations. The administration and distribution of

state water is a “core attribute of state sovereignty.”In entering into interstate water compacts, States

do not presume that they are waiving or limiting their

sovereign rights with respect to the United States. It

is a “well-established principle that States do not

easily cede their sovereign powers,” and silence is not

construed as a waiver of sovereignty.Unless a compacting State expressly cedes its

sovereign authority, the United States does not have

a role in the management of state water, including the

interpretation or enforcement of interstate water

compacts.The United States cannot and should not be able

to interfere with the sovereign authority of the States

to manage their water by pursuing compact claims or

an apportionment of water that is different than that

agreed to by compacting States. Accordingly, to the ex-

tent the United States participates in the administra-

tion or use of state water, it must comply with state

law.The United States’ Federal Water Project Does

Not Expand Its Limited Role in This Interstate

Water Compact Dispute.In limited circumstances, the Court may permit

the federal government to intervene in compact suits

to defend “distinctively federal interests.” Texas, 583

U.S. at 413 (quoting Maryland, 451 U.S. at 745, n.21).

But such limited intervention does not include

authority to determine the apportionment of water

between States or management of water within

States.Specifically, the United States seeks to insert itself

into the division of water among the States and into

the governance of state water within the borders of the

States. The United States argues it has a role in

determining Compact compliance regarding the

division of water between New Mexico and Texas and

in the appropriation and use of groundwater in New

Mexico.The Court should reject the United States’ attempt

to expand its power in this way. If the Court accepts

the United States’ argument, the inevitable result

will be further efforts by the United States to insert

itself into the interpretation and enforcement of

other interstate water compacts. The Court should

reject this obvious affront to federalism and

States’ sovereign powers.Nor can the United States justify its role in the

enforcement or interpretation of compact terms be-

cause there is a federal water project associated with

the Compact. See Exception at 30–34. Federal water

projects do not supersede interstate water compacts or

the States’ authority to manage their water to meet

compact obligations. The mere existence of a federal

water project associated with compact water does not

give the United States a role in the division of water

between States or in enforcing or interpreting terms

of an interstate water compact to which the United

States is not a party..Federal law requires the United States tocomply with state law relating to the control,appropriation, and distribution of water in federalwater projects..This provision requires the federal government, in

operating reclamation projects, to comply with state

water law and state water allocations. Water stored in

federal water projects must be appropriated and man-

aged subject to state law. Further, through the

McCarran Amendment, the United States has waived

its sovereign immunity and defers to state law regard-

ing the determination and administration of water

rights for federal reclamation projects. 43 U.S.C.

§ 666. The fact that water subject to a compact is also

associated with a federal water project does not dimin-

ish the sovereign authority of the State parties to the

compact or give the United States expanded control

over the compact terms or distribution of water under

the compact..That does not mean, however, that the United

States is without recourse. If the United States has a

claim regarding water appropriated to it in relation to

a federal water project, the United States, like all

other water right holders, may turn to state courts to

protect project water rights.The existence of a federal water project does not

give the United States authority to interpose its pre-

ferred interpretation or enforcement of interstate wa-

ter compact terms.

| I do not know if I have done a good job of selecting the best excerpts from the filing but the full filing is in the body of this article. I suggest that those interested in this subject read it. One way of looking at the arguments in this Amici Curiae filing is a separation of powers argument. It is also a Federalism argument. The Amici argue that it is not up to the U.S. to tell them how to implement agreements reached among states. Congress may ratify these agreements and the U.S. Supreme Court may hear disputes. But the implementation of the agreements is determined by state law not the Federal Government. Even if there is a Federal Project that is related to or interconnected with agreements among states, this does not give the Federal Government the right to interfere in how states implement and enforce their agreements with other states. |

| I am assuming that the Special Master will agree with the arguments made by New Mexico, Colorado and Texas which mirror the arguments made in this Amici Curiae Brief or it may be the other way around and I expect the Supreme Court to accept the recommendations of the Special Master. |

| Doing so would clarify this matter. If the Special Master does not accept the arguments presented by Colorado, New Mexico and Texas or if the Supreme Court does not accept the recommendation by the Special Master to accept this interpretation of the role of the Federal Government in the administration of river compacts (and I think it extends to other interstate compacts), it would represent a sea change in the relationship between the states and the Federal Government. The sovereignty of states would be significantly compromised. But there could be some nuances involved. |

| A friend of mine is continually reminding me that much water law in the U.S. springs from another somewhat related case: United States v. Rio Grande Dam & Irrigation Co., 174 U.S. 690 (1899)

So this sort of confirms his assessment of the history of water law in the U.S. |

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 24, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

Let’s Take a Look at What is Considered Normal Precipitation, December 23, 2023

When articles discuss “normal” or “climatology”, what does it mean? Right now it means what the weather was like on average from 1991 through 2020. To me, this is pretty arbitrary and faulty in many respects but that is how NOAA does it. At the end of every decade, the definition is updated with the most recent decade of data added and the most distant decade removed. If there was no long-term trend or long-period cycles this definition would be fine but there is a trend most noticeable in temperature and there are long cycles like the Atlantic Multidecadal Oscillation and Pacific Decadal Oscillation. If these cycles last approximately 60 years a 30-year average IMO is not a good approach but quite frankly I have not thought of a better way.

