08 JAN 2025 Market Close & Major Financial Headlines: Today’s Session Was A Roller Coaster, Crossing The Unchanged Line Seemingly Going Nowhere, Finally Closing Mixed

EconCurrents is transitioning to Substack in 2025. The existing newsletter will be discontinued no later than 01February2025 .Note that the stock markets will not be open tomorrow. The stock markets and government offices will be closed on Thursday, January 9, 2025, in observance of a national day of mourning for former President Jimmy Carter. Therefore there will be no newsletter tomorrow. |

Summary Of the Markets Today:

- The Dow closed up 107 points or 0.25%,

- Nasdaq closed down 11 points or 0.06%,

- S&P 500 closed up 9 points or 0.16%,

- Gold $2,681 up $15.50 or 0.590%,

- WTI crude oil settled at $73 up $0.91 or 1.21%,

- 10-year U.S. Treasury 4.677 up 0.006 points or 0.128%,

- USD index $109.01 up $0.47 or 0.43%,

- Bitcoin $93,811 down $2,805 or 2.99%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

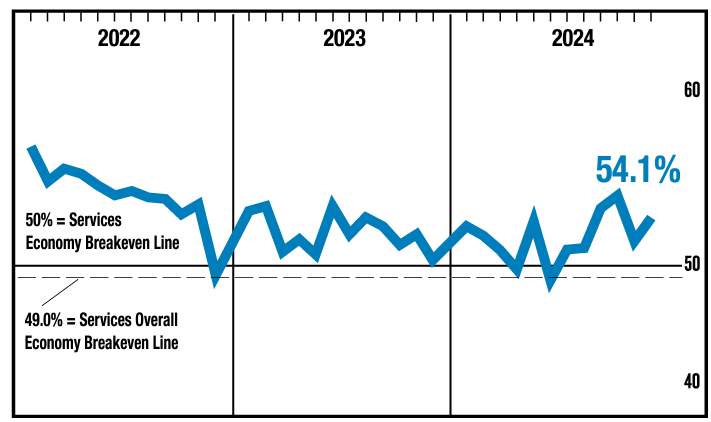

US stocks showed mixed performance on Wednesday as investors reacted to reports of President-elect Donald Trump potentially declaring a national economic emergency to implement proposed tariffs. The S&P 500 and Dow Jones Industrial Average saw slight gains, while the NASDAQ Composite closed marginally lower. The market was influenced by several key factors. Trump’s potential tariff plans: CNN reported that Trump is considering using emergency powers to enact his proposed tariff framework, which has caused some market uncertainty. Minutes from the Fed’s December meeting indicated support for a gradual pace of interest rate cuts in 2025. Recent strong economic indicators, including service sector growth and job openings, have raised concerns about persistent inflation. The 10-year Treasury yield remained around 4.7%, reflecting market expectations of potentially slower interest rate cuts. Private sector job growth slowed in December, but unemployment claims unexpectedly fell, suggesting a stable labor market. Investors are closely monitoring these developments as they assess the economic outlook and potential policy shifts under the incoming Trump administration.

Click here to read our current Economic Forecast – January 2025 Economic Forecast: Little Change And Still Indicating a Weak Economy – One Recession Flag Removed

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

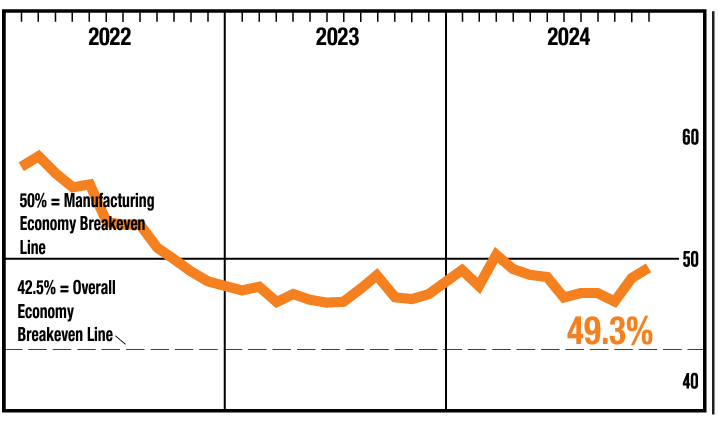

Private employers added 122,000 jobs in December 2024 according to ADP. Hiring slowed in several industries. Employment in manufacturing shrank for the third straight month. Pay gains continued to slow. Year-over-year pay for job stayers was up 4.6 percent. For job-changers, pay rose 7.1 percent. Most of this year, one month ADP has higher employment gains – then the next month, the BLS has higher gains,. If this pattern continues – the BLS employment gains in December will be less than 122,000. But 122,000 is far from stellar growth, and below the growth necessary to employ new entrants to the labor force. According to Nela Richardson, Chief Economist, ADP:

The labor market downshifted to a more modest pace of growth in the final month of 2024, with a slowdown in both hiring and pay gains. Health care stood out in the second half of the year, creating more jobs than any other sector.

