Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sat Aug 17 2024

Valid 12Z Sat Aug 17 2024 – 12Z Mon Aug 19 2024

…There is a Slight Risk of excessive rainfall over parts of the

Mid-Atlantic on Saturday/Sunday and Southwest/Eastern Great Basin on

Saturday…

…There is a Slight Risk of severe thunderstorms over parts of the

Pacific Northwest, Great Basin, and Ohio Valley on Saturday and southern

Mid-Atlantic to Southeast/Lower Mississippi Valley on Sunday…

…There are Excessive Heat Warnings and Heat Advisories over parts of the

Southern Plains and Lower Mississippi Valley…

A front extending from the Great Lakes/Ohio Valley across the Middle

Mississippi Valley and then to the Central High Plains will move eastward

to the Mid-Atlantic/Southeast Coast and southward to the Southern Plains

by Monday. On Saturday, showers and thunderstorms will develop along and

ahead of the boundary from the Great Lakes/Ohio Valley to the

Tennessee/Lower Mississippi Valleys.

Additionally, upper-level energy will intersect a pool of tropical

moisture over the northern Mid-Atlantic, producing heavy rain. Therefore,

the WPC has issued a Slight Risk (level 2/4) of excessive rainfall over

parts of the northern Mid-Atlantic through Sunday morning. The associated

heavy rain will create mainly localized areas of flash flooding, with

urban areas, roads, small streams, and low-lying areas the most

vulnerable.

Furthermore, the boundary will trigger showers and severe thunderstorms

over parts of southwestern Ohio, eastern Kentucky, and extreme

north-central Tennessee. Therefore, the SPC has issued a Slight Risk

(level 2/5) of severe thunderstorms over parts of the Ohio/Tennessee

Valleys through Sunday morning. The hazards associated with these

thunderstorms are frequent lightning, severe thunderstorm wind gusts,

hail, and a few tornadoes.

Moreover, upper-level energy and a plume of monsoonal moisture will aid in

creating showers and thunderstorms with heavy rain over parts of southern

Utah and northwestern Arizona. Therefore, the WPC has issued a Slight Risk

(level 2/4) of excessive rainfall over parts of the Great Basin/Southwest

through Sunday morning. The associated heavy rain will create mainly

localized areas of flash flooding, with urban areas, roads, small streams,

and low-lying areas the most vulnerable.

In addition, the energy will produce showers and severe thunderstorms over

parts of the Great Basin. Therefore, the SPC has issued a Slight Risk

(level 2/5) of severe thunderstorms over parts of the Great Basin through

Sunday morning. The hazards associated with these thunderstorms are

frequent lightning, severe thunderstorm wind gusts, and a minimal threat

of hail and tornadoes.

Also, an upper-level low over the Pacific Northwest Coast and associated

energy will develop showers and severe thunderstorms over parts of Oregon

and Washington State on Saturday. Therefore, the SPC has issued a Slight

Risk (level 2/5) of severe thunderstorms over parts of the Pacific

Northwest through Sunday morning. The hazards associated with these

thunderstorms are frequent lightning, severe thunderstorm wind gusts,

hail, and a minimal threat of tornadoes.

On Sunday, as the front moves into the Mid-Atlantic, Southeast, and Lower

Mississippi Valley, showers and severe thunderstorms will develop along

and ahead of the boundary. Therefore, the SPC has issued a Slight Risk

(level 2/5) of severe thunderstorms over parts of the southern

Mid-Atlantic to Southeast/Lower Mississippi Valley from Sunday through

Monday morning. The hazards associated with these thunderstorms are

frequent lightning, severe thunderstorm wind gusts, hail, and a minimal

threat of tornadoes.

Further, a strong pool of moisture will be over the Mid-Atlantic on

Sunday, aiding in producing showers and thunderstorms with heavy rain over

parts of the northern Mid-Atlantic. Therefore, the WPC has issued a Slight

Risk (level 2/4) of excessive rainfall over parts of the northern

Mid-Atlantic from Sunday through Monday morning. The associated heavy

rain will create mainly localized areas of flash flooding, with urban

areas, roads, small streams, and low-lying areas the most vulnerable.

Moreover, monsoonal moisture and daytime heating will create showers and

thunderstorms over parts of the Southwest, Eastern Great Basin, and

Central Rockies from late afternoon into late evening on Sunday.

Additionally, the upper-level low over the Northwest will produce rain,

with maybe an embedded thunderstorm over the region on Sunday.