In this Climate.Gov article, (which you can access HERE), we are just looking at precipitation. We are not looking at anomalies but the actual values. We start with Precipitation over the 30-year period that defines “Normal” or “Climatology”. Outlooks issues by NOAA often will be in terms of the predicted deviation from the below when precipitation is being considered.

If you are planning to move, the above information may help you decide where you want to live.

In the body of the article and some will have to click the “read more” button to access it, we take the above and show it by month so that there are twelve maps. There is one for each month averaged over the period 1991 – 2020. We are entering into 2024 so there is some time before the climatology will be updated. That update has a big impact on the historical outlook maps to the extent they are revised to show anomalies based on the new normal or climatology.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 23, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

22 Dec 2023 Market Close & Major Financial Headlines: Markets Opened Mixed, Climbed Fractionally Higher, Traded Mostly Sideways, Closing Mixed

Summary Of the Markets Today:

- The Dow closed down 18 points or 0.05%,

- Nasdaq closed up 0.19%,

- S&P 500 closed up 0.17%,

- Gold $2,064 up $13.10,

- WTI crude oil settled at $74 down $0.34,

- 10-year U.S. Treasury 3.901% up 0.007 points,

- USD Index $101.71 down $0.130,

- Bitcoin $43,736 down $91 ( 0.04% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured durable goods in November 2023 were up 9.5% year-over-year (3.2% inflation adjusted). The surge this month in durable goods is attributable to civilian aircraft orders.

Real Disposable Personal income for November 2023 increased 4.3% year-over-year whilst real personal consumption expenditures (real PCE) increased 2.7% year-over-year. The PCE price index was 2.6% year-over-year (3.2% less food and energy) which is nearing the Federal Reserve’s 2% goal. Spending remains in a tight range which does not indicate an upcoming recession.

Sales of new single‐family houses in November 2023 declined to just 1.4% above the November 2022 level. The median sales price of new houses sold in November 2023 was $434,700. The average sales price was $488,900. The seasonally adjusted estimate of new houses for sale at the end of November was 451,000. This represents a supply of 9.2 months at the current sales rate. This was a disappointing month for home sales.

Here is a summary of headlines we are reading today:

- Russia To Cut Oil Exports From Sea Ports in January

- U.S. Clean Hydrogen Tax Credit Proposal Leaves Out Nuclear Energy

- Falling Nickel Prices Weigh Heavy on Stainless Steel Industry

- Buffett’s Berkshire Hathaway Raises Occidental Stake To 27.7%

- Oil Prices Gain Ahead Of Christmas

- S&P 500 closes higher Friday, registers longest weekly win streak since 2017: Live updates

- Fed’s favorite inflation gauge shows prices rose at 3.2% annual rate in November, less than expected

- Stocks making the biggest moves midday: Nike, Rocket Lab, Bristol Myers, NetEase and more

- Nike, Foot Locker shares sink after athletic apparel maker cuts revenue outlook

- ‘Pursuing Litigation, Not Democracy’ – Federal Judge Rejects Lawsuit To Remove Trump From Ballot

- Treasury yields end mostly higher after subdued U.S. inflation reading in holiday-shortened session