November 2024 sales of merchant wholesalers were up 0.9% from the revised November 2023 level. Total inventories were up 0.8% from the revised November 2023 level. The November inventories/sales ratio for merchant wholesalers was 1.33. The November 2023 ratio was 1.35. I am sure that NOBODY in government knows really what a wholesaler is – and the statistics are likely garbage. The inventory to sales ratios are little changed which normally indicates there is no inventory gain (which is a sign of recession).

In the week ending January 4, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 213,000, a decrease of 10,250 from the previous week’s unrevised average of 223,250. The unemployment claims are low historically and consistent with a growing economy.

The Federal Open Market Committee (FOMC) meeting in December 2024 provided updated economic projections and insights into monetary policy decisions. Note that I do not believe inflation is under control as any new development could set off another round of inflation. Key points include:

Economic Projections

-

- Real GDP growth: Median projection revised upward to 2.5% for 2024 and 2.1% for 2025.

- Unemployment rate: Projected to be 4.2% in 2024, slightly lower than previous estimates.

- Inflation: PCE inflation projections raised for 2024 (2.4%) and 2025 (2.5%).

Monetary Policy

-

- The federal funds rate was lowered by 25 basis points to a range of 4.25% to 4.5%.

- FOMC members anticipate two 25 basis point rate cuts in 2025, totaling 50 basis points.

- The median projection for the federal funds rate at the end of 2025 is now 3.9%, up from 3.4% in September.

Economic Outlook

-

- Inflation is expected to continue moving towards the 2% target, but the process may take longer than previously anticipated. Several participants observed that the disinflationary process may have stalled temporarily or noted the risk that it could.

- Economic activity continues to expand at a solid pace, with consumer spending stronger than expected. Participants believe the strength of economic activity was unlikely to be a source of upward inflation pressures.

- Labor market conditions are gradually easing while remaining solid overall.

Risks and Uncertainties

-

- Upside risks to inflation have increased due to recent higher-than-expected readings and potential policy changes.

- Uncertainties remain regarding the effects of potential changes in trade and immigration policies – bottom line they were worried about Trump.

- The Committee views risks to its dual mandate objectives as roughly balanced.

The FOMC indicated a cautious approach to future policy decisions, emphasizing the need to carefully assess evolving economic conditions and maintain flexibility in monetary policy adjustments.

According to the Federal Reserve, “In November, consumer credit decreased at a seasonally adjusted annual rate of 1.8 percent. Revolving credit decreased at an annual rate of 12 percent, while nonrevolving credit increased at an annual rate of 2 percent.” Two things: 1) this data is not inflation adjusted and at least 2% should be subtracted from growth for inflation; and 2) I prefer year-over-year analysis which shows total consumer credit is up 1.7% year-over-year with components revolving credit (credit cards) up 3.6% year-over-year and nonrevolving credit (like car loans and student loans) up 1.0% year-over-year. The trend lines show less and less reliance on credit for consumer spending which constrains consumer spending.

Here is a summary of headlines we are reading today:

- New Railway to Connect China, Kyrgyzstan, and Uzbekistan

- Taliban Takeover of Afghanistan Fuels Militancy in Pakistan

- Chevron Targets $6-8 bln In Free Cash Flow Growth By 2026

- DOE Issues $1.8B Loan Guarantee To Arizona Utility For Renewable Energy

- Guyana’s Crude Oil Exports Surged by 54% in 2024

- Higher Taxes Could Slow China’s Fuel Oil Imports

- Trump Not Ruling Out Force in Threats to Take Over Panama Canal

- Nvidia’s Jensen Huang is ‘dead wrong’ about quantum computers, D-Wave CEO says

- First major stock benchmark nears correction as small-cap Russell 2000 trade unravels

- Judge approves Tesla directors’ nearly $1 billion deal to end excess pay case

- Bitcoin falls to $94,000, giving back most of 2025’s early gains: CNBC Crypto World

- This January indicator is an ‘early warning system’ for how the year will go

- FOMC Minutes Show ‘Almost All’ Fed Members See Higher Inflation Risks, Cite Trump Policies

- Most Fed officials were worried about higher inflation, but not enough to put rate hikes on the table, minutes of December meeting show

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.