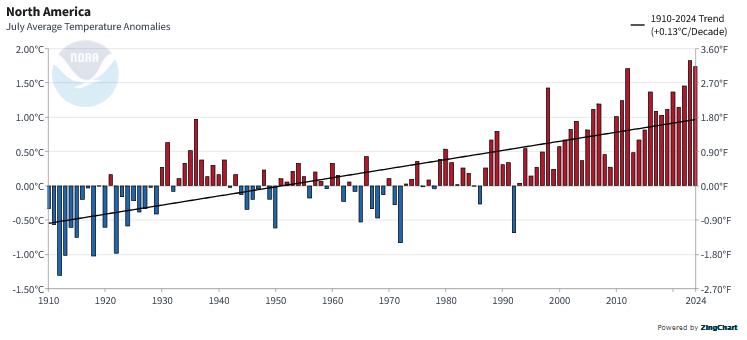

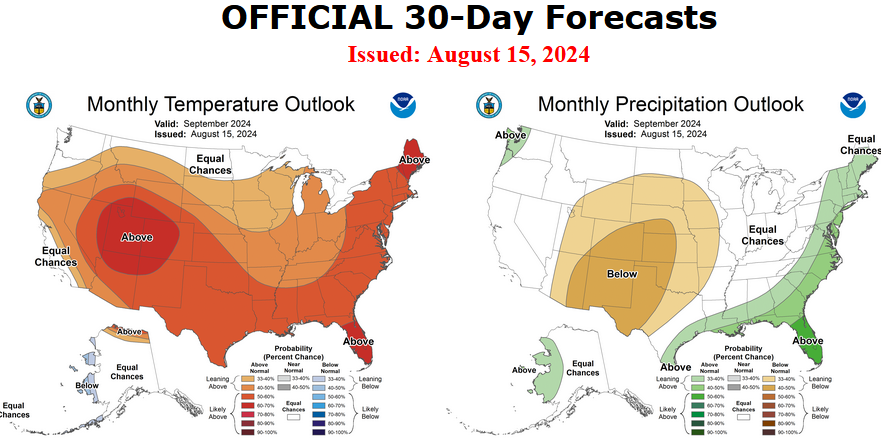

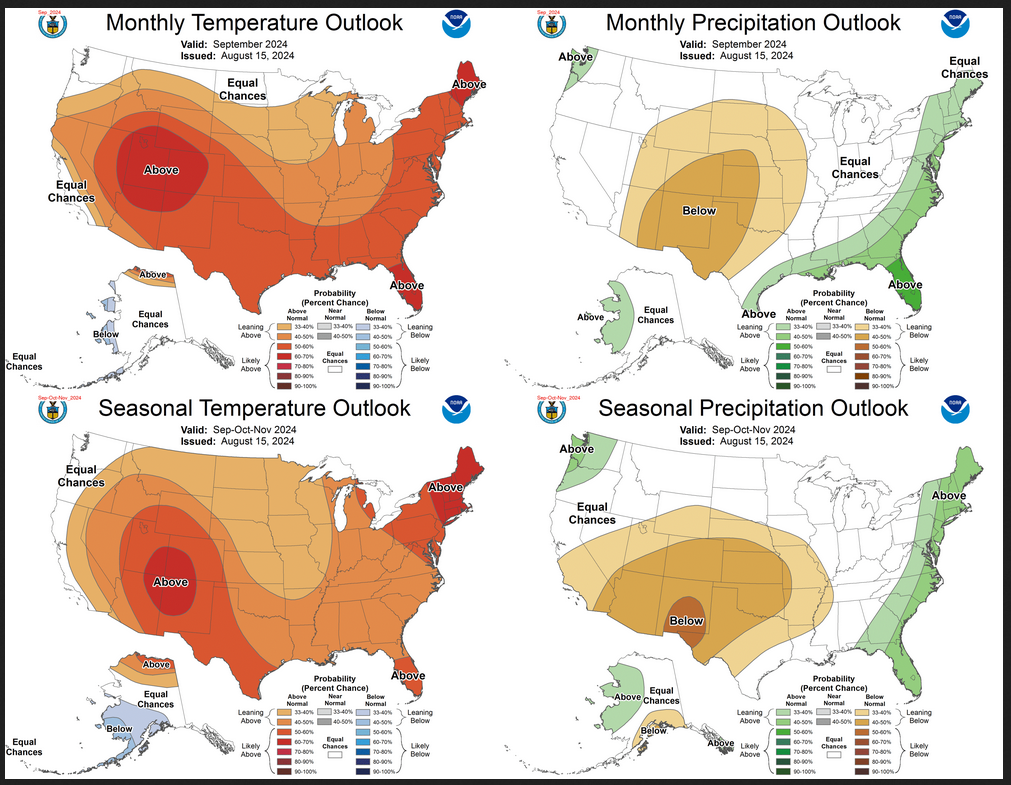

Meanwhile, upper-level ridging over parts of the Southern Plains and

Lower Mississippi Valley will produce high temperatures in the upper-90s

to low-100s with dew points in the low to mid-70s have prompted Excessive

Heat Warnings and Heat Advisories over parts of the Southern Plains and

Lower Mississippi Valley. The sweltering summer heat will continue over

the south. A prolonged stretch of high temperatures in the upper 90s and

triple digits will be focused over portions of the Southern Plains and

Gulf Coast through Monday. Low temperatures in the low-80s/upper-70s are

also forecast along the Gulf Coast, providing little relief from the heat

overnight. Moreover, the combination of summer heat and high humidity will

support daily maximum heat indices near 110F. People spending more time or

effort outdoors or in a building without cooling are at an increased risk

of heat-related illness.