13 Jun 2024 Market Close & Major Financial Headlines: For The Third Session, The Nasdaq Set New Historic Highs After A small Gap Up At The opening Bell, The Dow And The S&P 500 Traded Mostly In the Red, Finally Closing Mixed

Summary Of the Markets Today:

- The Dow closed down 66 points or 0.17%,

- Nasdaq closed up 0.34%, (Closed at 17,668, New Historic high 17,742)

- S&P 500 closed up 0.23%,

- Gold $2,320 down $35.30,

- WTI crude oil settled at $78 down $0.42,

- 10-year U.S. Treasury 4.244 down 0.051 points,

- USD index $105.20 up $0.56,

- Bitcoin $66,564 down $1,685 or 2.47%

*Stock data, cryptocurrency, and commodity prices at the market closing.

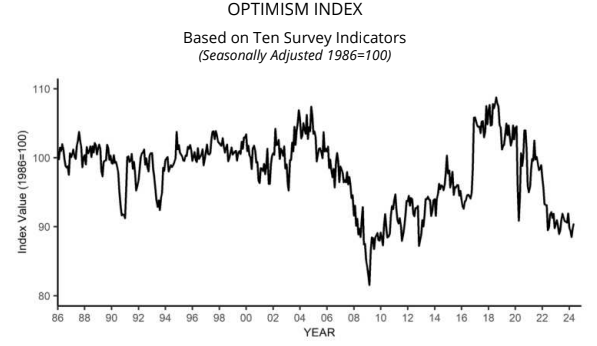

Click here to read our current Economic Forecast – June 2024 Economic Forecast: Our Index Marginally Weakened And There Is Another Indicator Warning Of A Recession

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Honestly, I am really glad I do the analysis of inflation myself. If you read the vomit spewed by the financial wizards of the mass media you would be convinced inflation is abating. In fact, the way US Census released the Producer Price Index for final demand was also misleading: “The Producer Price Index for final demand declined 0.2 percent in May…”. Because of the convoluted seasonal adjustments, data errors, and other analytic BS – the only way to wash the info is to do a year-over-year analysis which does not require seasonal adjustments and averages out the data errors. The truth is that the PPI inflation is up 2.24% in May 2024 which is down from April’s 2.27% – literally no change in the inflation rate in this level below retail. And the primary reason the PPI did not rise is due to a 7.1% decline in the price for gasoline. Look at the table below which displays the year-over-year inflation changes from May 2023 – do you see where inflation is abating?

| Month | Change in final demand from 12 months ago (unadj.) | Change in final demand less foods, energy, and trade from 12mo. ago (unadj.) |

|---|---|---|

| 2023 | ||

| May | 1.1 | 2.9 |

| June | 0.3 | 2.9 |

| July | 1.1 | 2.9 |

| Aug. | 1.9 | 2.9 |

| Sept. | 1.8 | 2.9 |

| Oct. | 1.1 | 2.8 |

| Nov. | 0.8 | 2.5 |

| Dec. | 1.1 | 2.7 |

| 2024 | ||

| Jan. | 1.0 | 2.7 |

| Feb. | 1.6 | 2.8 |

| Mar. | 1.9 | 2.9 |

| Apr. | 2.3 | 3.2 |

| May | 2.2 | 3.2 |

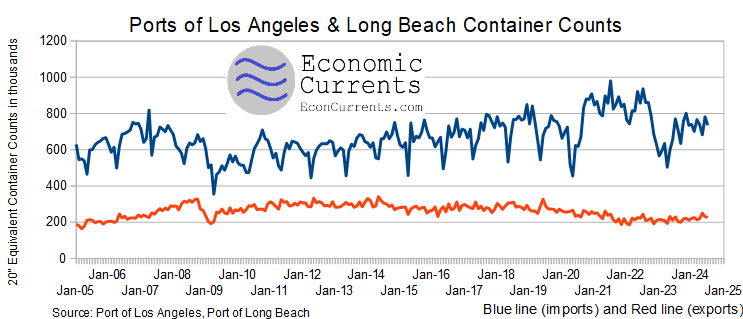

When the Port of Los Angeles is combined with the Port of Long Beach, the two ports handled approximately 29% of all containerized international waterborne trade in the U.S. These ports release their statistics early – and give us an insight into trade statistics for the entire nation. In May 2023, imports were down 5% year-over-year whilst exports were down 1%. Imports correlate to U.S. consumer spending – and this data is generally saying spending is down. However, before COVID, May was one of the lowest months for container imports. Over the last year – every month has been relatively equal. Therefore, I am challenged to offer an opinion on what this month’s data means – and I will pass this month.

In the week ending June 8, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 227,000, an increase of 4,750 from the previous week’s unrevised average of 222,250.

Here are some of headlines we are reading today:

- U.S. Automakers Race to Offset the Rise in Copper Prices

- Microsoft: Russian and Chinese State Hackers Pose Growing Threat

- JPMorgan Analysts Cast Doubt on Tesla’s Robotaxi Revenue

- Nvidia CEO Jensen Huang Declares a New Industrial Revolution

- Falling Energy Prices Spark Hopes for Fed Rate Cuts

- S&P 500 posts its fourth straight record close, buoyed by cooler inflation data: Live updates

- Trump floats eliminating U.S. income tax and replacing it with tariffs on imports

- Taylor Swift’s Eras Tour shows trigger earthquake readings in Scotland; estimated $98 million economic boost

- FOMC Holds Rates As Expected, Dot-Plot Shifts More Hawkish In 2024

- FOMC Preview: From Three Rate Cuts To Two

- Housing demand wanes as buyers bank on rate cut

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.