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

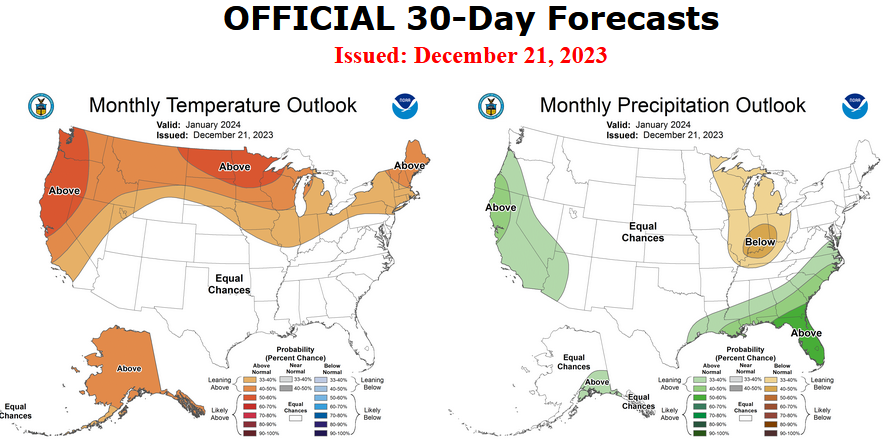

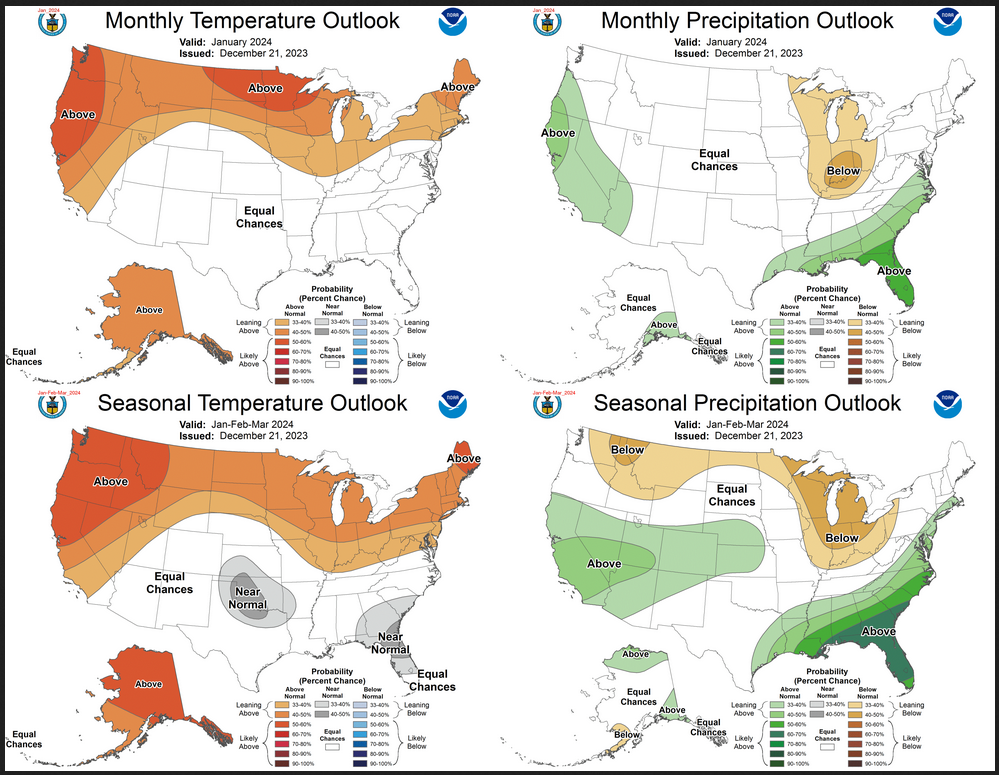

NOAA Updates Its Seasonal Outlook on December 21, 2023 – Sudden Stratospheric Warming (SSW) Watch

On the third Thursday of the month right on schedule NOAA issued their updated Seasonal Outlook which I describe as their Four-Season Outlook because it extends a bit more than one year into the future. The information released also included the Mid-Month Outlook for the following month plus the weather and drought outlook for the next three months. I present the information issued by NOAA and try to add context to it. It is quite a challenge for NOAA to address the subsequent month, the subsequent three-month period as well as the twelve successive three-month periods for a year or a bit more.

First, Let’s Take a Look at the (mid-month) Outlook for January.

It will be updated on the last day of December which is soon because the third Thursday of this month occurred at the latest time possible because December 1 the first day of the month was a Monday.

Then I present a graphic that shows both the preliminary Outlook for December and the three-month outlook for DJF 2023-2024. So you get the full picture in one graphic. For some, that may be all they are interested in. Others will be interested in the longer-term predictions and also the rationale supporting the predictions which is mostly provided by the NOAA discussion.

The top row is what is now called the Mid-Month Outlook for next month which will be updated at the end of this month. There is a temperature map and a precipitation map. The second row is a three-month outlook that includes next month. I think the outlook maps are self-explanatory. What is important to remember is that they show deviations from the current definition of normal which is the period 1991 through 2020. So this is not a forecast of the absolute value of temperature or precipitation but the change from what is defined as normal or to use the technical term “climatology”.

| Notice that the outlook for next month and the three-month outlooks are somewhat different, particularly with respect to precipitation. This tells us that February and March will be different than January to some extent. |