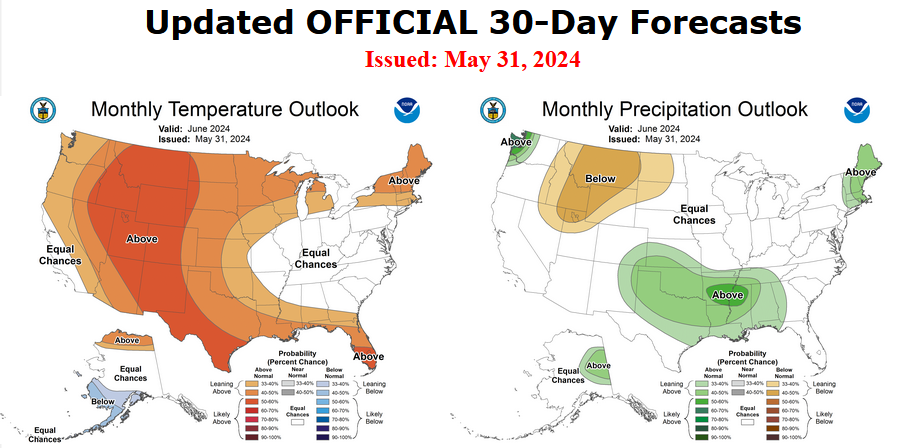

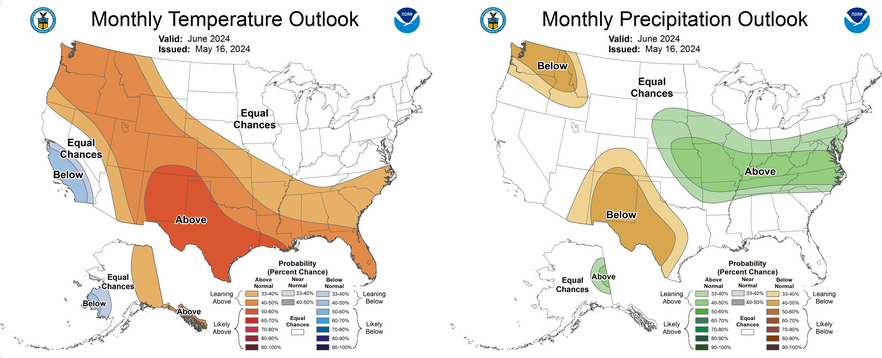

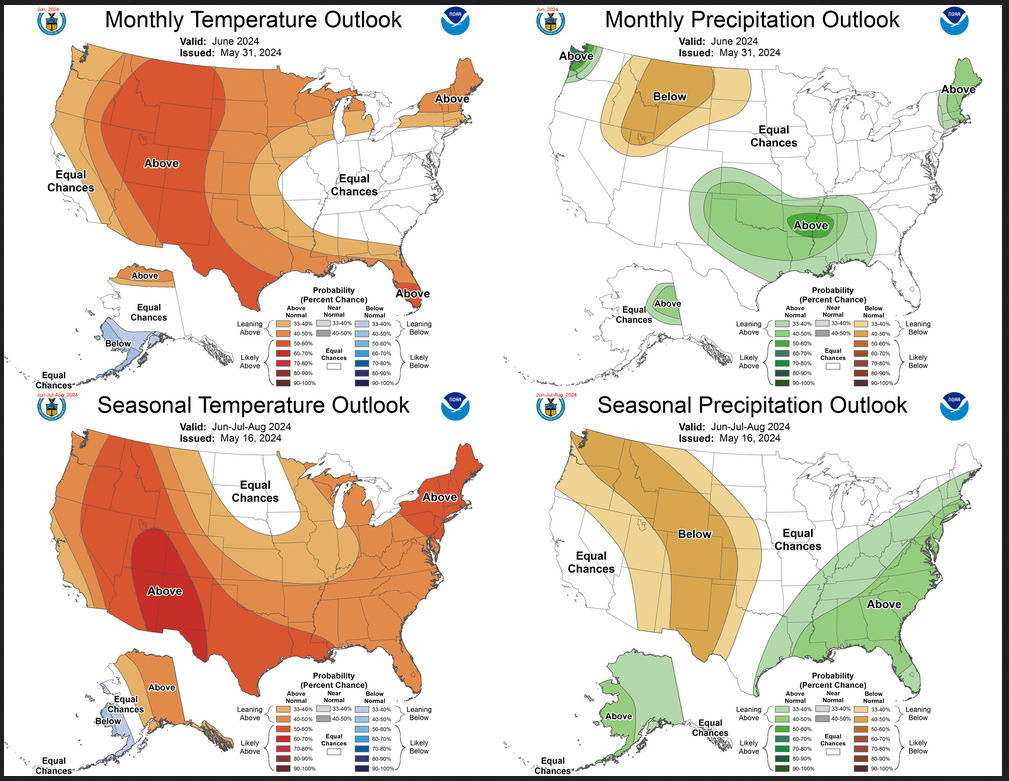

Today Through the Fourth Friday (22 to 28 days) Weather Outlook for the U.S. and a Six-Day Forecast for the World: posted June 3, 2024

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here after about 4 p.m. New York time but it is unlikely to have changed very much from the morning update. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Mon Jun 03 2024

Valid 12Z Mon Jun 03 2024 – 12Z Wed Jun 05 2024…Excessive Rainfall and Severe Weather threaten portions of the

Mississippi Valley and Southern Plains today……Increasing Excessive Heat Risk potential over parts of the West and

southern Texas through mid-week…Shortwave energy spinning through the Northwest will support showers and

thunderstorm activity across the region today. Rainfall rates over the

favored terrain of the Cascades and Northern Rockies will be high enough

to warrant an Excessive Rainfall threat. Thus, a Slight Risk (at least

15%) of Excessive Rainfall leading to Flash Flooding is in effect for

portions of the Northern Rockies, while a Marginal Risk (at least 5%) area

is in place over the Cascades, Olympics and Seattle Metro area. Elsewhere,

showers and thunderstorms are expected to continue over parts of the Great

Plains and Mississippi Valley today. Pockets of severe thunderstorms

capable of producing heavy to excessive rainfall may develop over parts of

the Southern Plains into the Mississippi Valley. Slight Risks of Excessive

Rainfall and Severe Thunderstorms are in effect over those areas, where a

swath of damaging wind gusts are possible. The severe thunderstorm threat

concentrates over parts of the Central Plains and Middle Mississippi

Valley on Tuesday, where a Slight Risk is in effect. Large hail is

possible at the outset when storms are more cellular, but will then be

followed by a congealing of cells into a line of storms with damaging wind

gusts eventually being the main threat.An upper ridge is expected to develop over the West early to mid-week.

High temperatures will gradually climb into 100s by Wednesday and Thursday

with many records potentially being tied or broken on those days.

Excessive Heat Warnings are in effect for the central valley region of

California while Excessive Heat Watches are in effect for parts of the

Desert Southwest. Extreme HeatRisk is probable to continue for much of

southern Texas through Wednesday. This level of heat risk means that there

will likely be little to no overnight relief for those without effective

cooling and/or adequate hydration.