Summary Of the Markets Today:

- The Dow closed up 141 points or 0.37%,

- Nasdaq closed up 0.07%,

- S&P 500 closed up 0.23%,

- Gold $2,052 up $9.10,

- WTI crude oil settled at $74 up $0.72,

- 10-year U.S. Treasury 4.089% down 0.075 points,

- USD index $104.16 down $0.29,

- Bitcoin $43,107 up $739 (1.78%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

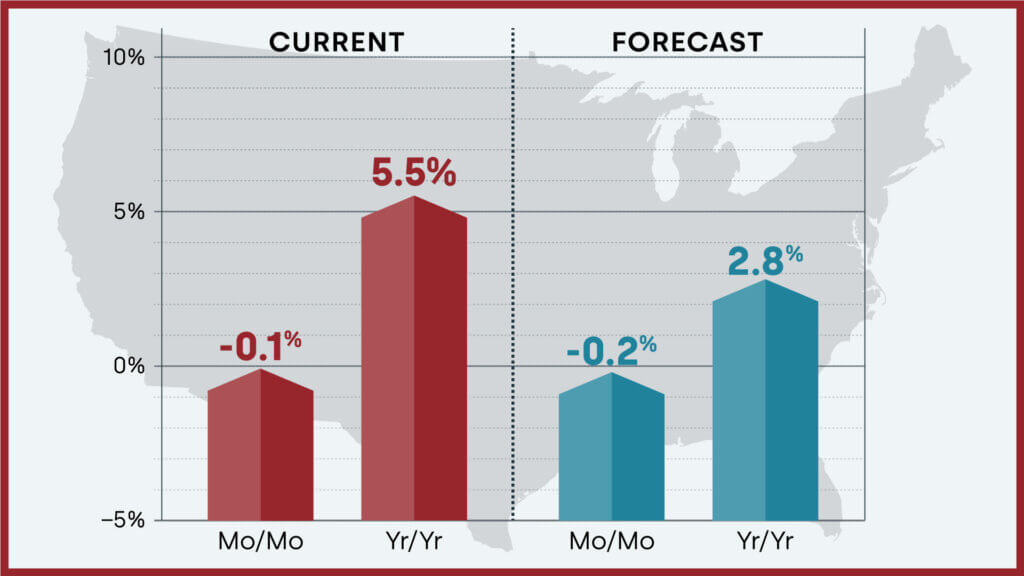

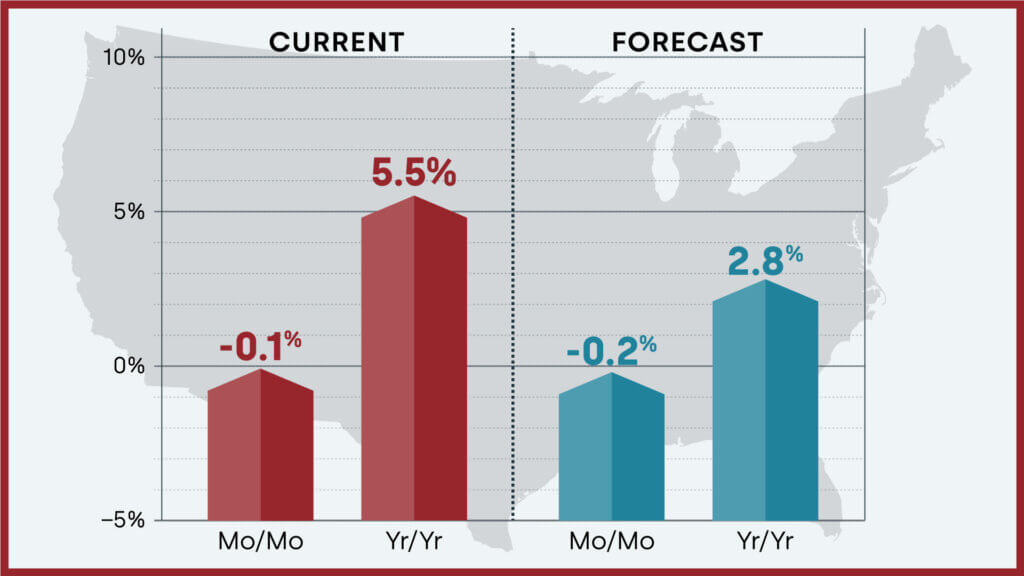

Home prices nationwide, including distressed sales, increased year over year by 5.5% in December 2023 compared with December 2022. Dr. Selma Hepp, Chief Economist for CoreLogic stated:

Last winter’s mortgage rate surge impacted seasonal home price changes in many markets and suggests that annual gains may have reached the cycle peak and will level off in the coming months. But while appreciation is projected to slow, home prices will continue to extend to new highs entering the typically busy spring homebuying season. Also, while the recent dip in mortgage rates help improve some affordability challenges, additional rate declines may not arrive until the second half of 2024. The 2024 homebuying season should enjoy a boost because of pent-up demand, as well as a robust job market and wage growth. Geographic patterns in price gains continued to favor housing markets in the Northeast and the South, especially those that remain more affordable and have lagged in home price increases over the past couple of years.

Here is a summary of headlines we are reading today:

- AI to Transform Solar Cell Production

- Oil Market Needs $14 Trillion: OPEC Secretary General

- U.S. Crude Oil Production To See Zero Growth This Year: EIA

- Diesel Prices Set to Spike This Year: Kemp

- U.S. Thermal Coal Finds New Life Overseas

- Palantir shares rocket 30% after revenue beat, strong demand for AI

- New York Community Bancorp stock falls 22% as slump extends

- Credit card delinquencies surged in 2023, indicating ‘financial stress,’ New York Fed says

- Somali pirates are back on the attack at a level not seen in years, adding to global shipping threats

- WeWork’s ousted boss plots buyback of bankrupt firm

- Treasury yields finish lower as buyers return and Fed officials reiterate need to hold off on rate cuts

- AMC’s stock rallies more than 11%, on pace for biggest gain since August

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.