16 Jan 2023 Market Close & Major Financial Headlines: Markets Opened Lower, Nasdaq Saw Green Once, Dow Dropped Over 300 Points, Finally Closing Moderately Down In The Red

Summary Of the Markets Today:

- The Dow closed down 232 points or 0.62%,

- Nasdaq closed down 0.19%,

- S&P 500 closed down 0.37%,

- Gold $2,032 down $19.50,

- WTI crude oil settled at $72 down $0.68,

- 10-year U.S. Treasury 4.068% up 0.116 points,

- USD index $103.36 up $0.96,

- Bitcoin $43,236 up $346 (0.81%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – January 2024 Economic Forecast: Our Index Turns Slightly Negative

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

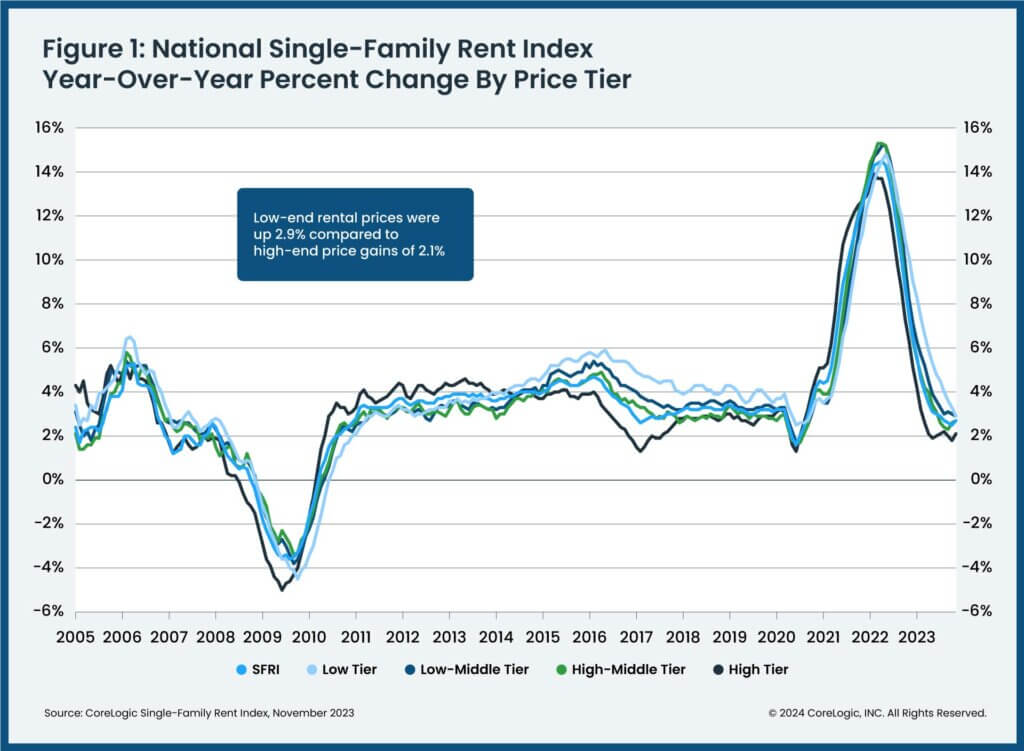

CoreLogic Single-Family Rent Index (SFRI) shows national single-family rent growth remained stable in November 2023. As in the past few months, rental demand is picking up in pricier coastal areas of the U.S., with the Boston, New York, San Diego, and San Francisco metros all ranking in the top five for annual gains in November. Molly Boesel, principal economist for CoreLogic stated:

More than three years of increasing U.S. single-family rents and the rising costs of other goods have made many renters sensitive to the cost of living. Many renters are renewing their current leases, and others who are moving are seeking lower-priced alternatives.

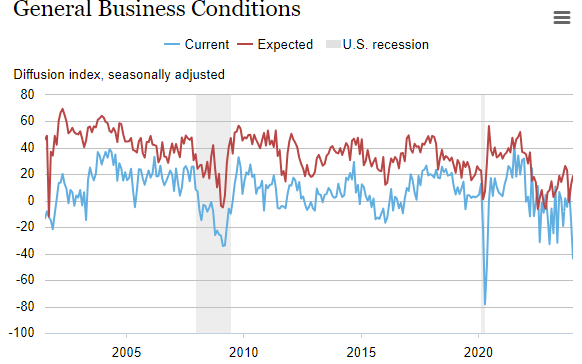

The January 2024 Empire State Manufacturing Survey shows the headline general business conditions index fell twenty-nine points to -43.7, its lowest reading since May 2020. New orders and shipments also posted sharp declines. Unfilled orders continued to shrink significantly, and delivery times continued to shorten. Inventories edged lower. Employment and the average workweek declined modestly. Even though I am not a fan of surveys, this one is extremely recessionary. Manufacturing as a sector has been in recession for over one year.

Here is a summary of headlines we are reading today:

- The World’s Top 50 Power-Hungry Data Center Markets

- North Dakota Oil Output Down Up to 650,000 BPD in Severe Storm

- Navy SEALs Seize Vessel with Iranian Missile Parts Bound for Houthis

- Shell To Sell its Onshore Oil Business in Nigeria

- Shell Halts All Red Sea Shipments as Tensions Rise

- Qatar Halts Red Sea LNG Shipments As Regional Tensions Escalate

- Dow closes more than 200 points lower Tuesday after 10-year Treasury yield tops 4%: Live updates

- AMD shares jump 7% and head for highest close since 2021 on AI chip demand

- UBS raises S&P 500 target for 2024, sees nearly 8% gain from here

- Hush Money: JP Morgan Pays $18 Million Fine For Violating Whistleblower Protection Rules

- No rate cuts in 2024? Why investors should think about the ‘unthinkable.’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.